This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8801

for the current year.

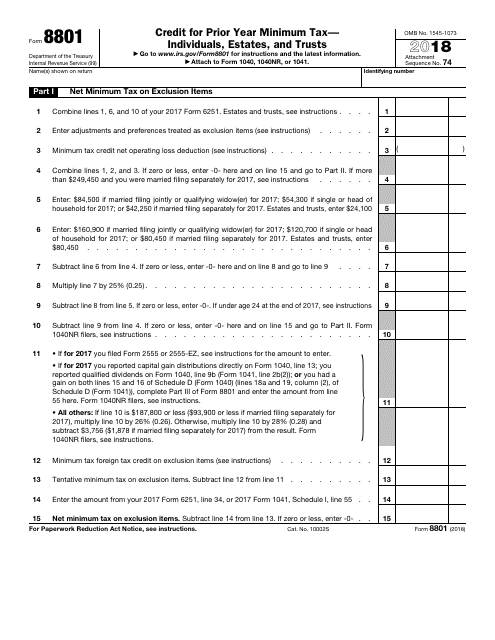

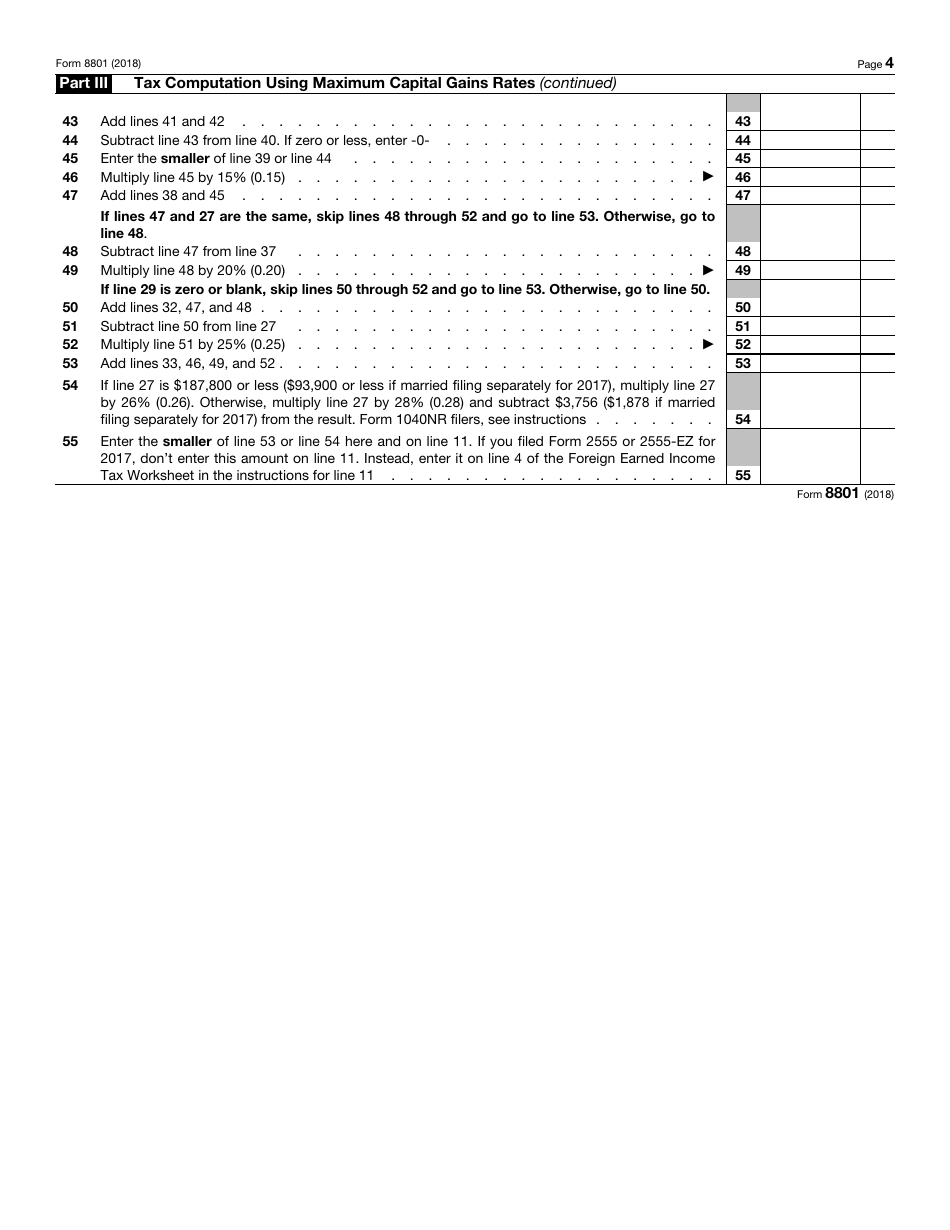

IRS Form 8801 Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts

What Is IRS Form 8801?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8801?

