This version of the form is not currently in use and is provided for reference only. Download this version of

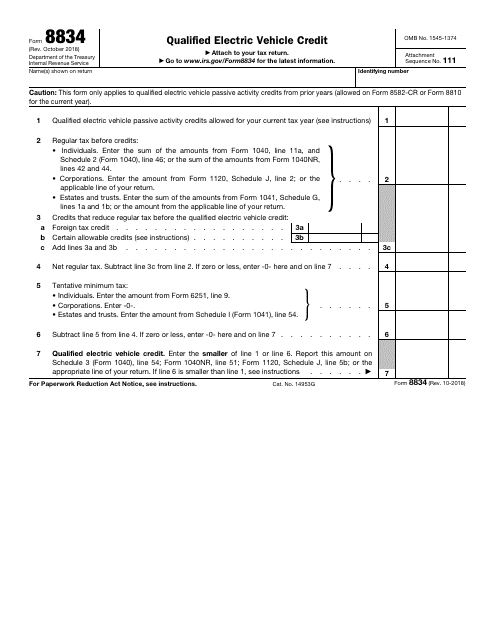

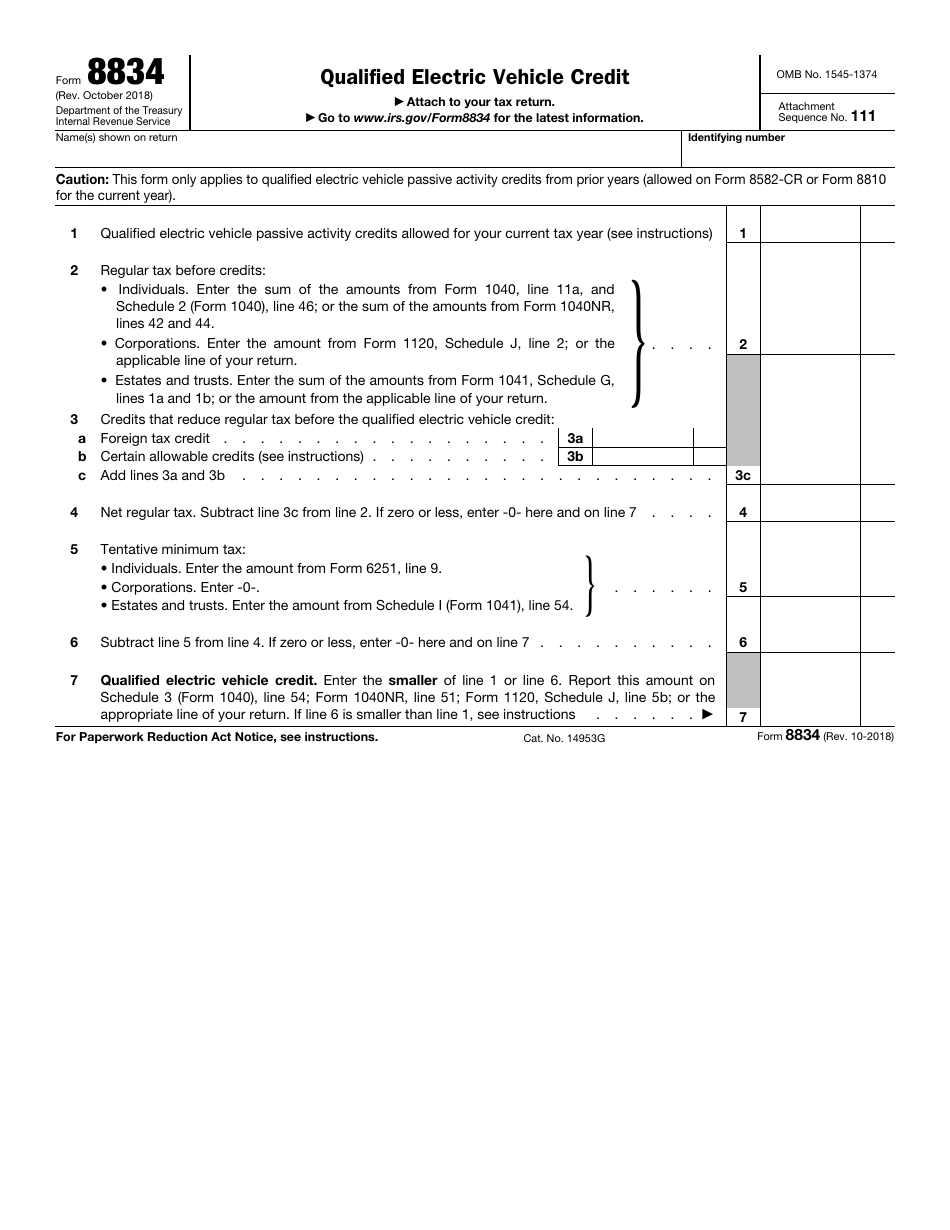

IRS Form 8834

for the current year.

IRS Form 8834 Qualified Electric Vehicle Credit

What Is IRS Form 8834?

