This version of the form is not currently in use and is provided for reference only. Download this version of

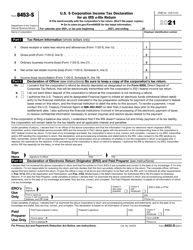

IRS Form 8453

for the current year.

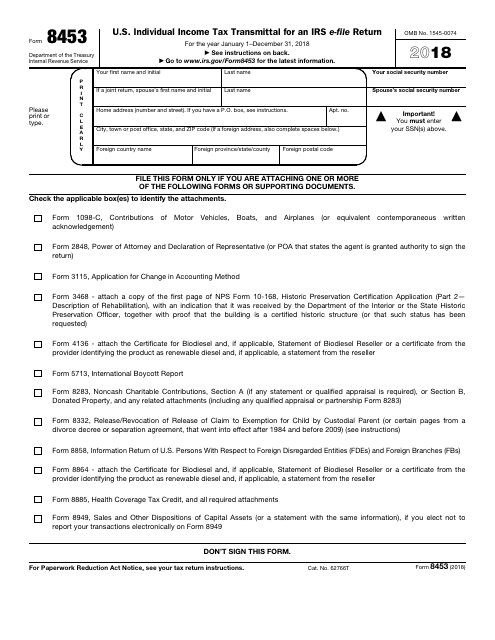

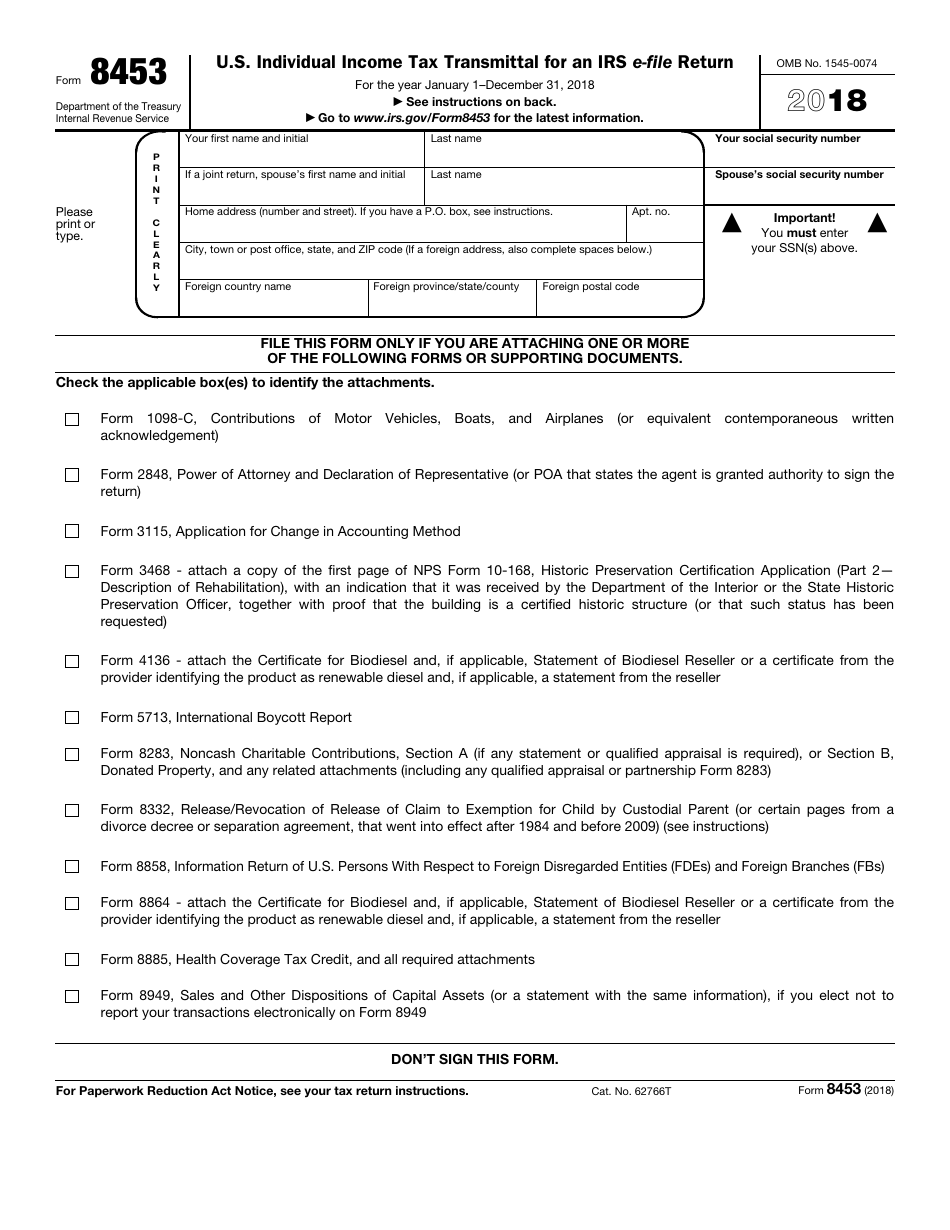

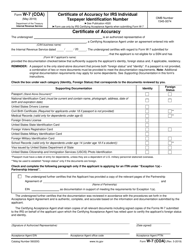

IRS Form 8453 U.S. Individual Income Tax Transmittal for an IRS E-File Return

What Is IRS Form 8453?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8453?

