This version of the form is not currently in use and is provided for reference only. Download this version of

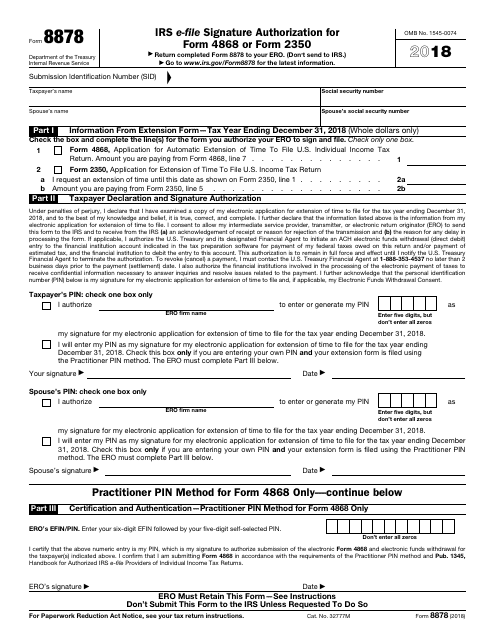

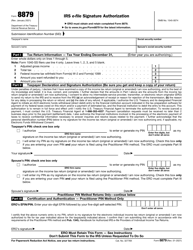

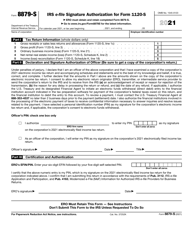

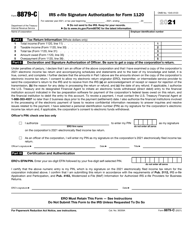

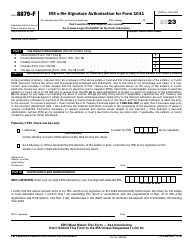

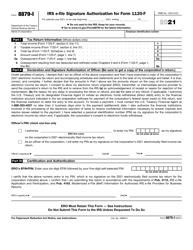

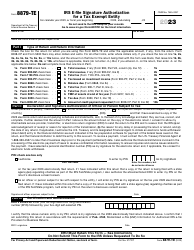

IRS Form 8878

for the current year.

