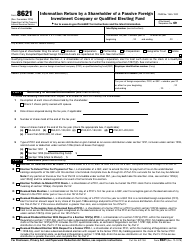

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8582

for the current year.

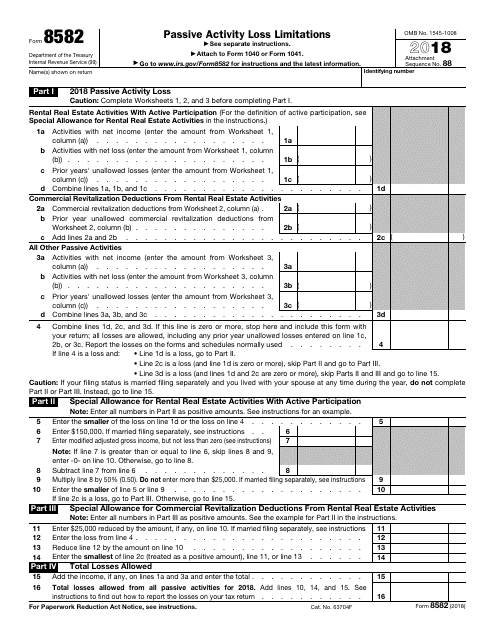

IRS Form 8582 Passive Activity Loss Limitations

What Is IRS Form 8582?

IRS Form 8582, Passive Activity Loss Limitations is the document used by noncorporate taxpayers. Its main purpose is to help you to calculate the amount of any passive activity loss (PAL). You can use this form to report the application of the unallowed PALs for the previous tax year.

The issuing agency of the document is the Internal Revenue Service (IRS) . The form is revised annually. Download the latest fillable IRS Form 8582 using the link provided below. To facilitate filing, the IRS also provides official Instructions for Form 8582 containing detailed explanations and useful examples.

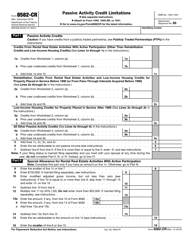

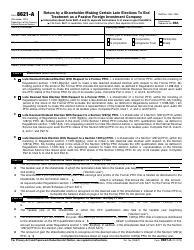

The form is related to Form 8582-CR, Passive Activity Credit Limitations. This document is filled out by trusts, estates, and individuals in order to calculate the amount of a passive activity credit for the current tax year and unallowed credits any prior year. This form also serves to figure the amount of credit allowed for the current year, as well as to elect the increase of the credit property basis when a taxpayer disposes of the interest in an activity.

Can I Deduct Passive Activity Loss?

A PAL is the excess of total losses from all passive activities you are involved in over the total income. Passive activities are considered:

- Trade or business activities you did not materially participate in. The material participation is considered any work done in connection with the activity in which you own interest regardless of your capacity in this activity;

- All rental activities, whether you participate in them or not.

When calculating their tax deductions, homeowners should mind that if they actively participate in rental real estate activities and meet the specific conditions, they are not subject to passive activity loss limitations.

Usually, if your losses from passive activities exceed the income from these activities, these losses are considered disallowed. The PALs that are not allowed in the current year are carried forward to the next taxable year until allowed. If you dispose of your entire interest in the activity, you are generally allowed to deduct any PALs disallowed before in full.

