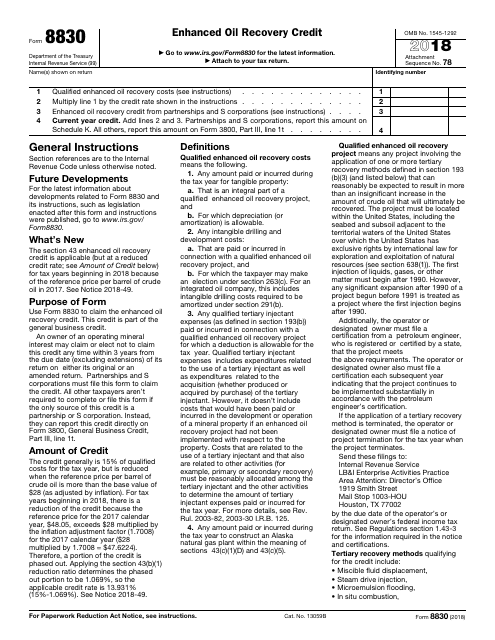

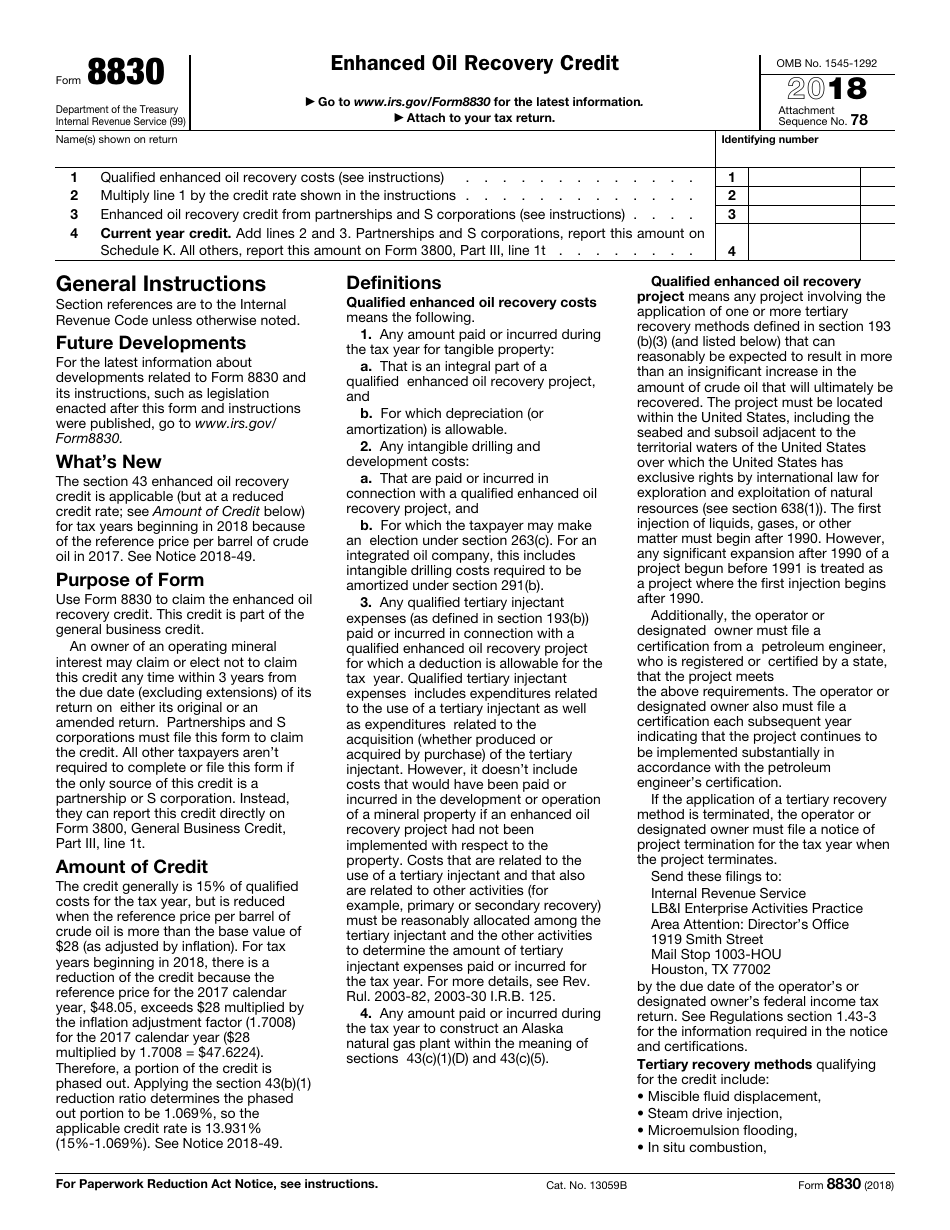

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8830

for the current year.

IRS Form 8830 Enhanced Oil Recovery Credit

What Is IRS Form 8830?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8830?

A: IRS Form 8830 is a form used to claim the Enhanced Oil Recovery Credit.

Q: What is the Enhanced Oil Recovery Credit?

A: The Enhanced Oil Recovery Credit is a tax credit that incentivizes the use of enhanced oil recovery methods to increase domestic oil production.

Q: Who is eligible to claim the Enhanced Oil Recovery Credit?

A: Oil producers and investors who engage in enhanced oil recovery activities are eligible to claim the credit.

Q: What are enhanced oil recovery methods?

A: Enhanced oil recovery methods are techniques used to increase the extraction of oil from existing oil wells, such as injecting chemicals or steam into the well.

Q: Why is the Enhanced Oil Recovery Credit important?

A: The credit encourages investment in innovative oil extraction methods, reduces dependence on foreign oil, and stimulates domestic oil production.

Q: How do I fill out IRS Form 8830?

A: To fill out IRS Form 8830, you will need to provide information about your oil production activities and calculate the amount of credit you are eligible for.

Q: Are there any deadlines for filing IRS Form 8830?

A: Yes, IRS Form 8830 must be filed with your annual tax return by the due date, including extensions.

Q: What documentation do I need to support my Enhanced Oil Recovery Credit claim?

A: You should keep records and documentation that support your claim, such as production reports, invoices, and receipts for qualified expenses.

Q: Can I claim the Enhanced Oil Recovery Credit if I am not an oil producer?

A: No, only oil producers and investors directly involved in enhanced oil recovery activities are eligible to claim the credit.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8830 through the link below or browse more documents in our library of IRS Forms.