This version of the form is not currently in use and is provided for reference only. Download this version of

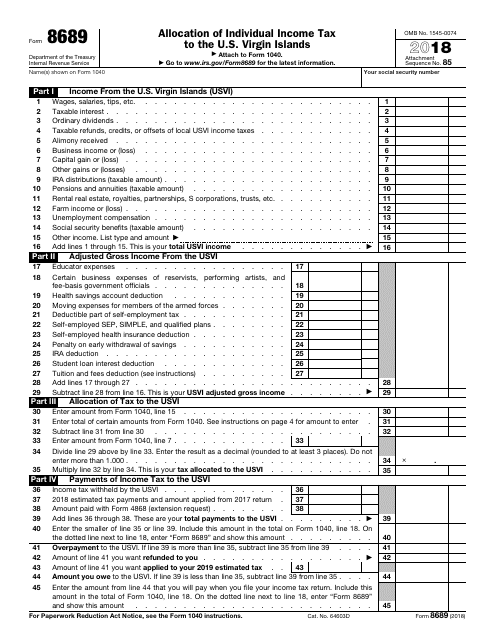

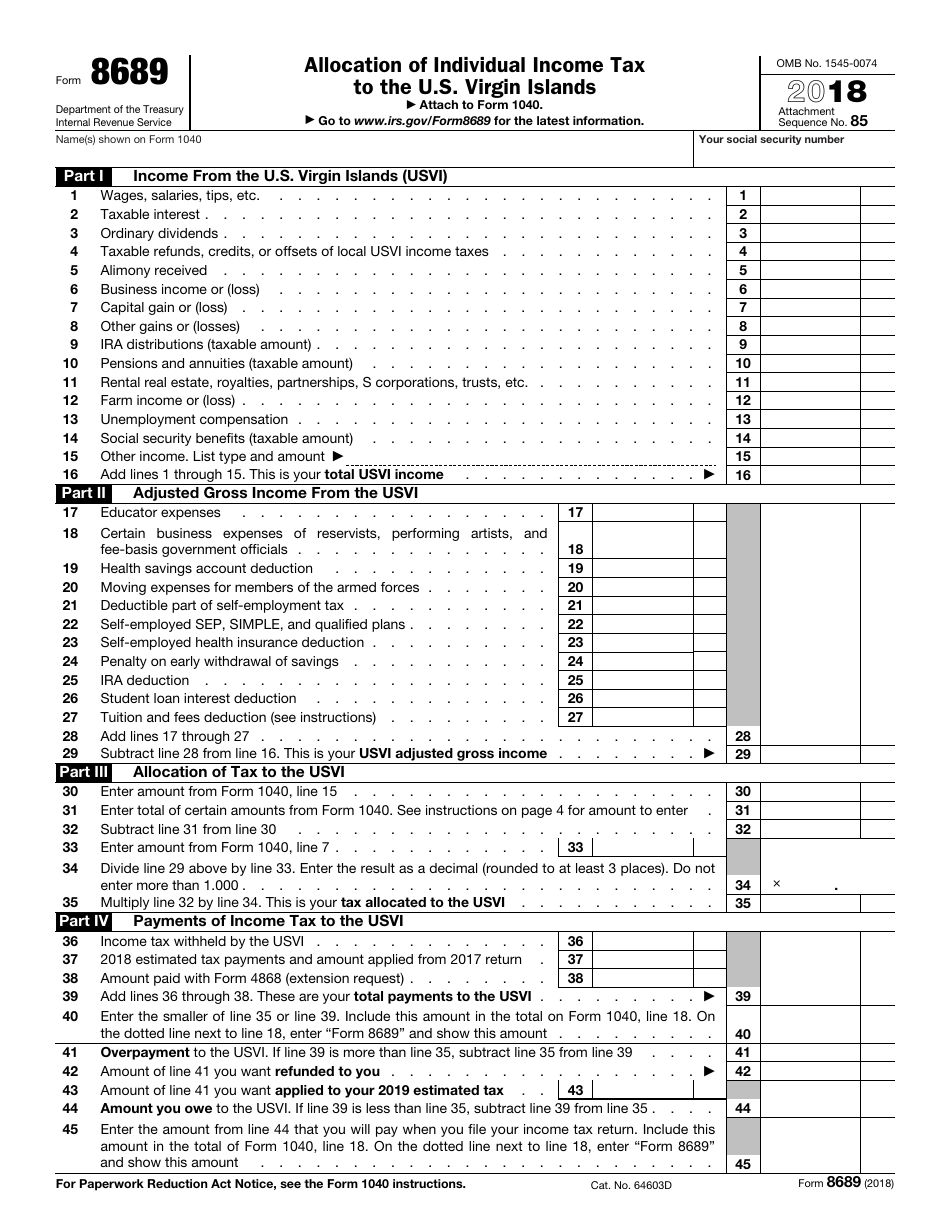

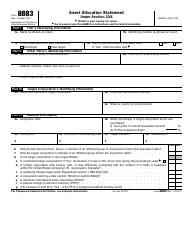

IRS Form 8689

for the current year.

IRS Form 8689 Allocation of Individual Income Tax to the U.S. Virgin Islands

What Is IRS Form 8689?

