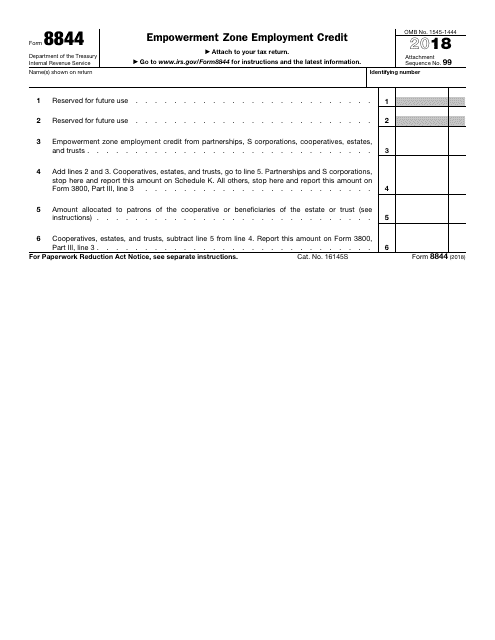

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8844

for the current year.

IRS Form 8844 Empowerment Zone Employment Credit

What Is IRS Form 8844?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8844?

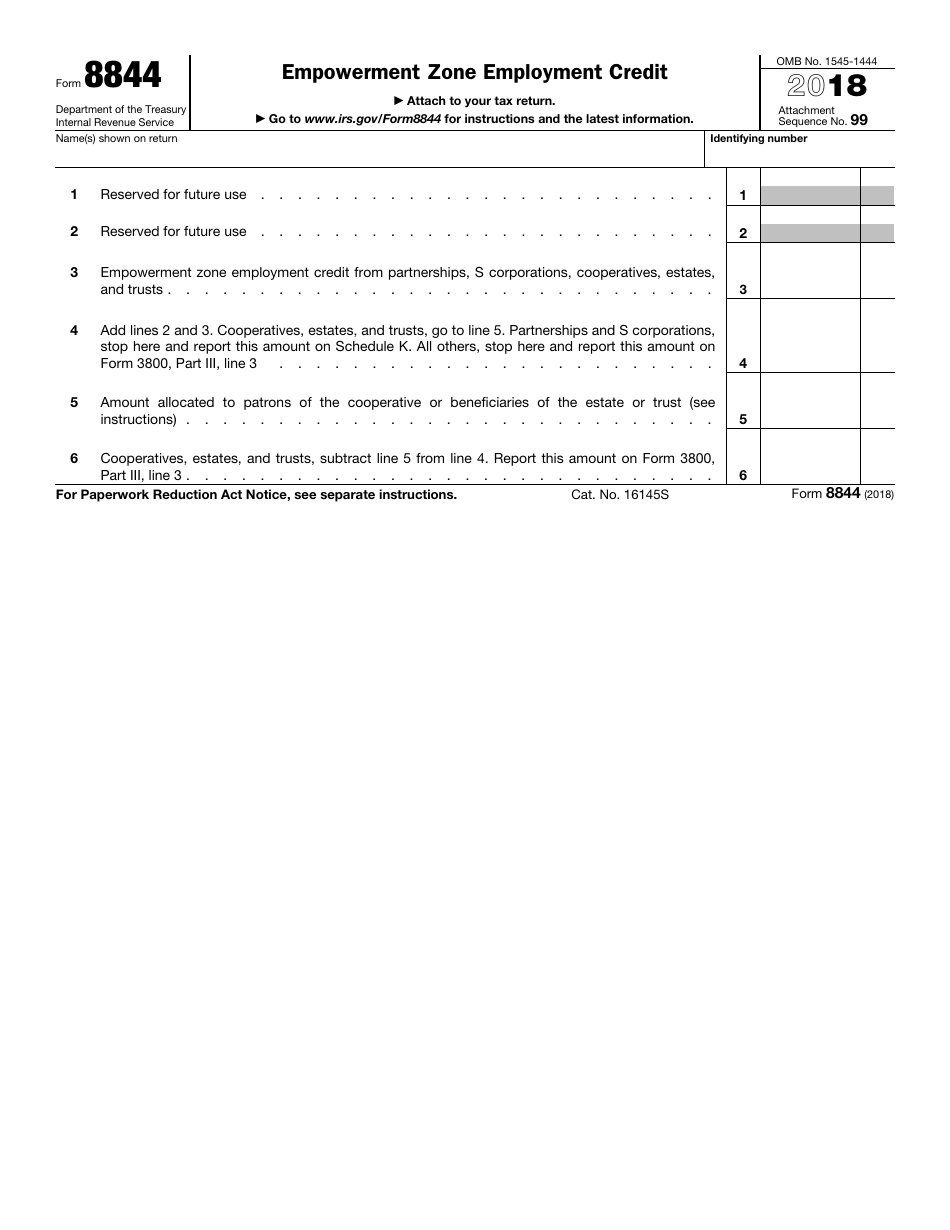

A: IRS Form 8844 is a tax form related to the Empowerment Zone Employment Credit.

Q: What is the Empowerment Zone Employment Credit?

A: The Empowerment Zone Employment Credit is a tax credit aimed at promoting employment in designated empowerment zones.

Q: Who is eligible for the Empowerment Zone Employment Credit?

A: Employers who hire employees who live and work in designated empowerment zones may be eligible for the credit.

Q: What is the purpose of Form 8844?

A: Form 8844 is used to claim the Empowerment Zone Employment Credit on your tax return.

Q: What information is required on Form 8844?

A: Form 8844 requires information about the employer, the qualified employee, and details about qualifying wages and employment.

Q: When is the deadline to file Form 8844?

A: Form 8844 is generally filed with your annual tax return, which is due on April 15th.

Q: How much is the Empowerment Zone Employment Credit?

A: The amount of the credit depends on various factors, such as the number of qualified employees and their wages.

Q: Can I claim the Empowerment Zone Employment Credit for multiple years?

A: Yes, the credit can be claimed for multiple tax years as long as the eligibility requirements are met.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8844 through the link below or browse more documents in our library of IRS Forms.