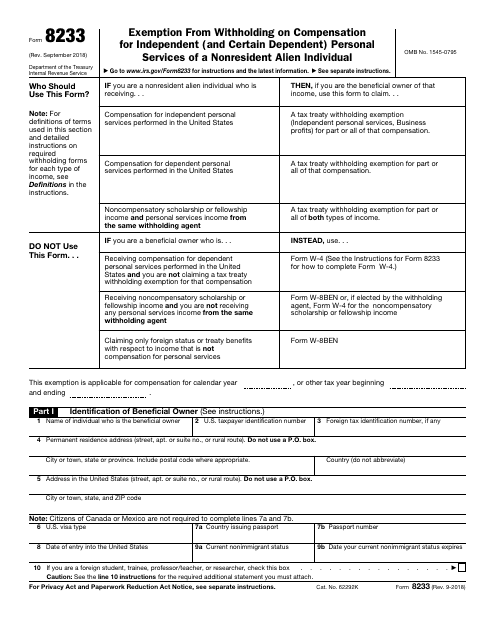

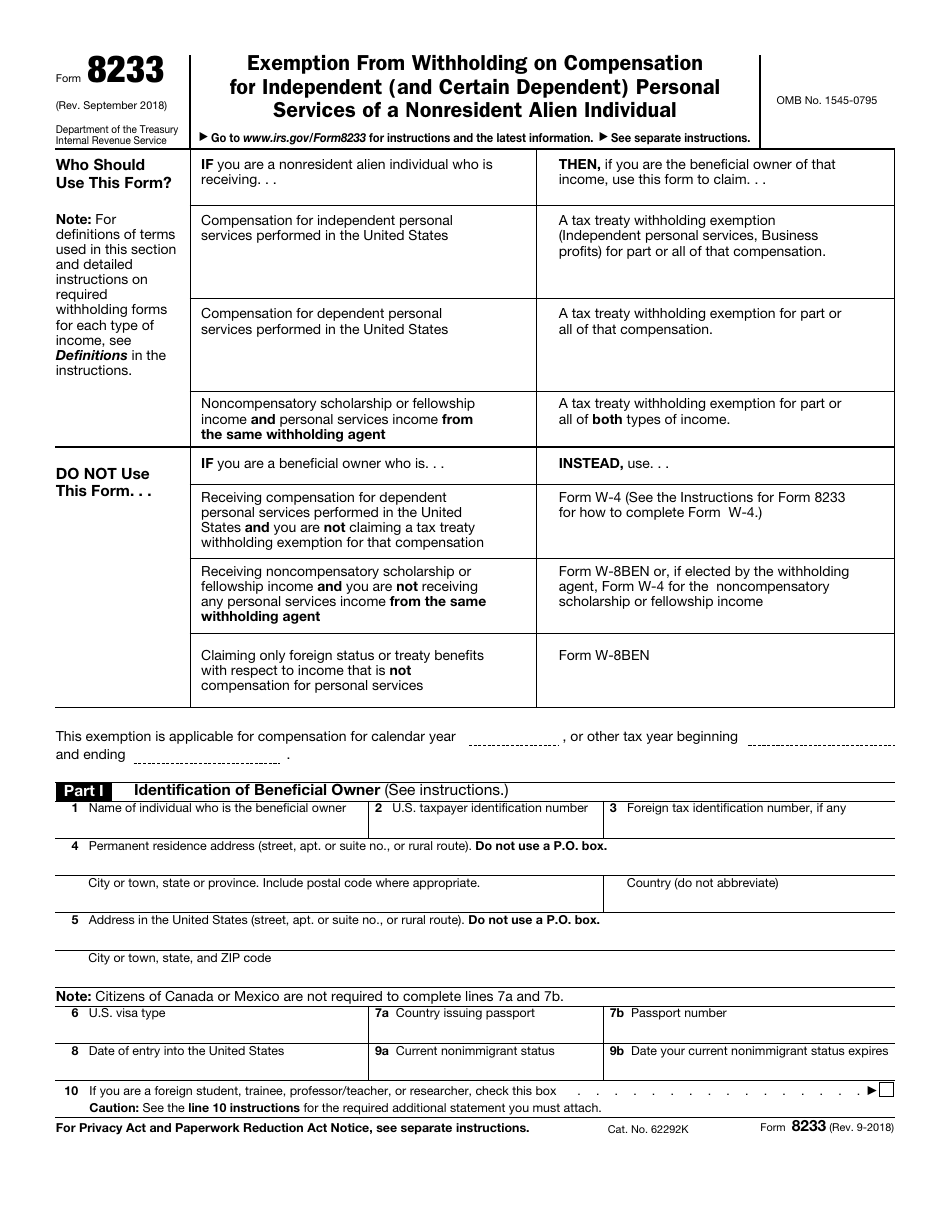

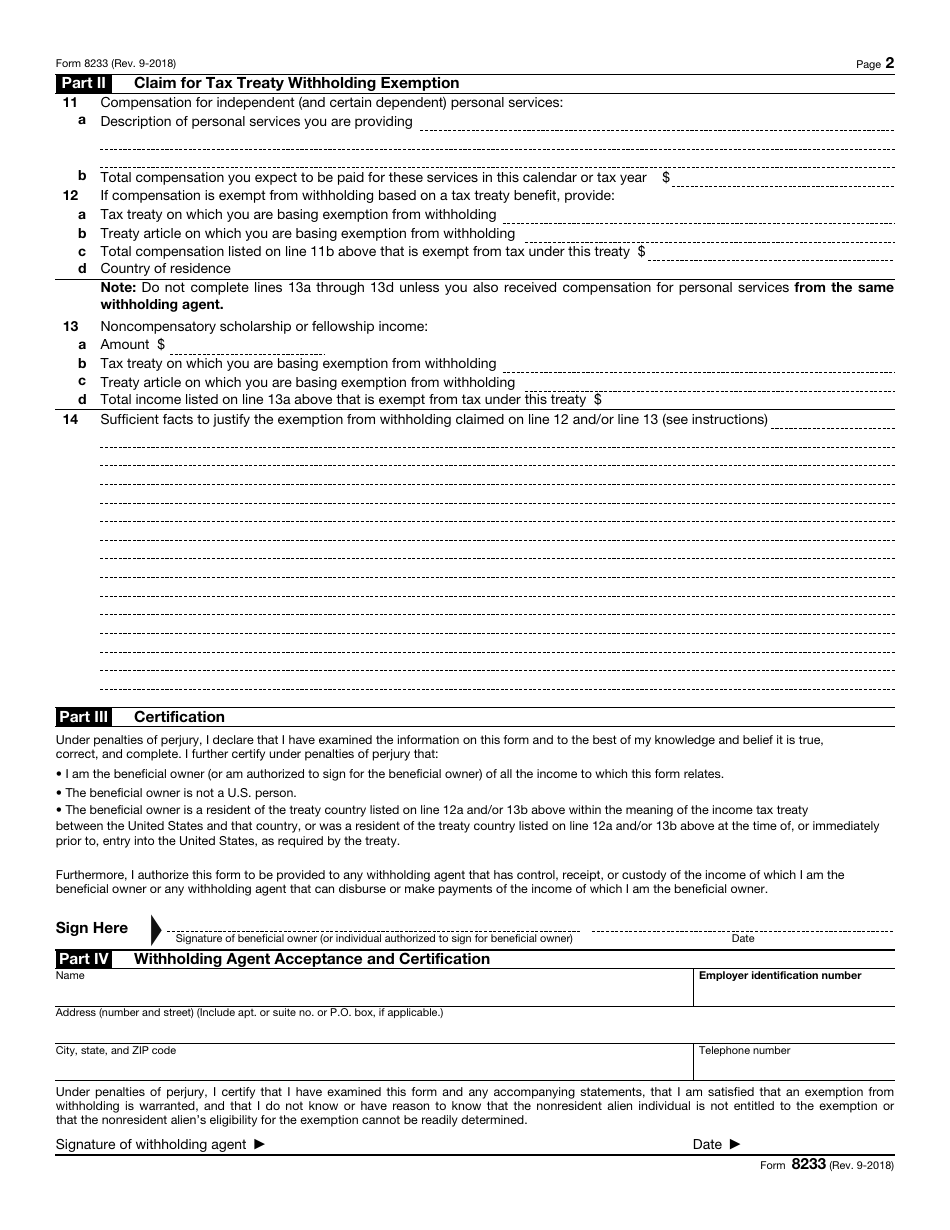

IRS Form 8233 Exemption From Withholding on Compensation for Independent (And Certain Dependent) Personal Services of a Nonresident Alien Individual

What Is IRS Form 8233?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8233?

A: IRS Form 8233 is a form used to claim exemption from withholding on compensation for nonresident alien individuals.

Q: Who can use IRS Form 8233?

A: Nonresident alien individuals who are eligible for a tax treaty exemption can use IRS Form 8233.

Q: What does IRS Form 8233 exempt?

A: IRS Form 8233 exempts certain compensation paid to nonresident aliens for independent or dependent personal services.

Q: Why would someone use IRS Form 8233?

A: Someone would use IRS Form 8233 to avoid having income tax withheld from their compensation due to a tax treaty exemption.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8233 through the link below or browse more documents in our library of IRS Forms.