This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8027-T

for the current year.

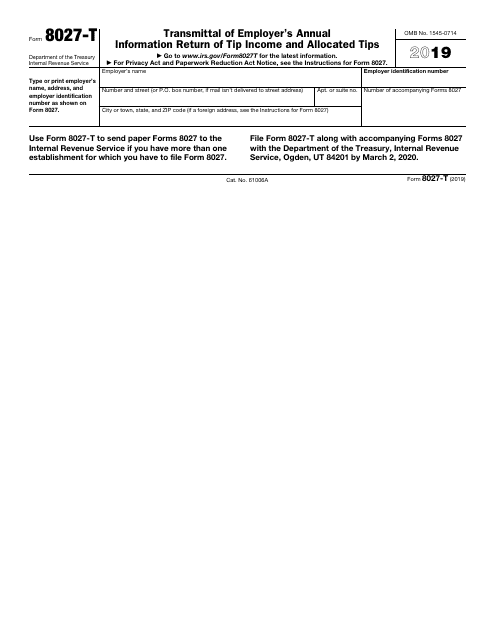

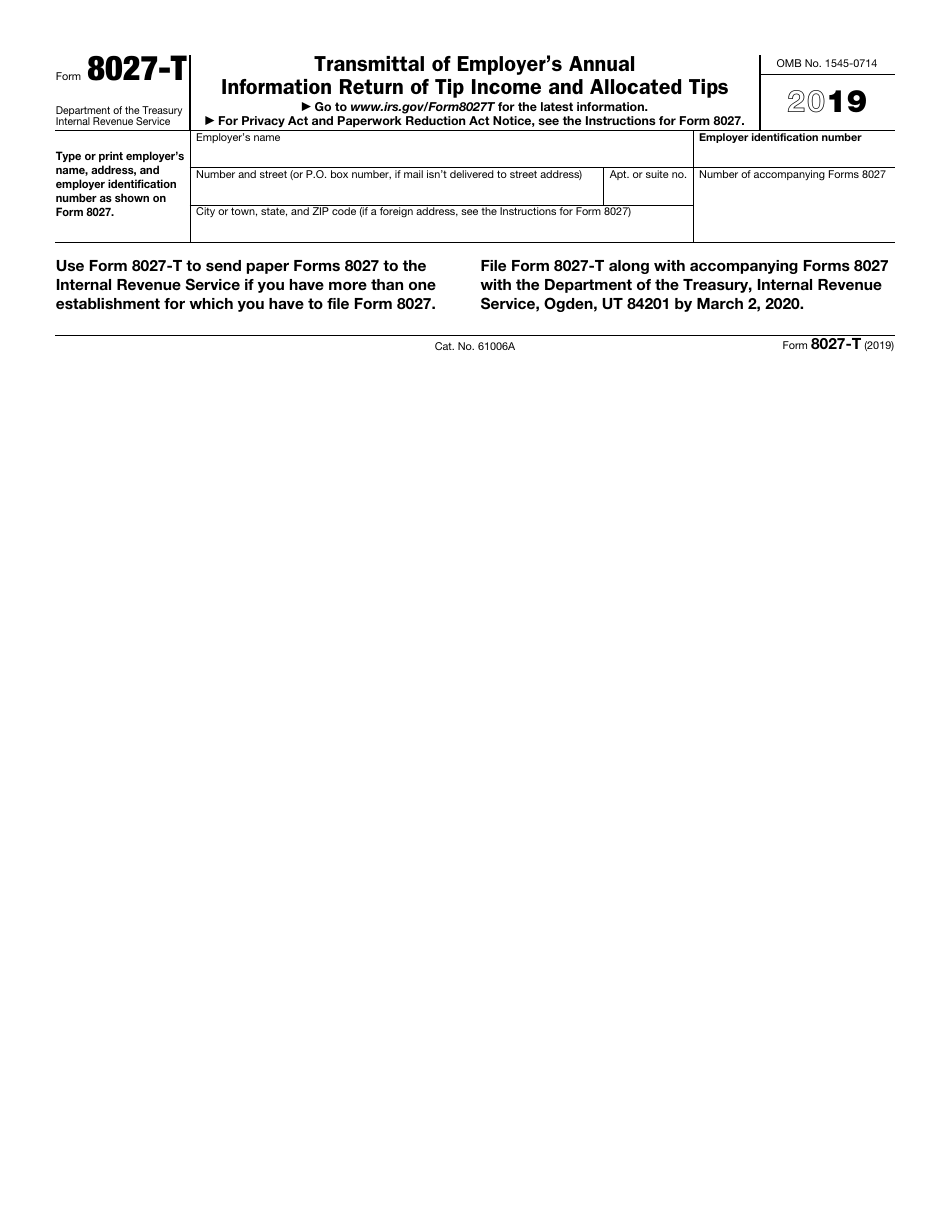

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

What Is IRS Form 8027-T?

IRS Form 8027-T, Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips is a supplemental form. You have to fill out this document if you are an employer who operates more than one food or beverage establishment for which you submit paper versions of Form 8027.

The issuing department of this document is the Internal Revenue Service (IRS) . The document was last revised in 2019 . Download a fillable version of IRS Form 8027-T through the link below.

Form 8027-T has two related forms:

- IRS Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips. This document is completed by the employers wishing to make an annual report of tips from their large food or beverage establishment and to calculate the allocated tips.

- IRS Form 4070, Employee's Report of Tips to Employer. This form is filled out by the employee in order to inform the employer about the tips received in cases when their amount exceeds $20 per month, including cash tips, debit and credit card tips, and tips received from other employees.

IRS Form 8027-T Instructions

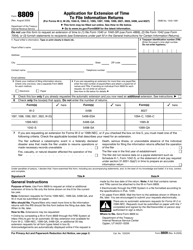

The due date of the form is February 28 . If you fail to submit this document on time, the IRS will subject you to penalties, unless you have a reasonable explanation of the delay. You can request the extension of time to file your forms using IRS Form 8809, Application for Extension of Time to File Information Returns.

Fill out the Form 8027-T using the following guidelines:

- Employer Identification Number. Enter the same Employer Identification Number (EIN) as provided on the accompanying Forms 8027;

- Employer's Name. Indicate the name of an individual or entity whose EIN is used;

- Number and Street. You may also provide the P.O. box number in this field if your mail is not delivered to the street address;

- Apartment or Suite No. Self-explanatory;

- City or Town, State, and ZIP Code. If you use a foreign address, provide city, province or state, and country. Enter the name of the country in full. No abbreviations are allowed;

- The Number of Accompanying Forms 8027. Self-explanatory.

Use this form only if you submit paper versions of the document. If filing through the Filing Information Returns Electronically system, it does not require a transmittal. Do not staple or otherwise attach this document to any other form you submit it with. Mail both forms (8027 and 8027-T) to the following address: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201 .