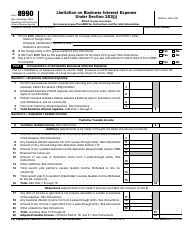

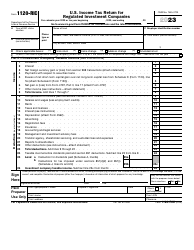

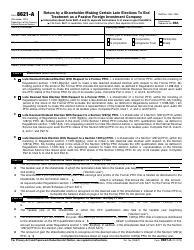

This version of the form is not currently in use and is provided for reference only. Download this version of

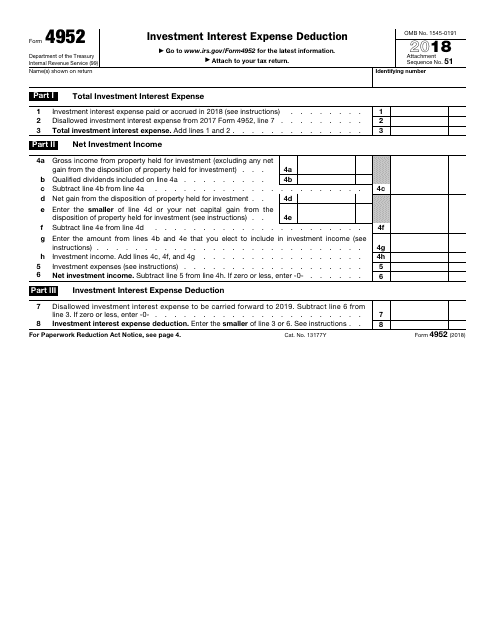

IRS Form 4952

for the current year.

IRS Form 4952 Investment Interest Expense Deduction

What Is IRS Form 4952?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4952?

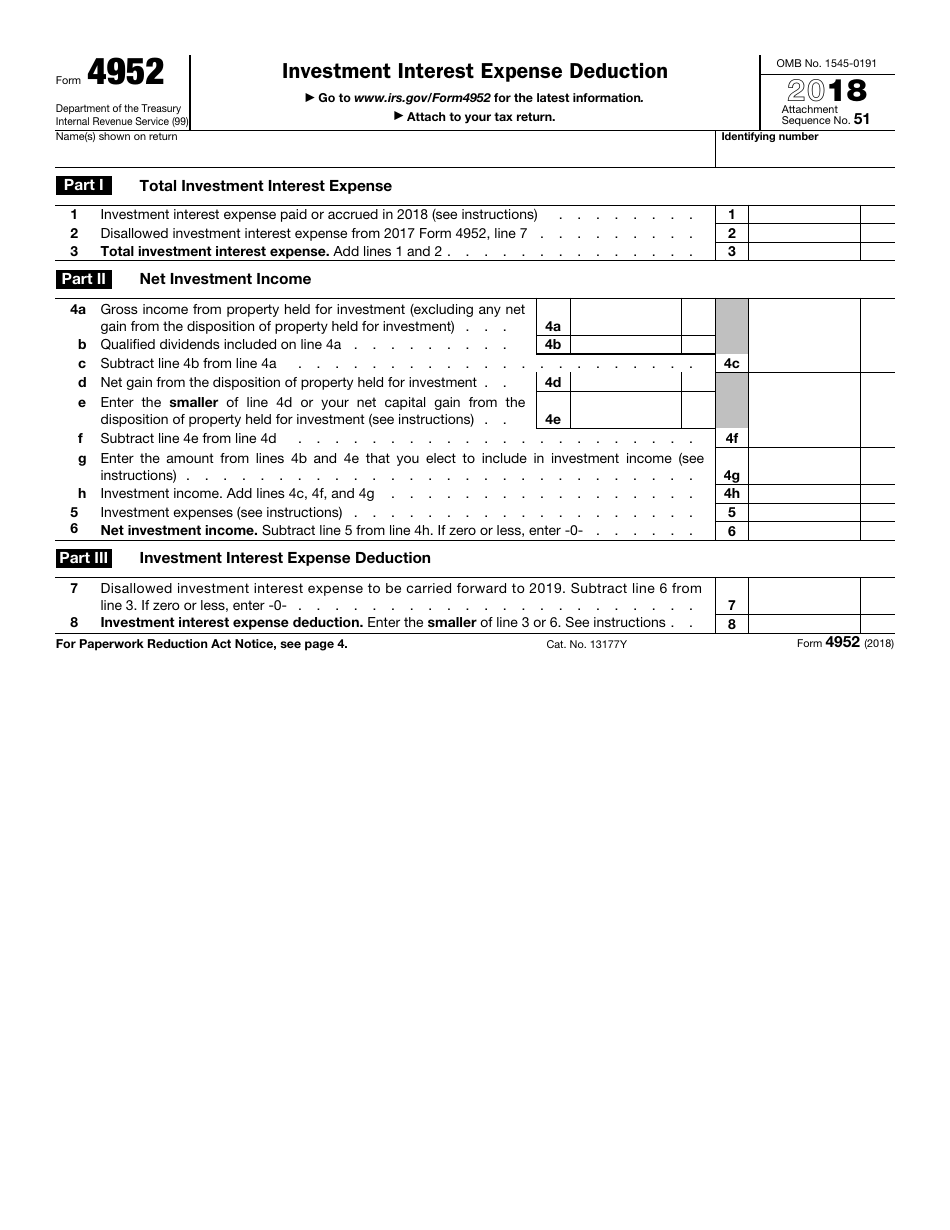

A: IRS Form 4952 is a tax form used to calculate and claim the deduction for investment interest expenses.