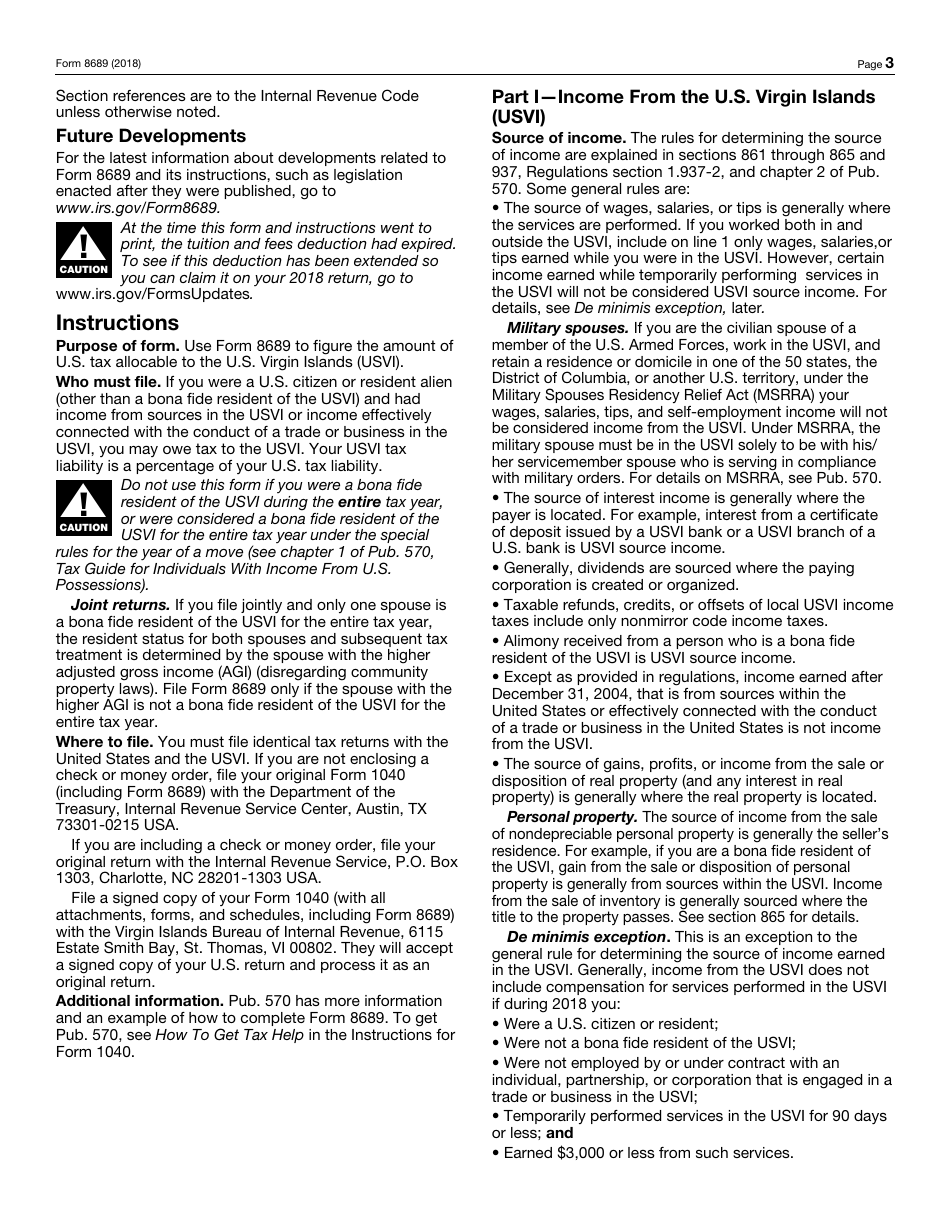

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8689?

A: IRS Form 8689 is the Allocation of Individual Income Tax to the U.S. Virgin Islands form.

Q: Who should fill out Form 8689?

A: Form 8689 should be filled out by individuals who have income from the U.S. Virgin Islands and need to allocate their income tax.

Q: What is the purpose of Form 8689?

A: The purpose of Form 8689 is to allocate income tax between the United States and the U.S. Virgin Islands.

Q: Are there any filing deadlines for Form 8689?

A: Yes, the deadline for filing Form 8689 is generally the same as the deadline for filing your federal income tax return.

Q: Do I need to attach any supporting documents with Form 8689?

A: Yes, you may need to attach additional documents to support your allocation of income tax.

Q: What happens if I don't file Form 8689?

A: If you have income from the U.S. Virgin Islands and fail to file Form 8689, you may not be able to properly allocate your income tax and may face penalties or interest.

Form Details:

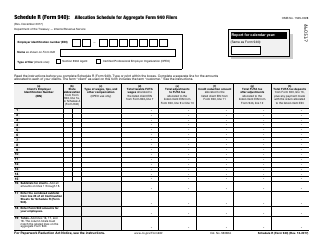

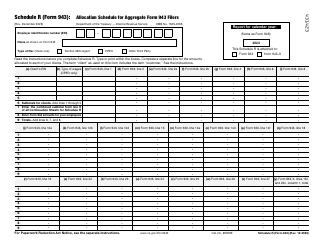

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8689 through the link below or browse more documents in our library of IRS Forms.