This version of the form is not currently in use and is provided for reference only. Download this version of

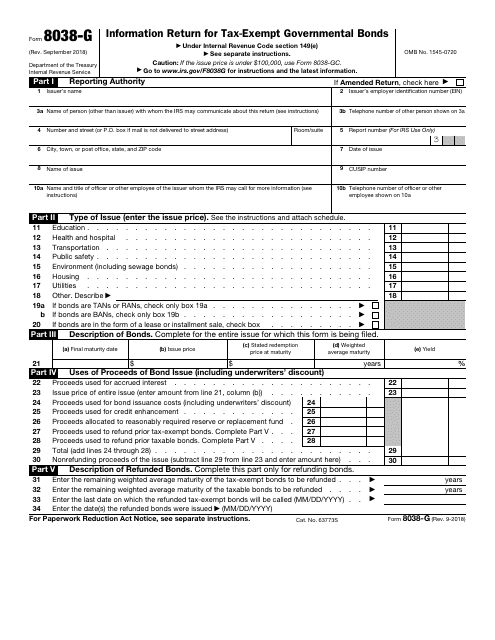

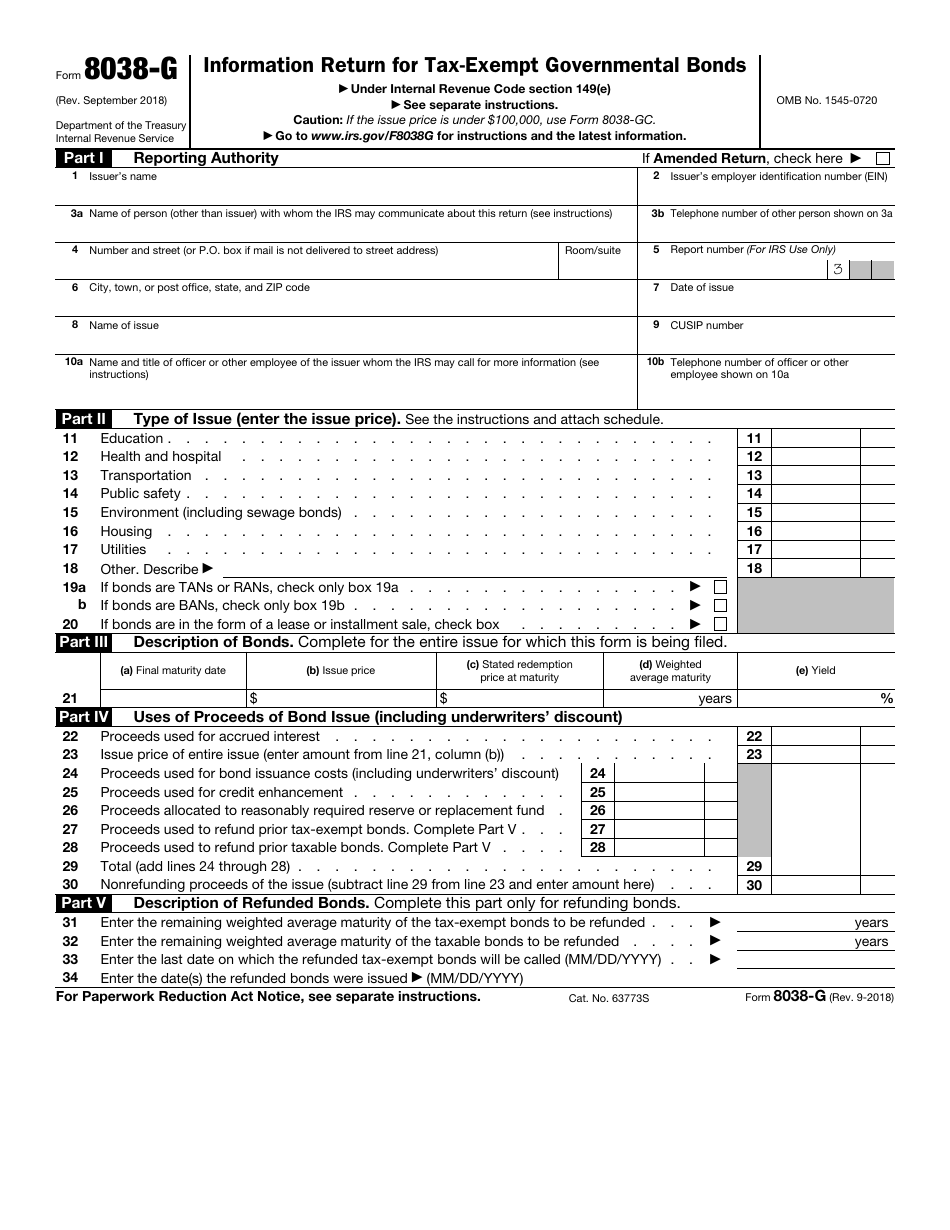

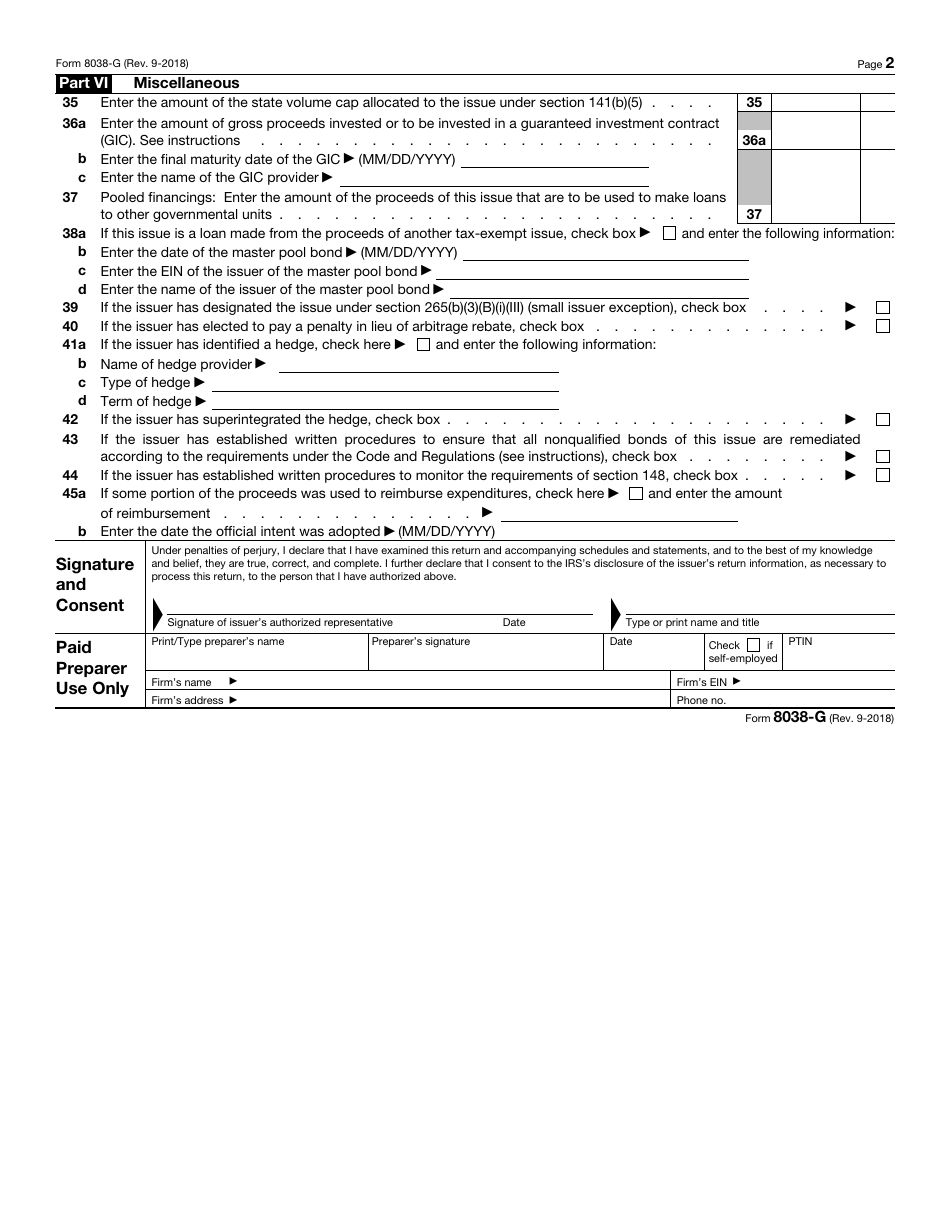

IRS Form 8038-G

for the current year.

IRS Form 8038-G Information Return for Tax-Exempt Governmental Bonds

What Is IRS Form 8038-G?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038-G?

A: IRS Form 8038-G is an Information Return for Tax-Exempt Governmental Bonds.

Q: Who needs to file IRS Form 8038-G?

A: Governmental entities issuing tax-exempt bonds need to file IRS Form 8038-G.

Q: What is the purpose of IRS Form 8038-G?

A: IRS Form 8038-G is used to provide information about tax-exempt governmental bonds to the IRS.

Q: When is IRS Form 8038-G due?

A: IRS Form 8038-G is generally due within 30 days after the bond issue date.

Q: What information is required on IRS Form 8038-G?

A: IRS Form 8038-G requires information about the bond issuer, bond issue, and related parties.

Q: Are there any penalties for not filing IRS Form 8038-G?

A: Yes, there can be penalties for not filing IRS Form 8038-G or for filing it late.

Q: Can I file IRS Form 8038-G electronically?

A: No, IRS Form 8038-G cannot be filed electronically and must be filed by mail.

Q: Is IRS Form 8038-G for individuals or businesses?

A: IRS Form 8038-G is for governmental entities, not individuals or businesses.

Q: Do I need to include supporting documents with IRS Form 8038-G?

A: Yes, certain supporting documents need to be included with IRS Form 8038-G.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038-G through the link below or browse more documents in our library of IRS Forms.