This version of the form is not currently in use and is provided for reference only. Download this version of

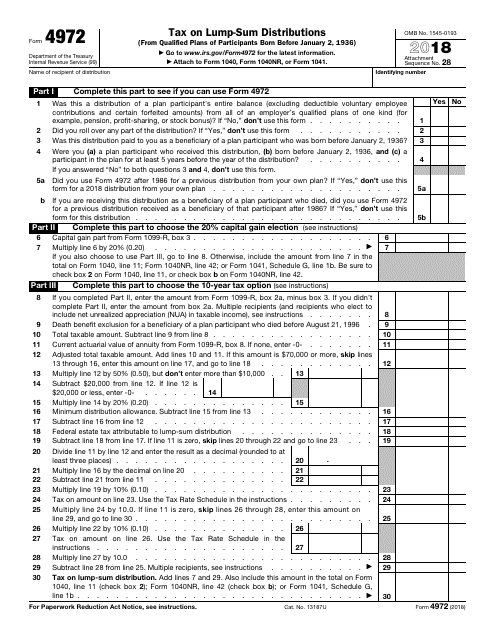

IRS Form 4972

for the current year.

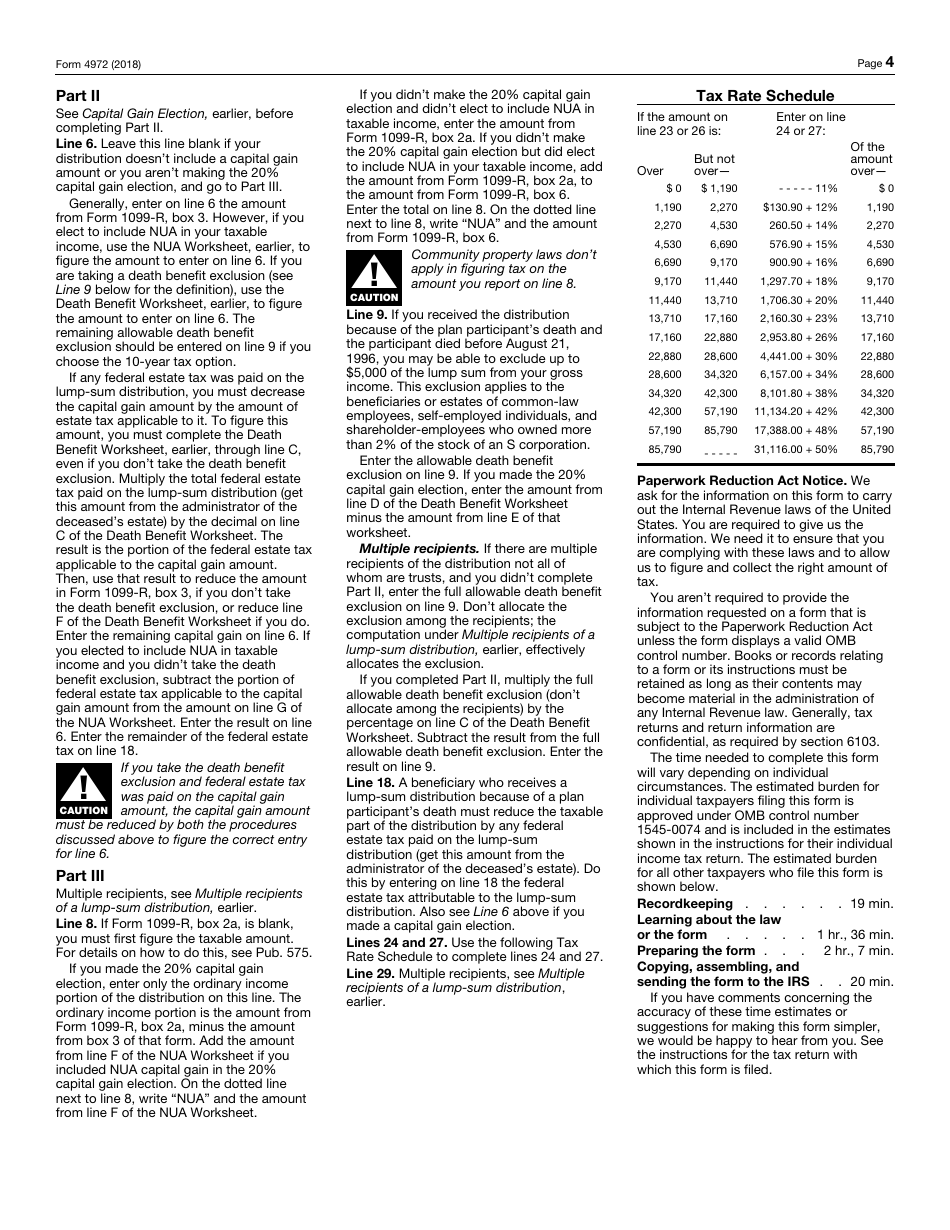

IRS Form 4972 Tax on Lump-Sum Distributions

What Is IRS Form 4972?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4972?

A: IRS Form 4972 is a tax form used to calculate and report the tax on lump-sum distributions from qualified retirement plans.

Q: What are lump-sum distributions?

A: Lump-sum distributions are one-time payments from retirement plans, such as a 401(k) or pension plan, that are paid out in a single year.

