This version of the form is not currently in use and is provided for reference only. Download this version of

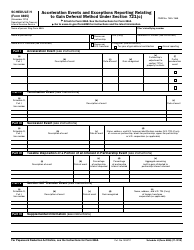

IRS Form 6781

for the current year.

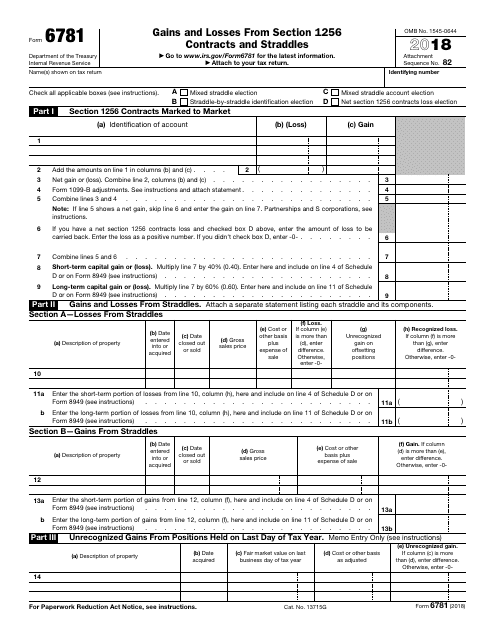

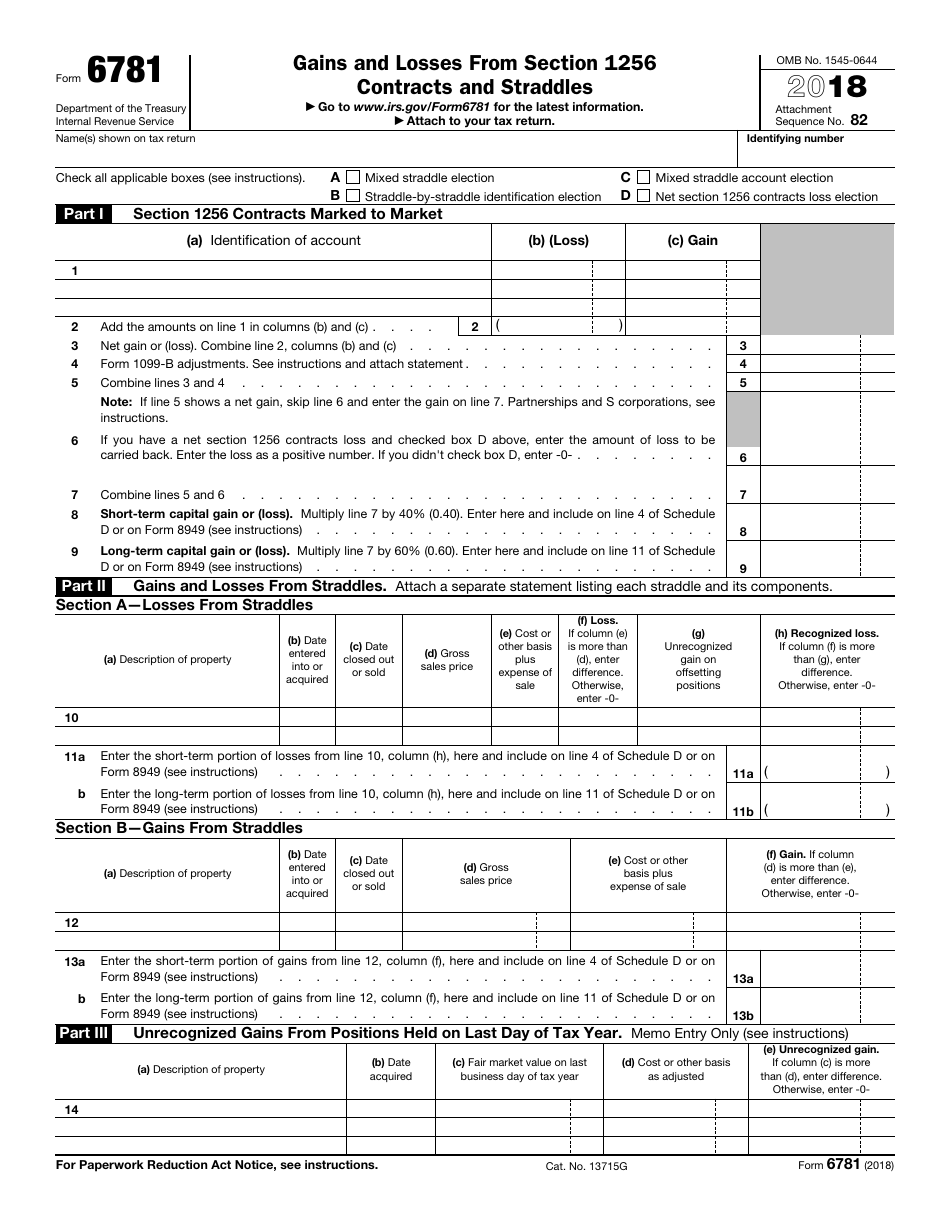

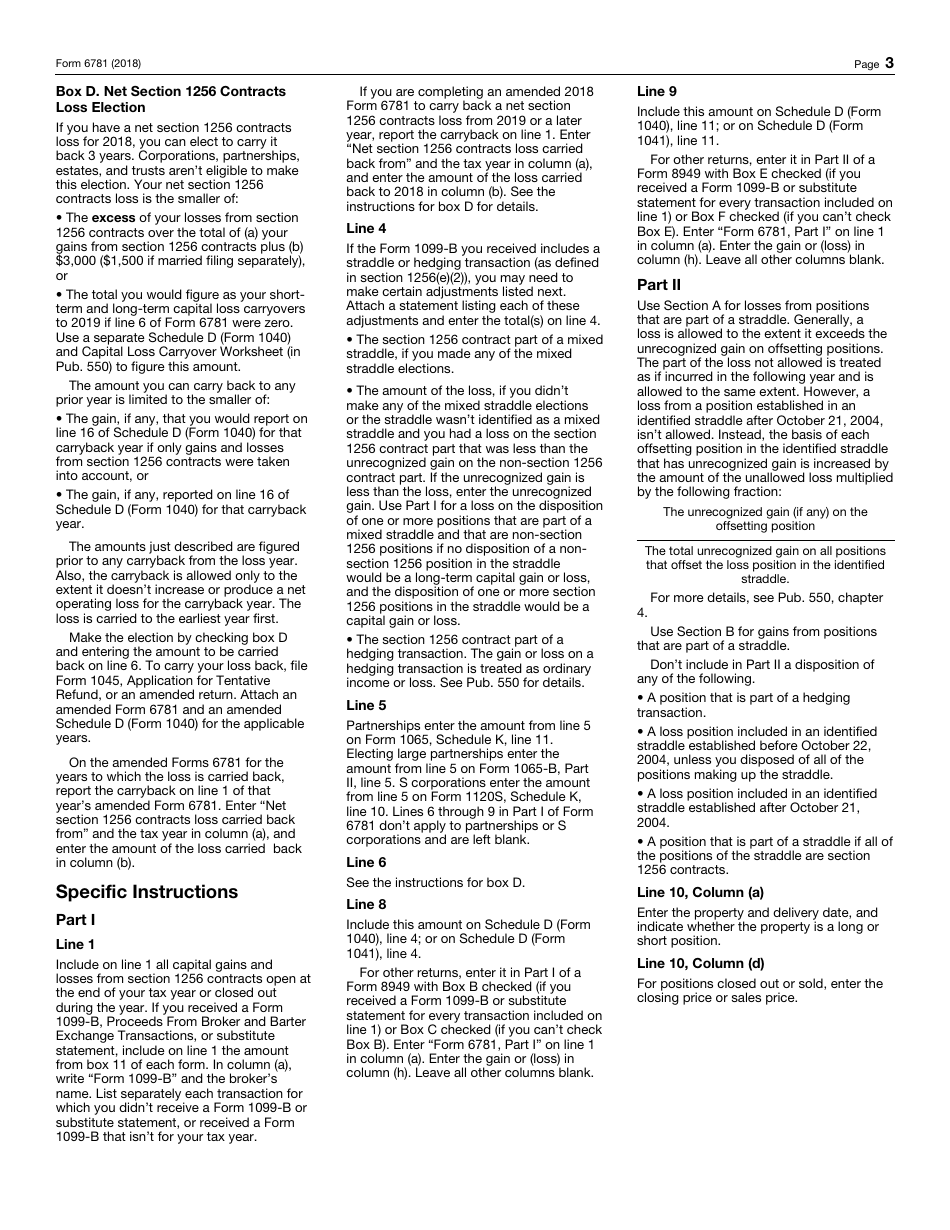

