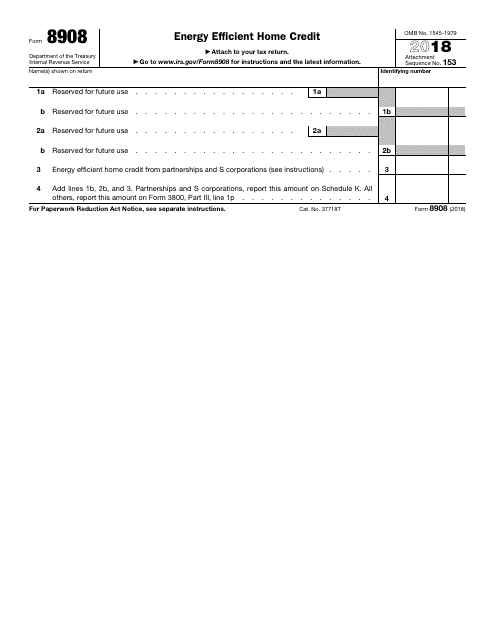

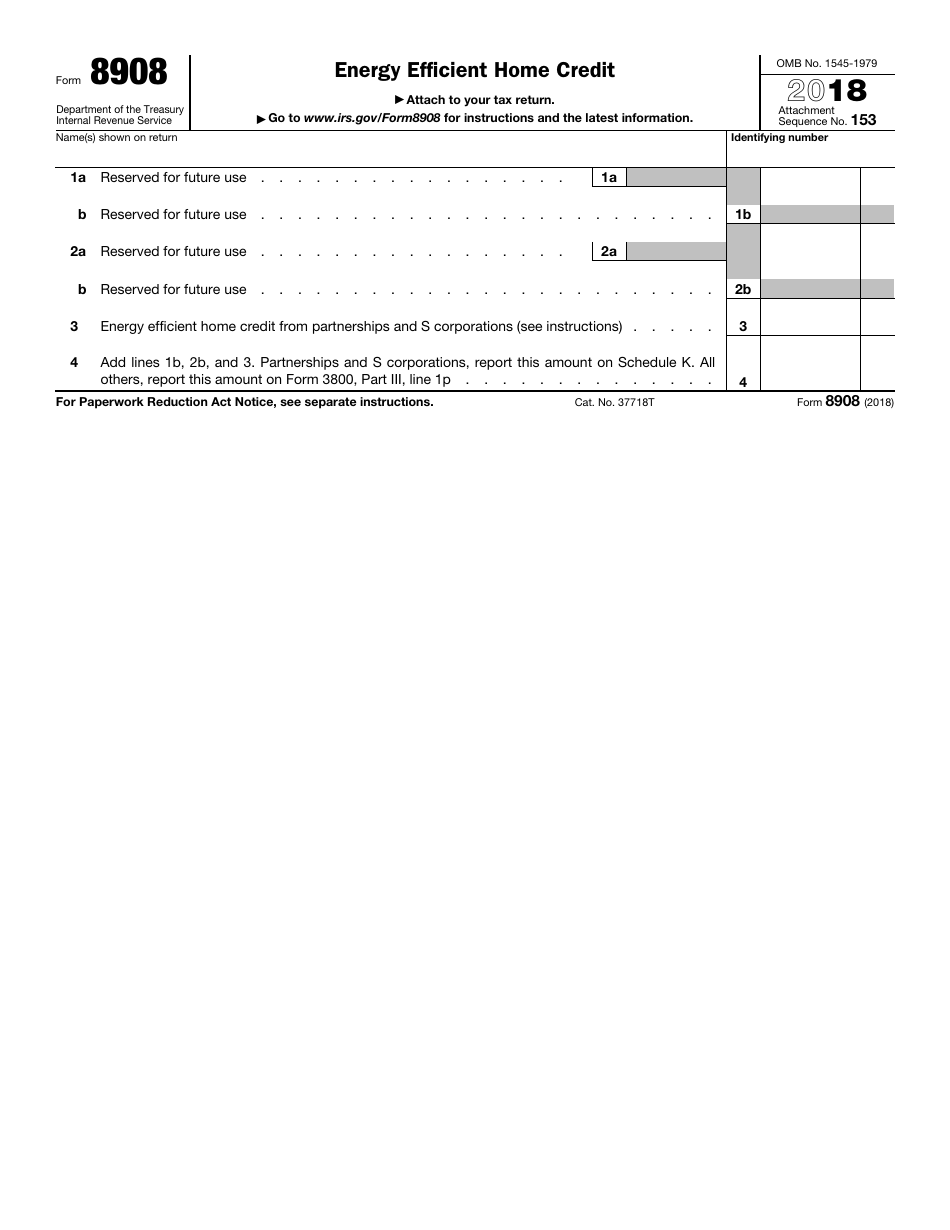

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8908

for the current year.

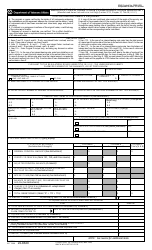

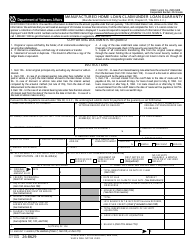

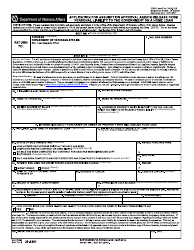

IRS Form 8908 Energy Efficient Home Credit

What Is IRS Form 8908?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8908?

A: IRS Form 8908 is a form used to claim the Energy Efficient Home Credit.

Q: What is the Energy Efficient Home Credit?

A: The Energy Efficient Home Credit is a tax credit available for homeowners who make qualified energy efficient improvements to their homes.

Q: What are the qualifying improvements for the Energy Efficient Home Credit?

A: Qualifying improvements include the installation of energy efficient windows, doors, insulation, roofing, and HVAC systems.

Q: How much is the Energy Efficient Home Credit?

A: The credit can be up to $2,000 for eligible taxpayers.

Q: How do I claim the Energy Efficient Home Credit?

A: To claim the credit, you must complete and file IRS Form 8908 along with your tax return.

Q: What are the eligibility requirements for the Energy Efficient Home Credit?

A: To be eligible, the improvements must be made to your primary residence and meet certain energy efficiency standards.

Q: Are there any income limitations for the Energy Efficient Home Credit?

A: No, there are no income limitations for claiming the Energy Efficient Home Credit.

Q: Can I claim the Energy Efficient Home Credit for improvements made in previous years?

A: No, the credit is only available for improvements made within the current tax year.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8908 through the link below or browse more documents in our library of IRS Forms.