This version of the form is not currently in use and is provided for reference only. Download this version of

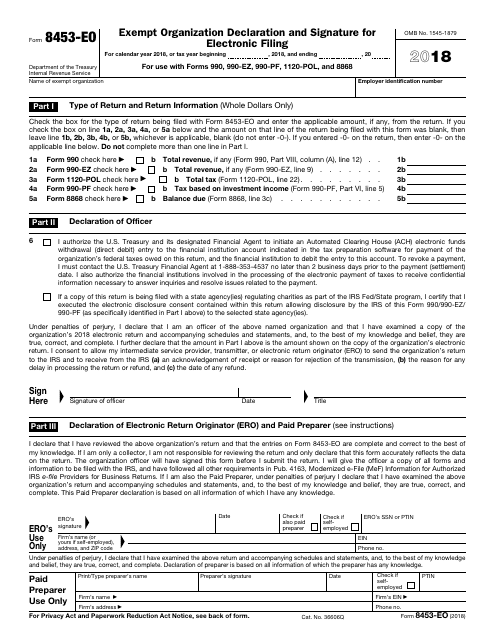

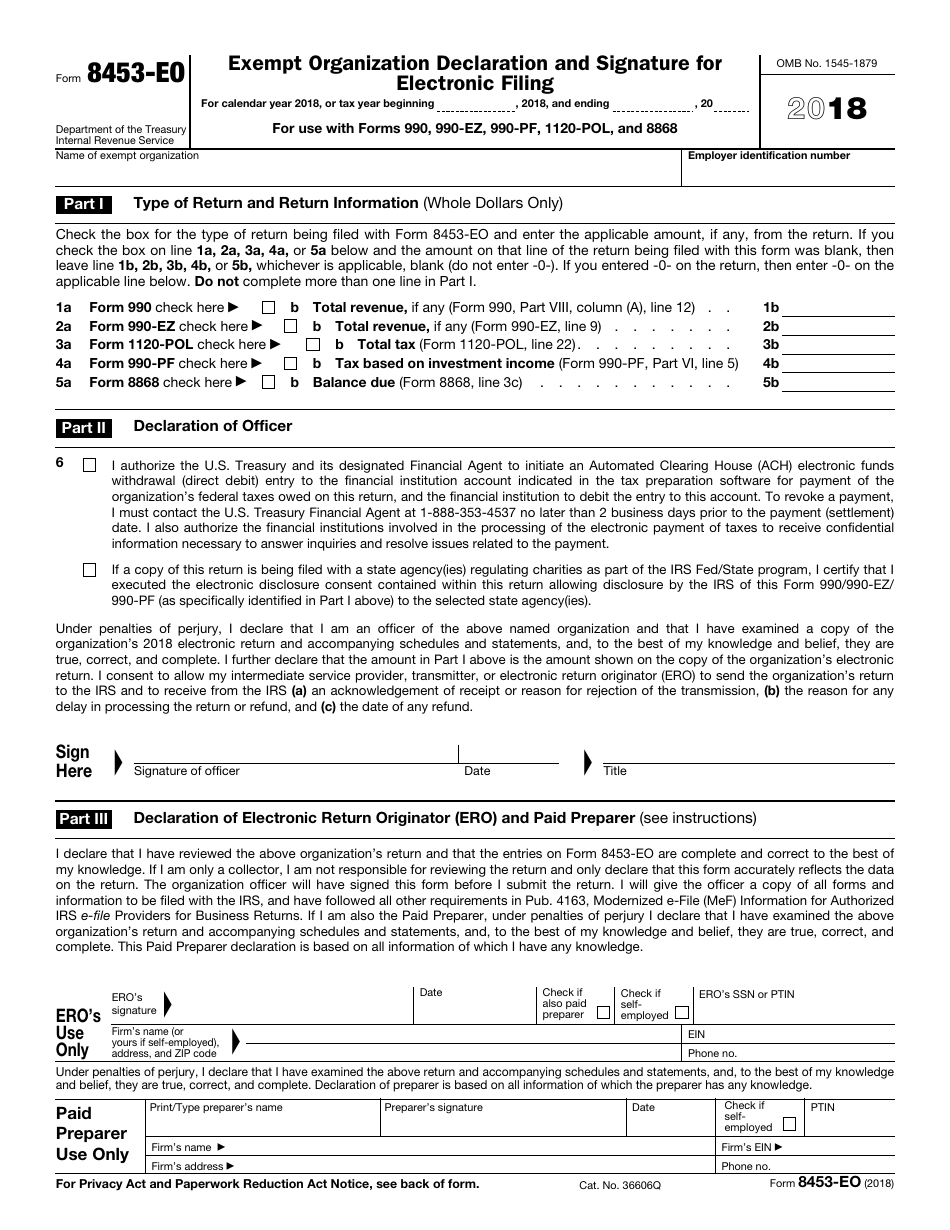

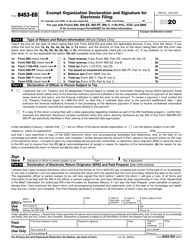

IRS Form 8453-E0

for the current year.

IRS Form 8453-E0 Exempt Organization Declaration and Signature for Electronic Filing

What Is IRS Form 8453-E0?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8453-E0?

A: IRS Form 8453-E0 is the Exempt Organization Declaration and Signature for Electronic Filing.

Q: Who needs to file IRS Form 8453-E0?

A: Exempt organizations that are required to file their tax returns electronically need to file IRS Form 8453-E0.

Q: What is the purpose of IRS Form 8453-E0?

A: The purpose of IRS Form 8453-E0 is for exempt organizations to declare and provide their signature for electronic filing of their tax returns.

Q: Is IRS Form 8453-E0 mandatory?

A: Yes, if an exempt organization is required to file its tax returns electronically, filing IRS Form 8453-E0 is mandatory.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8453-E0 through the link below or browse more documents in our library of IRS Forms.