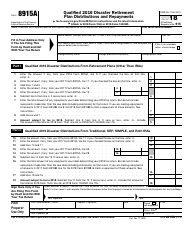

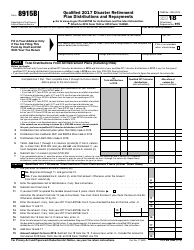

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8880

for the current year.

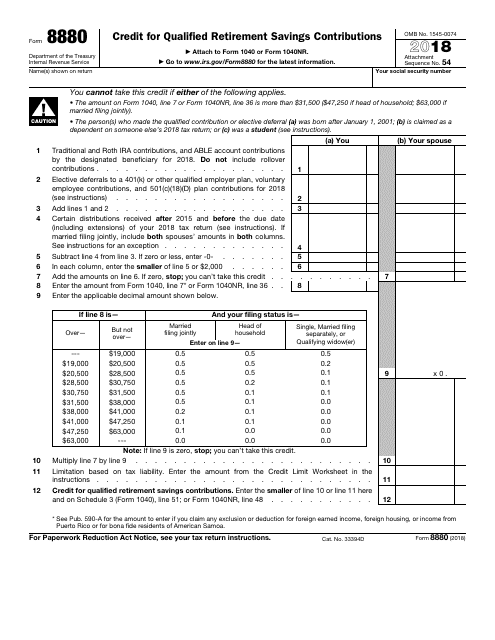

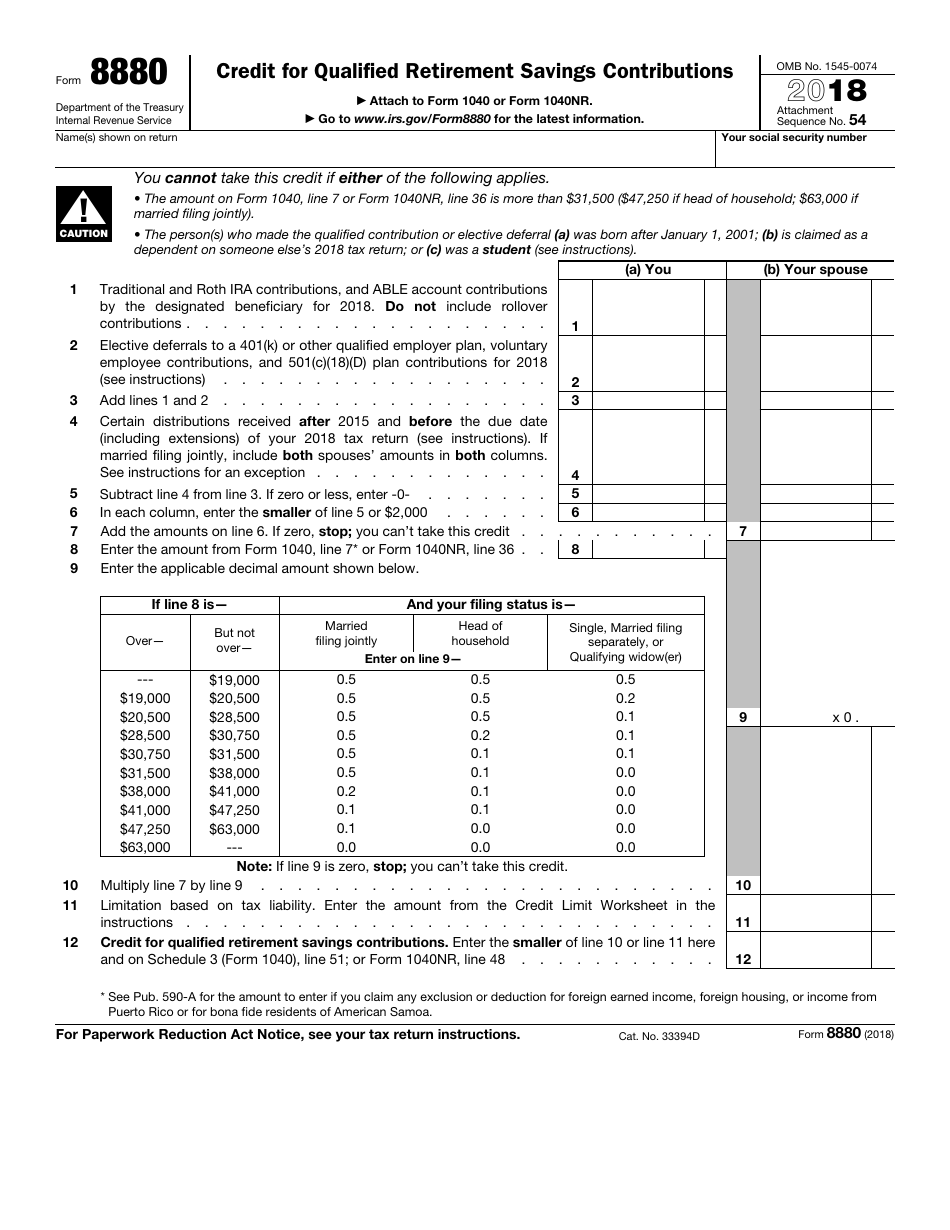

IRS Form 8880 Credit for Qualified Retirement Savings Contributions

What Is IRS Form 8880?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8880?

