This version of the form is not currently in use and is provided for reference only. Download this version of

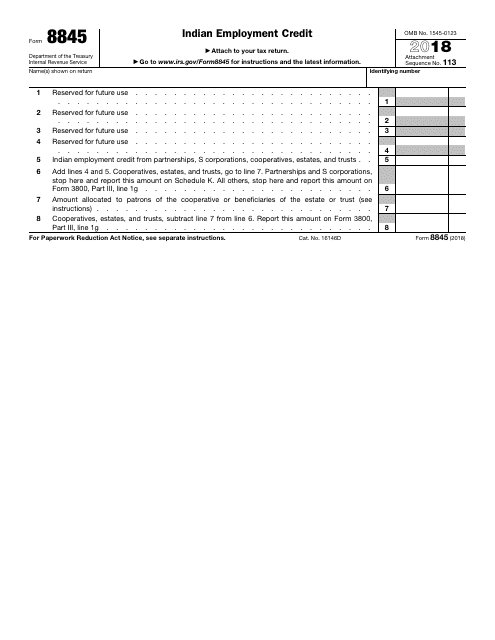

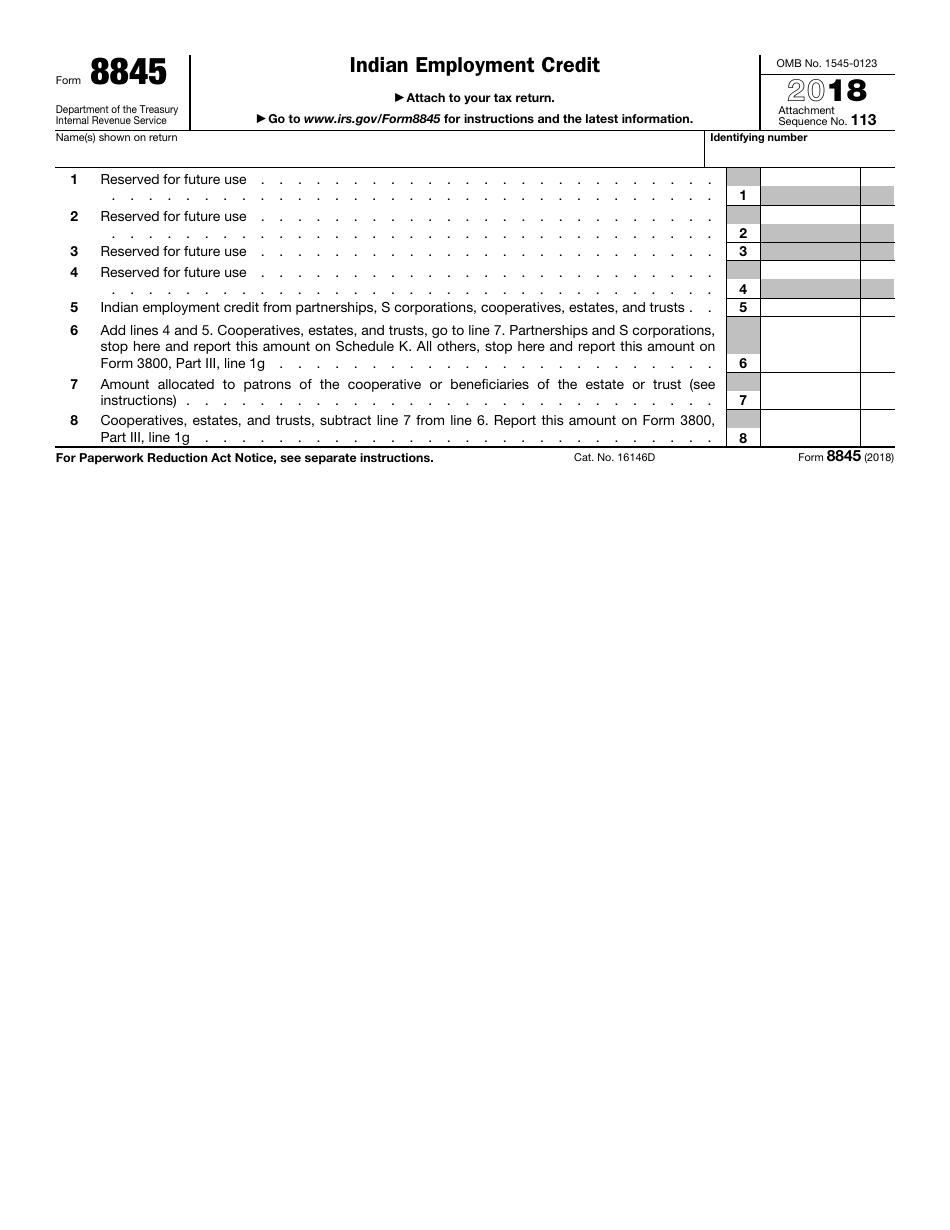

IRS Form 8845

for the current year.

IRS Form 8845 Indian Employment Credit

What Is IRS Form 8845?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8845?

A: IRS Form 8845 is a tax form used to claim the Indian Employment Credit.

Q: What is the Indian Employment Credit?

A: The Indian Employment Credit is a tax credit available to employers who hire Native American individuals that live on or near a reservation.

Q: Who is eligible to claim the Indian Employment Credit?

A: Employers who hire Native American individuals that live on or near a reservation are eligible to claim the Indian Employment Credit.

Q: How do I claim the Indian Employment Credit?

A: To claim the Indian Employment Credit, you need to complete and attach IRS Form 8845 to your tax return.

Q: Are there any specific requirements to qualify for the Indian Employment Credit?

A: Yes, there are specific requirements that need to be met in order to qualify for the Indian Employment Credit. These requirements include the employee being a Native American individual, residing on or near a reservation, and being employed by an eligible employer.

Q: What expenses can be considered for the Indian Employment Credit?

A: Expenses such as wages, health insurance, and retirement contributions paid to qualifying employees can be considered for the Indian Employment Credit.

Q: Is there a limit to the amount of credit that can be claimed?

A: Yes, there is a limit to the amount of Indian Employment Credit that can be claimed. The credit is generally 20% of the eligible expenses per qualified employee, up to a maximum credit of $20,000 per employee per year.

Q: Can the Indian Employment Credit be carried forward or backward?

A: Yes, any unused Indian Employment Credit can be carried forward for up to 20 years, or carried back for one year, to offset income tax liabilities.

Q: Are there any deadlines for filing IRS Form 8845?

A: IRS Form 8845 should be filed with your annual tax return by the due date of the return, including extensions.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8845 through the link below or browse more documents in our library of IRS Forms.