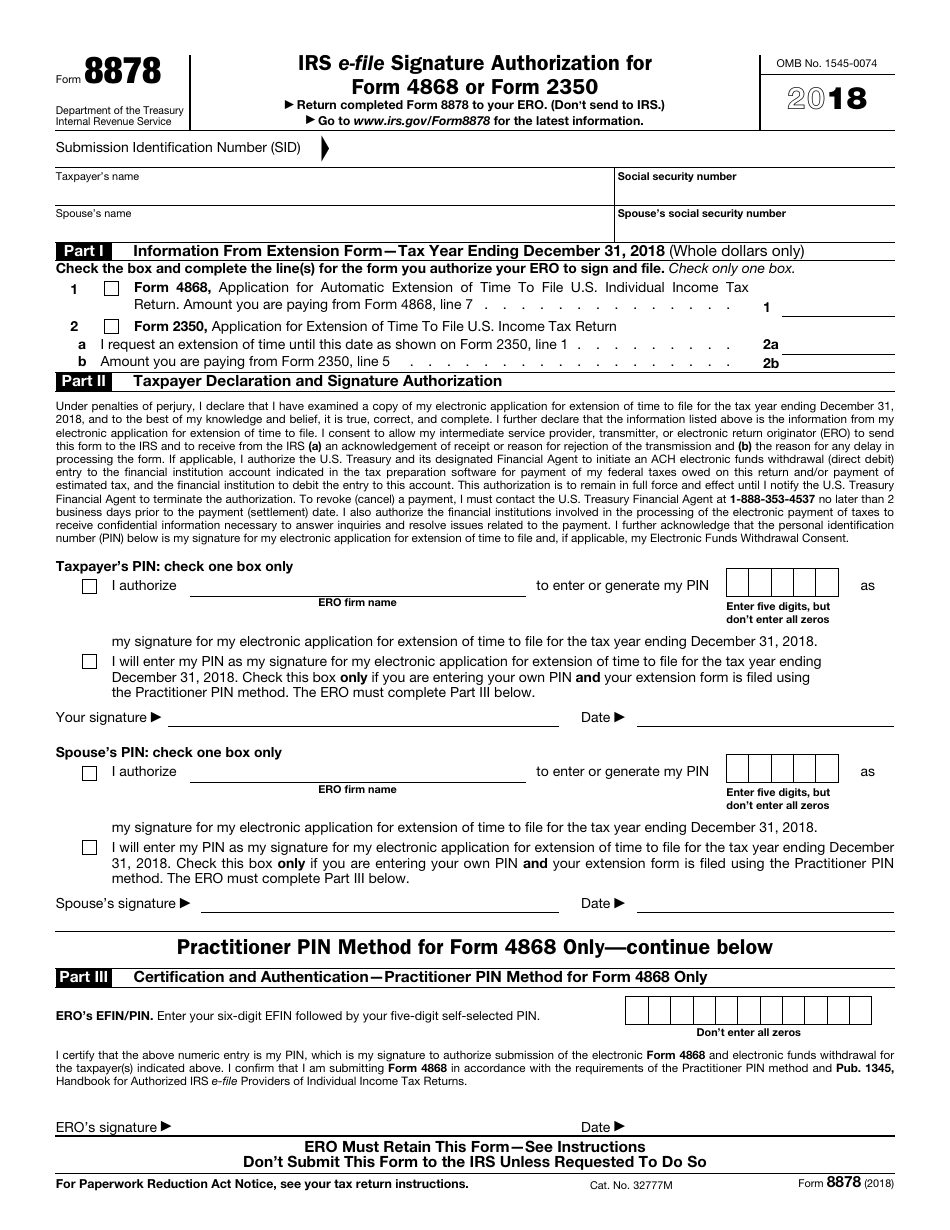

IRS Form 8878 IRS E-File Signature Authorization for Form 4868 or Form 2350

What Is IRS Form 8878?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8878?

A: IRS Form 8878 is the E-File Signature Authorization form.

Q: What is the purpose of IRS Form 8878?

