This version of the form is not currently in use and is provided for reference only. Download this version of

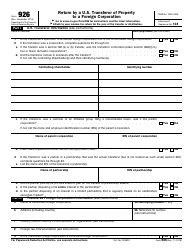

IRS Form 8453-I

for the current year.

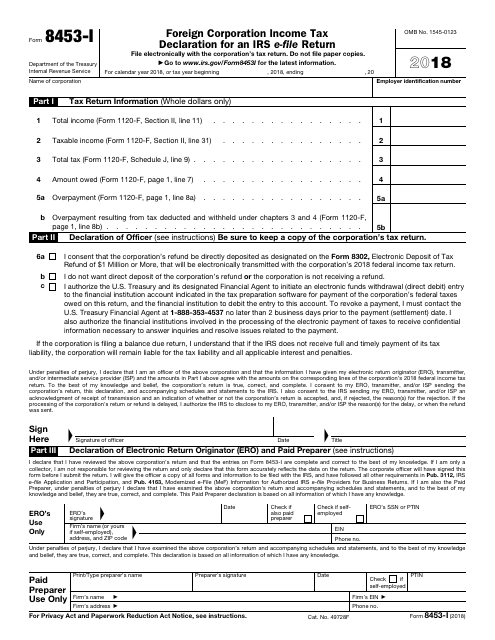

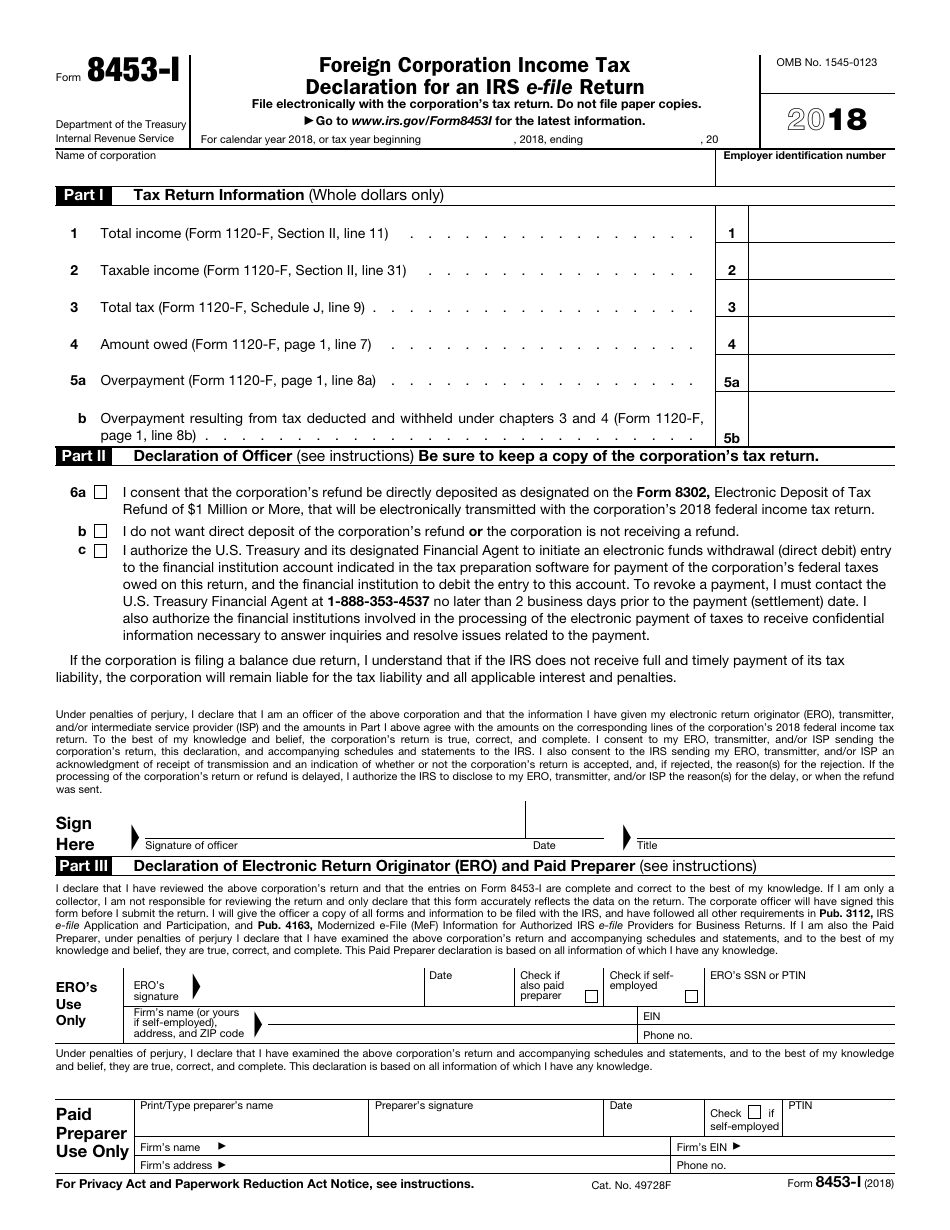

IRS Form 8453-I Foreign Corporation Income Tax Declaration for an IRS E-File Return

What Is IRS Form 8453-I?

