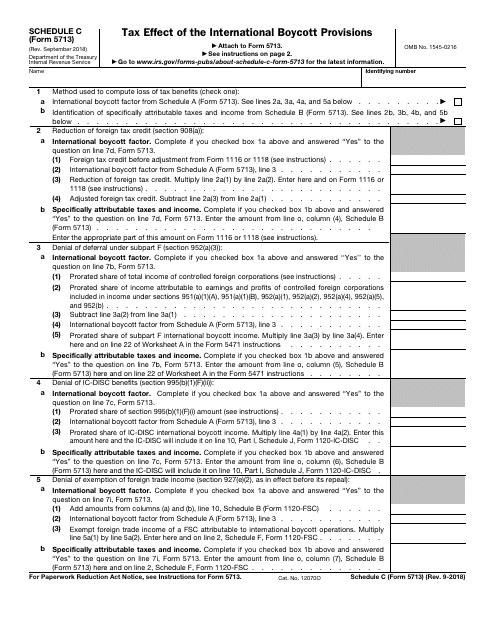

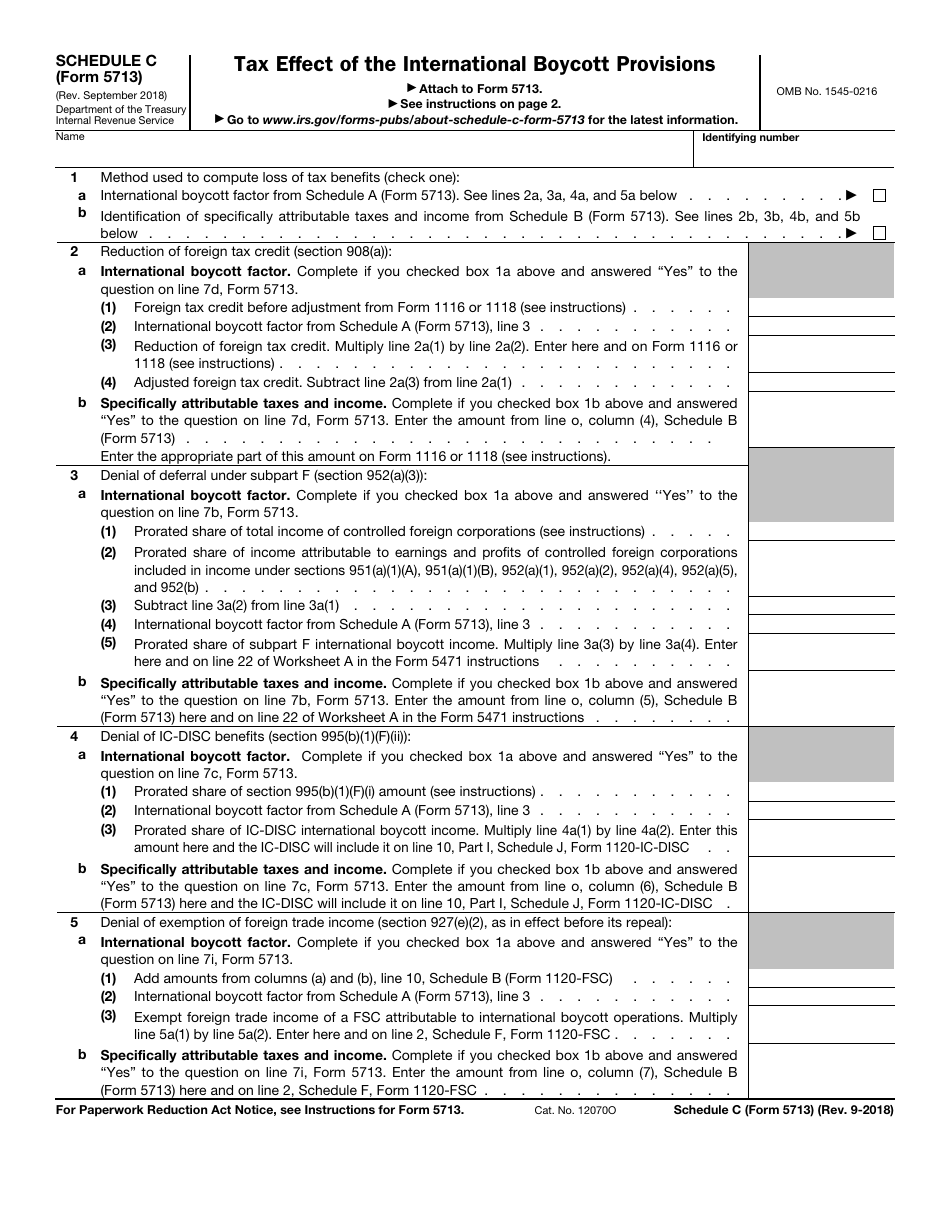

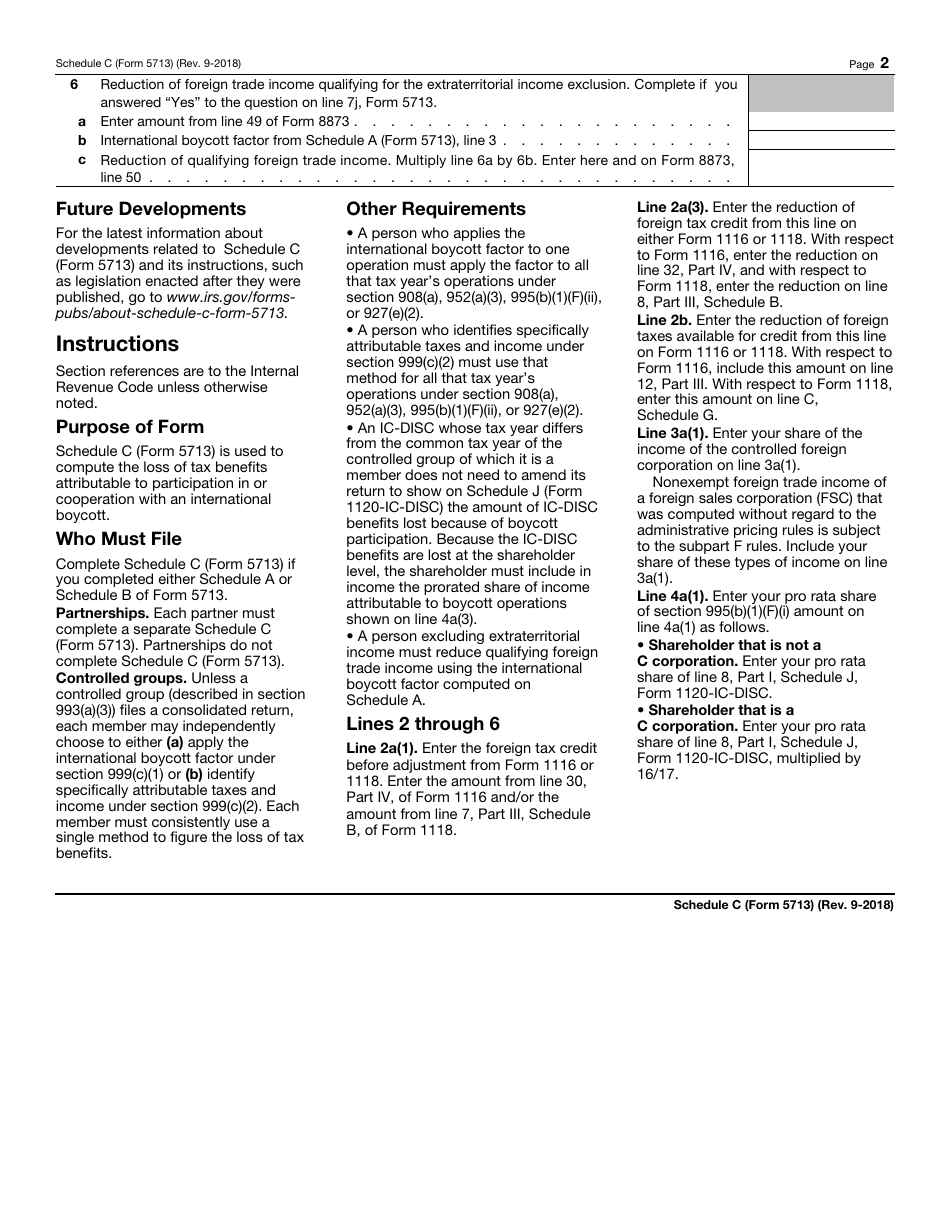

IRS Form 5713 Schedule C Tax Effect of the International Boycott Provisions

What Is IRS Form 5713 Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. The document is a supplement to IRS Form 5713, International Boycott Report. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5713?

A: IRS Form 5713 is a form used to report the tax effect of the International Boycott Provisions.

Q: Who needs to file IRS Form 5713?

A: Anyone who engages in or has operations in countries that participate in or cooperate with an international boycott recognized by the United States must file IRS Form 5713.

Q: What is the purpose of IRS Form 5713?

A: The purpose of IRS Form 5713 is to calculate and report the tax consequences of participating in an international boycott.

Q: What are the International Boycott Provisions?

A: The International Boycott Provisions are laws that aim to discourage U.S. taxpayers from participating in or cooperating with international boycotts that are not sanctioned by the U.S. government.

Q: Do I need to fill out Schedule C on IRS Form 5713?

A: Yes, you need to fill out Schedule C on IRS Form 5713 to report the details of your international boycott participation.

Q: Is IRS Form 5713 required for individuals or only for businesses?

A: IRS Form 5713 is required for both individuals and businesses.

Q: Are there any penalties for not filing IRS Form 5713?

A: Yes, there are penalties for not filing IRS Form 5713 or for providing incomplete or inaccurate information on the form.

Q: Can I file IRS Form 5713 electronically?

A: No, IRS Form 5713 cannot be filed electronically. It must be filed by mail.

Q: Can I get an extension to file IRS Form 5713?

A: Yes, you can request an extension to file IRS Form 5713 by filing Form 7004.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5713 Schedule C through the link below or browse more documents in our library of IRS Forms.