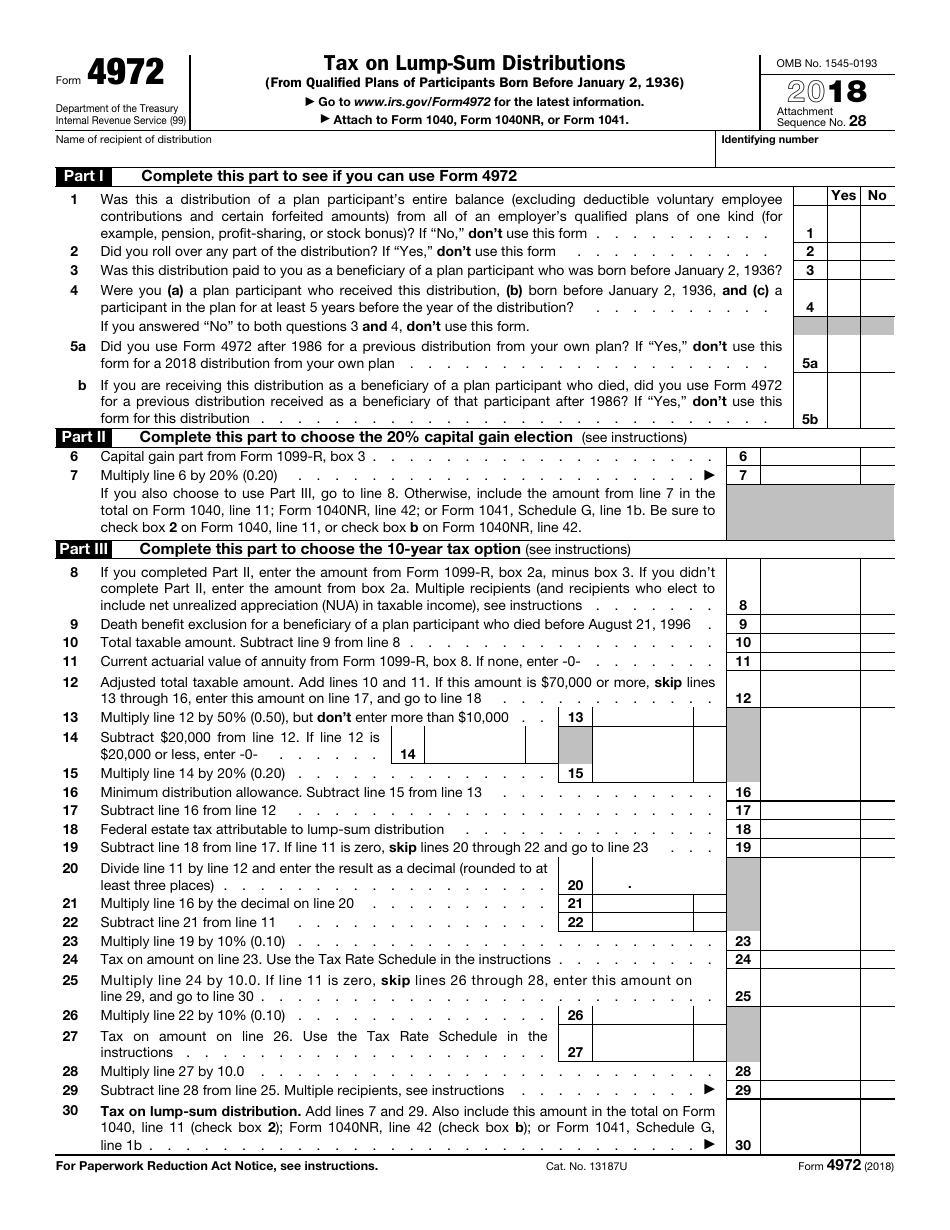

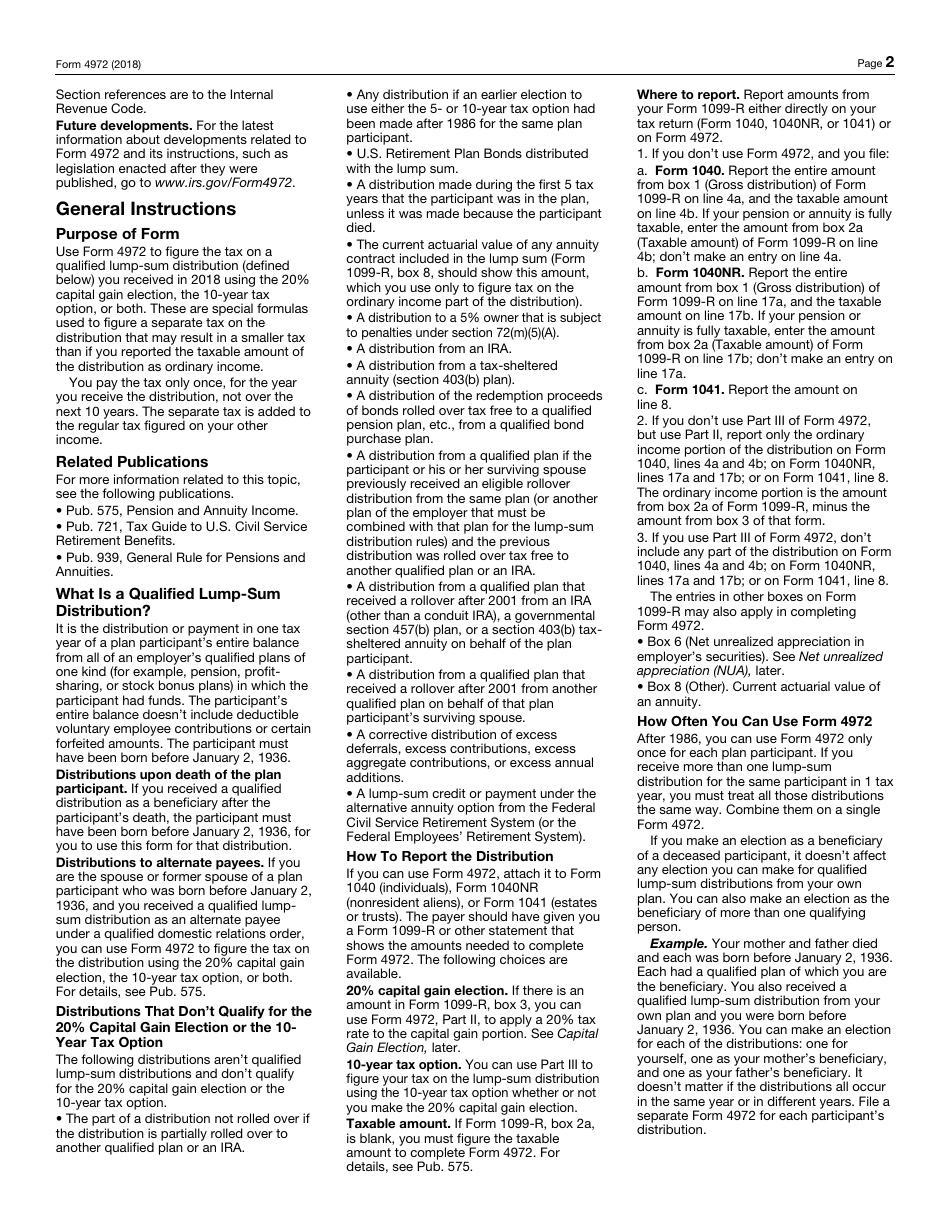

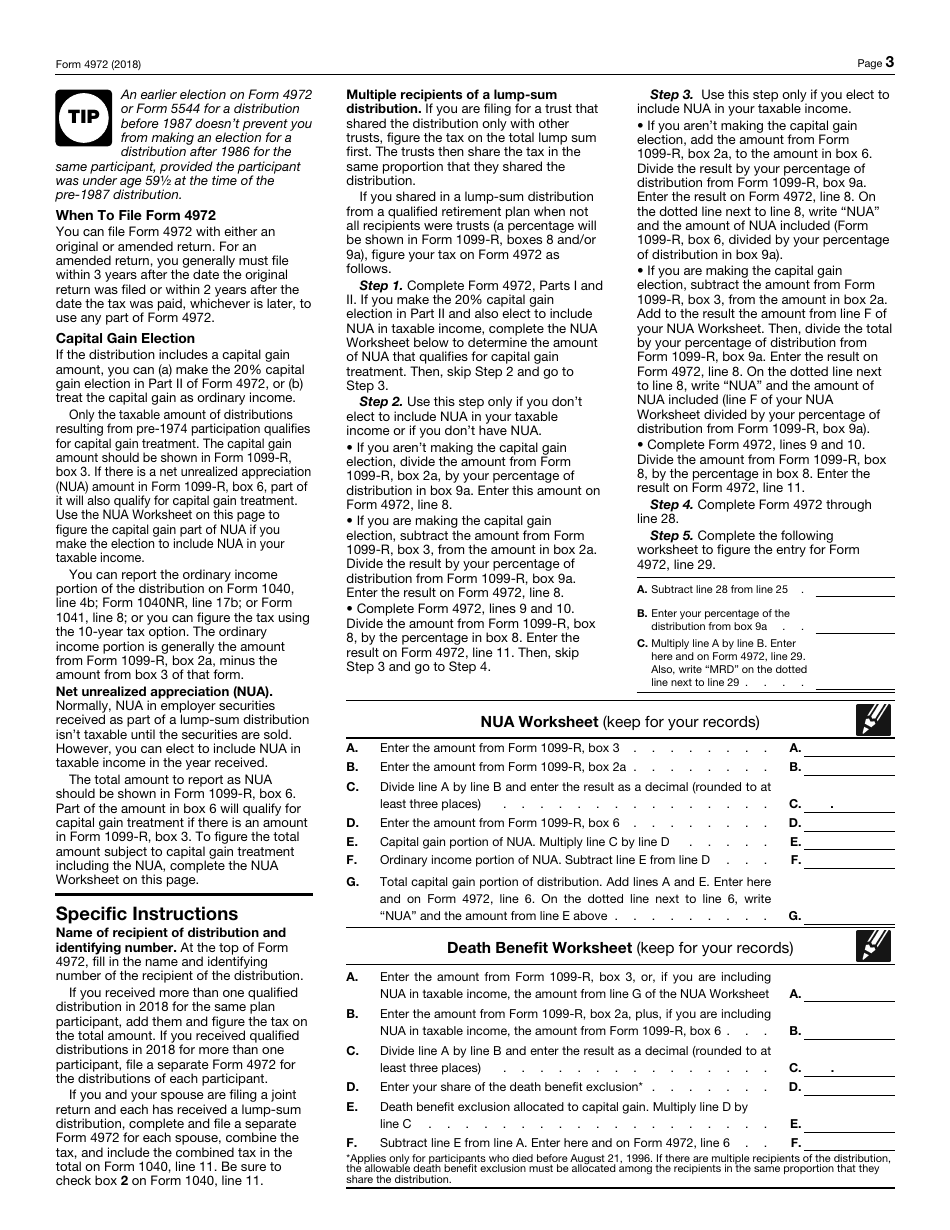

Q: How do I report the tax on lump-sum distributions?

A: You report the tax on lump-sum distributions using IRS Form 4972. The form helps you calculate the tax owed and reports it on your individual tax return.

Q: What information do I need to complete IRS Form 4972?

A: To complete IRS Form 4972, you will need information from your retirement plan, including the total distribution amount, your cost basis, and any additional taxable amounts.

Q: Are all lump-sum distributions subject to tax?

A: Not all lump-sum distributions are subject to tax. Certain distributions, such as those from Roth IRAs or after-tax contributions, may not be taxable. It's important to consult the instructions for IRS Form 4972 or a tax professional for guidance.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4972 through the link below or browse more documents in our library of IRS Forms.