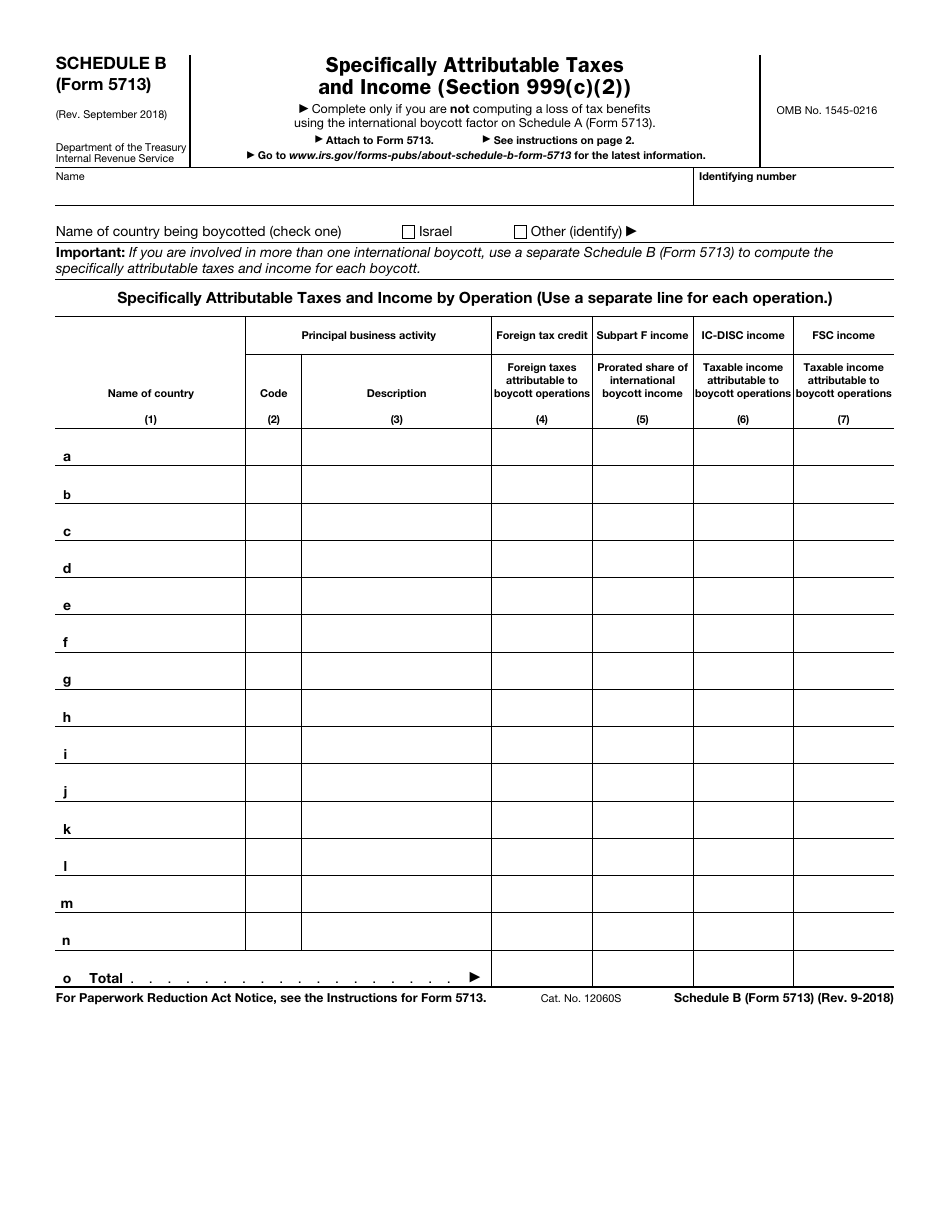

IRS Form 5713 Schedule B Specifically Attributable Taxes and Income (Section 999(C)(2))

What Is IRS Form 5713 Schedule B?

