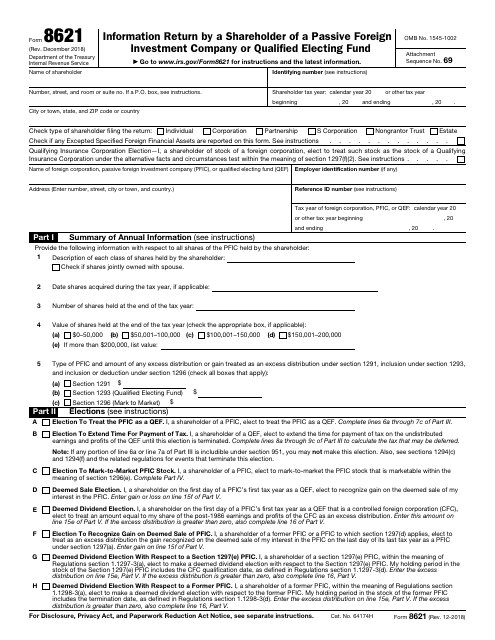

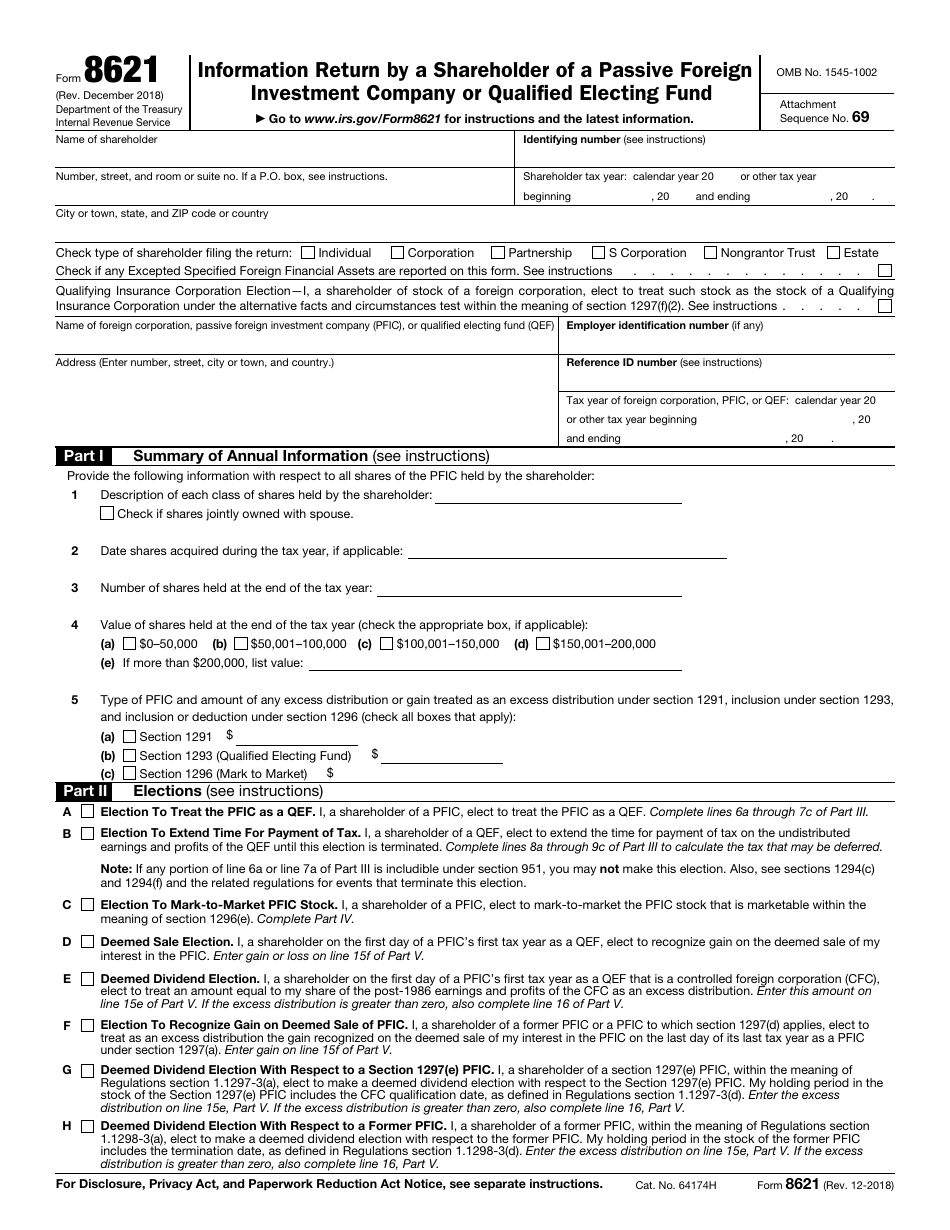

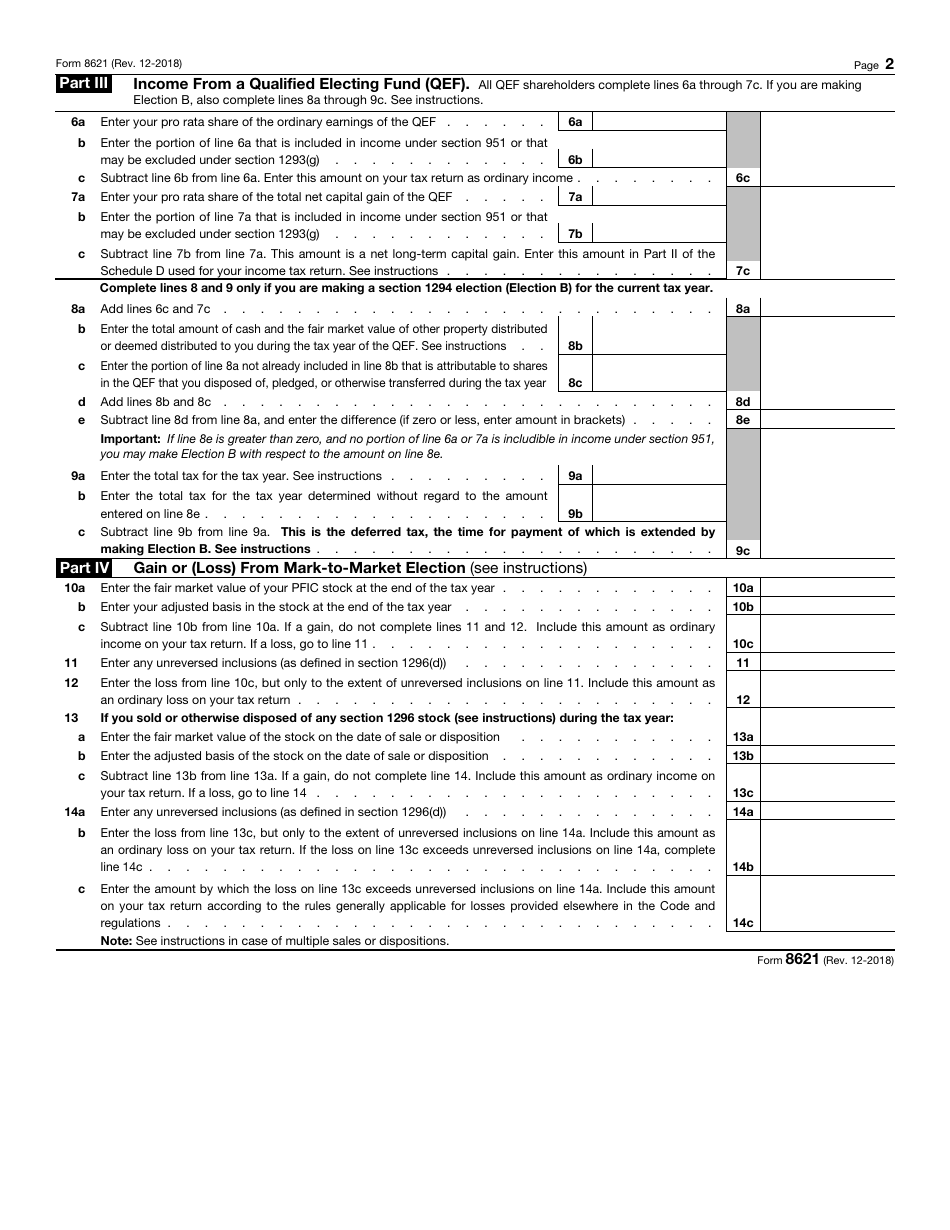

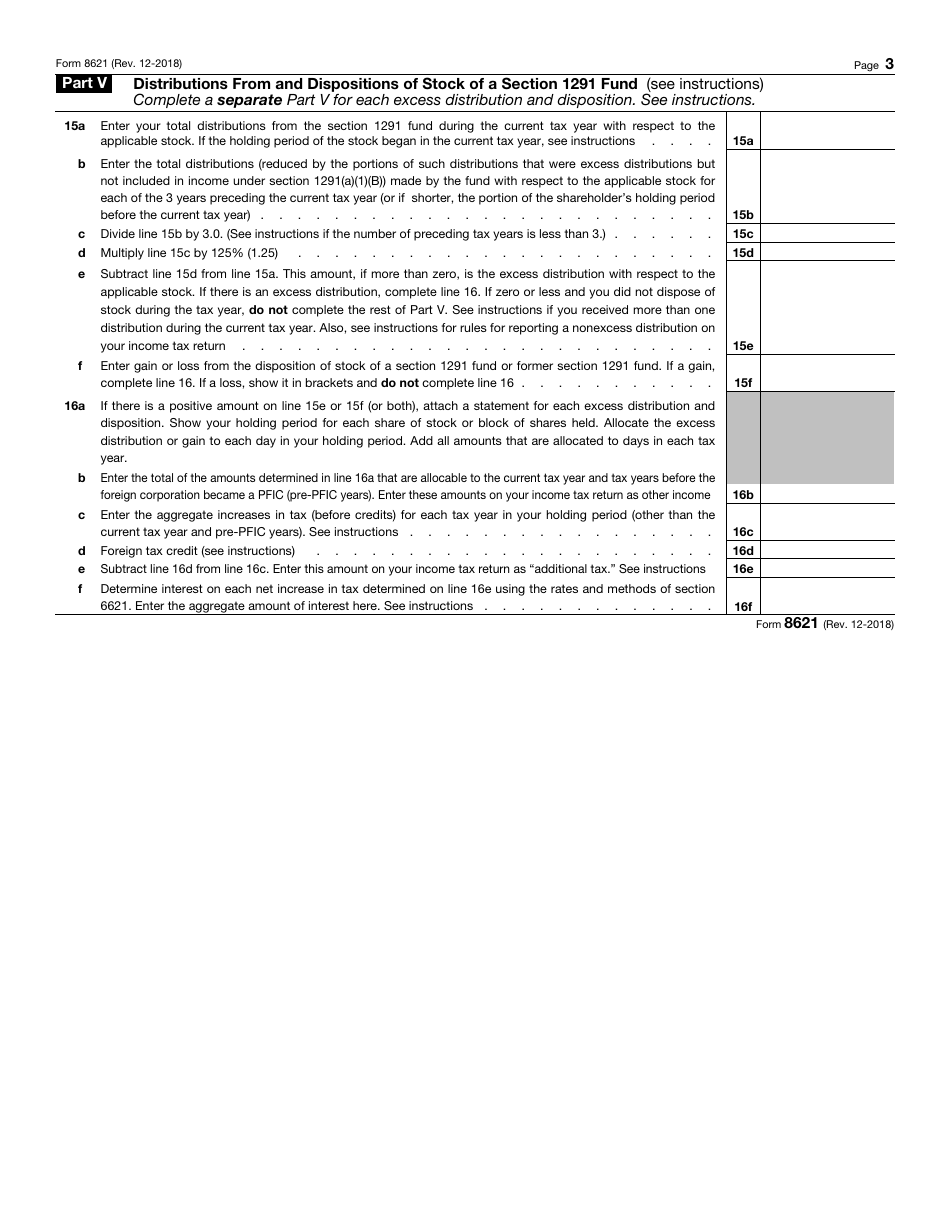

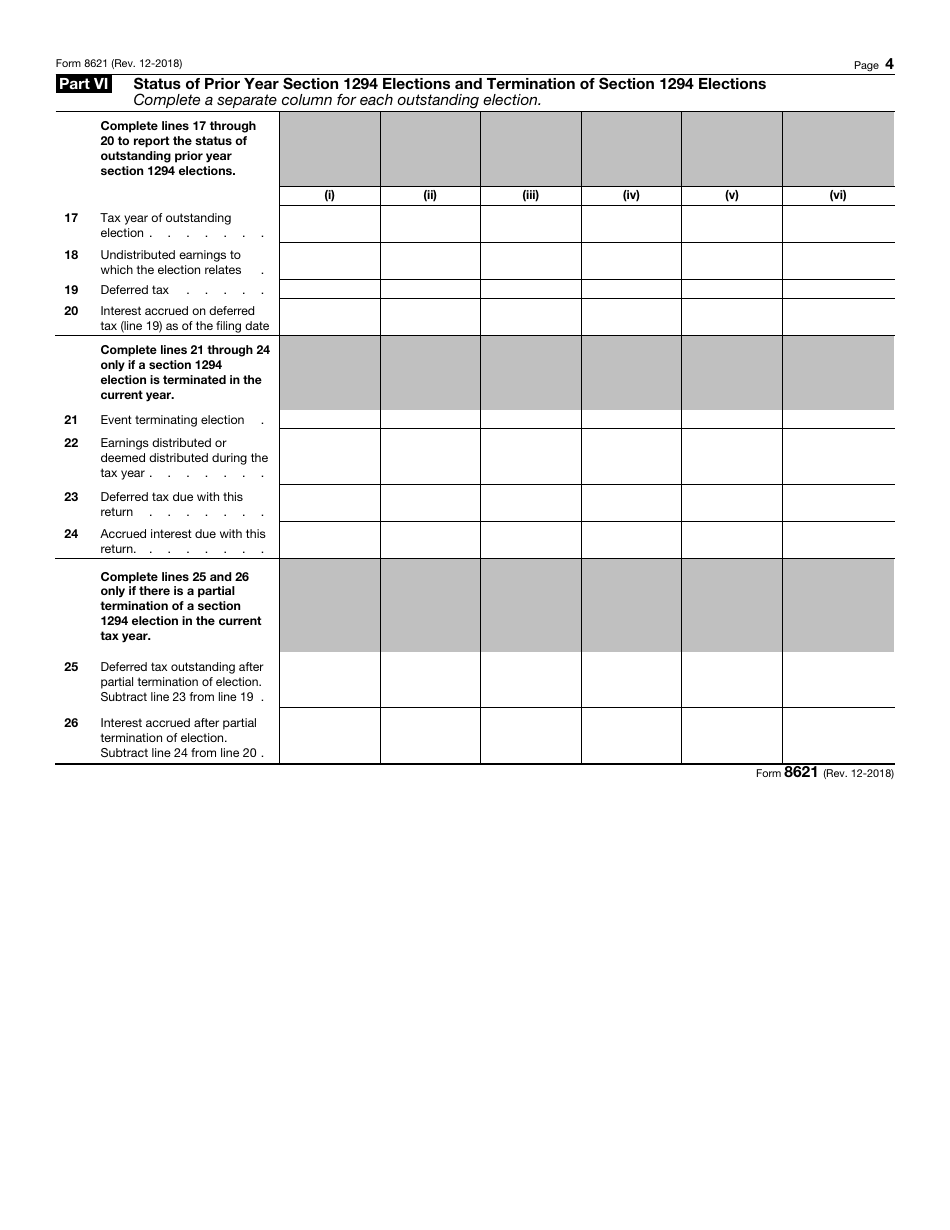

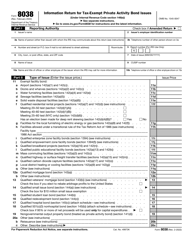

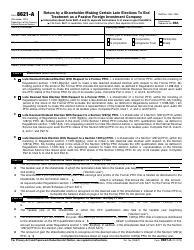

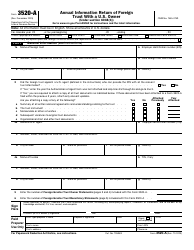

IRS Form 8621 Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund

What Is IRS Form 8621?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8621?

