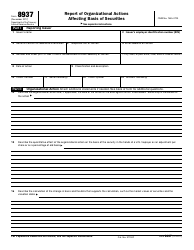

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8308

for the current year.

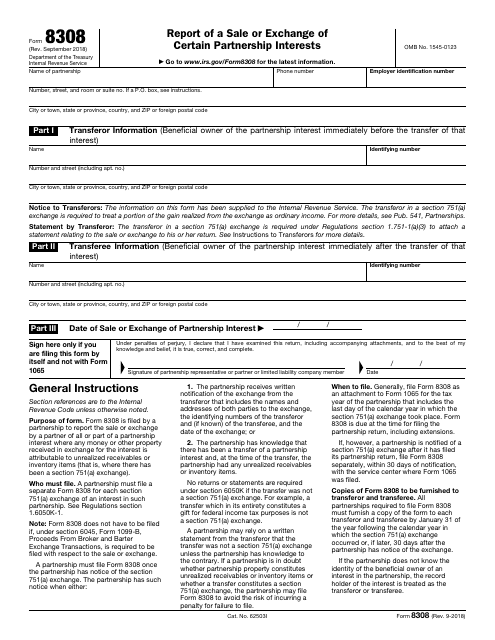

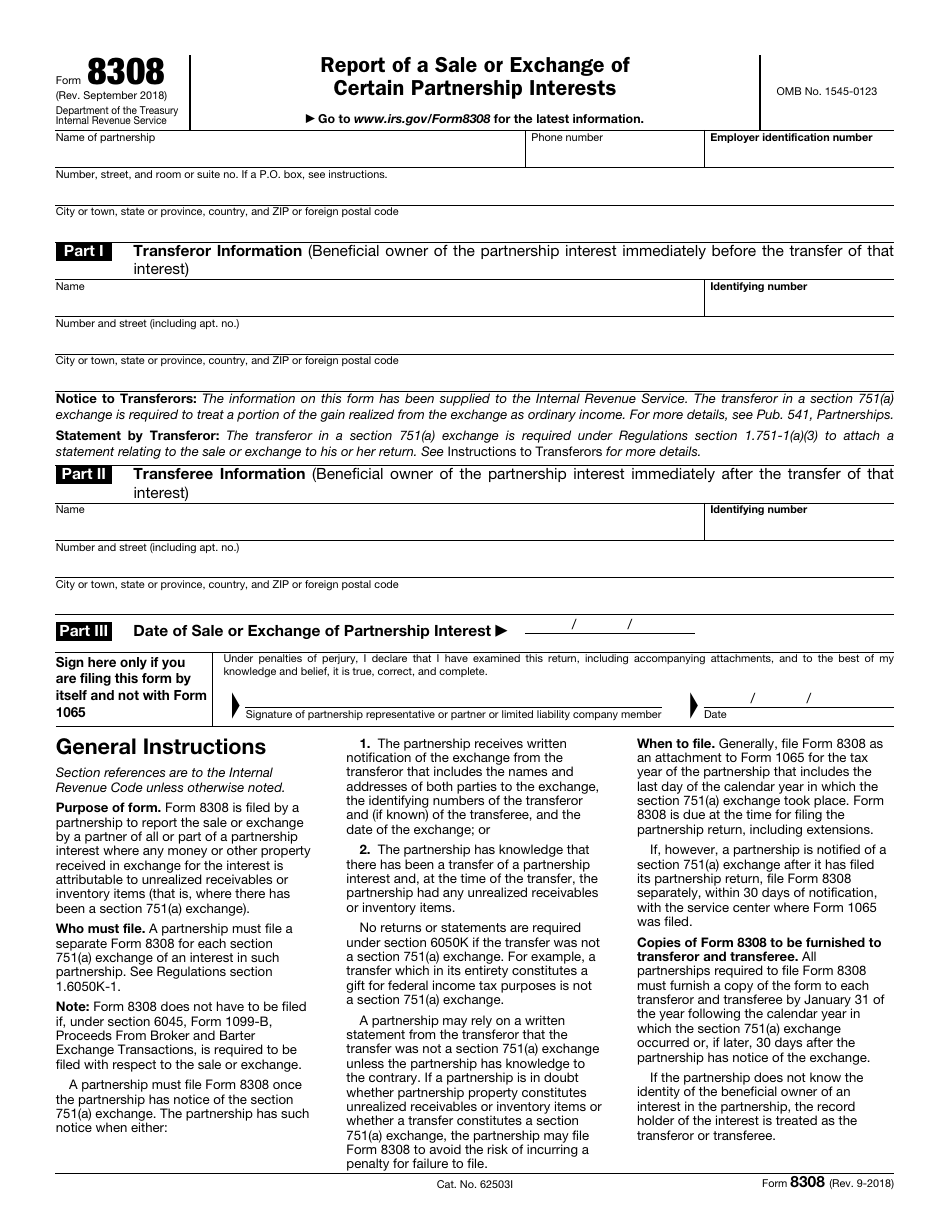

IRS Form 8308 Report of a Sale or Exchange of Certain Partnership Interests

What Is IRS Form 8308?

IRS Form 8308, Report of a Sale or Exchange of Certain Partnership Interests , is used by a partnership to report the exchange or sale by a partner of a partnership interest.

