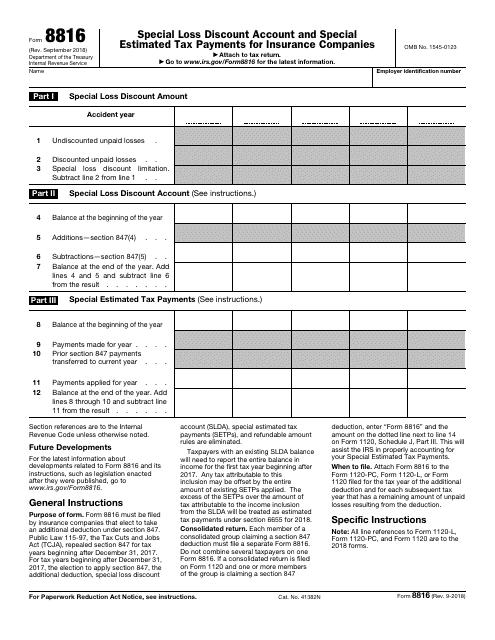

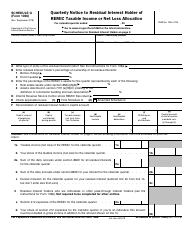

IRS Form 8816 Special Loss Discount Account and Special Estimated Tax Payments for Insurance Companies

What Is IRS Form 8816?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8816?

A: IRS Form 8816 is a form used by insurance companies to report their special loss discount account and make special estimated tax payments.

Q: What is a special loss discount account?

A: A special loss discount account is an account that insurance companies use to track deductions related to losses from certain insurance contracts.

Q: Who is required to file IRS Form 8816?

A: Insurance companies that have a special loss discount account and are making special estimated tax payments need to file IRS Form 8816.

Q: What are special estimated tax payments?

A: Special estimated tax payments are payments made by insurance companies to ensure that they are paying the correct amount of taxes throughout the year rather than waiting until the end of the year.

Q: When is IRS Form 8816 due?

A: IRS Form 8816 is typically due on the 15th day of the third month following the end of the insurance company's tax year.

Q: What happens if I don't file IRS Form 8816?

A: Failure to file IRS Form 8816 or make special estimated tax payments may result in penalties and interest being charged by the IRS.

Q: Are there any exceptions or special rules for filing IRS Form 8816?

A: Yes, there are certain exceptions and special rules that may apply. Insurance companies should consult the instructions for IRS Form 8816 or seek professional tax advice to determine their specific requirements.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8816 through the link below or browse more documents in our library of IRS Forms.