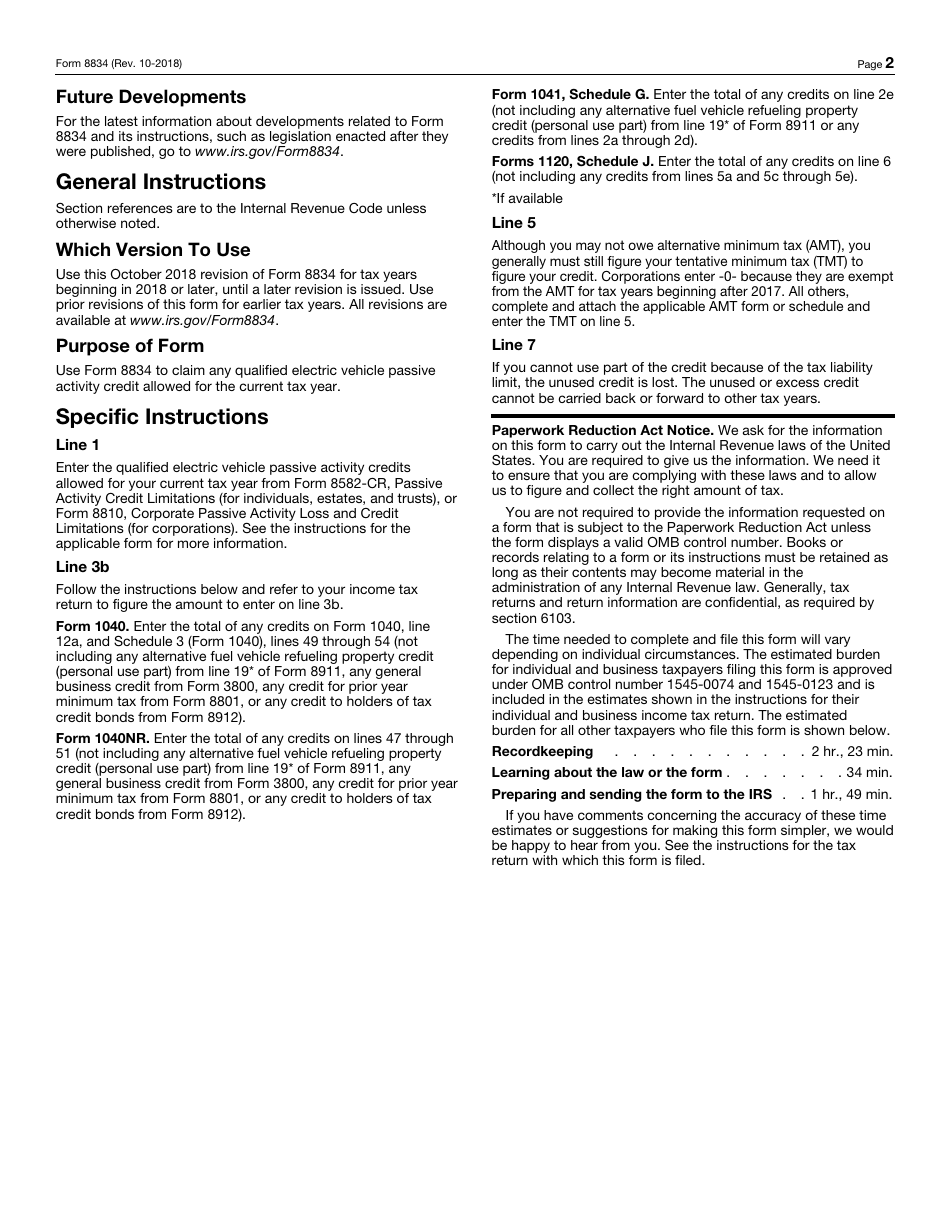

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8834?

A: IRS Form 8834 is a form used to claim the qualified electric vehicle credit.

Q: Who can use IRS Form 8834?

A: Taxpayers who have purchased a qualifying electric vehicle can use IRS Form 8834 to claim the tax credit.

Q: What is the qualified electric vehicle credit?

A: The qualified electric vehicle credit is a tax credit available to individuals who purchase a qualified electric vehicle.

Q: What is a qualifying electric vehicle?

A: A qualifying electric vehicle is a vehicle that is propelled primarily by an electric motor and meets certain requirements set by the IRS.

Q: How much is the electric vehicle credit?

A: The amount of the credit depends on the type of vehicle and its battery capacity, with a maximum credit of $7,500.

Q: Do all electric vehicles qualify for the credit?

A: No, only certain electric vehicles that meet the IRS criteria qualify for the credit.

Q: How do I claim the qualified electric vehicle credit?

A: To claim the credit, you need to complete and file IRS Form 8834 along with your annual tax return.

Q: Are there any limitations or restrictions on the qualified electric vehicle credit?

A: Yes, there are income limitations and phase-out rules that may affect the amount of the credit you can claim.

Q: Is the qualified electric vehicle credit refundable?

A: No, the qualified electric vehicle credit is not refundable, meaning it can only be used to offset your tax liability.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8834 through the link below or browse more documents in our library of IRS Forms.