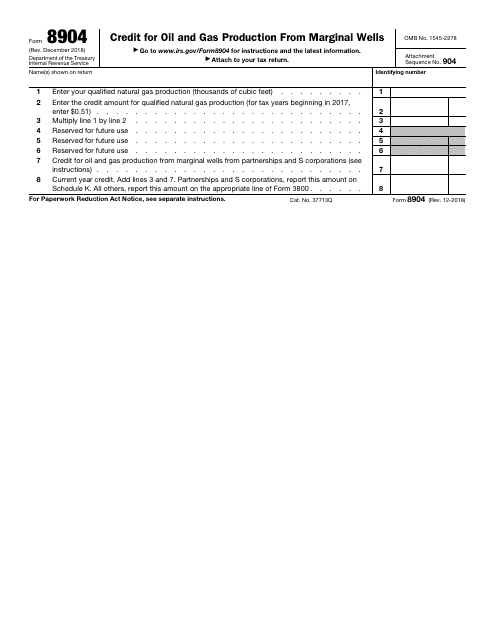

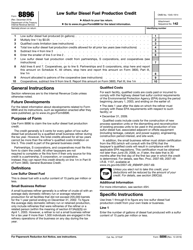

IRS Form 8904 Credit for Oil and Gas Production From Marginal Wells

What Is IRS Form 8904?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8904?

A: IRS Form 8904 is a tax form used to claim the Credit for Oil and Gas Production From Marginal Wells.

Q: Who can use IRS Form 8904?

A: This form can be used by taxpayers who have income from the production of oil or gas from marginal wells.

Q: What is the Credit for Oil and Gas Production From Marginal Wells?

A: The Credit for Oil and Gas Production From Marginal Wells is a tax credit available to qualifying taxpayers who produce oil or gas from marginal wells.

Q: What are marginal wells?

A: Marginal wells are oil or gas wells with low production levels, often located in economically less attractive areas.

Q: How is the credit calculated?

A: The credit is calculated based on the qualified production from marginal wells and is subject to certain limitations and requirements.

Q: Can I carry forward unused credits?

A: Yes, unused credits can be carried forward to future years.

Q: Is there a deadline for filing IRS Form 8904?

A: The form must be filed with your annual tax return by the due date, typically April 15th.

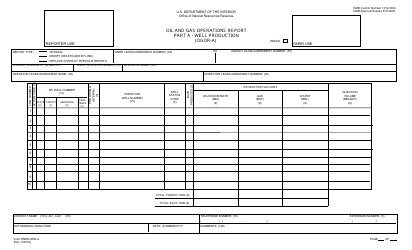

Q: Do I need to attach any additional documentation?

A: Yes, you may need to attach supporting documentation such as production records and schedules.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8904 through the link below or browse more documents in our library of IRS Forms.