IRS Form 8582 Instructions

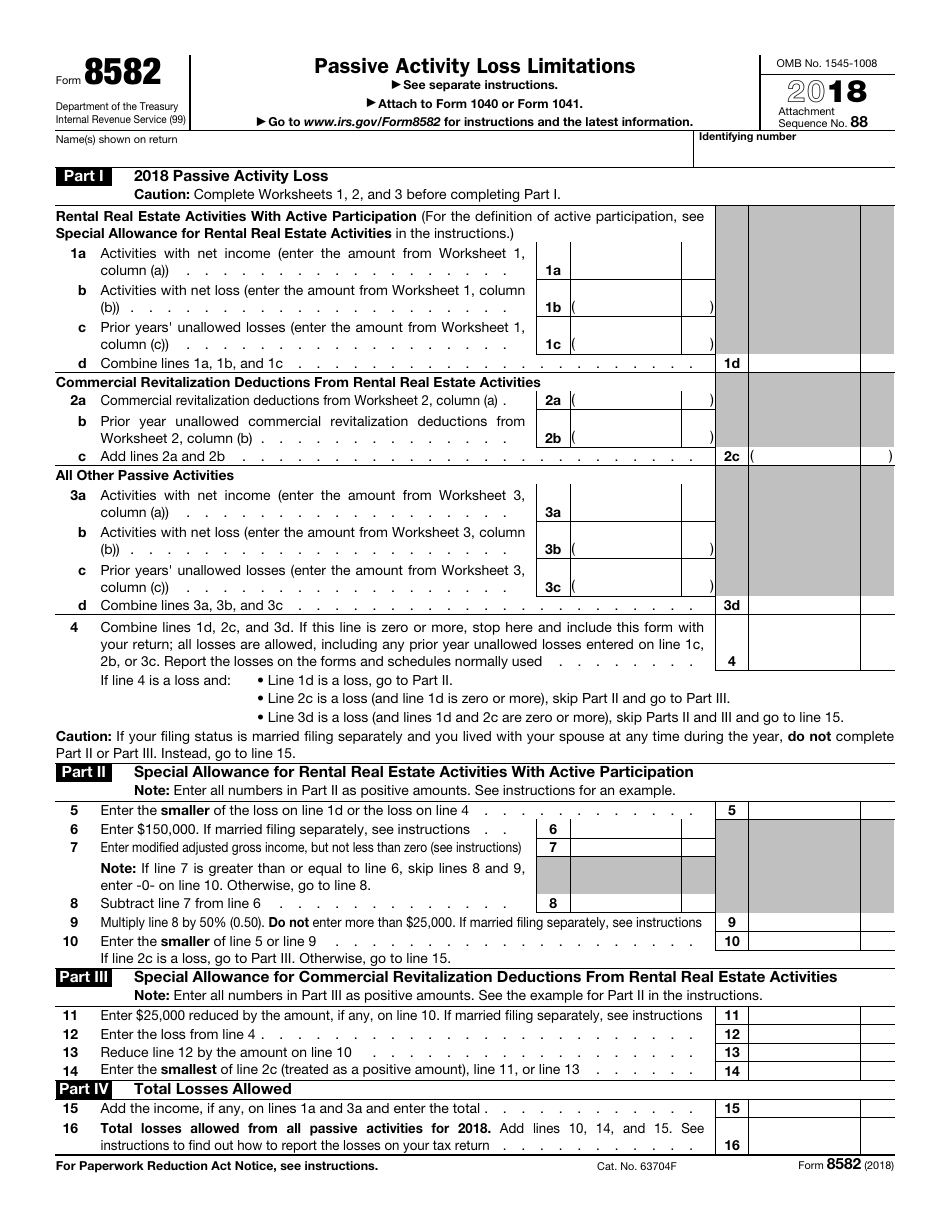

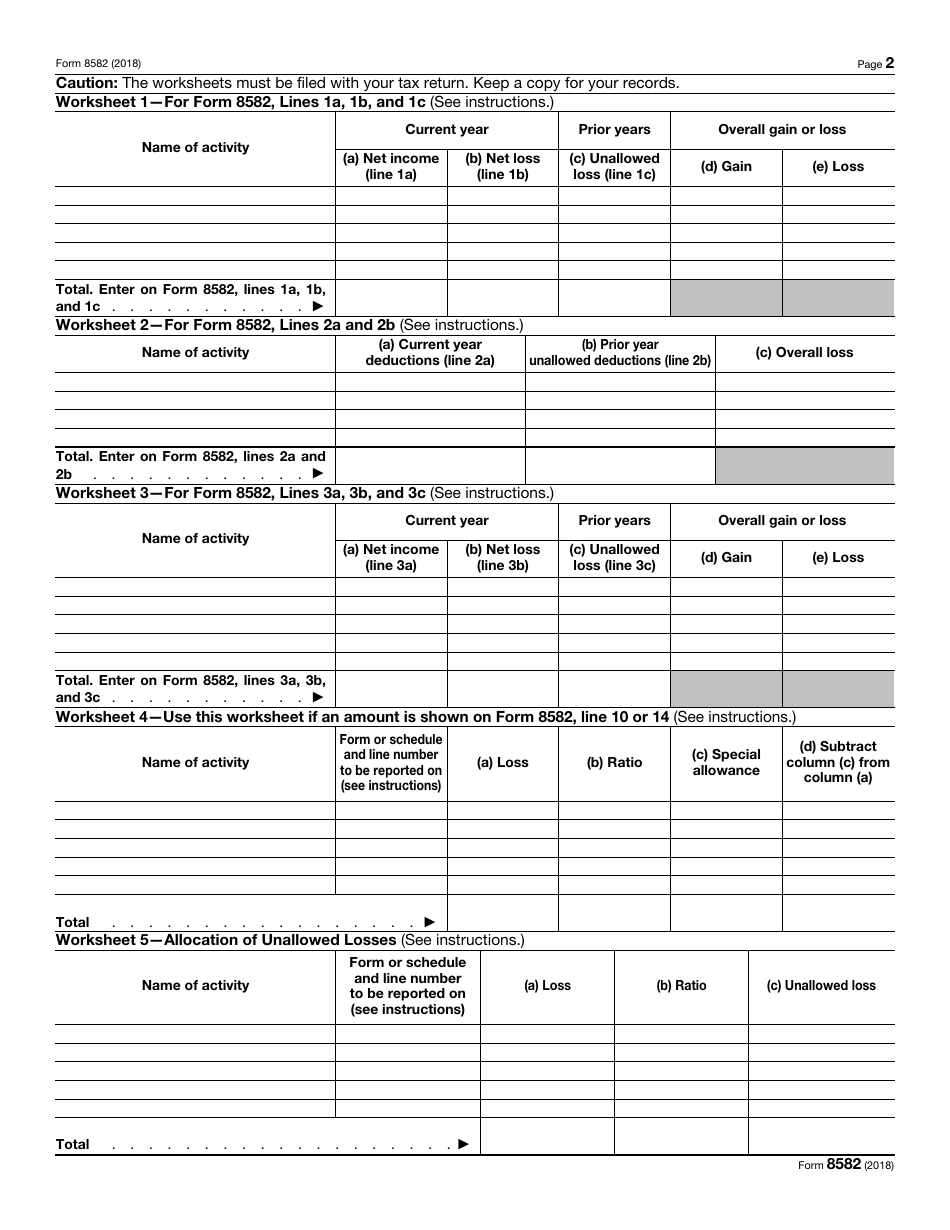

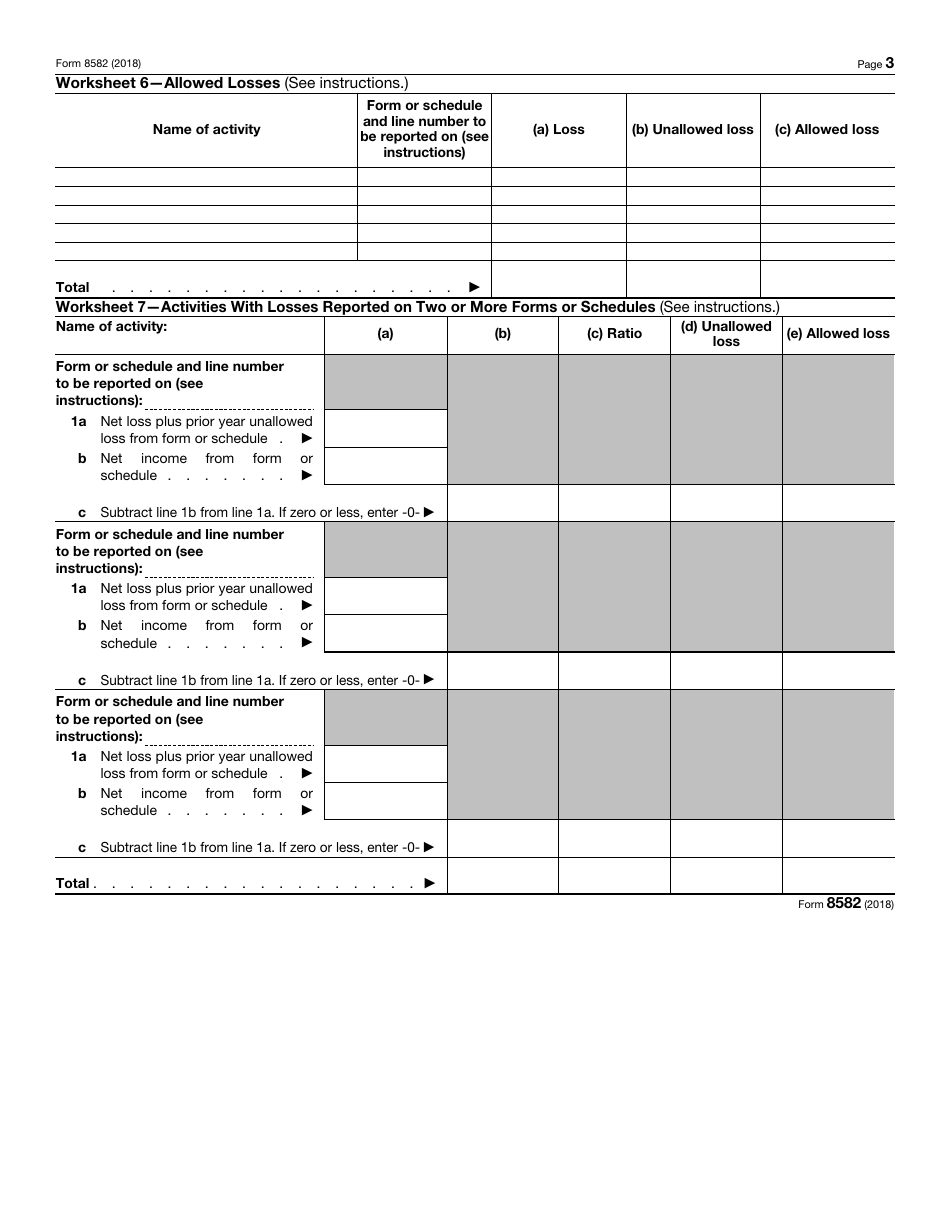

The IRS 8582 Form is a three-page form. Use the following instructions to file it properly:

-

The document consists of the form itself and seven worksheets. Unlike for many other reports, these worksheets must be submitted with the tax return;

-

Make copies of the completed form and worksheets before submitting it to the IRS;

-

Part I. Passive Activity Loss. This part combines net income and net loss from all passive activities. Fill it out to determine if you have any PALs for the tax year you complete this form for;

