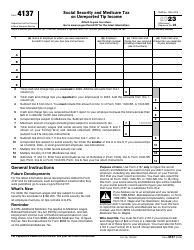

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8846

for the current year.

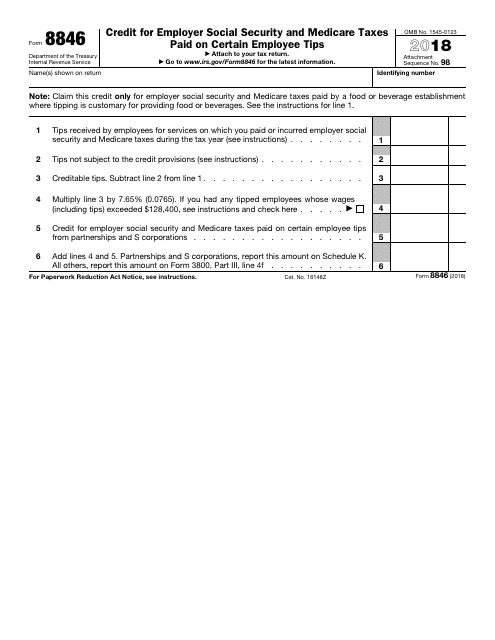

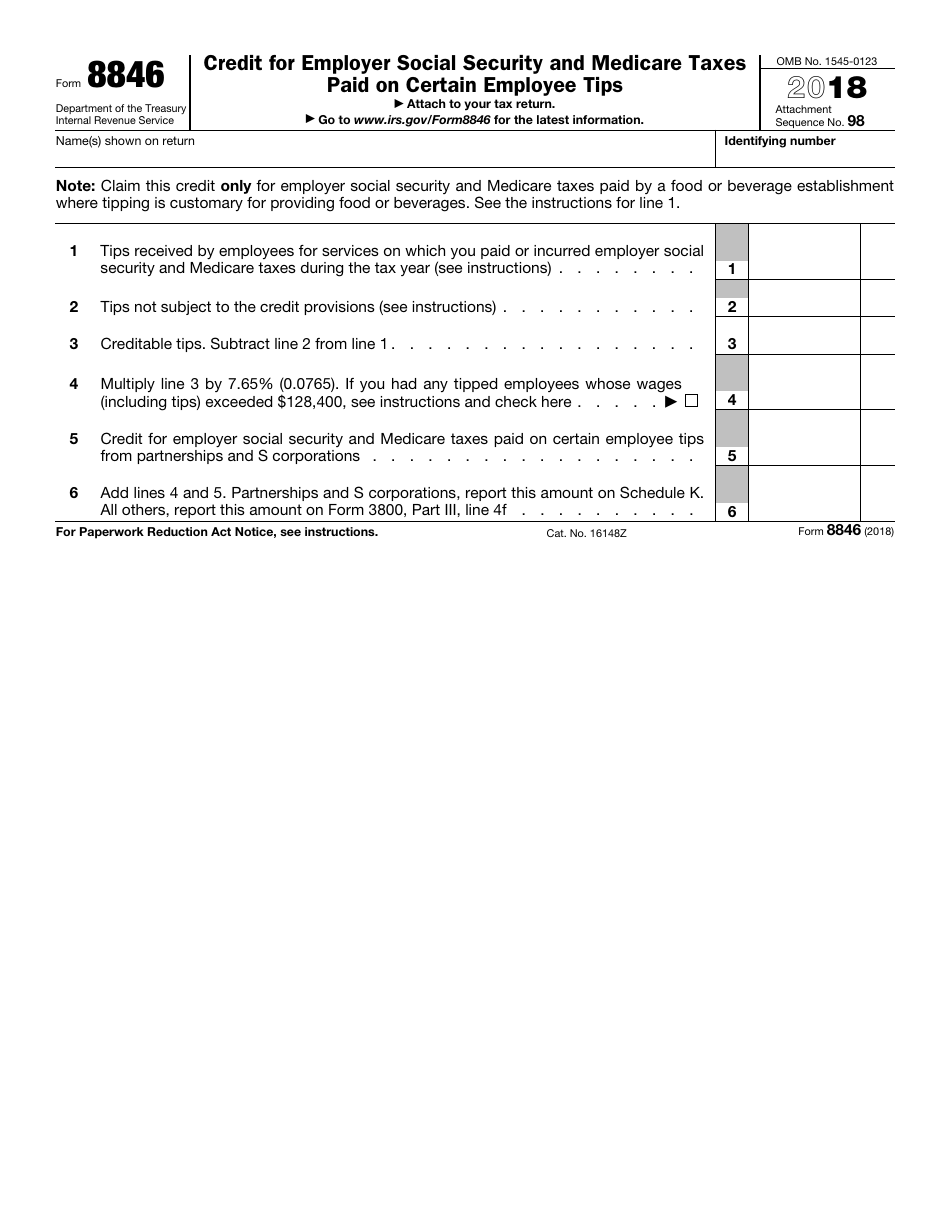

IRS Form 8846 Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips

What Is IRS Form 8846?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8846?

A: IRS Form 8846 is a form used to claim the credit for employer social security and Medicare taxes paid on certain employee tips.

Q: What is the purpose of IRS Form 8846?

A: The purpose of IRS Form 8846 is to claim a credit for the employer portion of social security and Medicare taxes paid on tips received by employees.

Q: Who should file IRS Form 8846?

A: Employers who have paid social security and Medicare taxes on tips received by their employees should file IRS Form 8846.

Q: What is the credit for employer social security and Medicare taxes on employee tips?

A: The credit is a dollar-for-dollar reduction in the employer's portion of social security and Medicare taxes paid on employee tips.

Q: How do I claim the credit for employer social security and Medicare taxes on employee tips?

A: To claim the credit, you need to complete IRS Form 8846 and attach it to your income tax return.

Q: Are there any eligibility requirements for claiming the credit?

A: Yes, there are eligibility requirements. The credit is only available to employers who operate a food and beverage establishment where tipping is customary and who have employees who receive tips.

Q: What documentation do I need to support my claim for the credit?

A: You will need to keep records of the tips reported to you by your employees and the social security and Medicare taxes you paid on those tips.

Q: Is there a deadline for filing IRS Form 8846?

A: Yes, IRS Form 8846 should be filed with your income tax return by the due date of the return, including extensions.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8846 through the link below or browse more documents in our library of IRS Forms.