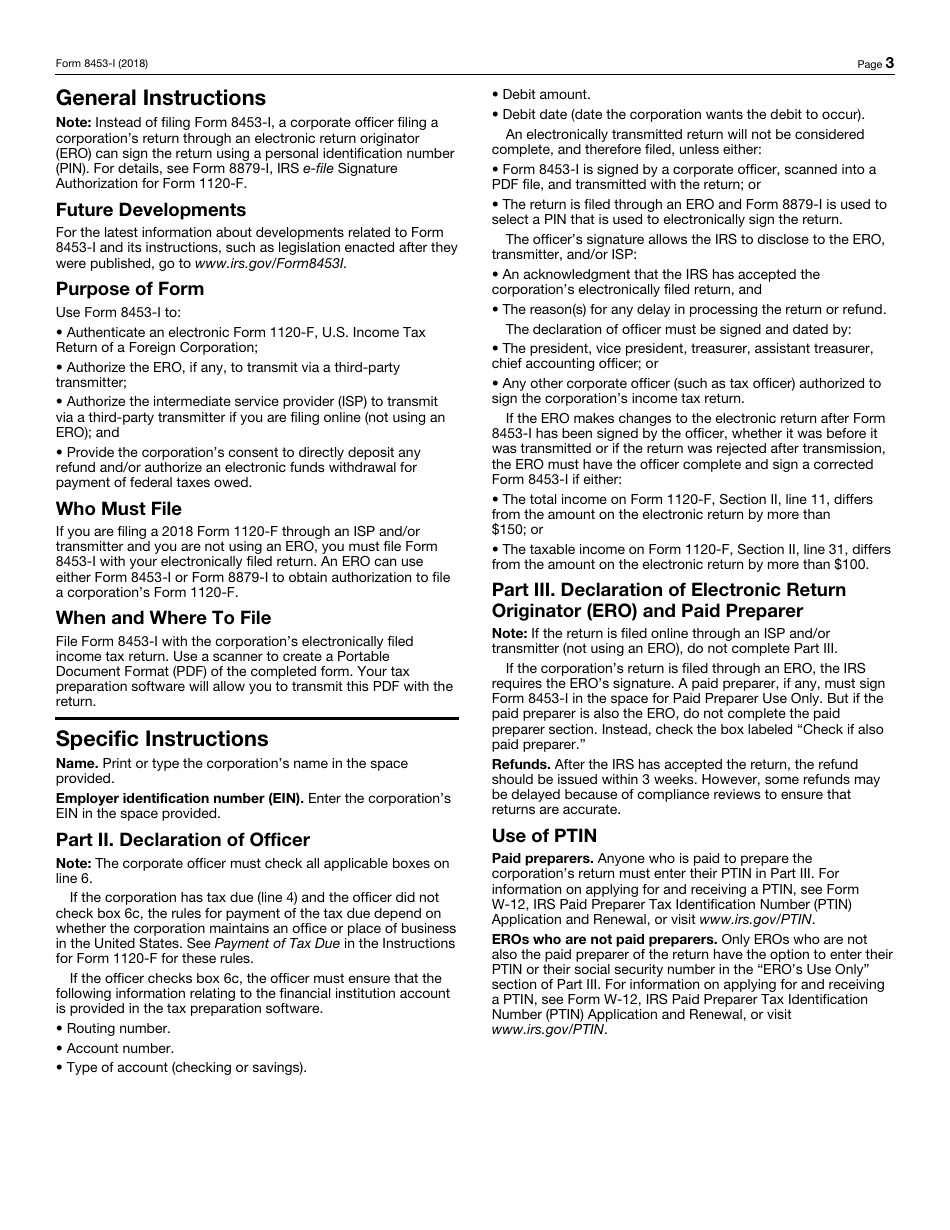

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8453-I?

A: IRS Form 8453-I is the Foreign Corporation Income Tax Declaration for an IRS E-File Return.

Q: Who needs to file IRS Form 8453-I?

A: Foreign corporations that are required to file an income tax return with the IRS electronically need to file Form 8453-I.

Q: What is the purpose of IRS Form 8453-I?

A: The purpose of Form 8453-I is to declare that the foreign corporation authorizes an Electronic Return Originator (ERO) to submit its income tax return to the IRS.

Q: When should IRS Form 8453-I be filed?

A: Form 8453-I should be filed at the same time the foreign corporation submits its income tax return to the IRS electronically.

Q: Are there any fees associated with filing IRS Form 8453-I?

A: No, there are no fees associated with filing Form 8453-I.

Form Details:

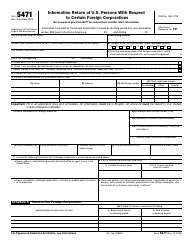

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8453-I through the link below or browse more documents in our library of IRS Forms.