This version of the form is not currently in use and is provided for reference only. Download this version of

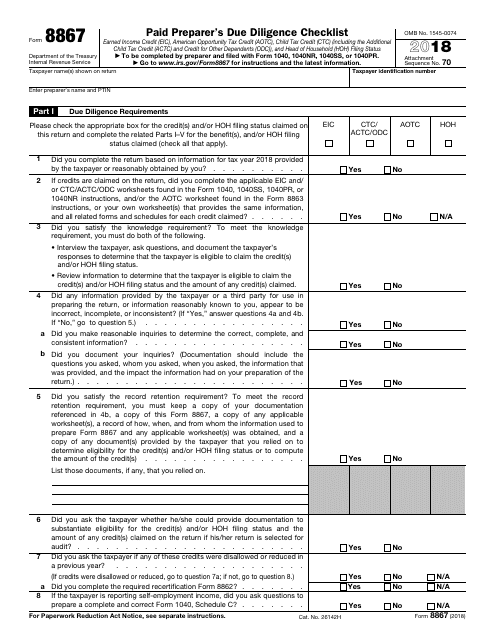

IRS Form 8867

for the current year.

IRS Form 8867 Paid Preparer's Due Diligence Checklist

What Is IRS Form 8867?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8867?

A: IRS Form 8867 is a Paid Preparer's Due Diligence Checklist.

Q: Who uses IRS Form 8867?

A: Paid preparers use IRS Form 8867.

Q: What is the purpose of IRS Form 8867?

A: The purpose of IRS Form 8867 is to help paid preparers determine if they have met due diligence requirements when preparing tax returns for their clients.

Q: What is due diligence in tax preparation?

A: Due diligence in tax preparation refers to the thoroughness and care that a paid preparer must exercise when preparing a tax return.