A: IRS Form 8621 is an Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund.

Q: Who needs to file IRS Form 8621?

A: Shareholders of a Passive Foreign Investment Company (PFIC) or Qualified Electing Fund (QEF) need to file IRS Form 8621.

Q: What is a Passive Foreign Investment Company (PFIC)?

A: A Passive Foreign Investment Company (PFIC) is a foreign corporation that meets certain ownership and income requirements.

Q: What is a Qualified Electing Fund (QEF)?

A: A Qualified Electing Fund (QEF) is an election that a US person can make to treat a PFIC as a QEF.

Q: What information is required to be reported on IRS Form 8621?

A: IRS Form 8621 requires information about the shareholder, the PFIC or QEF, and the shareholder's investment in the PFIC or QEF.

Q: When is IRS Form 8621 due?

A: IRS Form 8621 is generally due with the taxpayer's annual income tax return.

Q: Are there any penalties for not filing IRS Form 8621?

A: Yes, there are penalties for not filing IRS Form 8621, including the potential loss of certain tax benefits.

Q: Can I e-file IRS Form 8621?

A: No, IRS Form 8621 cannot be e-filed and must be filed by mail.

Form Details:

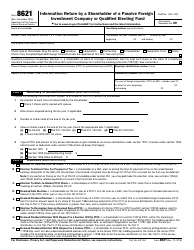

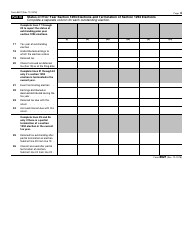

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8621 through the link below or browse more documents in our library of IRS Forms.