This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8027

for the current year.

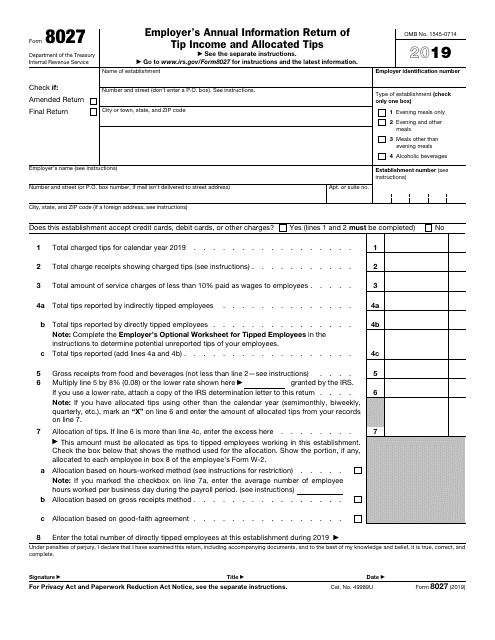

IRS Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips

What Is IRS Form 8027?

IRS Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips is a form used by the employer to annually report the receipts and tips their employee received to the Internal Revenue Service (IRS) , as well as to determine allocated tips.

The document was last revised in 2019 . Download a fillable Form 8027 through the link below.

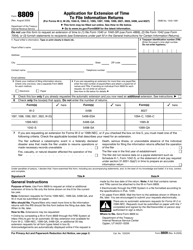

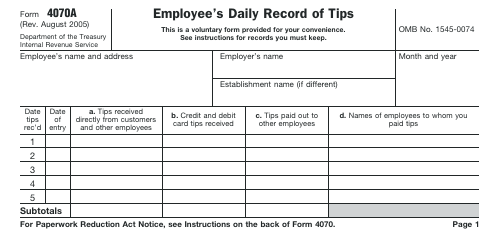

If you submit more than one IRS tip reporting form, you must enclose the related IRS Form 8027-T, Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips. This form has one more related document, e.g. IRS Form 4070, Employee's Report of Tips to Employer. This form is used by the employees for reporting to the employer cash tips, debit, and credit card tips, and tips received from other employees.

Who Has to File Form 8027?

File the IRS 8027 Form if you are an employer and operate a large food or beverage establishment. To be eligible for reporting tips to the IRS on this form, your establishment must meet the following criteria:

- To be located in one of the 50 states or in the District of Columbia;

- Giving tips to the employee is a custom practice in the establishment;

- There were usually more than 10 employees employed on a typical business day during the previous calendar year.

In order to assist you with determining if you need to submit this form, the IRS has designed a worksheet that can help you. Find the worksheet in the Instructions for the form.

When Is Form 8027 Due?

