This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8815

for the current year.

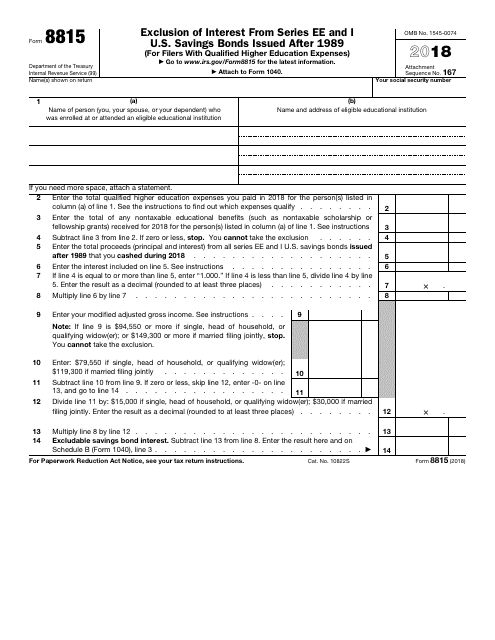

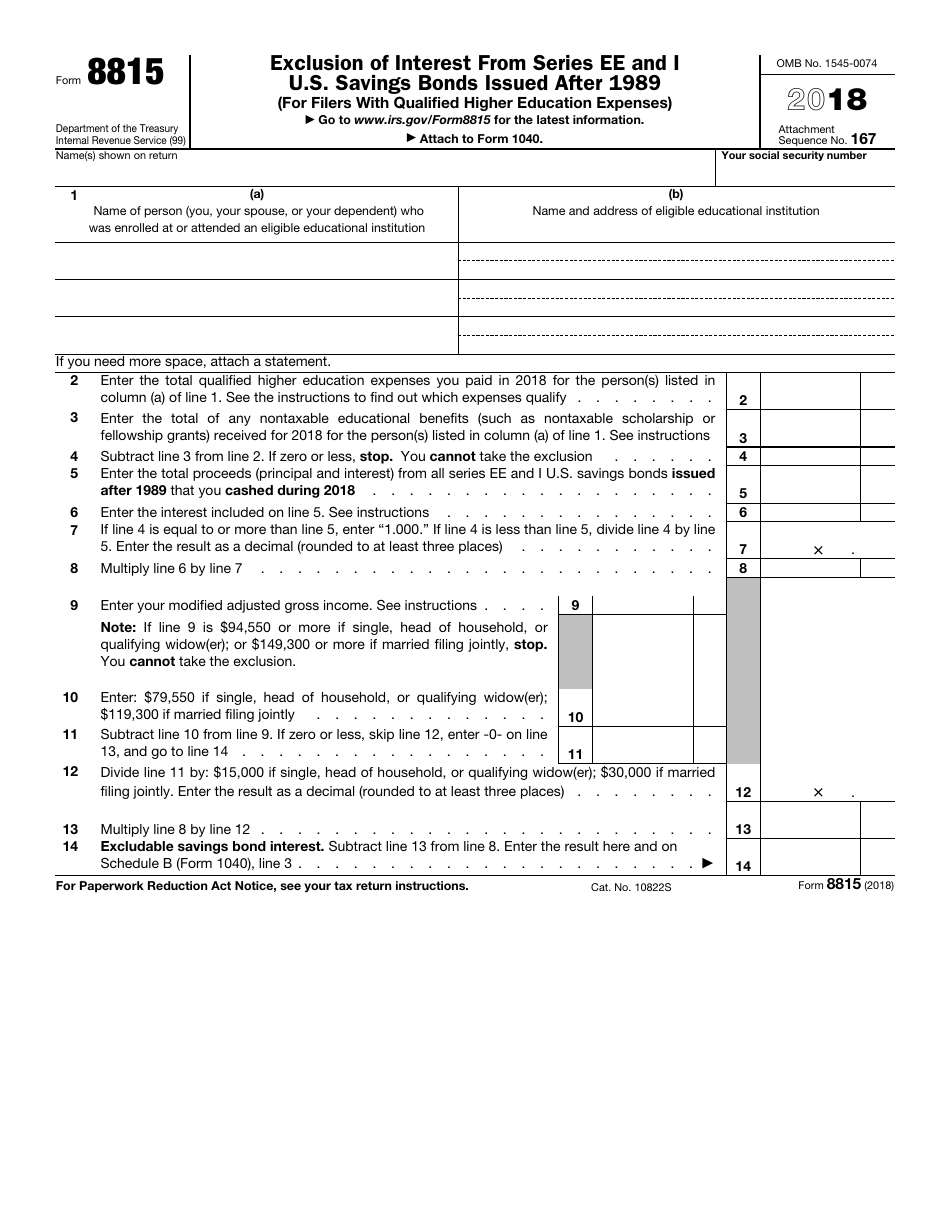

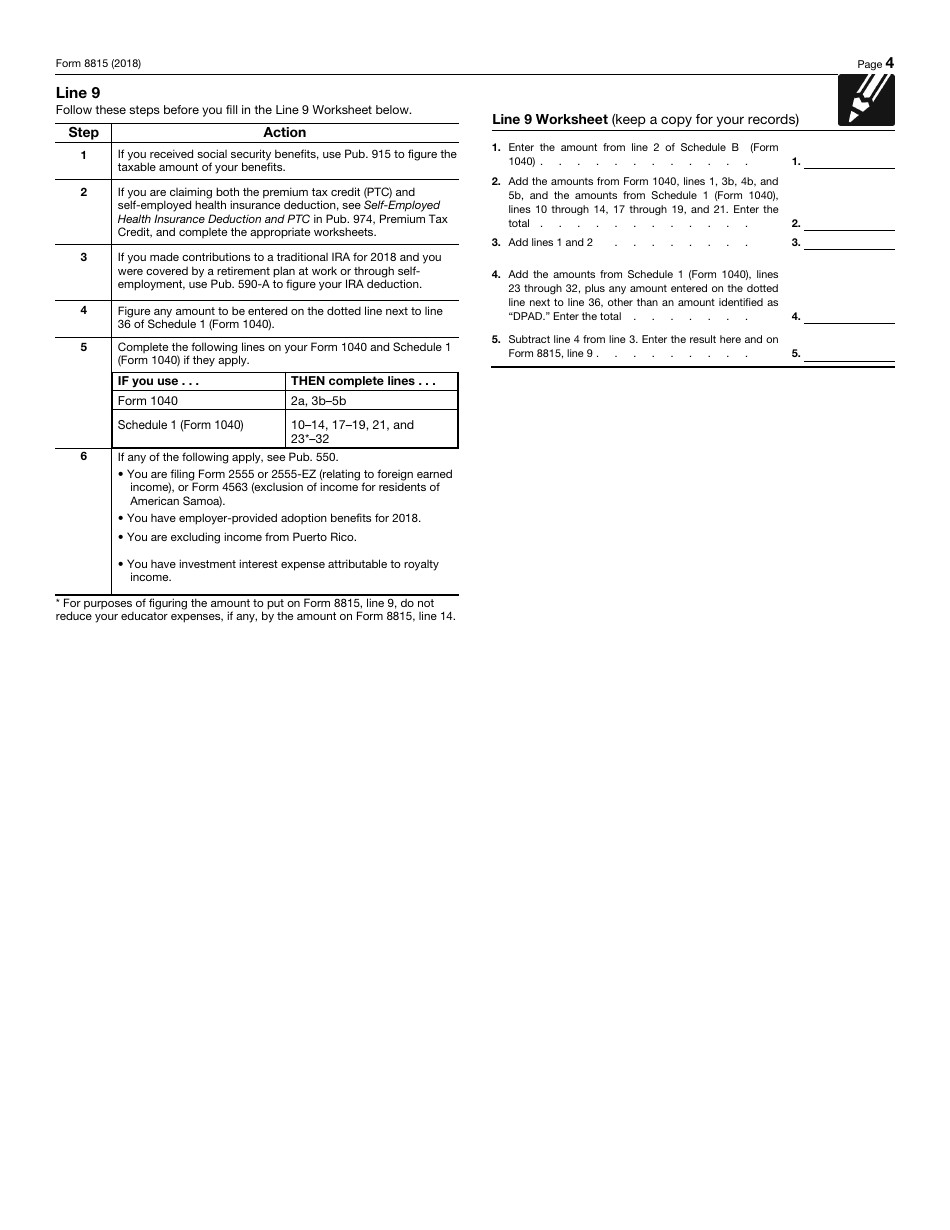

IRS Form 8815 Exclusion of Interest From Series Ee and I U.S. Savings Bonds Issued After 1989 (For Filers With Qualified Higher Education Expenses)

What Is IRS Form 8815?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8815?

A: IRS Form 8815 is a form used to exclude interest from Series EE and I U.S. Savings Bonds issued after 1989 for filers with qualified higher education expenses.

Q: Who is eligible to use IRS Form 8815?

A: Individuals who have incurred qualified higher education expenses and who meet certain requirements can use IRS Form 8815.

Q: What are qualified higher education expenses?

