This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8453-C

for the current year.

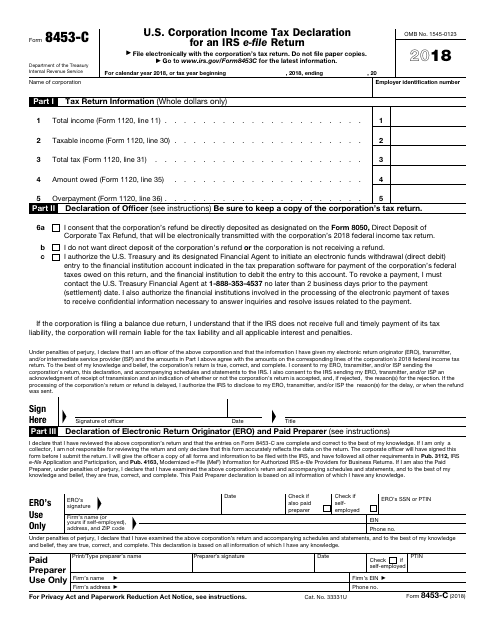

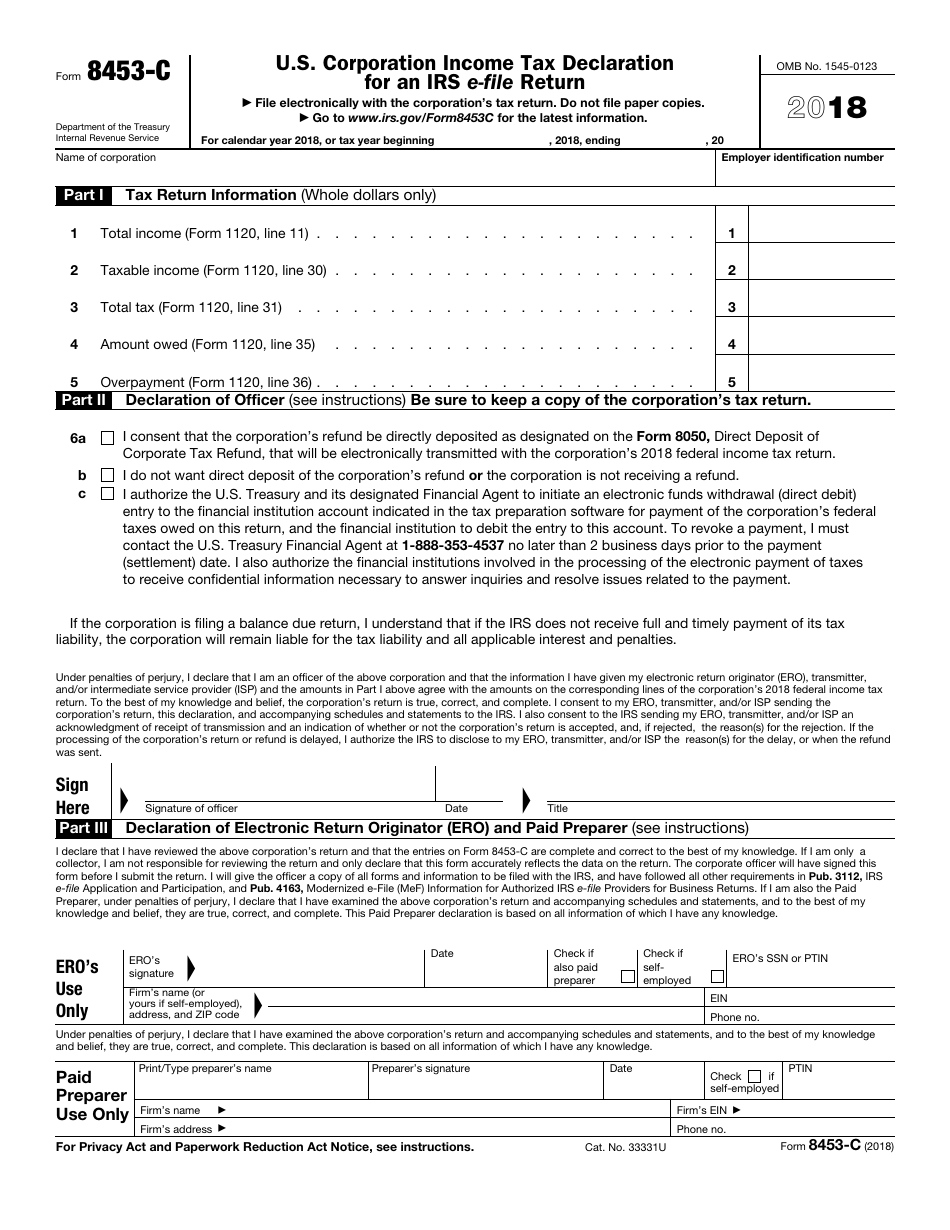

IRS Form 8453-C U.S. Corporation Income Tax Declaration for an IRS E-File Return

What Is IRS Form 8453-C?

