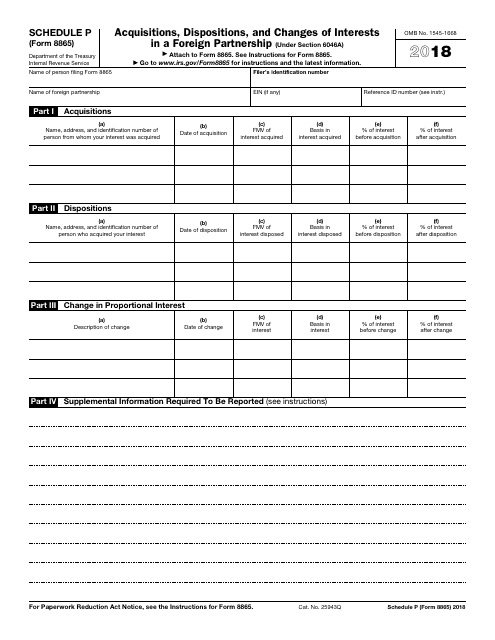

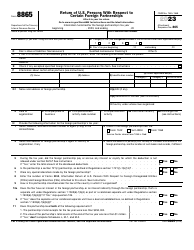

This version of the form is not currently in use and is provided for reference only. Download this version of

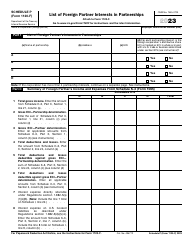

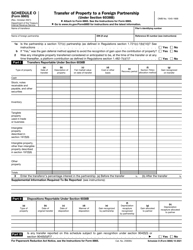

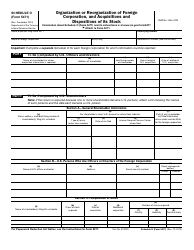

IRS Form 8865 Schedule P

for the current year.

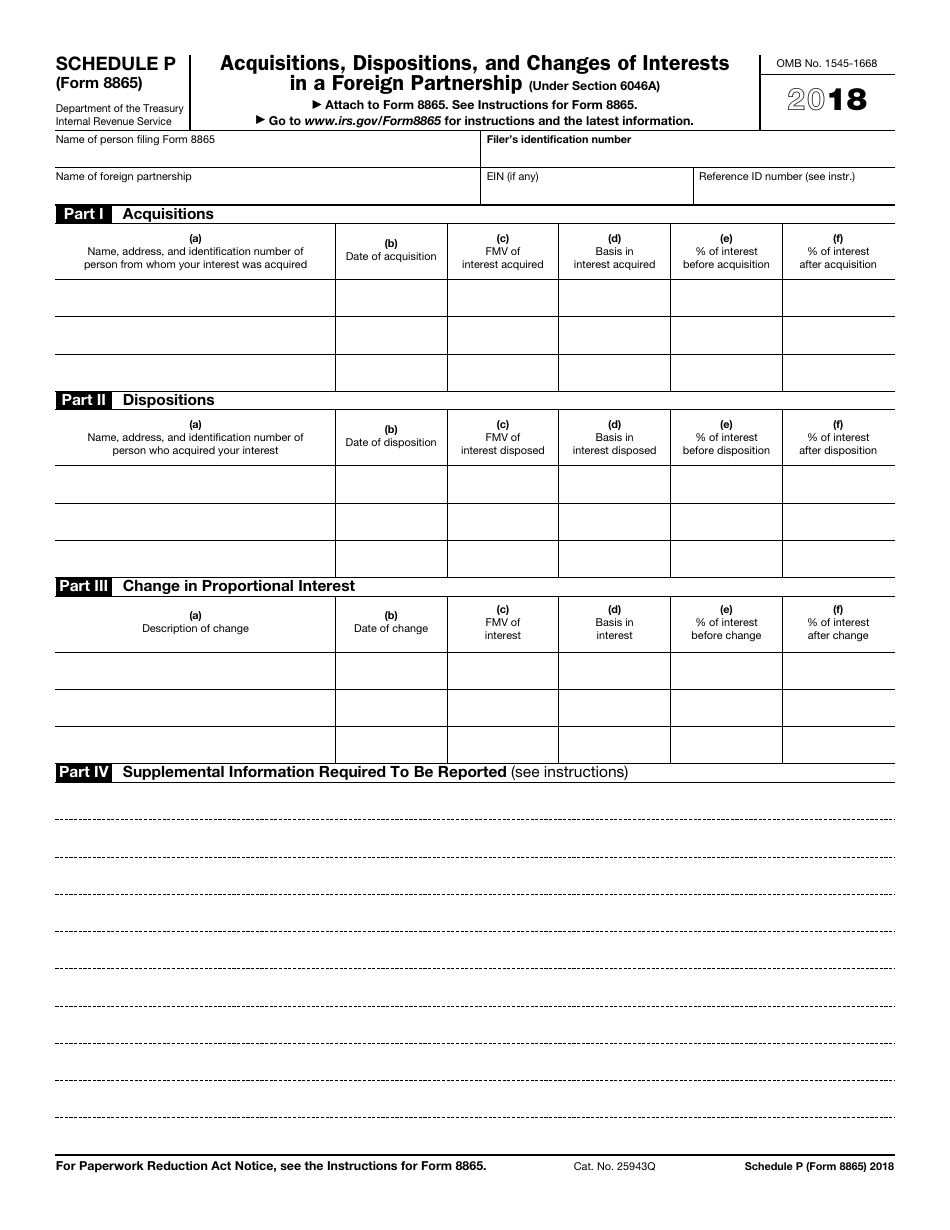

IRS Form 8865 Schedule P Acquisitions, Dispositions, and Changes of Interests in a Foreign Partnership (Under Section 6046a)

What Is IRS Form 8865 Schedule P?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8865 Schedule P used for?

A: IRS Form 8865 Schedule P is used to report acquisitions, dispositions, and changes of interests in a foreign partnership under Section 6046a.

Q: Who is required to file IRS Form 8865 Schedule P?

A: Partners who have an interest in a foreign partnership and who are required to file IRS Form 8865 are also required to file Schedule P if they had any acquisitions, dispositions, or changes of interests in the partnership during the tax year.

Q: What information needs to be provided in IRS Form 8865 Schedule P?

A: Schedule P requires information about the foreign partnership, the partner's interest in the partnership, and the acquisitions, dispositions, or changes of interests during the tax year.

Q: When is the deadline to file IRS Form 8865 Schedule P?

A: The deadline to file IRS Form 8865 Schedule P is generally the same as the deadline to file Form 8865, which is the 15th day of the 4th month following the end of the tax year.

Q: Are there any penalties for not filing IRS Form 8865 Schedule P?

A: Yes, failure to file IRS Form 8865 Schedule P or providing false information can result in penalties imposed by the IRS.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8865 Schedule P through the link below or browse more documents in our library of IRS Forms.