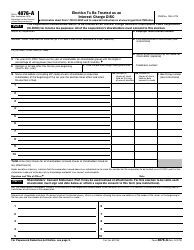

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8814

for the current year.

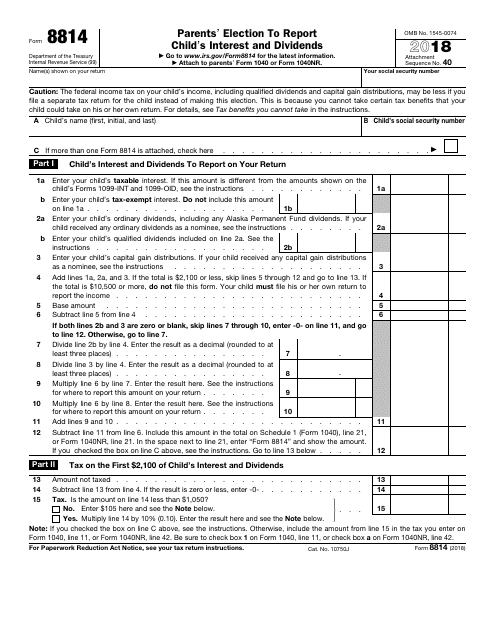

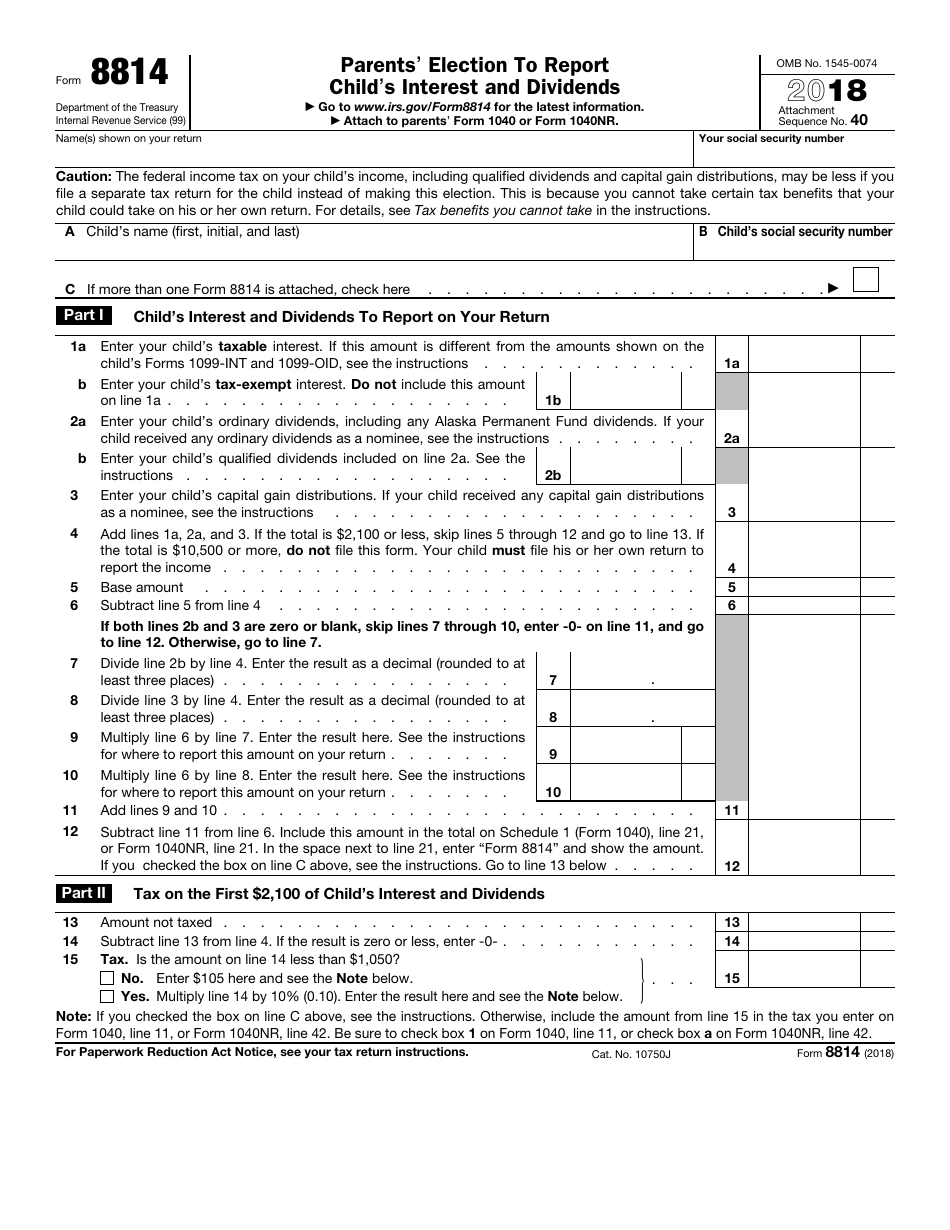

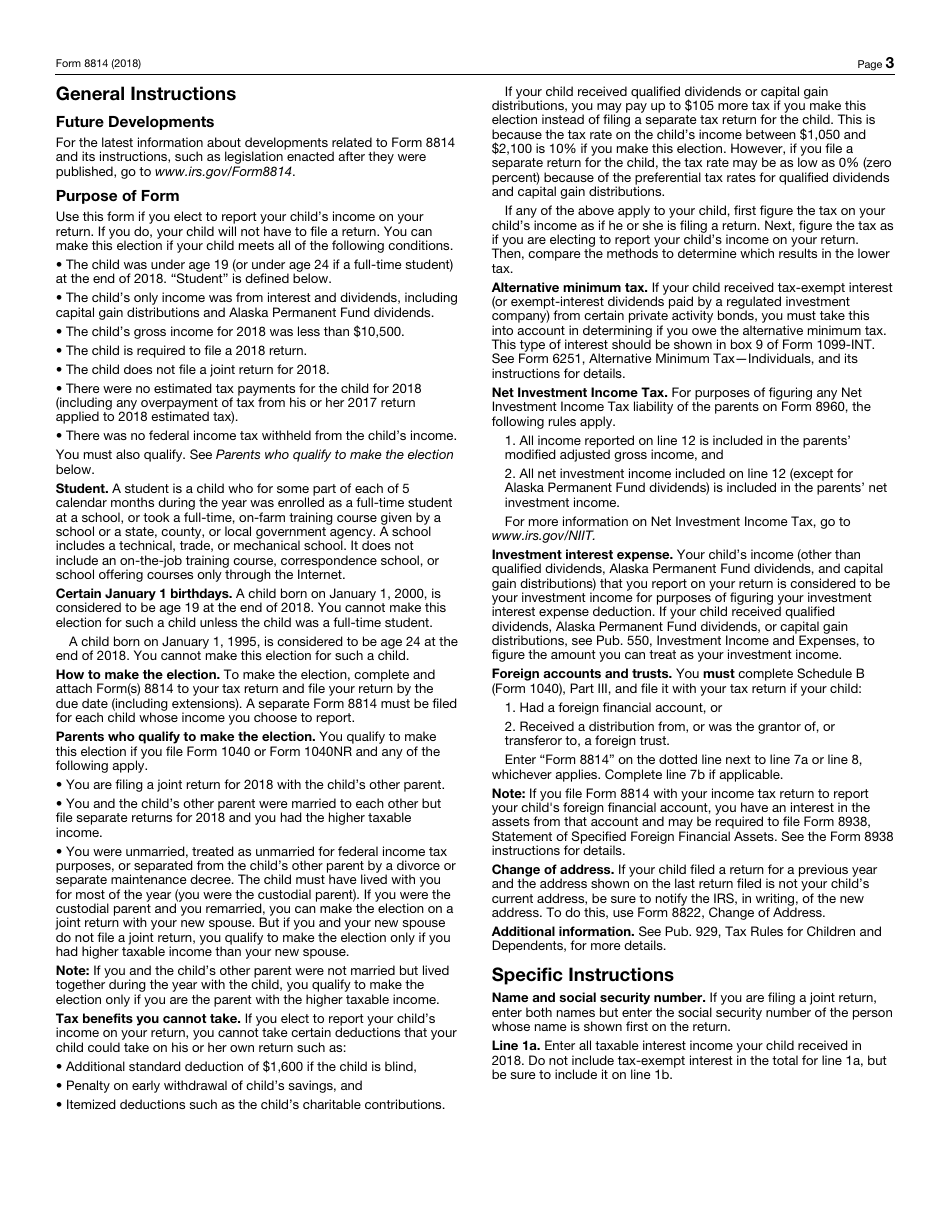

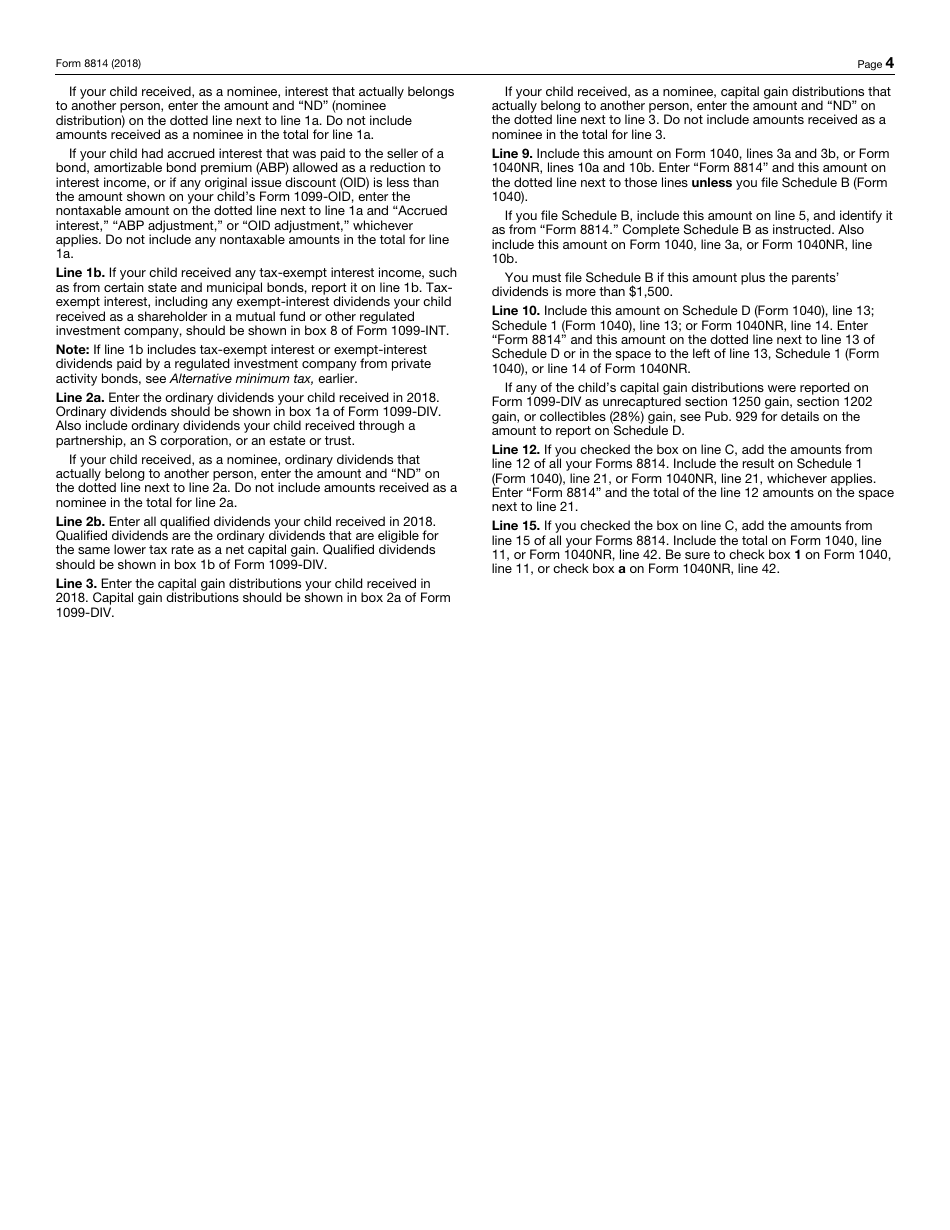

IRS Form 8814 Parents' Election to Report Child's Interest and Dividends

What Is IRS Form 8814?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8814?

A: IRS Form 8814 is a form used by parents to report their child's interest and dividends on their tax return.

Q: Who uses IRS Form 8814?

A: Parents use IRS Form 8814 to report their child's interest and dividends.

Q: What is the purpose of IRS Form 8814?

A: The purpose of IRS Form 8814 is to report a child's interest and dividends and elect to include them on the parent's tax return.

Q: When is IRS Form 8814 used?

A: IRS Form 8814 is used when a child has interest and dividend income and the parent wants to report it on their own tax return.

Q: Is IRS Form 8814 required?

A: IRS Form 8814 is not always required, but it may be beneficial for parents to report their child's interest and dividends on their own tax return.

Q: Are there any eligibility requirements to use IRS Form 8814?

A: Yes, there are eligibility requirements for using IRS Form 8814. The child must be under the age of 19 (or under 24 if a full-time student) and must not file a joint return.

Q: What should I do if I have questions about filling out IRS Form 8814?

A: If you have questions about filling out IRS Form 8814, you can consult the instructions provided by the IRS or seek guidance from a tax professional.

Q: Can I electronically file IRS Form 8814?

A: Yes, you can electronically file IRS Form 8814 using tax software or through a paid tax professional.

Q: What are the consequences of not filing IRS Form 8814?

A: If you are required to file IRS Form 8814 and fail to do so, you may face penalties and interest on any unreported income.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8814 through the link below or browse more documents in our library of IRS Forms.