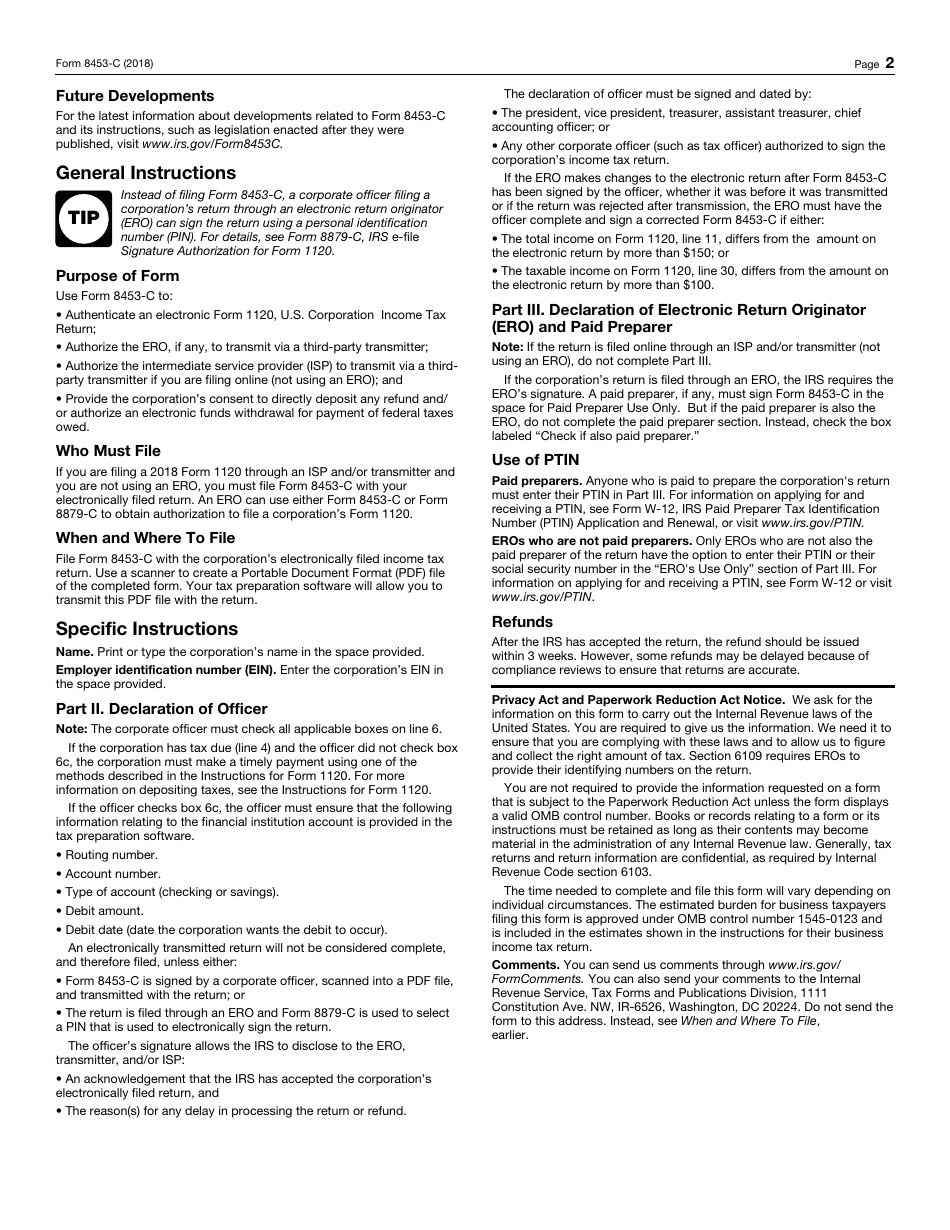

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8453-C?

A: IRS Form 8453-C is the U.S. Corporation Income Tax Declaration for an IRS E-File Return.

Q: Who needs to file IRS Form 8453-C?

A: U.S. corporations that are filing their income tax returns electronically need to file Form 8453-C.

Q: What is the purpose of IRS Form 8453-C?

A: The purpose of Form 8453-C is to authenticate and authorize the electronic submission of a U.S. corporation's income tax return.

Q: Do I need to attach any other documents with IRS Form 8453-C?

A: Yes, you may need to attach certain supporting documents with Form 8453-C, depending on your specific tax situation. Refer to the instructions for Form 8453-C for more information.

Q: Is there a deadline for filing IRS Form 8453-C?

A: Yes, the deadline for filing Form 8453-C is the same as the deadline for filing your U.S. corporation income tax return.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8453-C through the link below or browse more documents in our library of IRS Forms.