- Fill out Worksheets 1 - 3 before completing Part I;

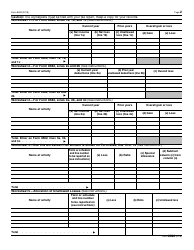

- Worksheet 1. Fill it out to make calculations for rental real estate activities with active participation;

- Worksheet 2. Use this worksheet to calculate commercial revitalization deductions from your rental real estate activities;

- Worksheet 3. Calculate here the rest of your passive activities;

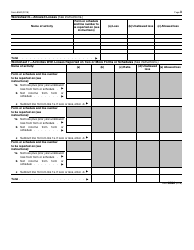

- If you need additional lines for any of the worksheets, copy the page containing this worksheet and attach it to the form. As an alternative, you can attach the schedule of the same format as the worksheet;

-

Part II. Special Allowance for Rental Real Estate Activities with Active Participation. Calculate the maximum amount of rental loss allowed in this part;

-

Part III. Special Allowance for Commercial Revitalization Deductions from Rental Real Estate Activities. Fill out this part to calculate the maximal commercial revitalization deductions;

-

Part IV. Total Losses Allowed. Figure the total amount of all PALs allowed for the tax year;

-

The rest of the Worksheets are optional.

Submit this document attached to your IRS Form 1040, U.S. Individual Income Tax Return or your IRS Form 1041, U.S. Income Tax Return for Estates and Trusts.