This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 4720

for the current year.

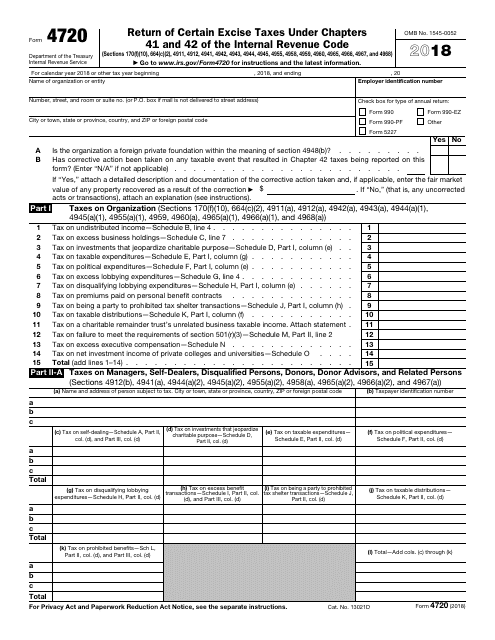

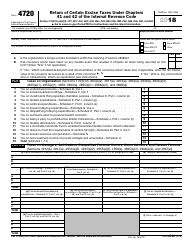

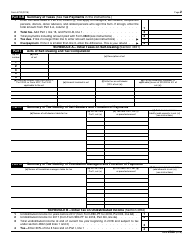

