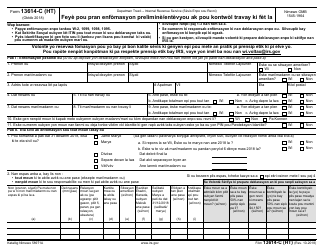

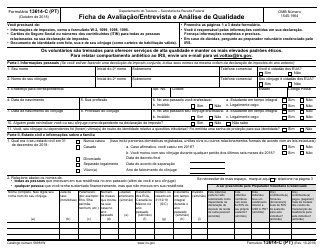

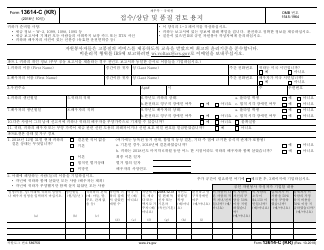

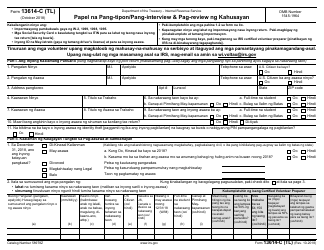

This version of the form is not currently in use and is provided for reference only. Download this version of

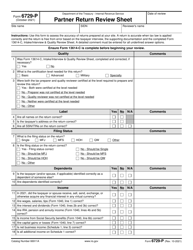

IRS Form 6729

for the current year.

