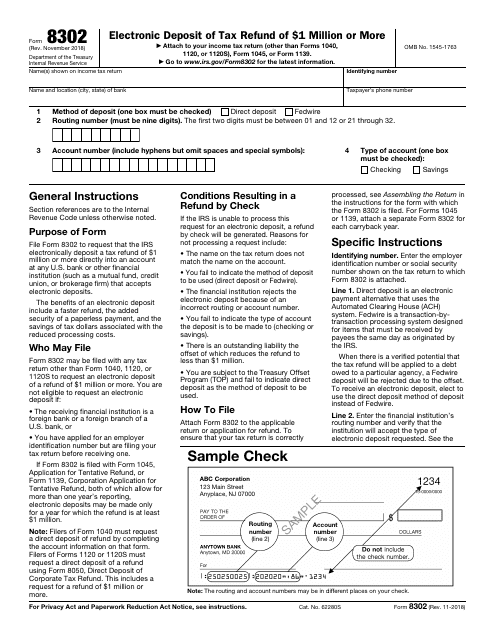

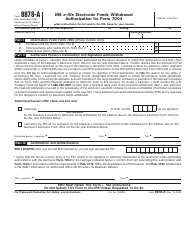

IRS Form 8302 Electronic Deposit of Tax Refund of $1 Million or More

What Is IRS Form 8302?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8302?

A: IRS Form 8302 is used for the electronic deposit of tax refunds of $1 million or more.

Q: Who needs to use IRS Form 8302?

A: Taxpayers who are expecting a tax refund of $1 million or more and want to receive it via electronic deposit need to use Form 8302.

Q: Can I use IRS Form 8302 for tax refunds less than $1 million?

A: No, Form 8302 is specifically for tax refunds of $1 million or more. For refunds less than $1 million, use other appropriate forms or methods available.

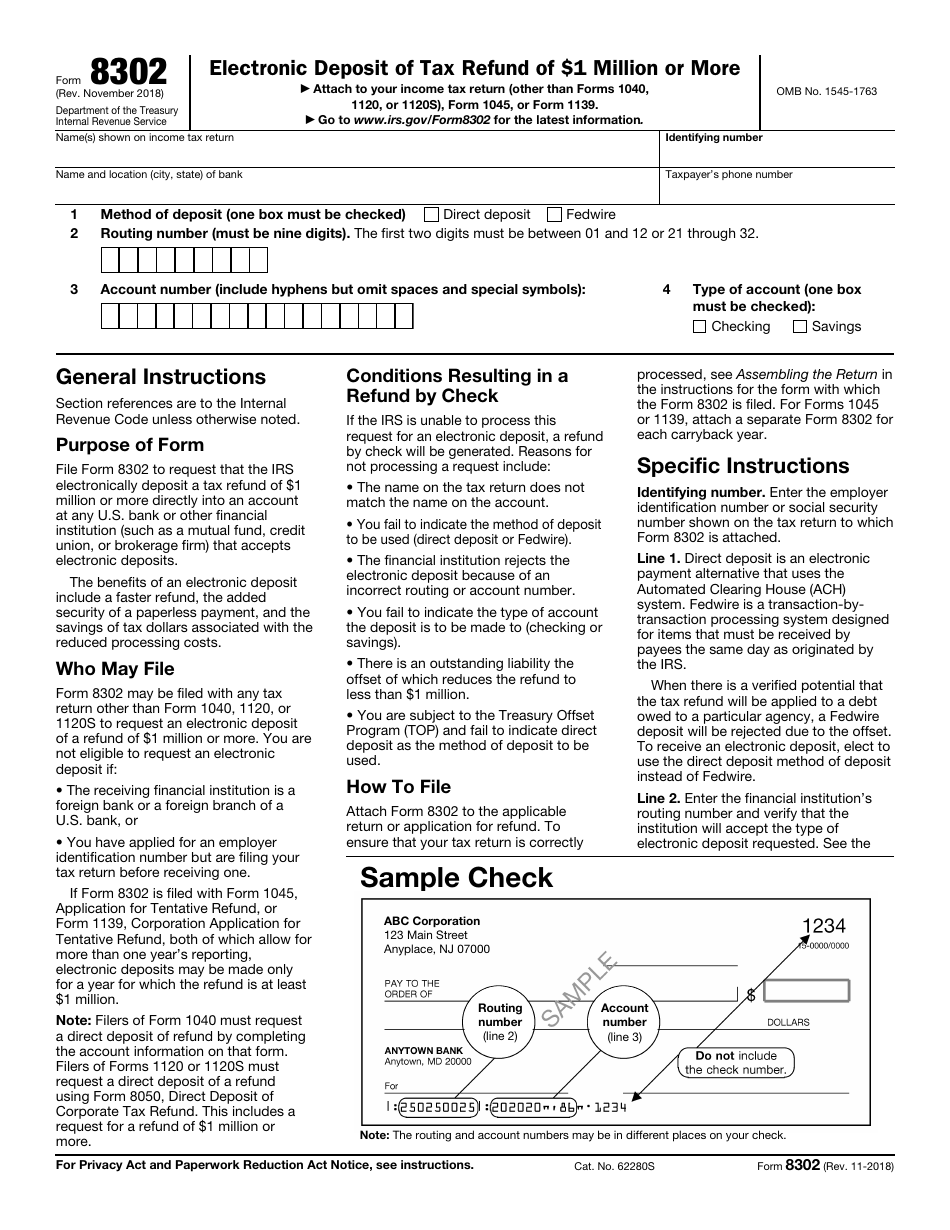

Q: How do I fill out IRS Form 8302?

A: You should follow the instructions provided in the form to accurately fill out IRS Form 8302.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8302 through the link below or browse more documents in our library of IRS Forms.