This version of the form is not currently in use and is provided for reference only. Download this version of

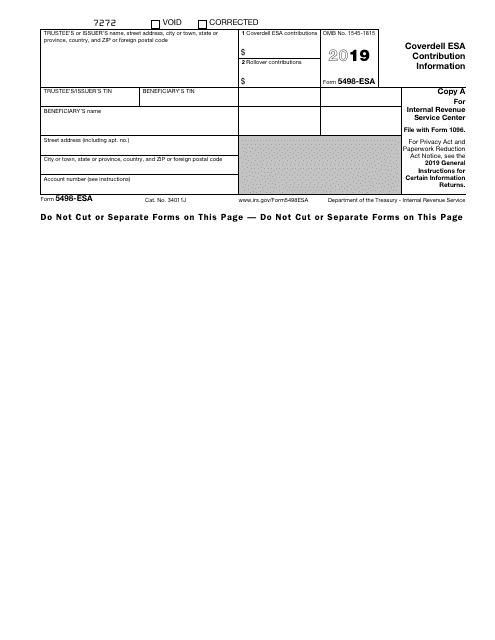

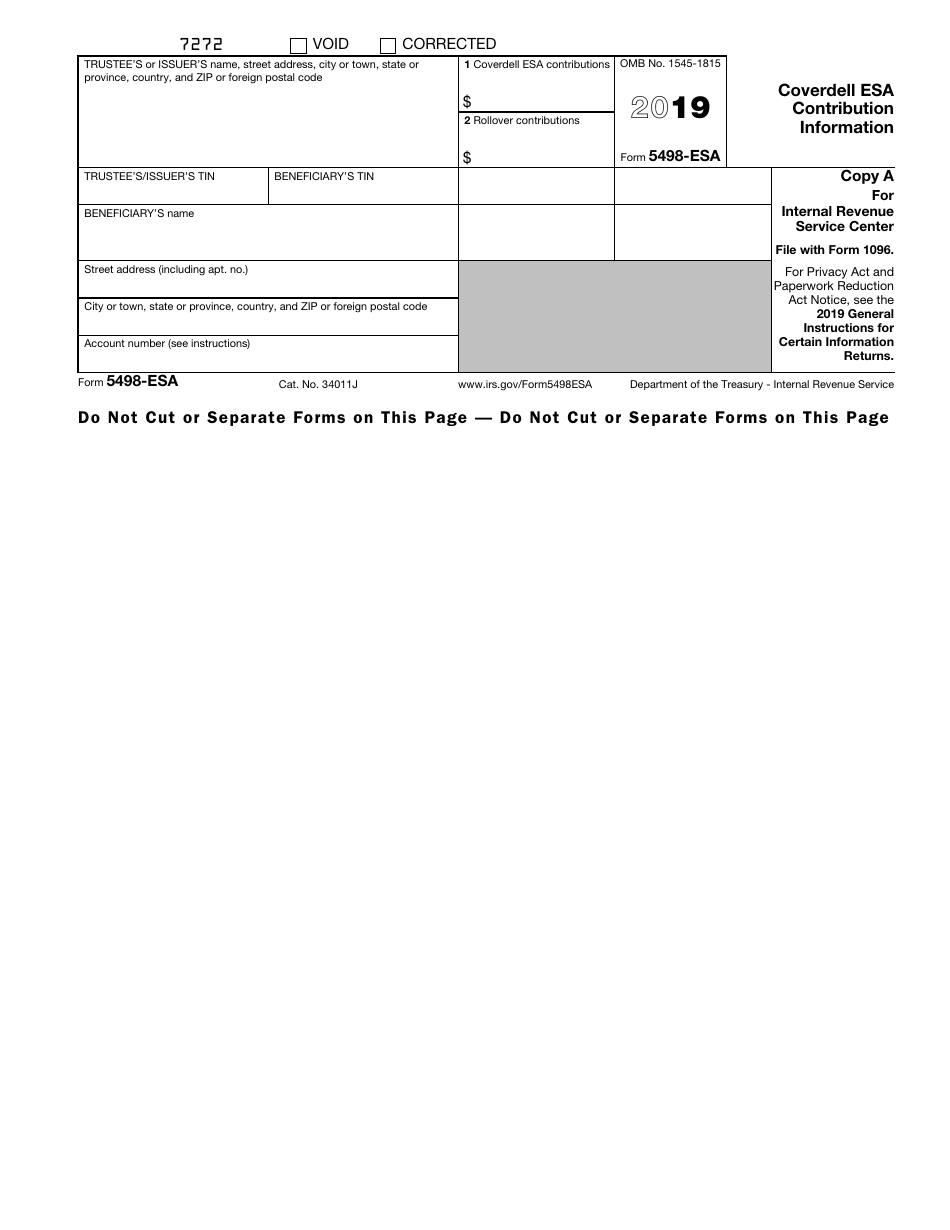

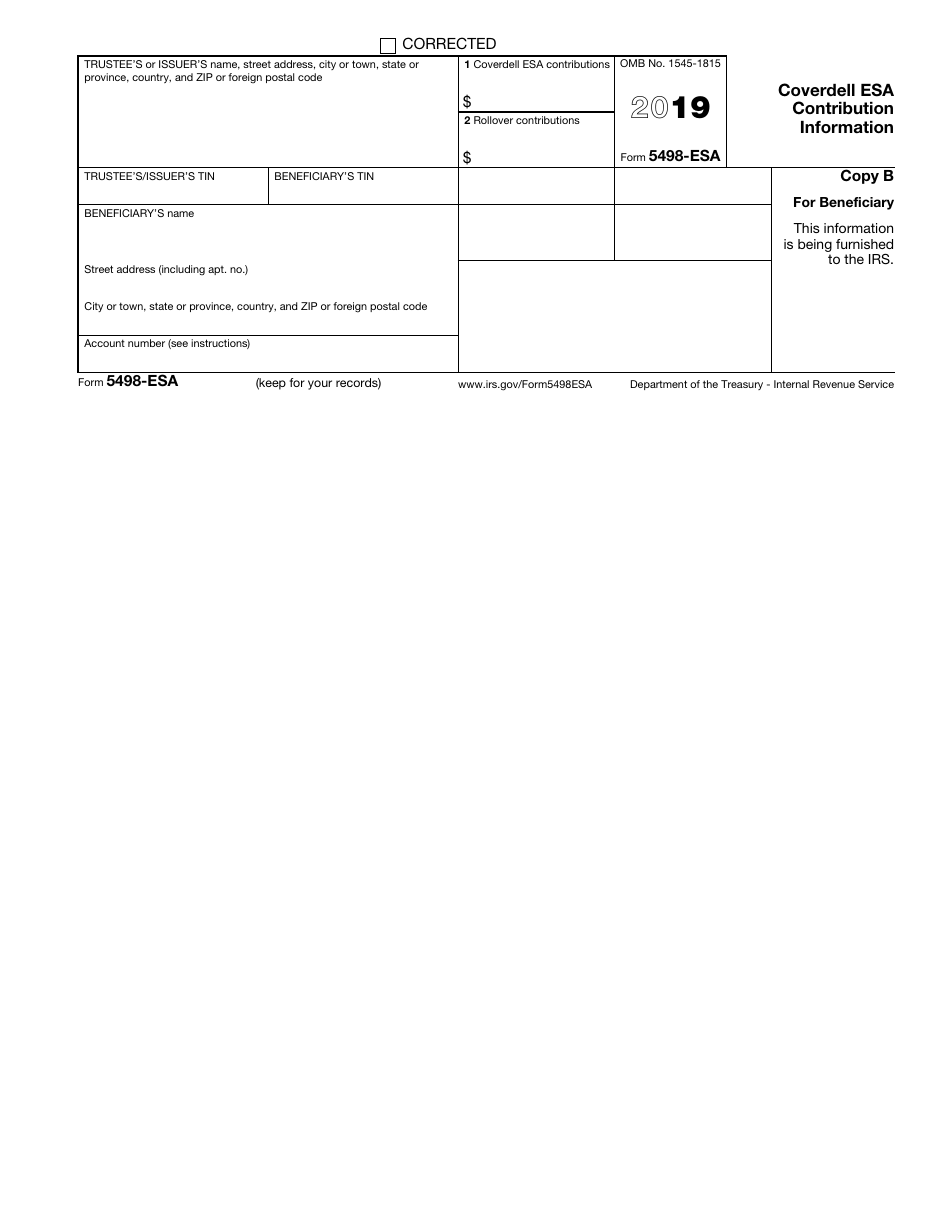

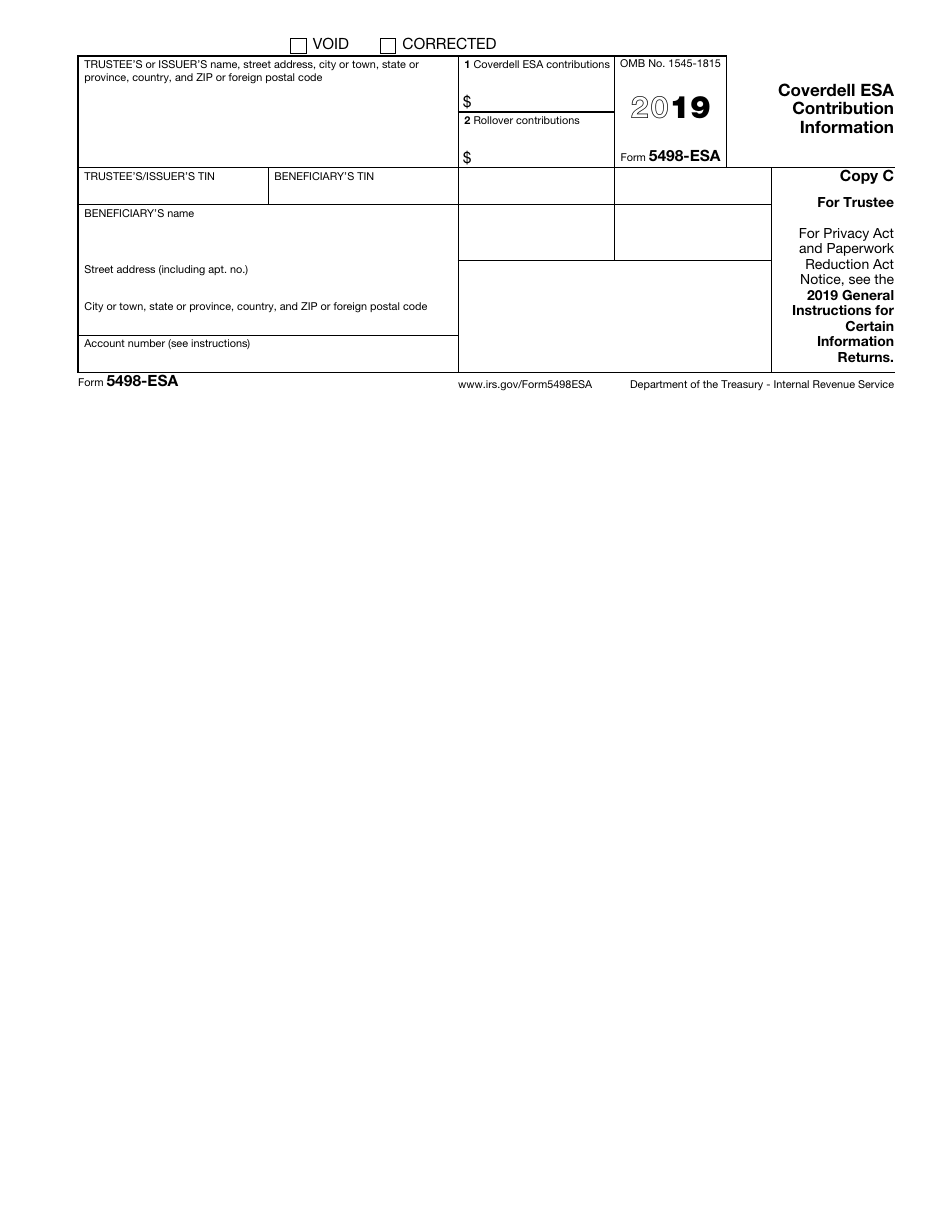

IRS Form 5498-ESA

for the current year.

IRS Form 5498-ESA Coverdell Esa Contribution Information

What Is Form 5498-ESA?

IRS Form 5498-ESA, Coverdell ESA Contribution Information is a form that trustees or issuers of a Coverdell education savings account (ESA) must file with the Internal Revenue Service (IRS) for each person an ESA was maintained for.

This form is used to report amounts of contributions (including rollover contributions) to a Coverdell ESA, and the fair market value (FMV) of an account for the calendar year. The form is issued by the IRS and is revised annually . A fillable IRS Form 5498-ESA is available for download below.

