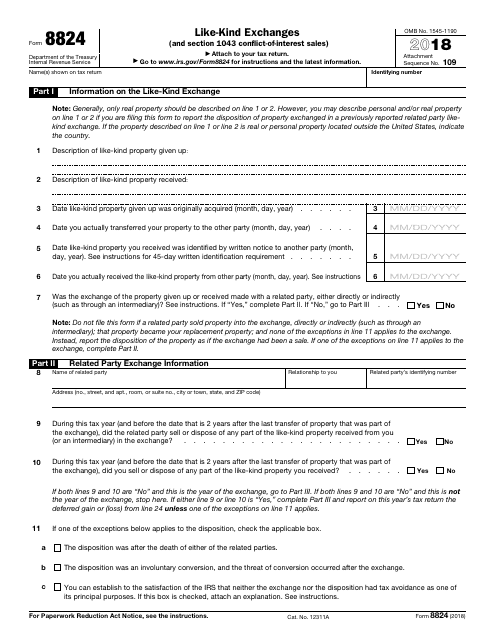

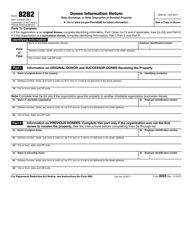

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8824

for the current year.

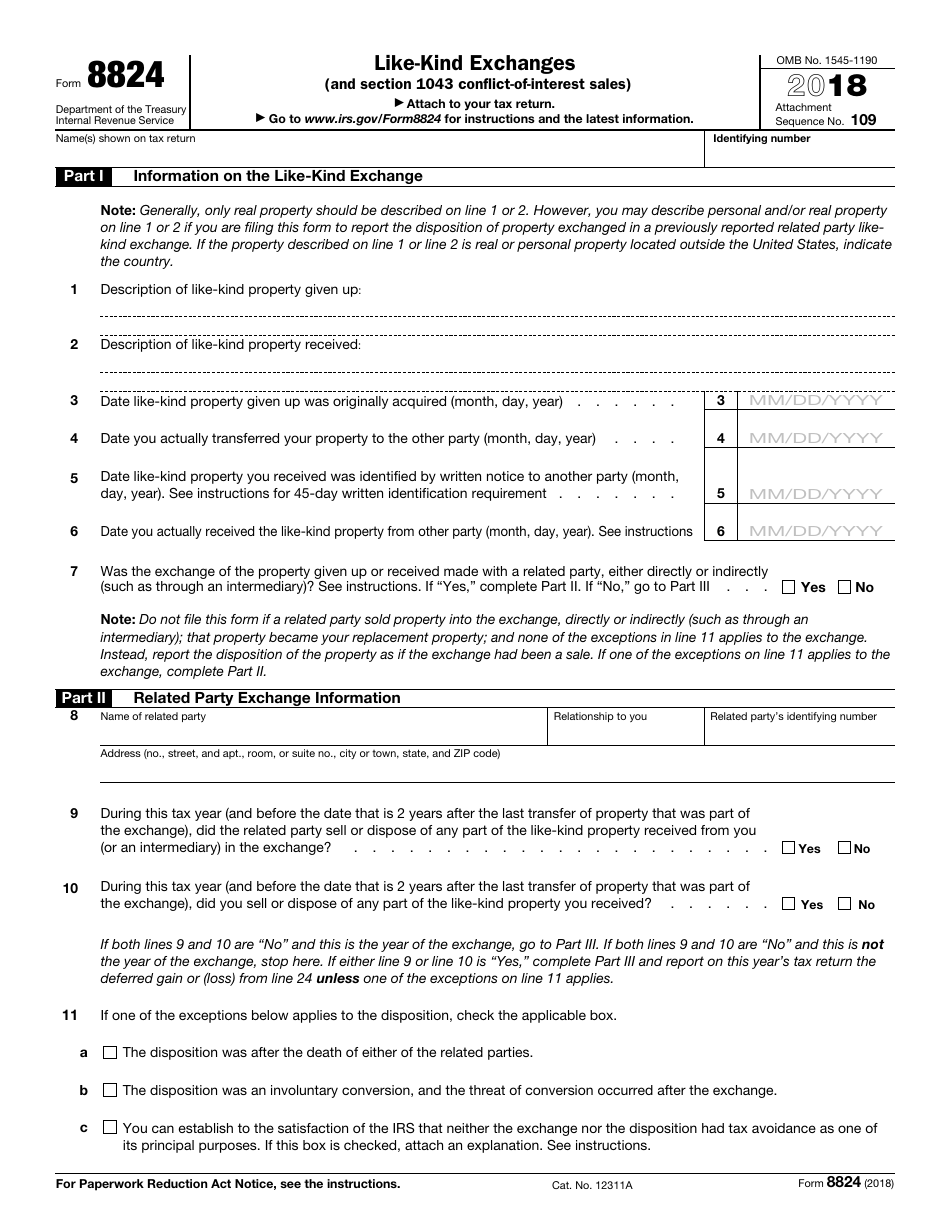

IRS Form 8824 Like-Kind Exchanges (And Section 1043 Conflict-Of-Interest Sales)

What Is IRS Form 8824?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8824?

A: IRS Form 8824 is used for reporting like-kind exchanges and section 1043 conflict-of-interest sales.

Q: What is a like-kind exchange?

A: A like-kind exchange is a transaction where you exchange property held for productive use or investment for another property that is similar in nature or character.

Q: What is a section 1043 conflict-of-interest sale?

A: A section 1043 conflict-of-interest sale is a transaction where you sell property acquired through a conflict of interest, such as the sale of property to avoid a potential conflict.

Q: Who needs to file IRS Form 8824?

A: Taxpayers who have engaged in a like-kind exchange or a section 1043 conflict-of-interest sale during the tax year must file IRS Form 8824.

Q: What information is required on IRS Form 8824?

A: IRS Form 8824 requires information about the properties exchanged, the cost or basis of the properties, any boot received or paid, and other details related to the exchange or sale.

Q: When is the deadline to file IRS Form 8824?

A: IRS Form 8824 should be filed with your tax return for the year in which the like-kind exchange or section 1043 conflict-of-interest sale occurred.

Q: Are there any special rules or considerations for like-kind exchanges?

A: Yes, there are specific rules and requirements that must be followed for a like-kind exchange to qualify for tax deferral. It is recommended to consult a tax professional for guidance.

Q: Can I e-file IRS Form 8824?

A: Yes, IRS Form 8824 can be e-filed along with your tax return, if supported by your chosen tax software or tax professional.

Q: Are there any penalties for not filing IRS Form 8824?

A: Failure to file IRS Form 8824 when required may result in penalties and interest on any taxes owed from the like-kind exchange or section 1043 conflict-of-interest sale.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8824 through the link below or browse more documents in our library of IRS Forms.