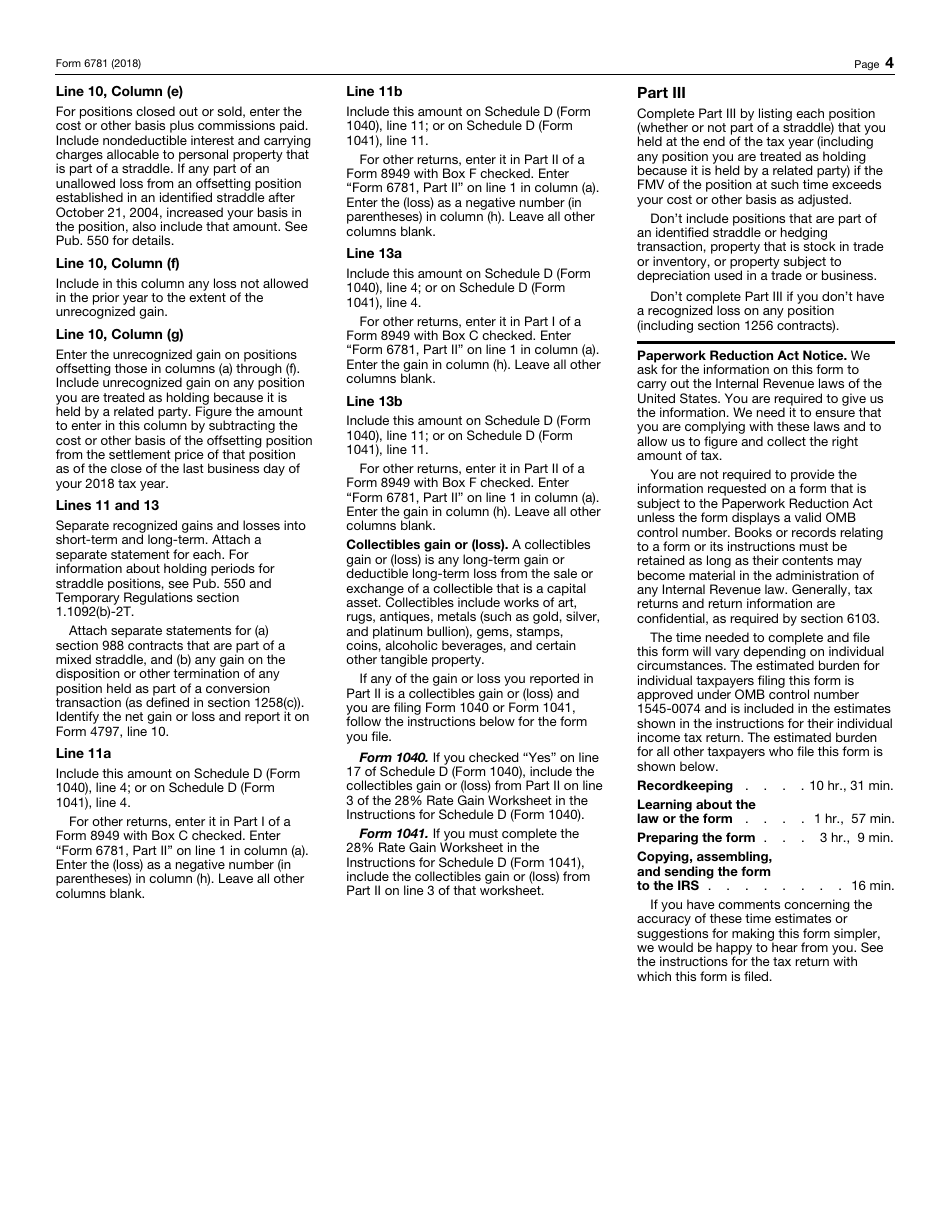

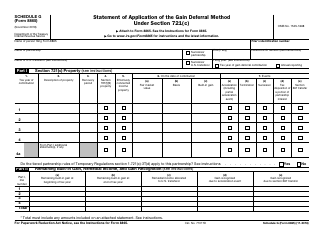

IRS Form 6781 Gains and Losses From Section 1256 Contracts and Straddles

What Is IRS Form 6781?

