This version of the form is not currently in use and is provided for reference only. Download this version of

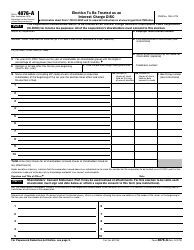

IRS Form 8404

for the current year.

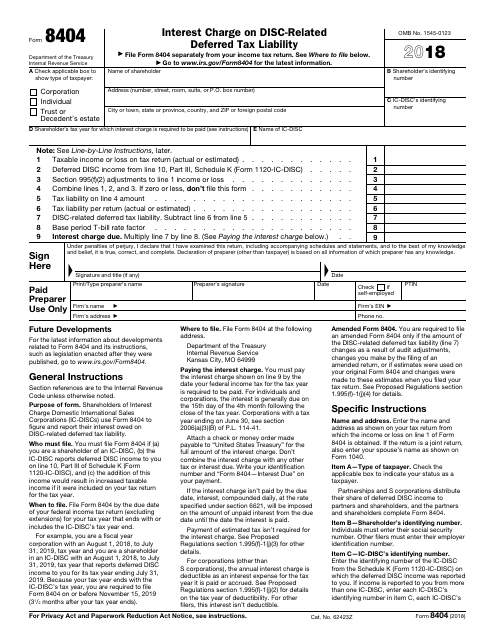

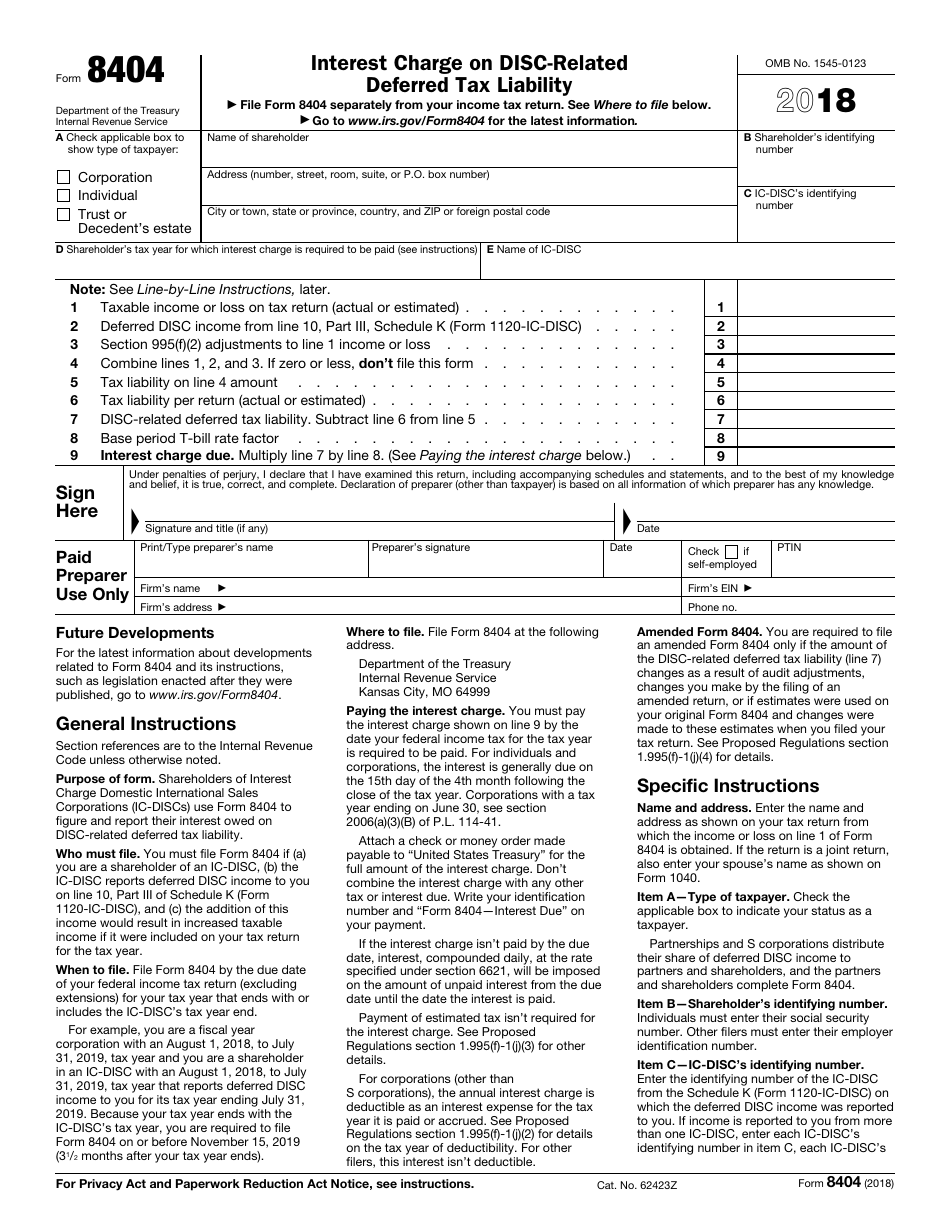

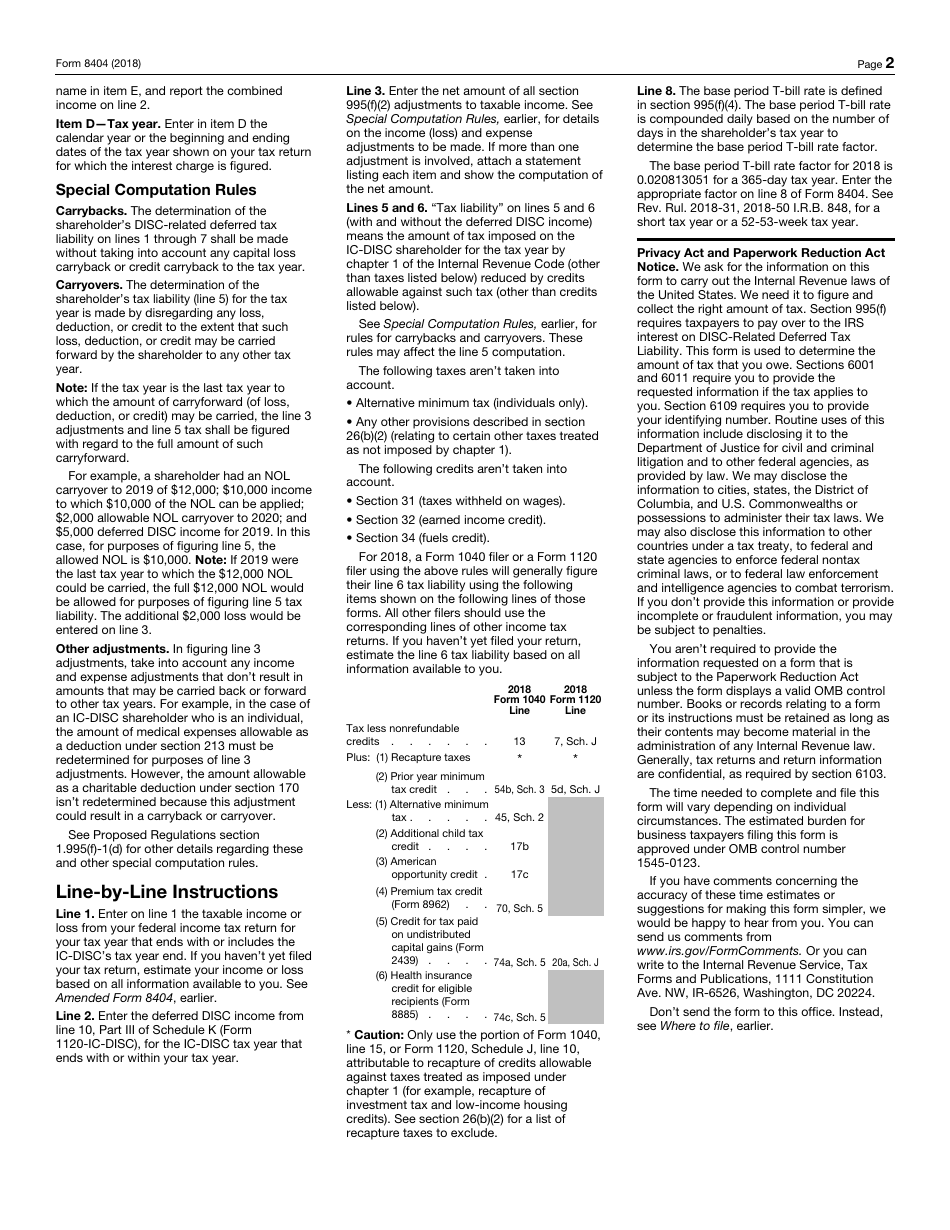

IRS Form 8404 Interest Charge on Disc-Related Deferred Tax Liability

What Is IRS Form 8404?

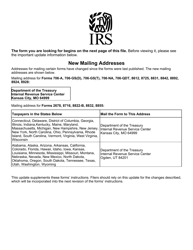

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8404?

A: IRS Form 8404 is used to calculate and report the interest charge on disc-related deferred tax liability.

Q: What does disc-related deferred tax liability mean?

A: Disc-related deferred tax liability refers to the deferral of tax liability on income earned through certain types of transactions, such as the use of a Domestic International Sales Corporation (DISC).

Q: Why do I have to report the interest charge on disc-related deferred tax liability?

A: The interest charge is required to be reported to ensure compliance with tax laws and regulations.

Q: How do I calculate the interest charge on disc-related deferred tax liability?

A: The interest charge can be calculated using the formula provided on IRS Form 8404 or by using an alternative method outlined in the instructions.

Q: Is IRS Form 8404 applicable to individuals or businesses?

A: IRS Form 8404 is primarily used by businesses, especially those engaging in disc-related transactions.

Q: Are there any penalties for not reporting the interest charge on disc-related deferred tax liability?

A: Failure to report the interest charge may result in penalties and potential audit by the IRS.

Q: Can I claim any deductions or credits related to disc-related deferred tax liability?

A: Deductions or credits related to disc-related deferred tax liability are subject to specific rules and limitations outlined by the IRS. Consulting with a tax professional is recommended.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8404 through the link below or browse more documents in our library of IRS Forms.