A: IRS Form 8453 is the U.S. Individual Income Tax Transmittal for an IRS E-File Return.

Q: Who needs to fill out IRS Form 8453?

A: Anyone who is filing their individual income tax return electronically with the IRS.

Q: What is the purpose of IRS Form 8453?

A: The form is used to transmit supporting documents, such as W-2s or 1099s, to the IRS when filing electronically.

Q: Is IRS Form 8453 required for all e-filed tax returns?

A: No, IRS Form 8453 is only required if you need to submit supporting documents along with your electronic tax return.

Q: Can I e-file my tax return without IRS Form 8453?

A: Yes, if you don't have any supporting documents to submit, you can e-file your tax return without IRS Form 8453.

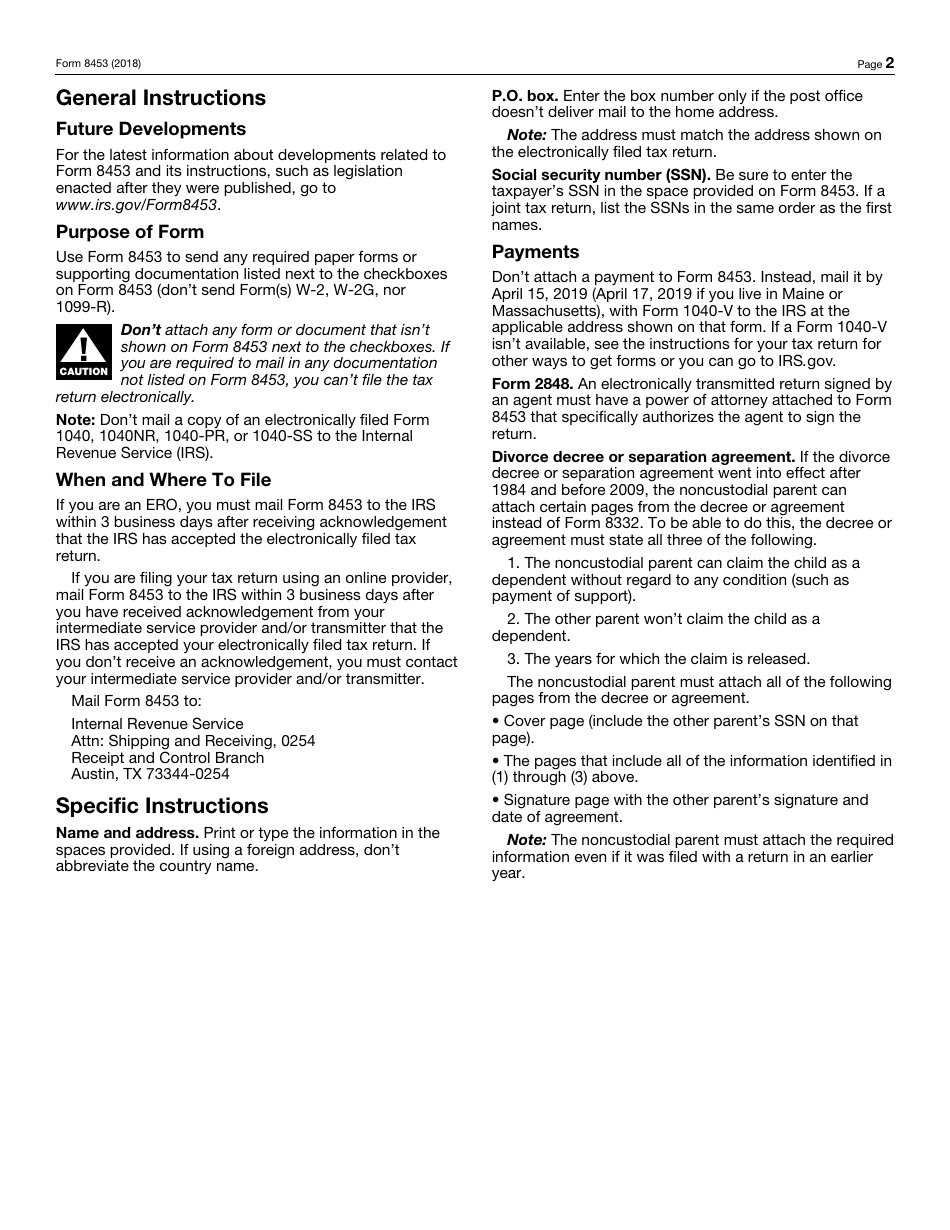

Q: Are there any specific instructions for filling out IRS Form 8453?

A: Yes, the form has specific instructions that should be followed carefully when completing and submitting it.

Q: What should I do with IRS Form 8453 after filling it out?

A: You should keep a copy of IRS Form 8453 for your records and submit the original form to the IRS along with your e-filed tax return.

Q: Is there a deadline for submitting IRS Form 8453?

A: The deadline for submitting IRS Form 8453 is the same as the deadline for filing your tax return, typically April 15th.

Q: Can I mail IRS Form 8453 instead of e-filing it?

A: No, IRS Form 8453 is specifically designed for transmitting supporting documents electronically and cannot be mailed separately.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8453 through the link below or browse more documents in our library of IRS Forms.