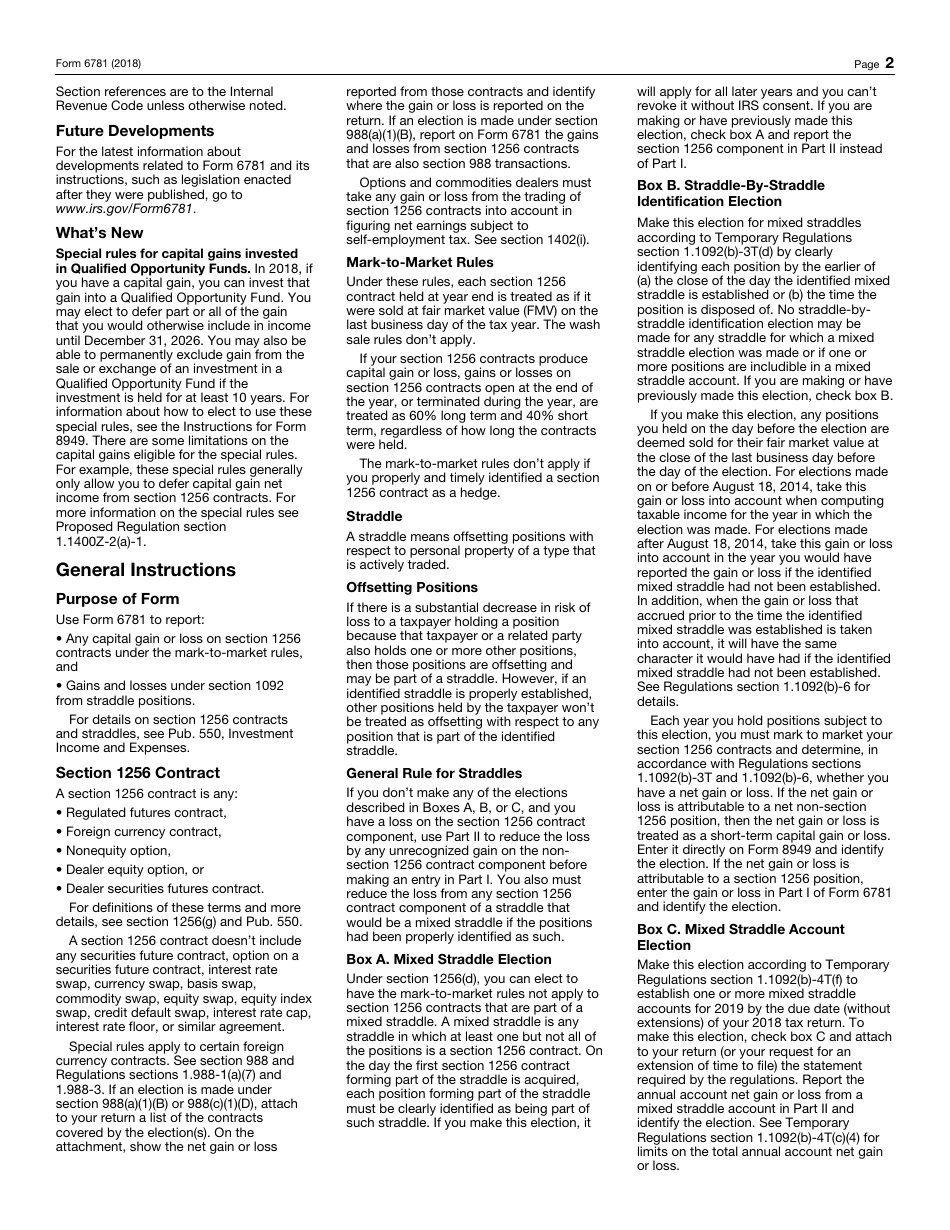

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 6781?

A: IRS Form 6781 is a tax form used to report gains and losses from section 1256 contracts and straddles.

Q: What are section 1256 contracts?

A: Section 1256 contracts are certain types of financial instruments, such as futures contracts and options, which are subject to special tax treatment.

Q: What is a straddle?

A: A straddle is an investment strategy where an individual or entity holds positions in both a call option and a put option with the same underlying asset, expiration date, and strike price.

Q: Who needs to file IRS Form 6781?

A: Anyone who has gains or losses from section 1256 contracts or straddles needs to file IRS Form 6781.

Q: What information is required on IRS Form 6781?

A: IRS Form 6781 requires you to provide detailed information about each section 1256 contract or straddle, including the description, dates, and amounts of gains or losses.

Q: When is the deadline to file IRS Form 6781?

A: IRS Form 6781 is generally due by April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any penalties for not filing IRS Form 6781?

A: Yes, failing to file IRS Form 6781 or reporting incorrect information can result in penalties and interest charges.

Q: Can IRS Form 6781 be filed electronically?

A: Yes, IRS Form 6781 can be filed electronically using tax software or through the IRS's e-file system.

Q: Do I need to attach any supporting documents with IRS Form 6781?

A: Generally, you do not need to attach supporting documents with IRS Form 6781. However, it is important to keep records and supporting documents in case of an audit.

Form Details:

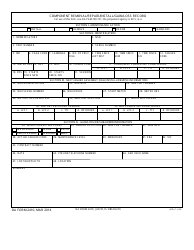

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6781 through the link below or browse more documents in our library of IRS Forms.