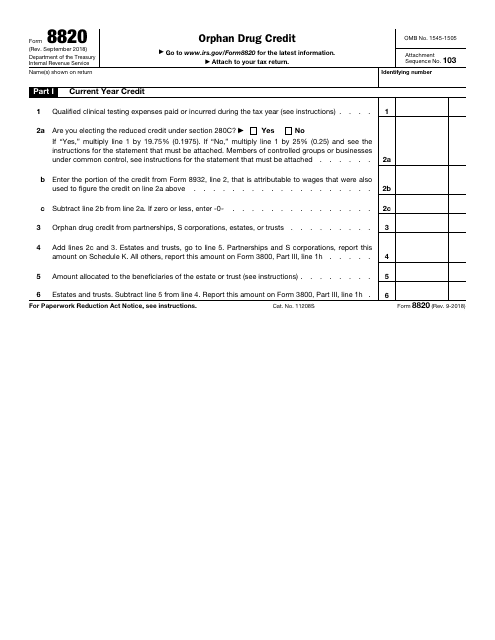

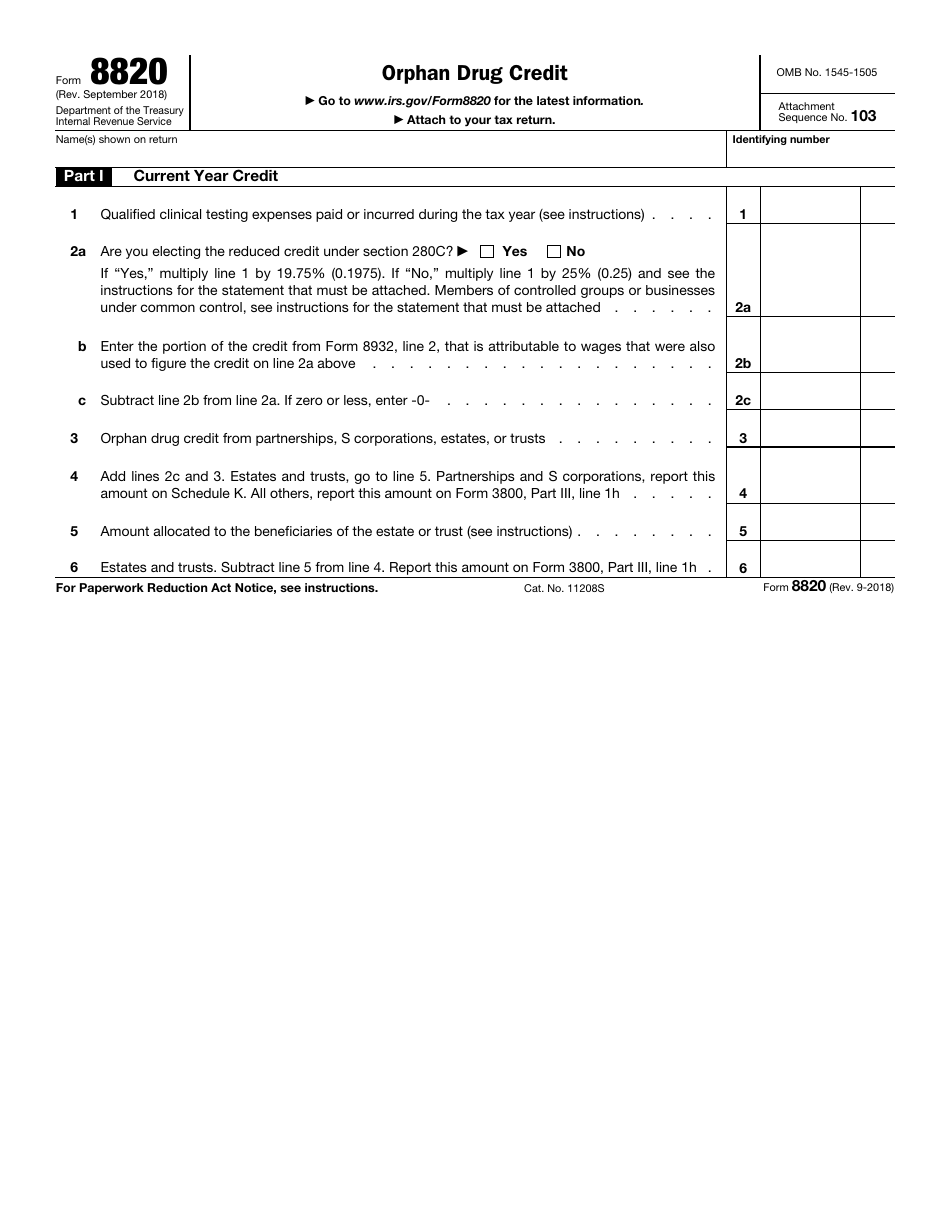

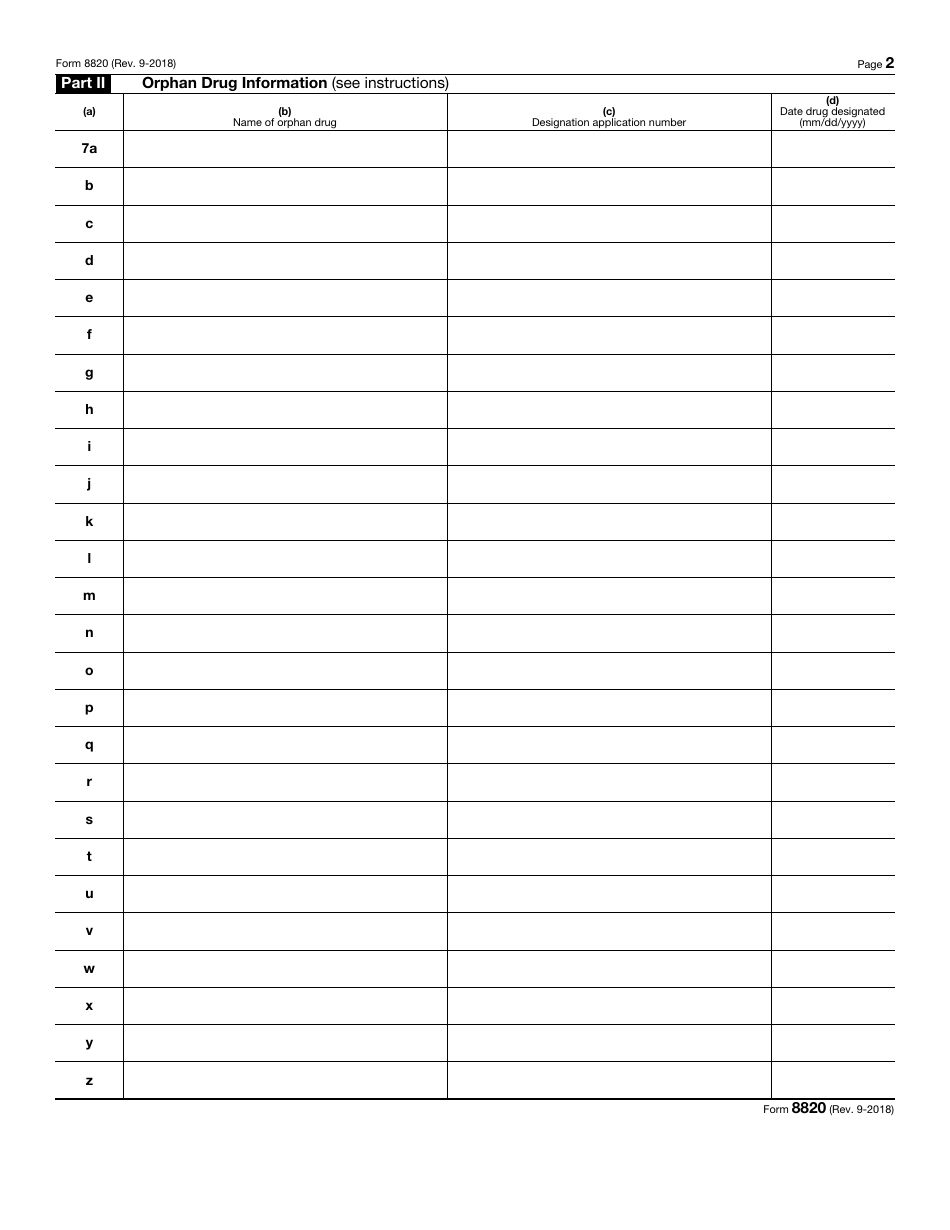

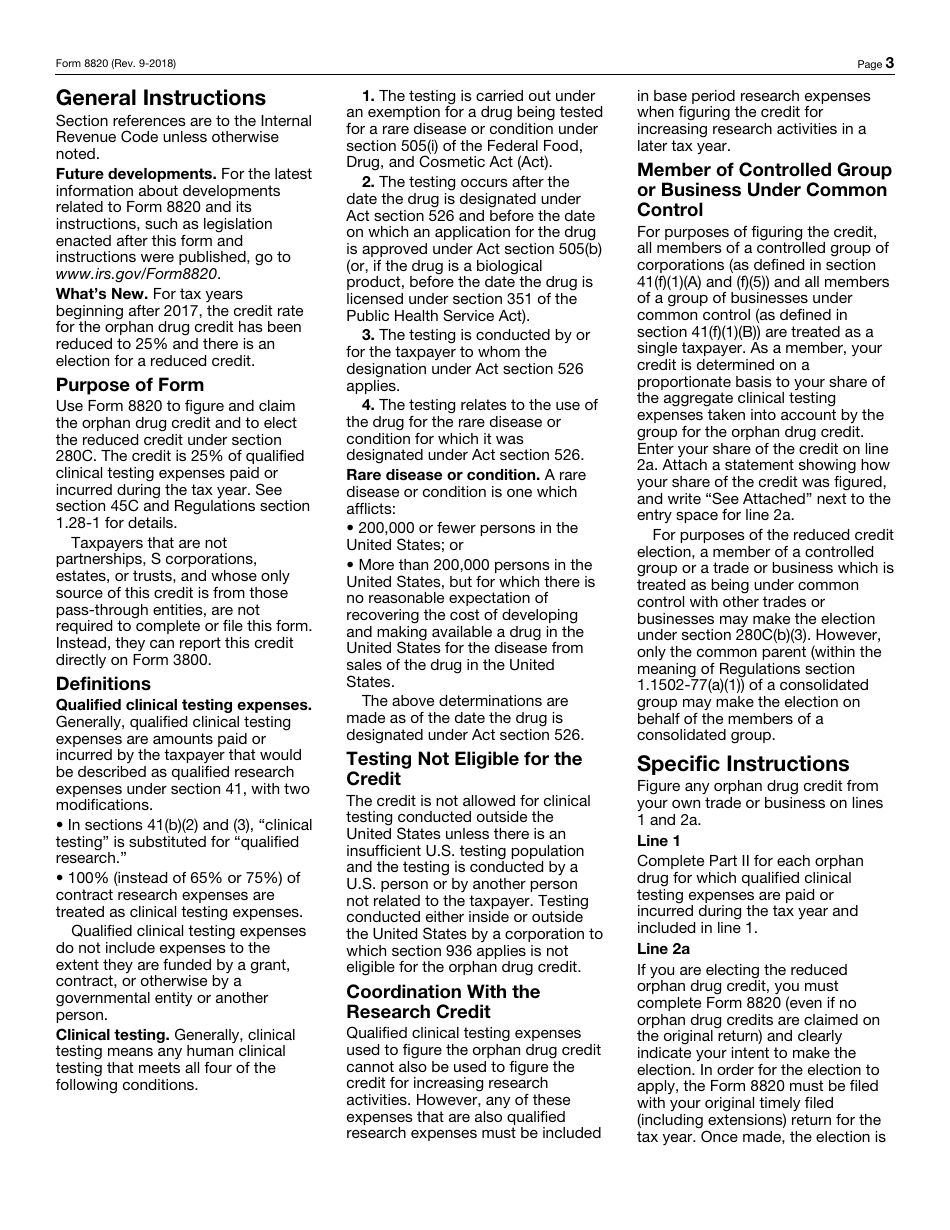

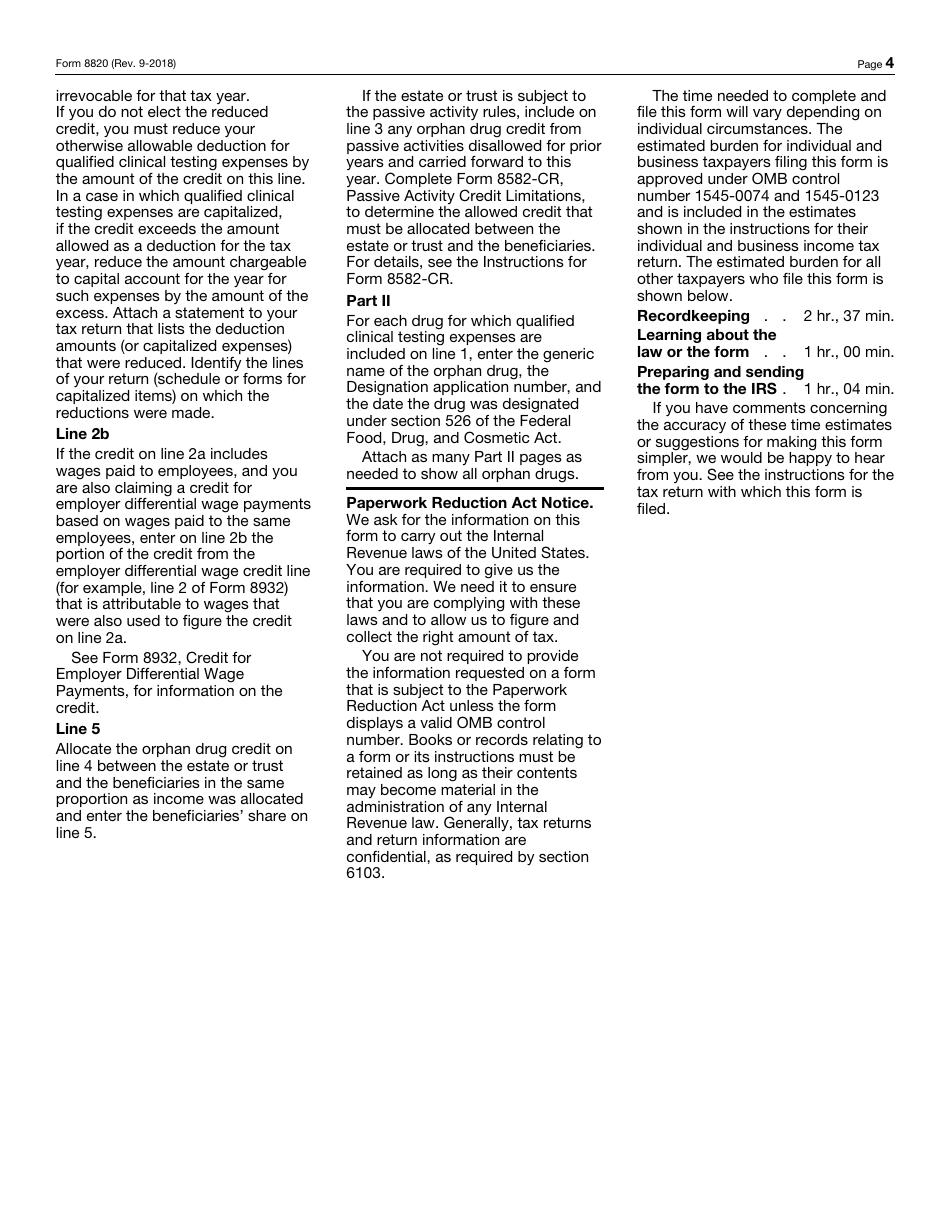

IRS Form 8820 Orphan Drug Credit

What Is IRS Form 8820?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8820?

A: IRS Form 8820, Orphan Drug Credit, is a form used to claim the orphan drug credit for qualified clinical testing expenses.

Q: What is the Orphan Drug Credit?

A: The Orphan Drug Credit is a tax credit provided by the IRS to incentivize companies to develop drugs for rare diseases.

Q: Who is eligible to claim the Orphan Drug Credit?

A: Companies that incur qualified clinical testing expenses for developing drugs for rare diseases may be eligible to claim the Orphan Drug Credit.

Q: What are qualified clinical testing expenses?

A: Qualified clinical testing expenses include wages, supplies, and other costs directly related to the clinical testing of a drug for a rare disease.

Q: How much is the Orphan Drug Credit?

A: The Orphan Drug Credit is equal to 25% of qualified clinical testing expenses incurred.

Q: How can I claim the Orphan Drug Credit?

A: You can claim the Orphan Drug Credit by completing and filing IRS Form 8820 with your tax return.

Q: Is there a deadline for claiming the Orphan Drug Credit?

A: The deadline for claiming the Orphan Drug Credit is the due date of your tax return, usually April 15th.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8820 through the link below or browse more documents in our library of IRS Forms.