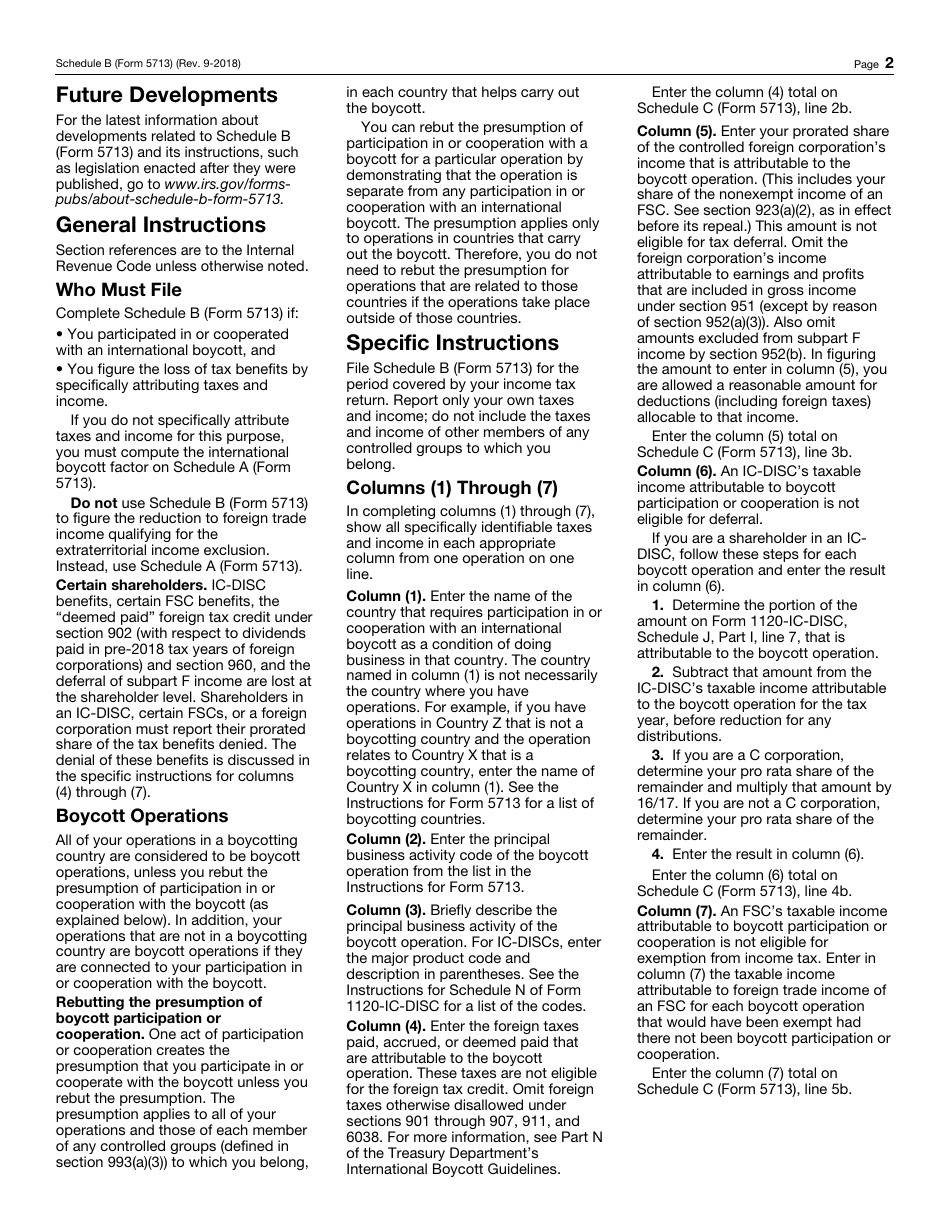

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. The document is a supplement to IRS Form 5713, International Boycott Report. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5713 Schedule B used for?

A: IRS Form 5713 Schedule B is used to report specifically attributable taxes and income under section 999(C)(2).

Q: What does specifically attributable taxes and income mean?

A: Specifically attributable taxes and income refers to taxes and income that can be directly linked to domestic production activities.

Q: Who needs to file IRS Form 5713 Schedule B?

A: Taxpayers who need to allocate expenses and income attributable to domestic production activities may need to file IRS Form 5713 Schedule B.

Q: What is Section 999(C)(2)?

A: Section 999(C)(2) refers to the section of the Internal Revenue Code that deals with specifically attributable taxes and income.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5713 Schedule B through the link below or browse more documents in our library of IRS Forms.