There are two parties to this report: a transferor and a transferee:

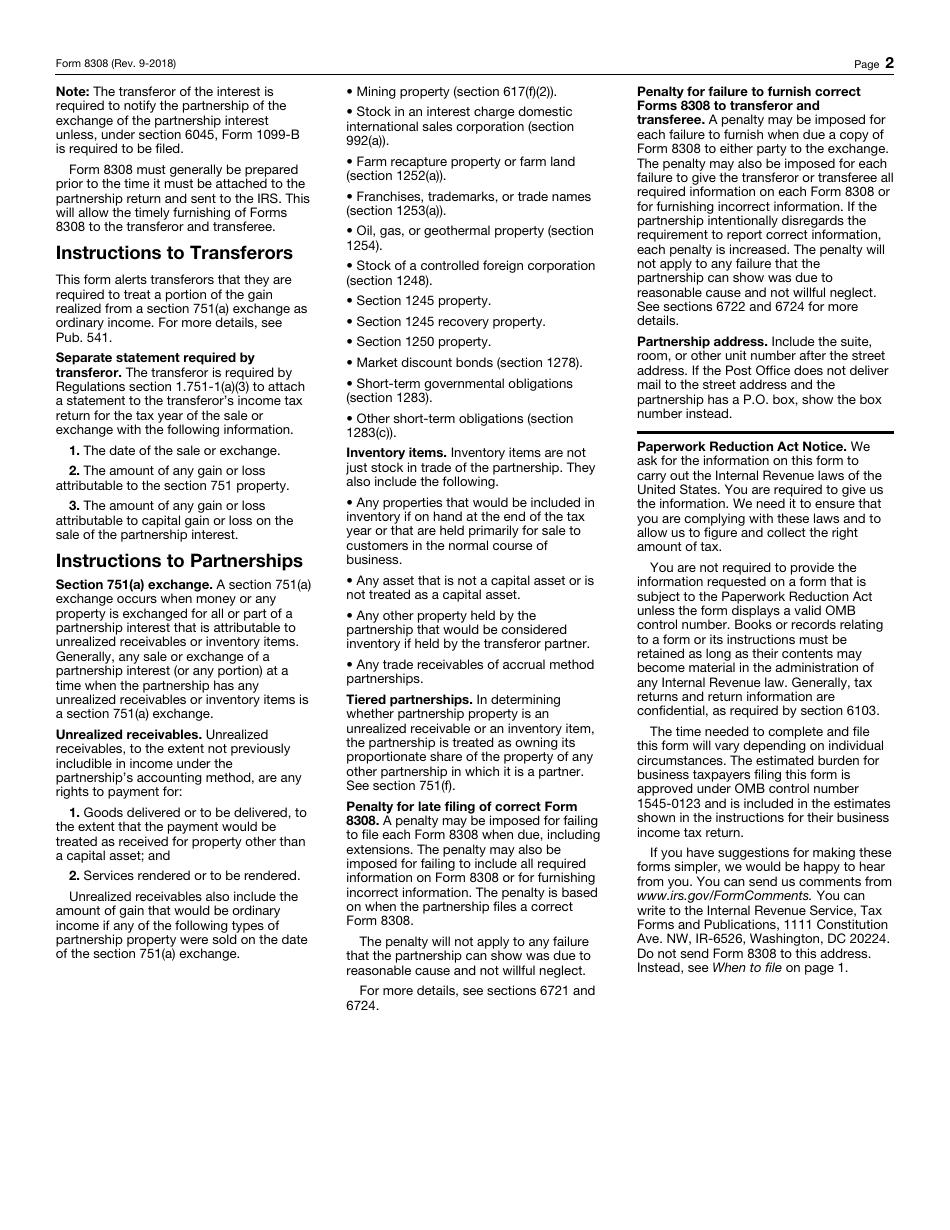

- The transferor is a beneficial owner of the partnership interest before the transfer of that interest. In exchange for the interest, the transferor gets money or other property relating to the unrealized receivables or inventory items. Unrealized receivables are any rights to payment for the goods delivered, the services rendered, the amount of gain that would be ordinary income in case of a sale of franchises, trademarks, and short-term obligations on the date of the exchange. Inventory items include the following: stock in trade of the partnership, an asset that is not a capital asset, and trade receivables of accrual method partnerships.

- The transferee is a beneficial owner of the partnership interest after the transfer of that interest. The transferee can contribute cash, assets, or services in exchange for a partnership interest. It allows them to get a percentage of ownership, and distributive shares.

Usually, Form 8308 is an attachment to Form 1065 for the tax year of the partnership that includes the last day of the calendar year in which the exchange took place. Form 1065, U.S. Return of Partnership Income, is used for reporting a tax return for income obtained through a business partnership. It calculates a partnership's profit or loss over a taxable year. If you are representing a large partnership you may also use Form 1065-B, U.S. Return of Income for Electing Large Partnerships.

IRS Form 8308 was released by the Internal Revenue Service (IRS) and the latest version was issued on September 1, 2018 . An IRS Form 8308 fillable version is available for download below.

When Is Form 8308 Required?

A partnership must file Form 8308 once it has notice of an exchange. It can be received as a written notification from the transferor or having knowledge that there has been a transfer of a partnership interest, and the partnership had unrealized receivables or inventory items at the time of the transfer.

IRS Form 8308 Instructions

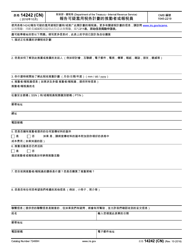

Form 8308 consists of three parts.

- Part I. The name, address, and the identifying number of the transferor should be indicated. The transferor is required to attach a statement relating to the sale or exchange for their return.

- Part II. The name, the address, and an identifying number of the transferee should be indicated here.

- Part III. This part contains the date of sale or exchange of partnership interest.

The form should contain the signature of the partner and the date. It should be signed in different places depending on whether it is being filed separately or with Form 1065.

Where Do I Mail IRS Form 8308?

According to the Form 8308 filing requirements it should be submitted as an attachment to Form 1065 for the tax year of the partnership. But in some cases, it can be submitted also separately with the service center where Form 1065 was filed.