Q: What are investment interest expenses?

A: Investment interest expenses are the interest paid on loans used to purchase investments, such as stocks or real estate.

Q: Who can claim the investment interest expense deduction?

A: Individual taxpayers, estates, and trusts can claim the investment interest expense deduction.

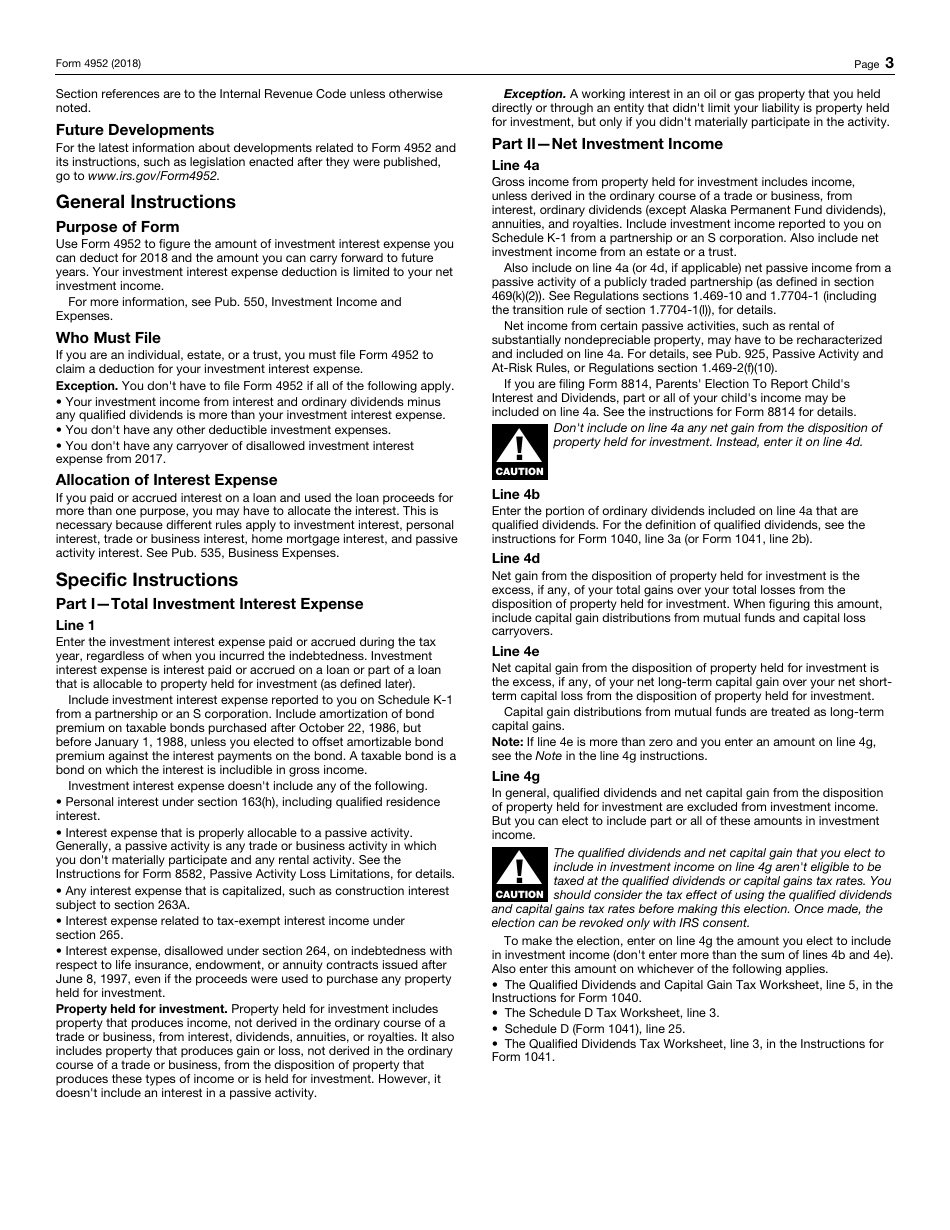

Q: How do I calculate the investment interest expense deduction?

A: To calculate the investment interest expense deduction, you need to fill out IRS Form 4952 and follow the instructions provided.

Q: What is the maximum deduction for investment interest expenses?

A: The maximum deduction for investment interest expenses is generally limited to the taxpayer's net investment income.

Q: Do I need to attach any documents to IRS Form 4952?

A: You may need to attach supporting documents, such as Form 1099-INT or mortgage statements, to IRS Form 4952.

Q: Can I e-file IRS Form 4952?

A: As of now, you cannot e-file IRS Form 4952. It must be filed by mail.

Q: When is the deadline for filing IRS Form 4952?

A: The deadline for filing IRS Form 4952 is usually the same as the deadline for filing your individual income tax return, which is April 15th.

Q: Do I need to keep a copy of IRS Form 4952 for my records?

A: Yes, you should keep a copy of IRS Form 4952 and any supporting documents for your records in case of an audit.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4952 through the link below or browse more documents in our library of IRS Forms.