A: IRS Form 8801, also known as the Credit for Prior Year Minimum Tax, is a form used by individuals, estates, and trusts to claim a credit for taxes paid in previous years.

Q: Who needs to file IRS Form 8801?

A: Individuals, estates, and trusts who paid alternative minimum tax (AMT) in a previous year and are eligible to claim a credit for that tax can use IRS Form 8801 to do so.

Q: What is the purpose of IRS Form 8801?

A: The purpose of IRS Form 8801 is to allow individuals, estates, and trusts to claim a credit for the AMT paid in a previous year. This credit helps offset any additional tax liability that may have been incurred due to the AMT.

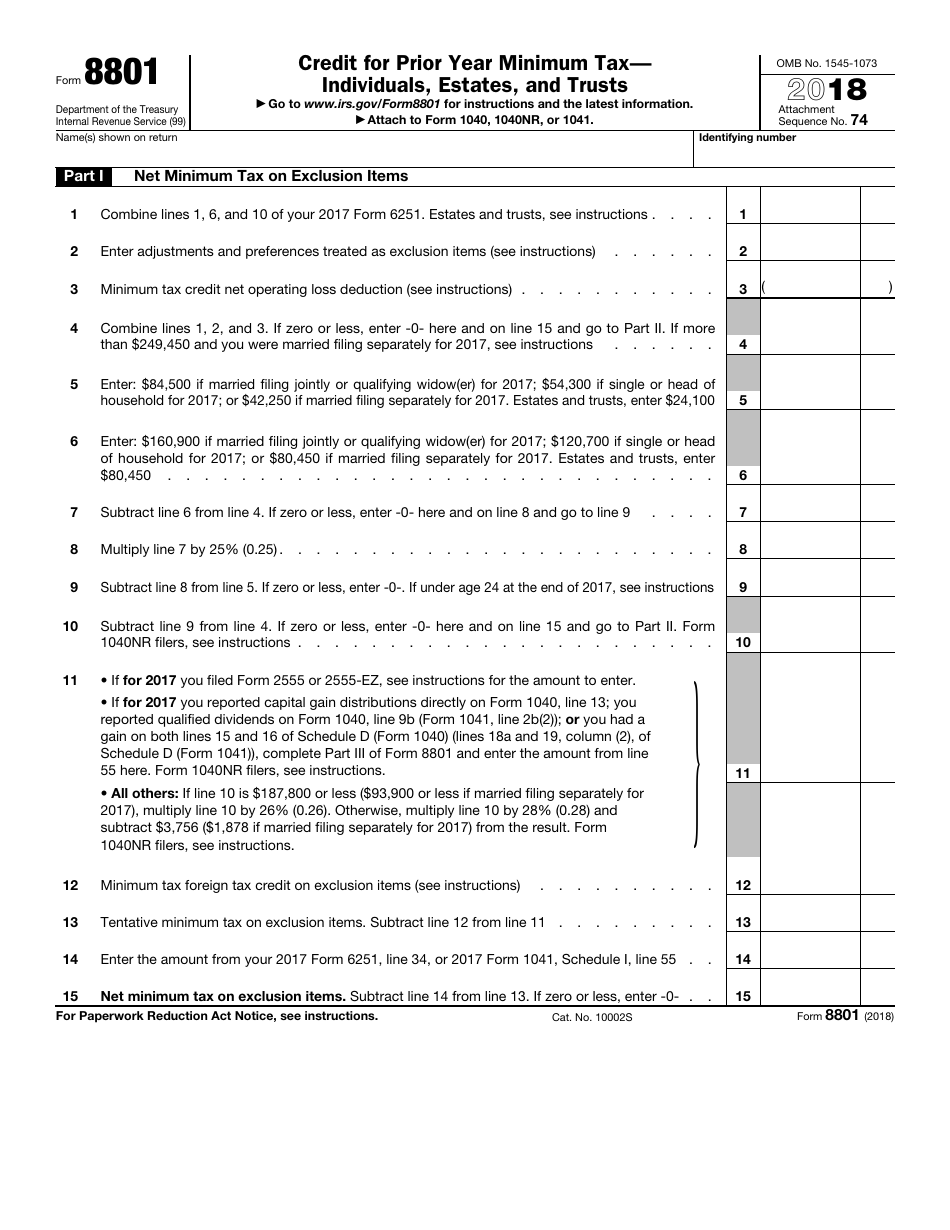

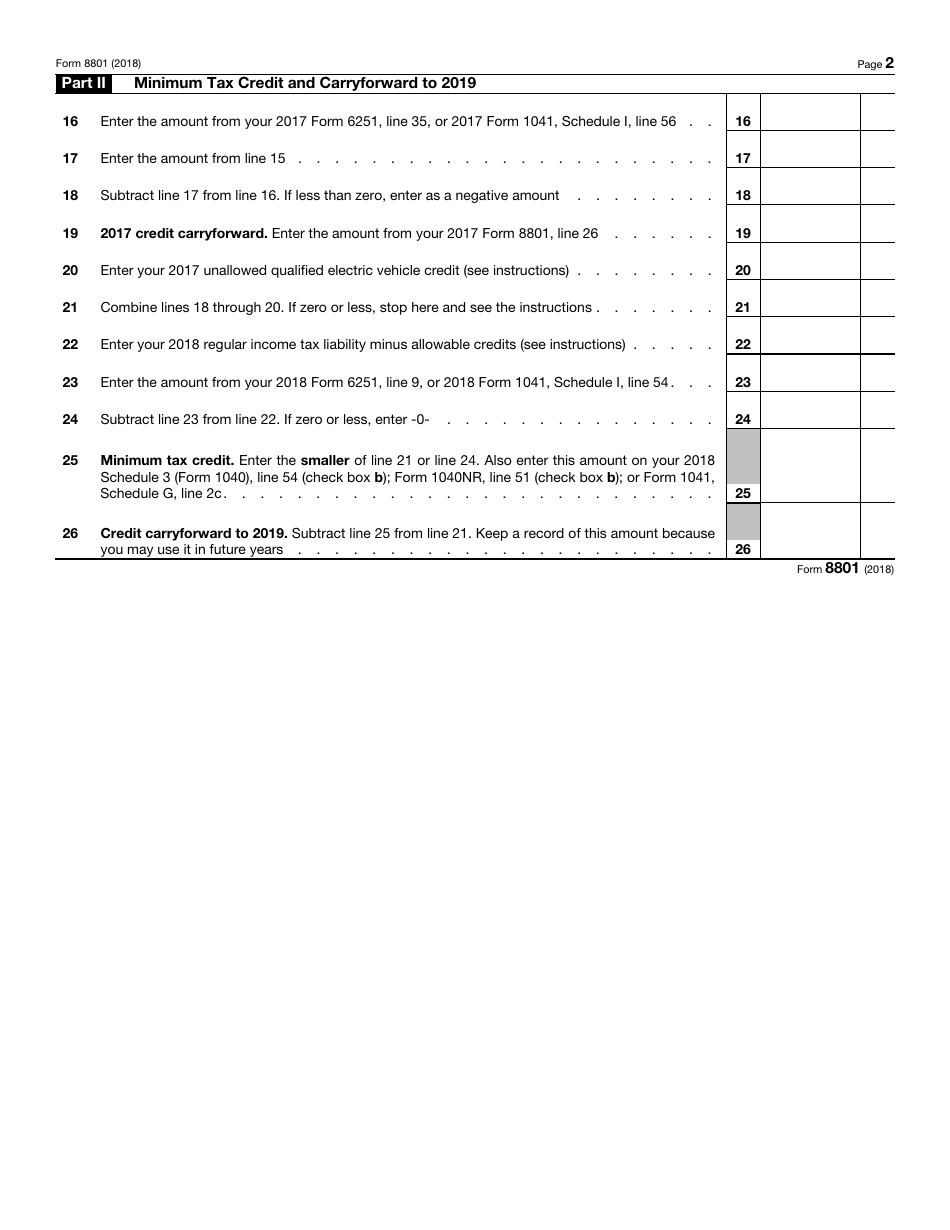

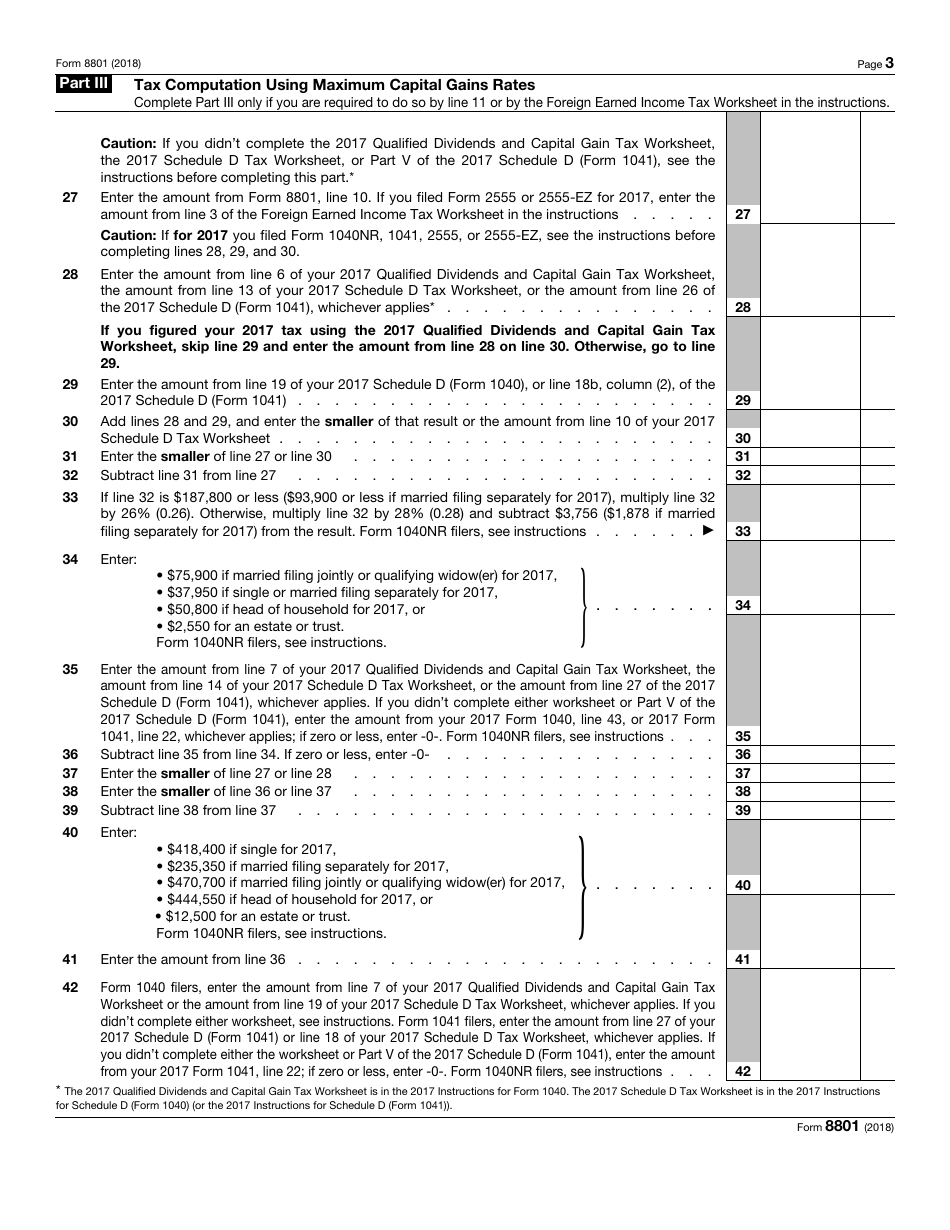

Q: How do I fill out IRS Form 8801?

A: To fill out IRS Form 8801, you will need to provide information about your tax liability for the current year and the amount of AMT paid in the previous year. The form includes instructions on how to calculate the credit and where to report it on your tax return.

Q: When is IRS Form 8801 due?

A: IRS Form 8801 is typically due on the same day as your individual, estate, or trust income tax return, which is usually April 15th. However, the due date may vary depending on certain circumstances, so it is important to check the instructions or consult a tax professional for specific deadlines.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8801 through the link below or browse more documents in our library of IRS Forms.