A: IRS Form 8880 is used to claim the Credit for Qualified Retirement Savings Contributions.

Q: What is the Credit for Qualified Retirement Savings Contributions?

A: The Credit for Qualified Retirement Savings Contributions is a tax credit that encourages individuals to save for retirement.

Q: Who is eligible for the credit?

A: Individuals with low to moderate income who contribute to a qualified retirement savings plan are eligible for the credit.

Q: What types of retirement savings plans are eligible?

A: Eligible retirement savings plans include traditional and Roth IRAs, employer-sponsored plans like 401(k)s, 403(b)s, and 457 plans, and certain other qualified plans.

Q: How much is the credit worth?

A: The credit is worth up to 50% of the contributions you make to your retirement savings plan, up to a maximum credit amount.

Q: What is the maximum credit amount?

A: The maximum credit amount varies depending on your filing status, adjusted gross income, and the amount of your qualified retirement contributions.

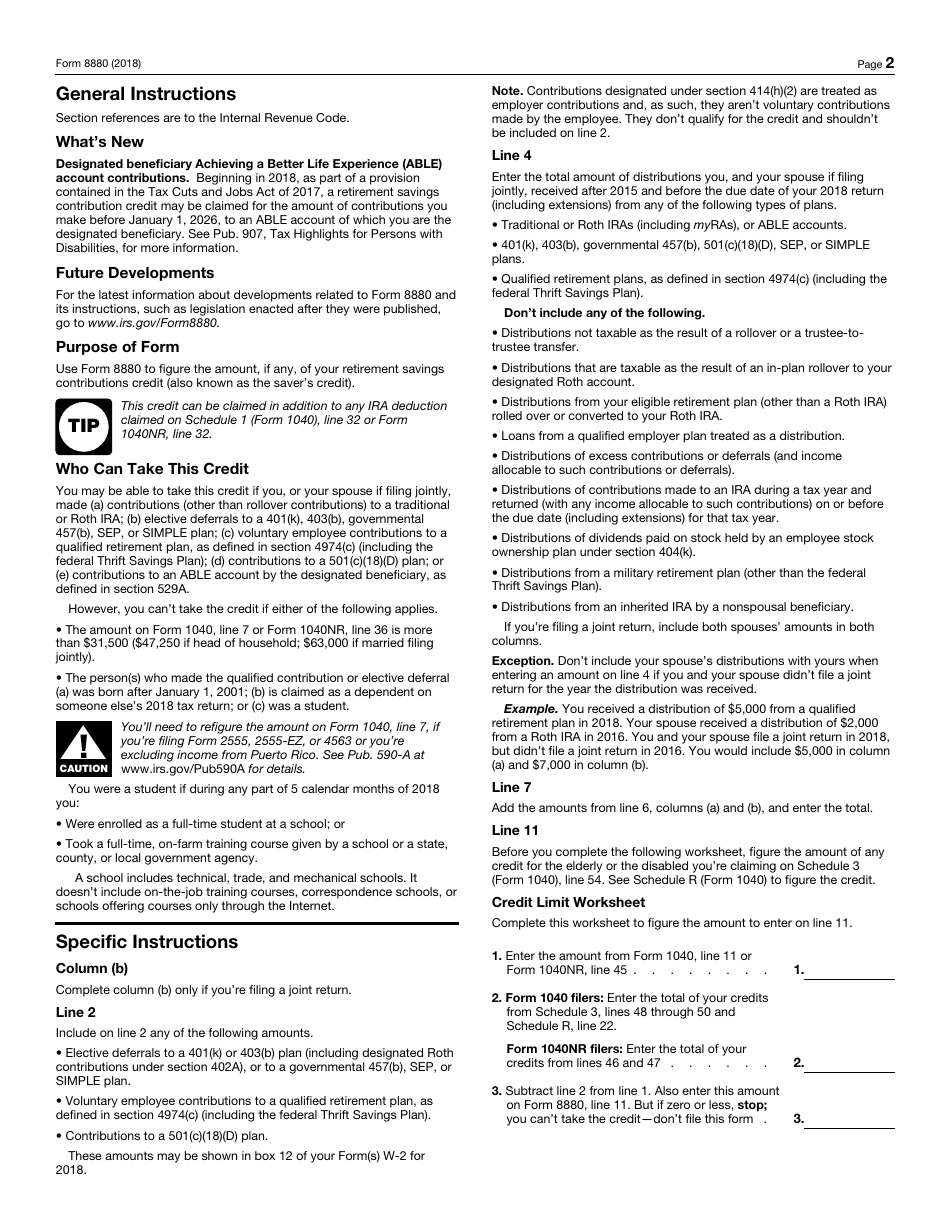

Q: How do I claim the credit?

A: To claim the credit, you must file IRS Form 8880 with your annual tax return.

Q: Can I claim the credit if I am not required to file a tax return?

A: No, you must file a tax return in order to claim the credit.

Q: Are there any other requirements to claim the credit?

A: Yes, you must be at least 18 years old and not a full-time student.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8880 through the link below or browse more documents in our library of IRS Forms.