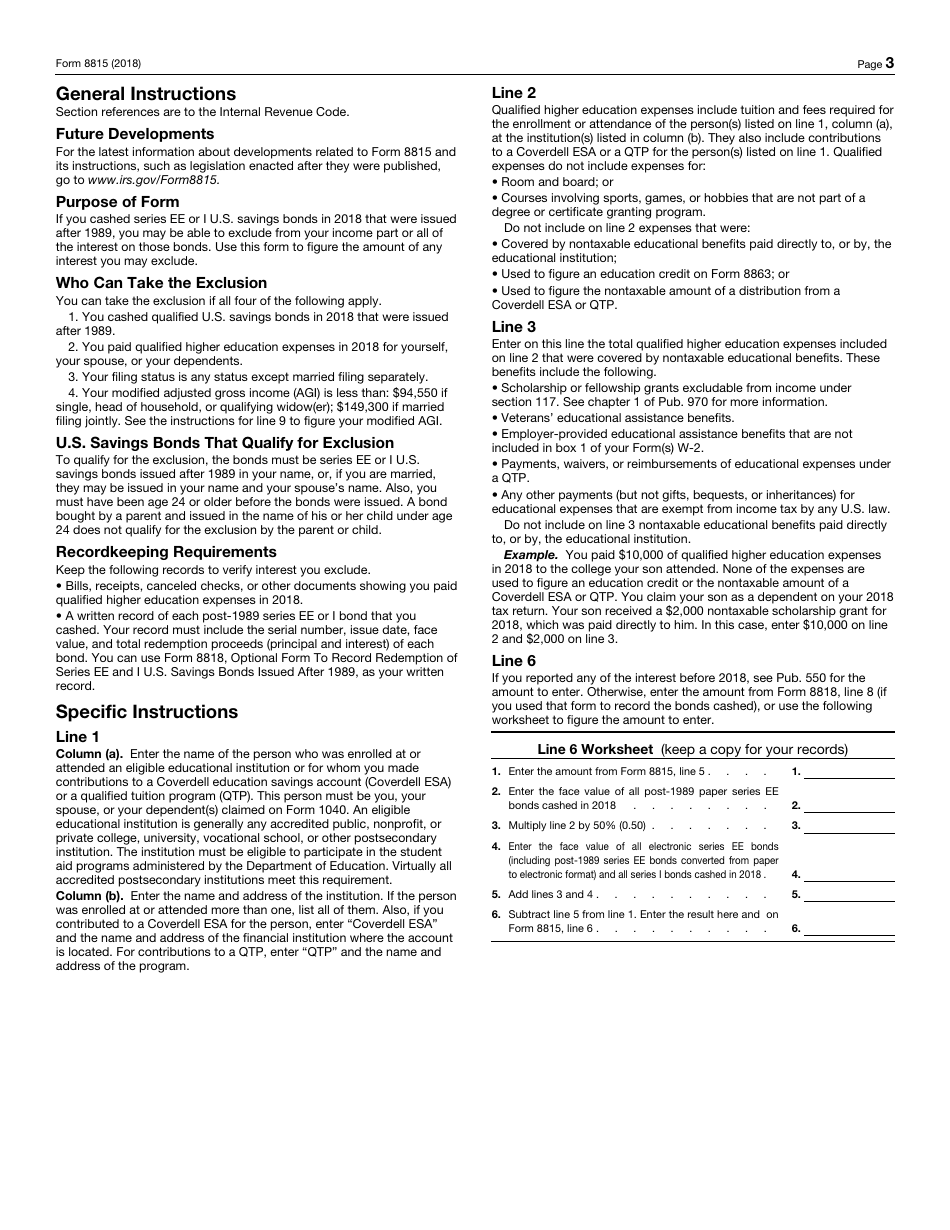

A: Qualified higher education expenses include tuition, fees, and certain other expenses related to higher education.

Q: How does IRS Form 8815 help with taxes?

A: By using IRS Form 8815, individuals can exclude the interest earned from Series EE and I U.S. Savings Bonds issued after 1989 from their taxable income if the interest is used for qualified higher education expenses.

Q: Are there any limitations on using IRS Form 8815?

A: Yes, there are income limitations and other requirements that must be met in order to use IRS Form 8815.

Q: Can I e-file IRS Form 8815?

A: Yes, IRS Form 8815 can be e-filed if you are using an electronically-filed tax return.

Q: What should I do if I have questions about IRS Form 8815?

A: If you have specific questions about IRS Form 8815, it is recommended to consult with a tax professional or the IRS directly for assistance.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8815 through the link below or browse more documents in our library of IRS Forms.