IRS Form 5498-ESA Instructions

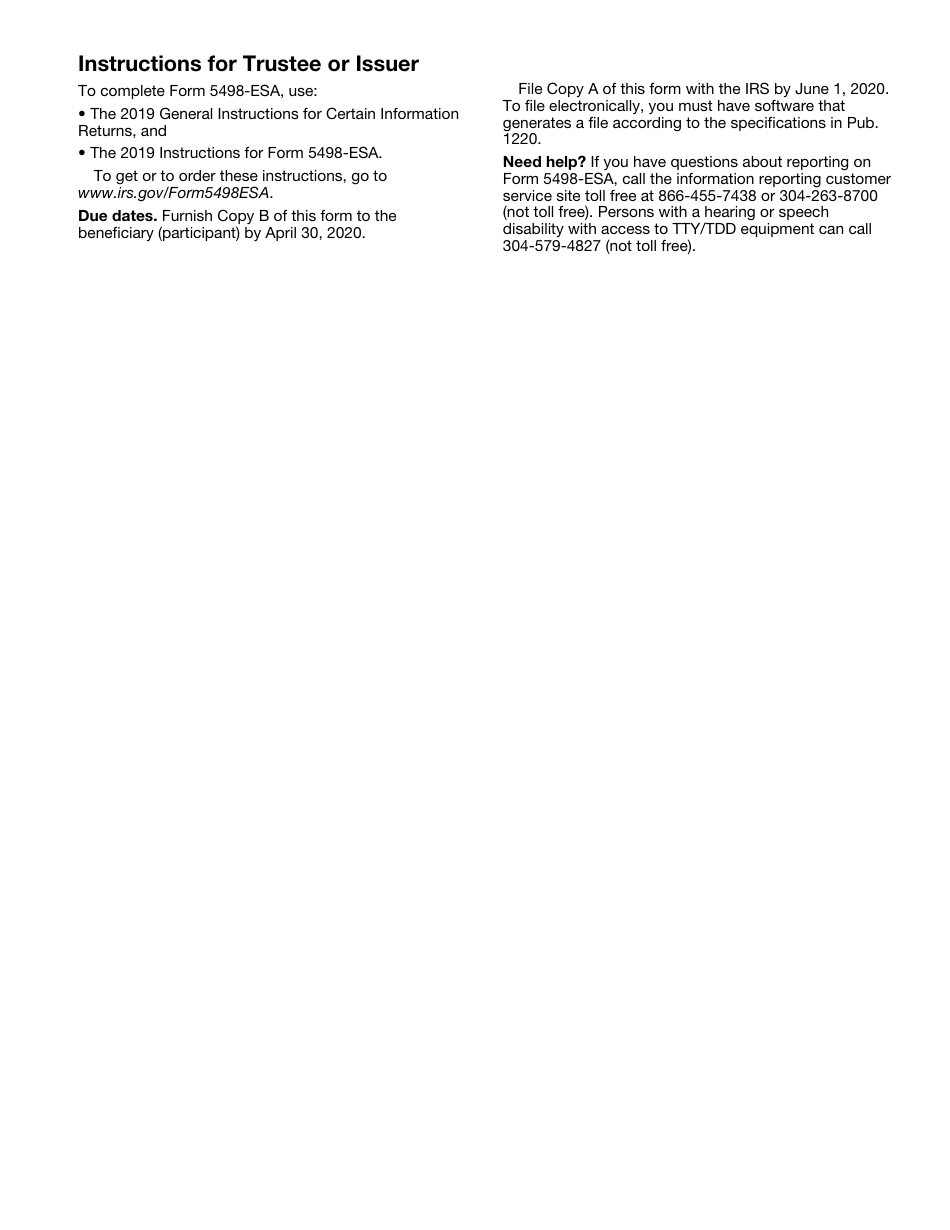

Coverdell ESA trustees or issuers must file Copy A of 5498-ESA tax form with the IRS by June 1, 2020 filing for 2019. They are also required to furnish Copy B of 5498-ESA Form to the beneficiary (participant) by April 30, 2020. Copy C of this form is to be kept in the trustee or issuer's records.

If the due date falls on a weekend or legal holiday, you may file the form on the next business day. You can request a 30-day extension of time to file by completing Form 8809 by the due date of the returns. The penalty if you fail to meet the 5498-ESA deadline is $50 per return with no maximum, except if the failure is due to a reasonable cause.

If you are filing Copies A on paper, you must send them accompanied by Form 1096, Annual Summary and Transmittal of U.S. Information Returns. These forms have been converted to online fillable PDF. The IRS accepts black-and-white Copies A of Form 5498-ESA.

If you must file 250 or more information returns, you are required to file them electronically. For this purpose, you can use the Filing Information Returns Electronically System (FIRE System).

IRS 5498-ESA Related Forms

IRS Form 5498-ESA is part of a series of forms, which includes three other related forms, briefly described below:

- IRS Form 5498, IRA Contribution Information is a form that a trustee or issuer of an individual retirement arrangement (IRAs) files with the IRS for each person for whom they maintained an IRA.

- IRS Form 5498-QA, ABLE Account Contribution Information which is a form filed with the IRS by any State or its agency or instrumentality in order to report the contributions made to an ABLE account for each qualified ABLE account they established and maintained.

- IRS Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information which is a form filed with the IRS by trustees or custodians of a Health Savings Account (HSA), Medicare Advantage MSA (MA MSA), or Archer Medical Savings Account (Archer MSA) for each person for whom they maintained one of these savings accounts.