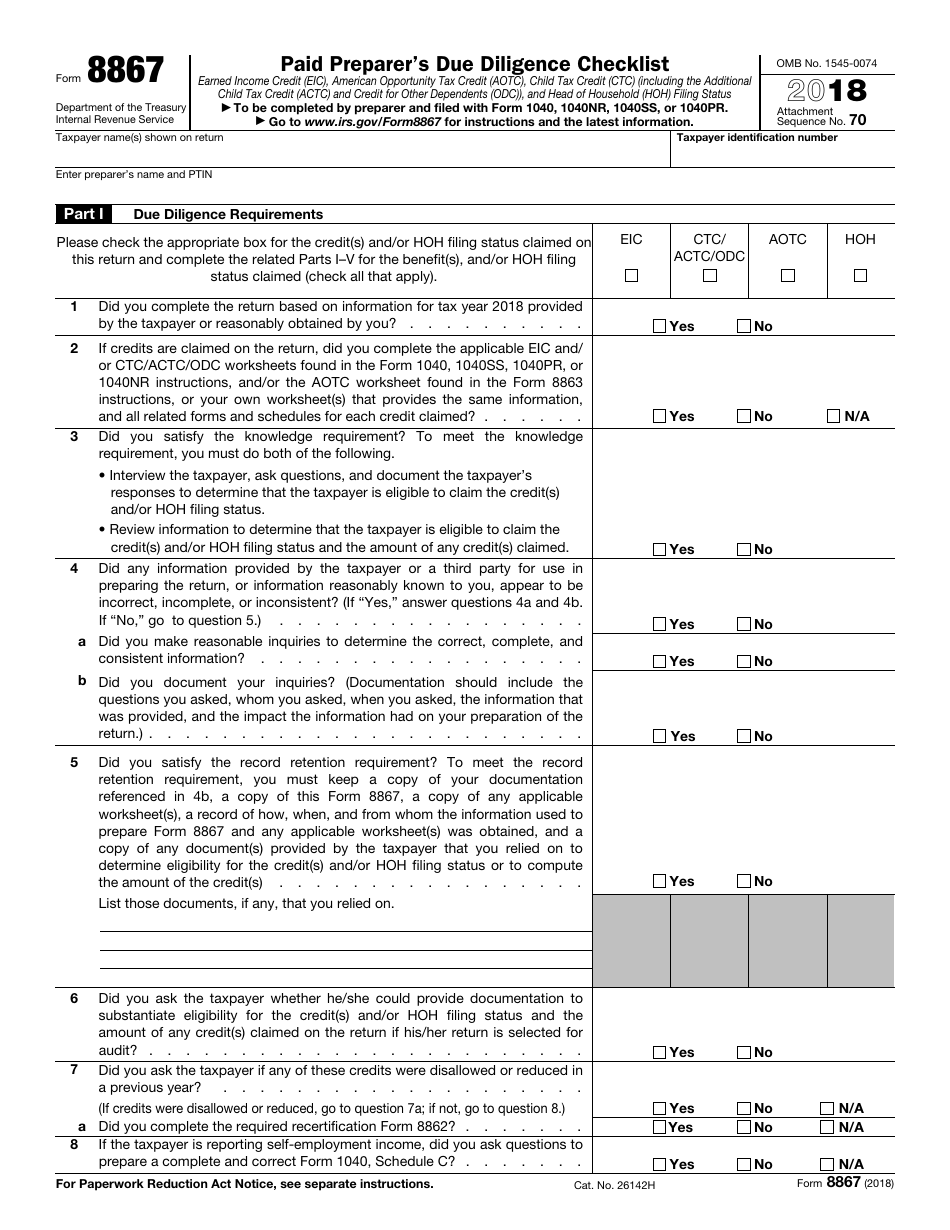

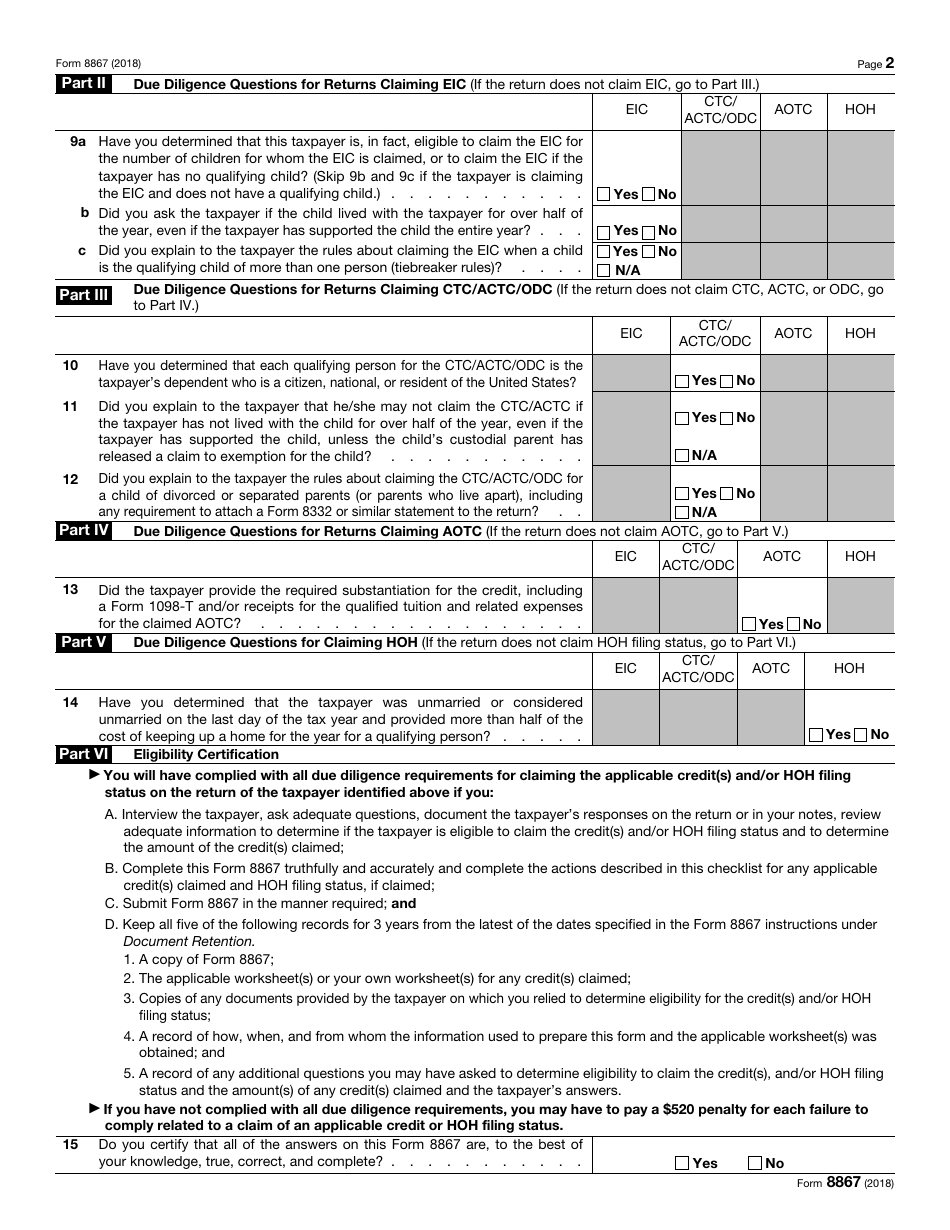

Q: What are some of the items covered in IRS Form 8867?

A: IRS Form 8867 covers various areas of due diligence including eligibility for certain credits, documentation requirements, and the preparer's knowledge and understanding of the tax laws.

Q: What penalties can a paid preparer face for not completing IRS Form 8867 correctly?

A: A paid preparer can face penalties for failing to complete IRS Form 8867 correctly, including potential monetary penalties and restrictions on their ability to prepare tax returns.

Q: Can a taxpayer be penalized for a paid preparer's failure to complete IRS Form 8867?

A: Yes, a taxpayer may be penalized if their paid preparer fails to complete IRS Form 8867 correctly, as it may result in errors or omissions on their tax return.

Q: Is IRS Form 8867 required for all tax returns?

A: No, IRS Form 8867 is required only for tax returns claiming certain credits, such as the Earned Income Credit (EIC) or Additional Child Tax Credit (ACTC).

Q: Can a taxpayer fill out IRS Form 8867 themselves?

A: No, IRS Form 8867 is a checklist that is completed by the paid preparer and not by the taxpayer.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8867 through the link below or browse more documents in our library of IRS Forms.