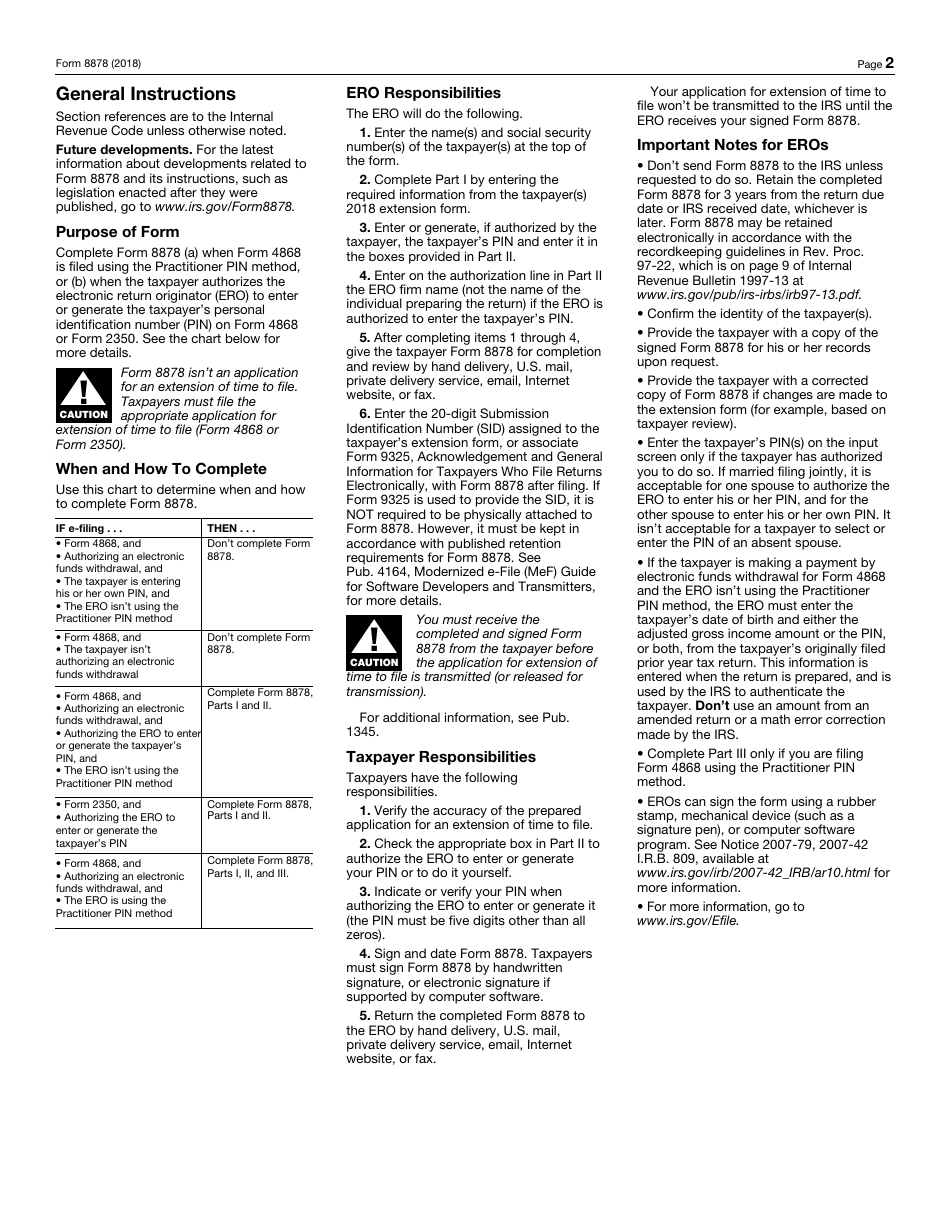

A: The purpose of IRS Form 8878 is to authorize the electronic filing of Form 4868 or Form 2350.

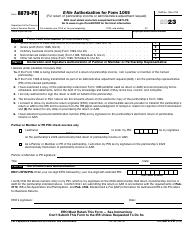

Q: What is Form 4868?

A: Form 4868 is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

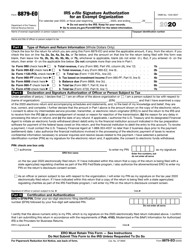

Q: What is Form 2350?

A: Form 2350 is the Application for Extension of Time to File U.S. Income Tax Return for U.S. Citizens and Resident Aliens Abroad.

Q: Do I need to file IRS Form 8878?

A: You need to file IRS Form 8878 if you want to electronically file either Form 4868 or Form 2350.

Q: Is there a deadline for filing IRS Form 8878?

A: There is no specific deadline for filing IRS Form 8878, but it should be submitted prior to or together with either Form 4868 or Form 2350.

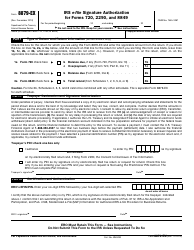

Q: Can I electronically sign IRS Form 8878?

A: Yes, IRS Form 8878 can be electronically signed using a Self-Select PIN or a Practitioner PIN.

Q: What is a Self-Select PIN?

A: A Self-Select PIN is a five-digit number that you choose to electronically sign your tax return.

Q: What is a Practitioner PIN?

A: A Practitioner PIN is a five-digit number that a tax professional uses to electronically sign the taxpayer's return on behalf of the taxpayer.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8878 through the link below or browse more documents in our library of IRS Forms.