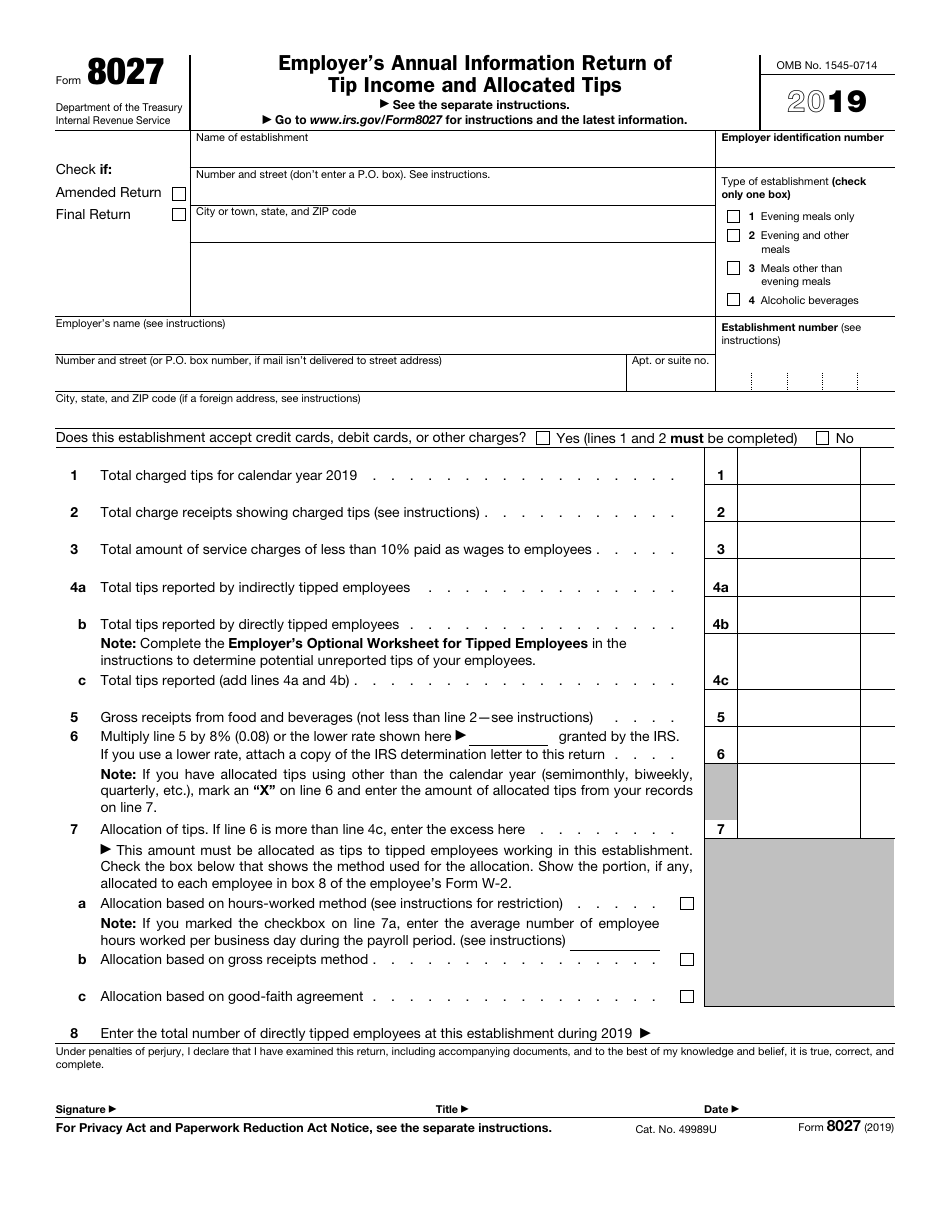

The document's due date is February 28 . However, if you choose to submit your report electronically, the filing deadline falls on April 1 . If you cannot file your form by the due dates, ask for an extension through the Form 8809, Application for Extension of Time to File Information Returns. Complete and submit this form as soon as you realize you need an extension. It must be done before the due dates, but not earlier than January 1 of the filing year.

IRS Form 8027 Instructions

The IRS released complete Instructions for the IRS Form 8027. Their summary is as follows:

- Submit a separate form for each food and beverage establishment;

- If the establishments are in the same building but occupy different areas of it, e.g., a hotel that includes a coffee shop, a lounge bar, and a fine restaurant, file a separate form for each of these establishments;

- If you file more than one paper form, enclose the Form 8027-T;

- Provide the name and the address of the establishment (not necessarily your mailing address) on the top part of the form. Indicate the name by which you are known to the customers (the one indicated on the front of the building or the name of the lounge bar situated within the casino);

- Do not forget to specify your Employer Identification Number (EIN). It must be the same as indicated on the Forms W-2 you give to your employees and Form 941 you use to report wages and taxes for your employees;

- Choose the type of your establishment from the list provided on the right part of the form. Check only one option;

- Provide the name and the address of the entity or person whose EIN was entered for the employer's name and address;

- To identify different establishments reported under the same EIN, assign a unique 5-digit number to every one of them. Once you assign the number to the establishment, you must always report it under the same number. Do not reassign this number to another establishment, even if you close the establishment the number was assigned to;

- You may round off cents for the amounts you report in lines 1 through 8 to the whole dollar. Note, if you choose to round, you must round all amounts;

- Do not forget to sign the form after completion, otherwise, it will not be valid.

The IRS provided detailed instructions with worksheets. You can either download an electronic version of the file or order a paper copy.

Where to Mail Form 8027?

If you file a paper version of your report, mail Forms 8027 and 8027-T to the Department of the Treasury, Internal Revenue Service, Ogden, Utah 84201 .

Enclose a copy of the timely filled out Form 8809 (if applicable), and a "lower rate" determination letter you received from the IRS. If you filed Form 8508, Request for Waiver from Filing Information Returns Electronically, attach a copy of it, too. Do not enclose any other documents.

If you need to submit 250 and more forms, you must do it electronically through the Filing Information Returns Electronically system. The IRS encourages you to file electronically even if you have to submit only one form.