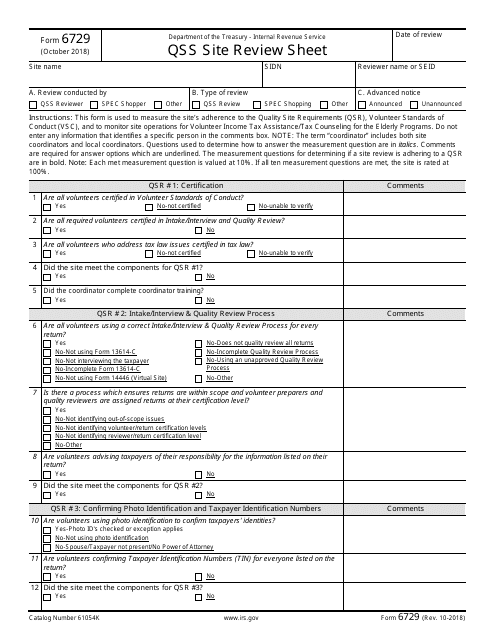

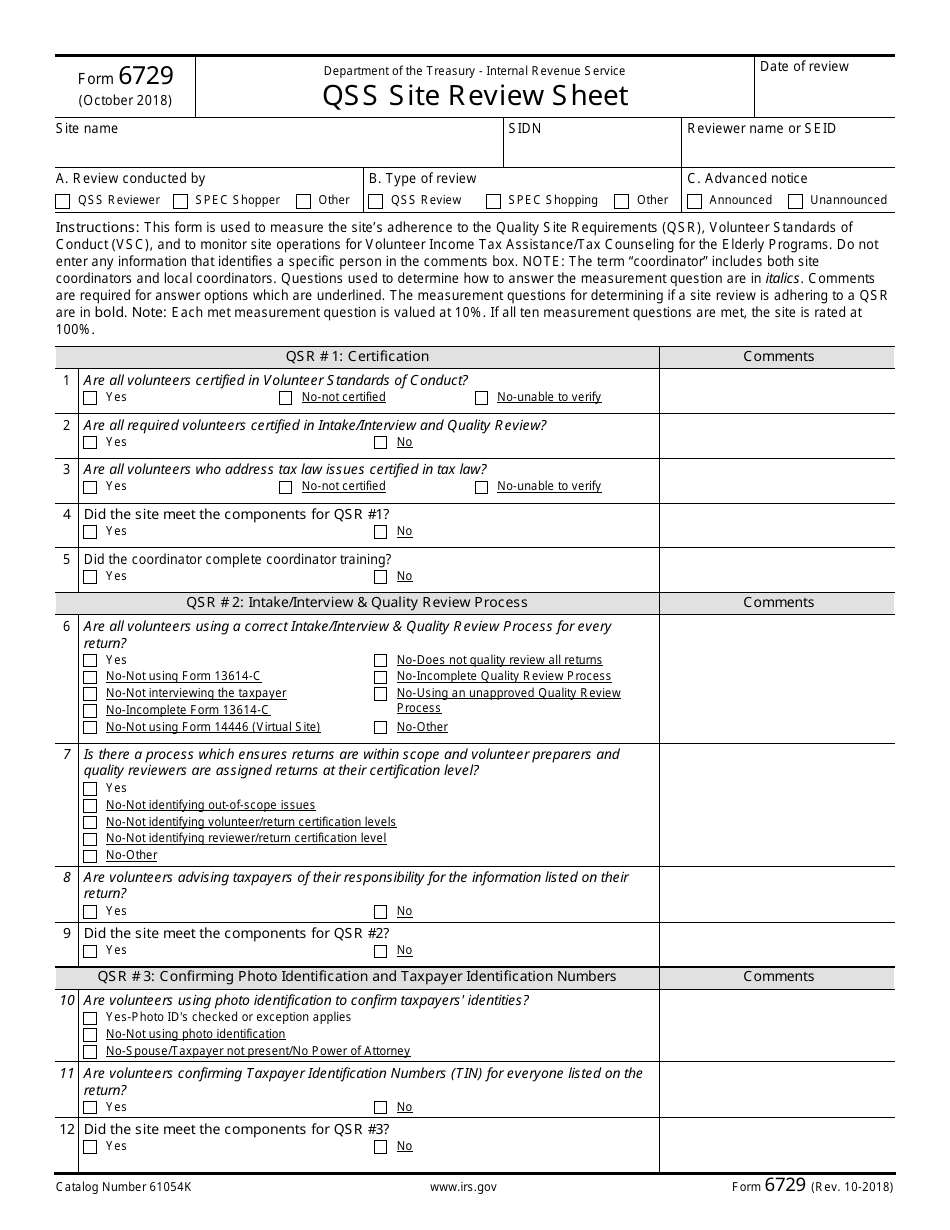

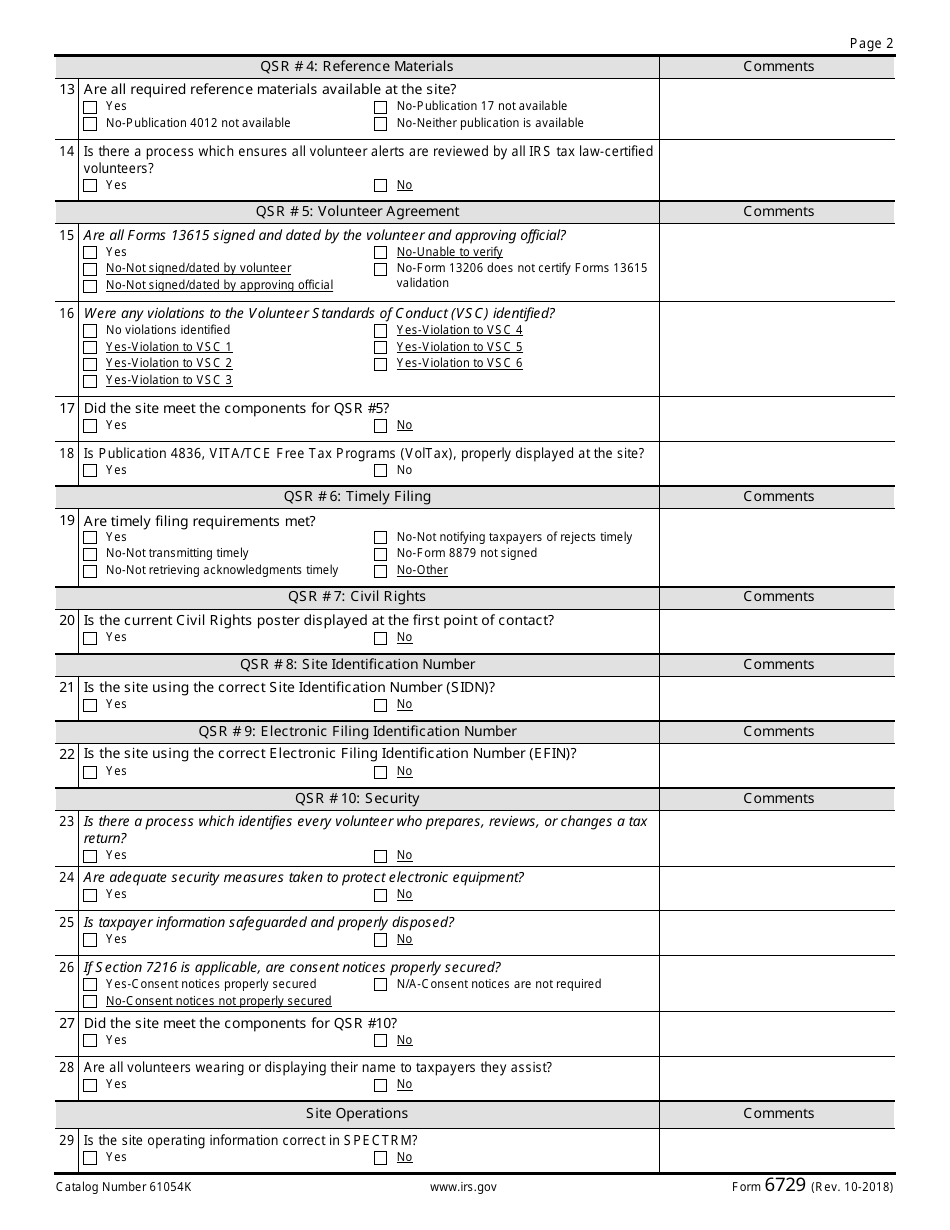

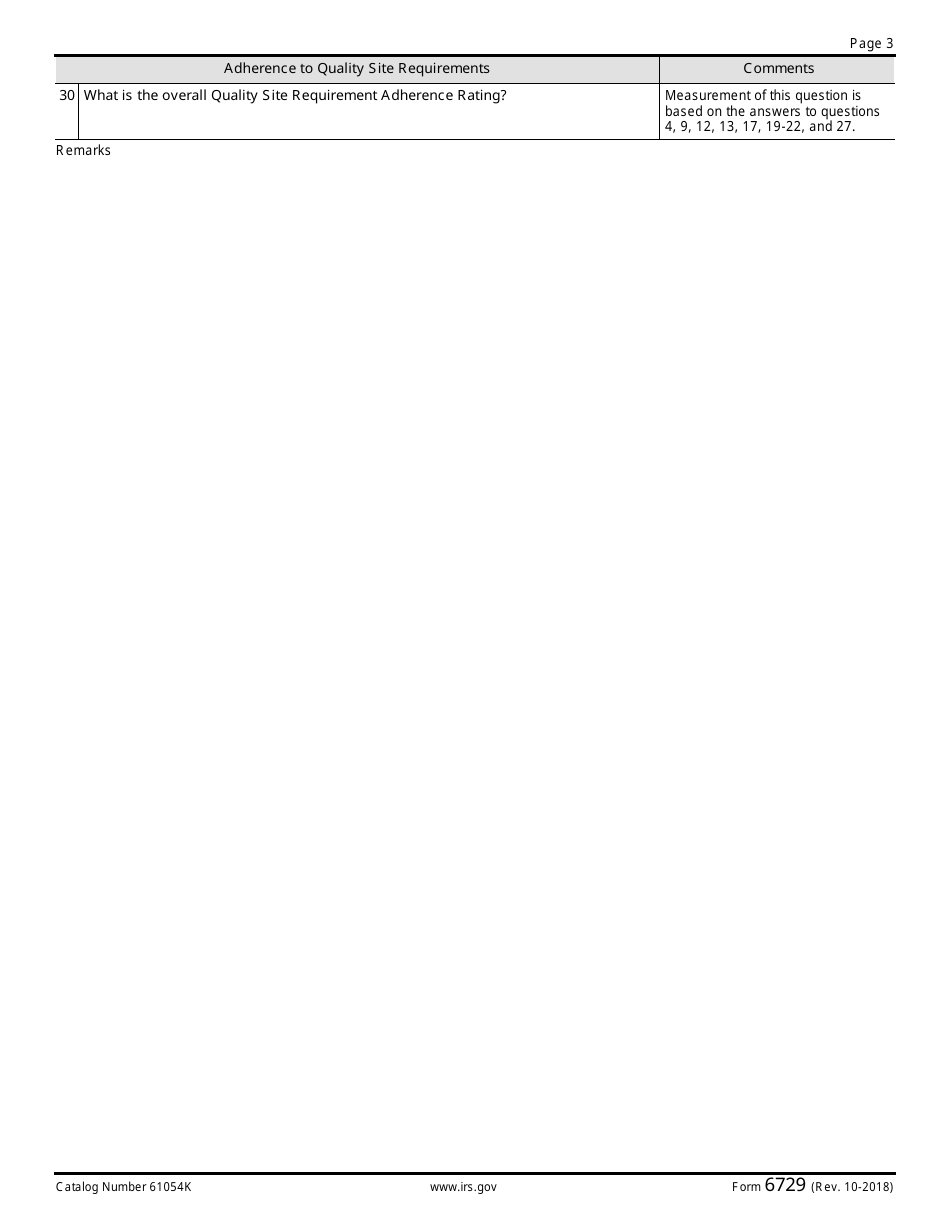

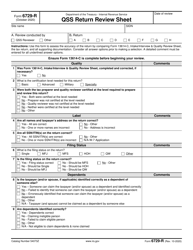

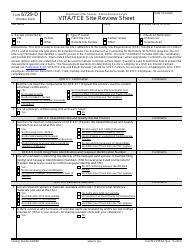

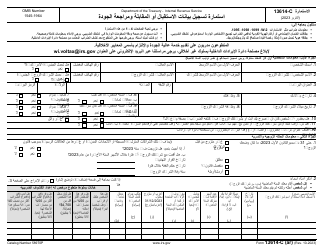

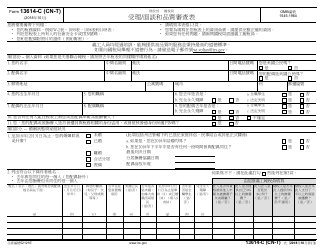

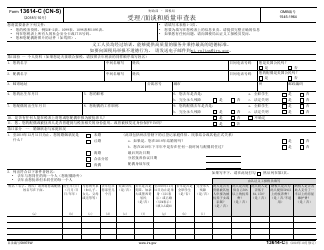

IRS Form 6729 Qss Site Review Sheet

What Is IRS Form 6729?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 6729?

A: IRS Form 6729 is a QSS Site Review Sheet.

Q: What is the purpose of IRS Form 6729?

A: The purpose of IRS Form 6729 is to conduct a review of the Quality Site Specialist (QSS) site.

Q: Who uses IRS Form 6729?

A: The IRS uses IRS Form 6729 to review QSS sites.

Q: What is a QSS site?

A: A QSS site is a location where Quality Site Specialists evaluate tax law compliance.

Q: Is IRS Form 6729 required for all businesses?

A: No, IRS Form 6729 is only required for businesses that undergo a QSS site review.

Q: What information is required on IRS Form 6729?

A: IRS Form 6729 requires information about the QSS site, including its location, contact person, and evaluation details.

Q: Are there any filing fees associated with IRS Form 6729?

A: No, there are no filing fees associated with IRS Form 6729.

Q: Can IRS Form 6729 be filed electronically?

A: No, IRS Form 6729 cannot be filed electronically. It must be completed manually and submitted by mail.

Q: What happens after submitting IRS Form 6729?

A: After submitting IRS Form 6729, the IRS will review the information provided and conduct a QSS site review based on the details provided.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6729 through the link below or browse more documents in our library of IRS Forms.