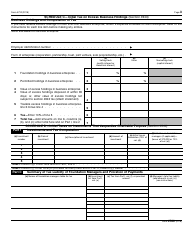

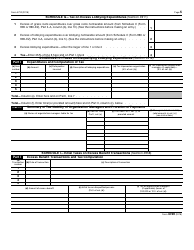

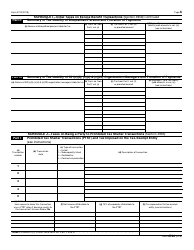

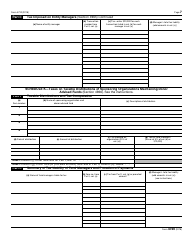

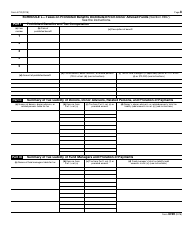

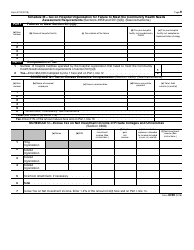

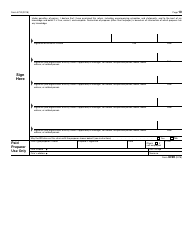

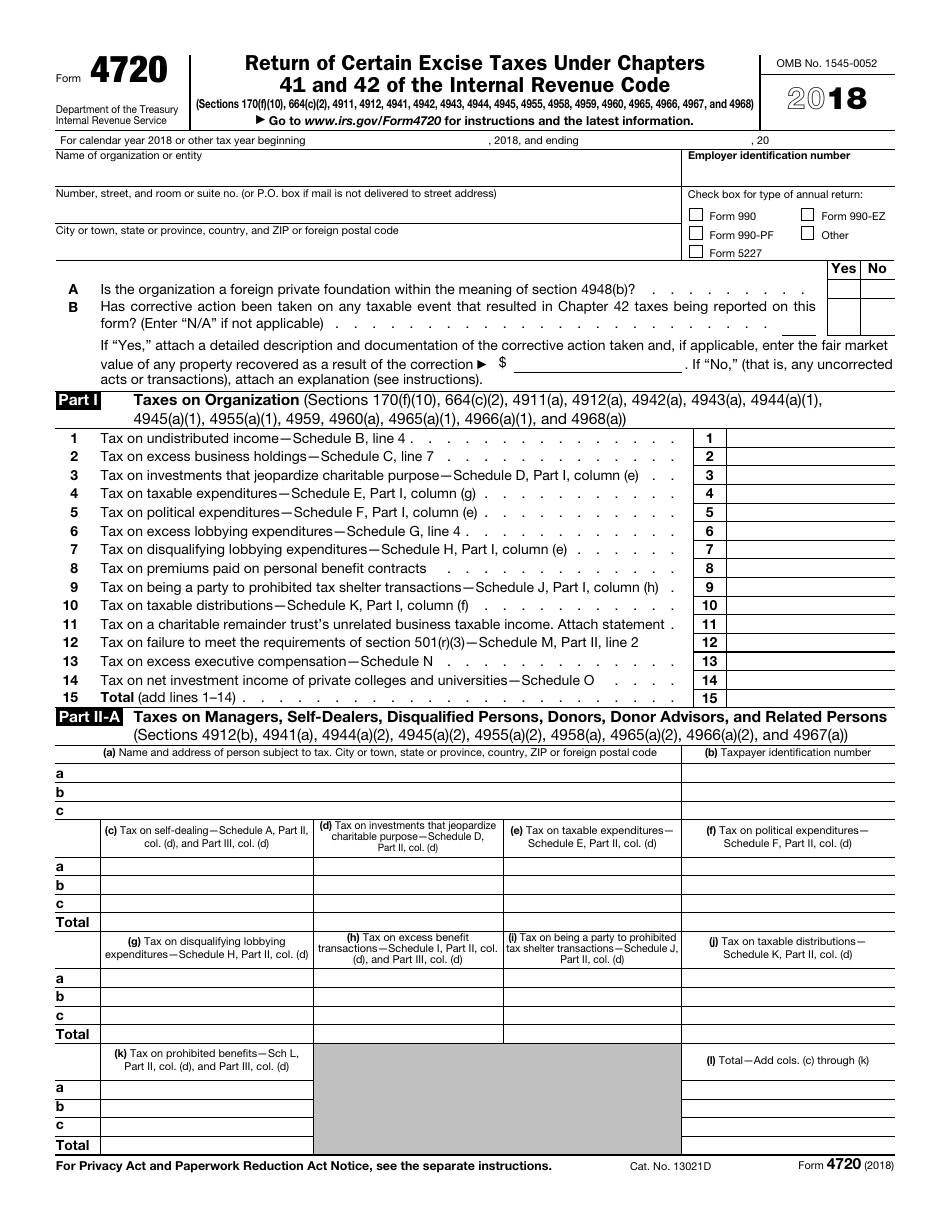

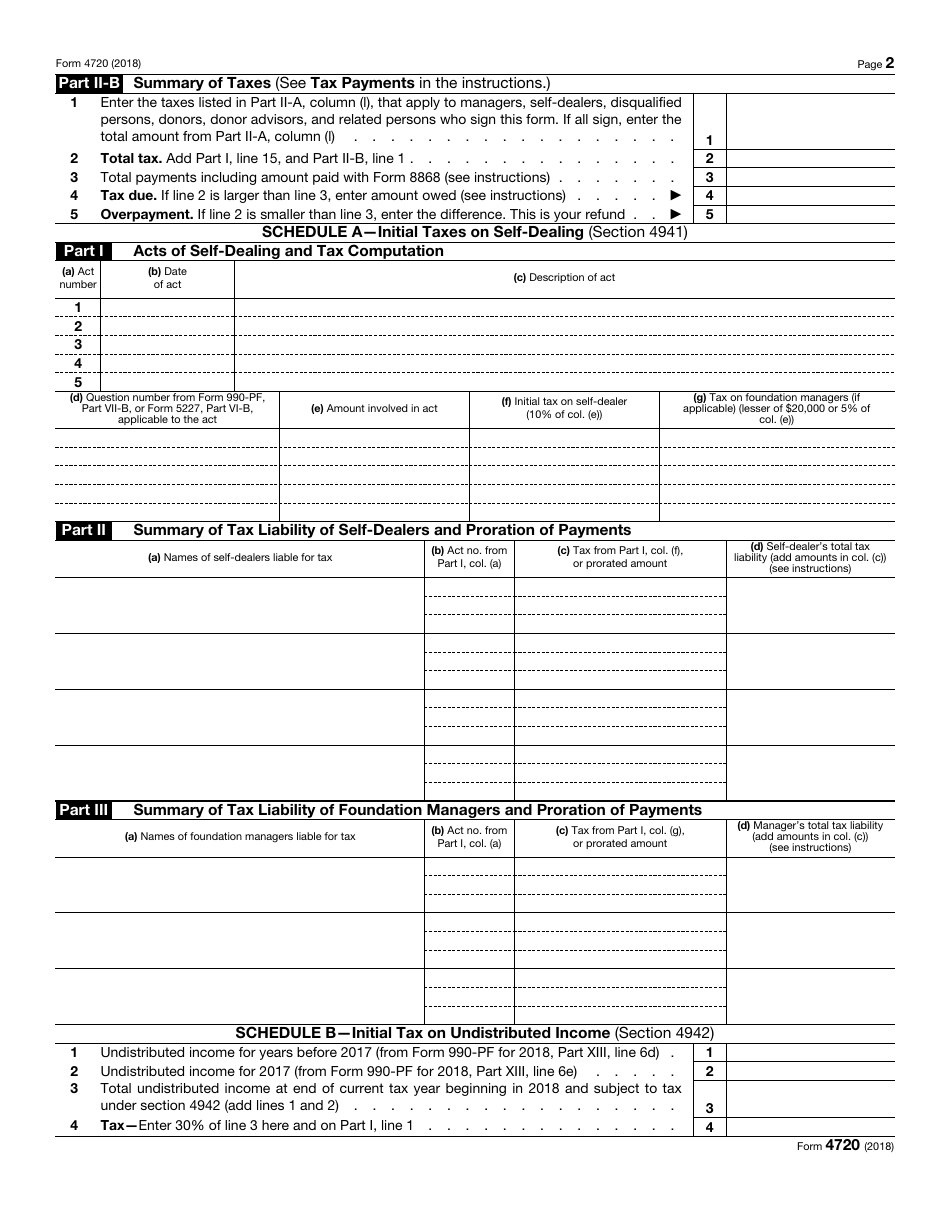

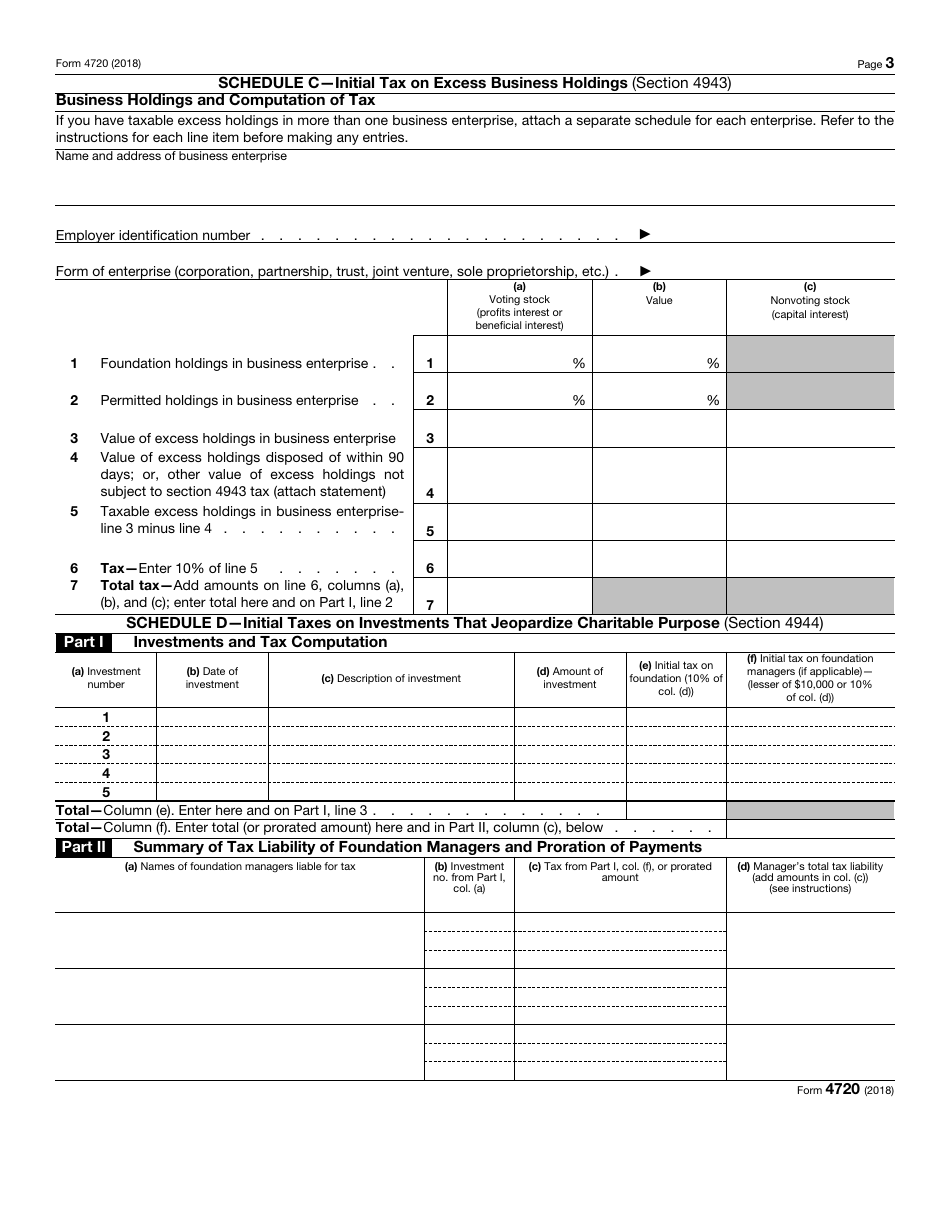

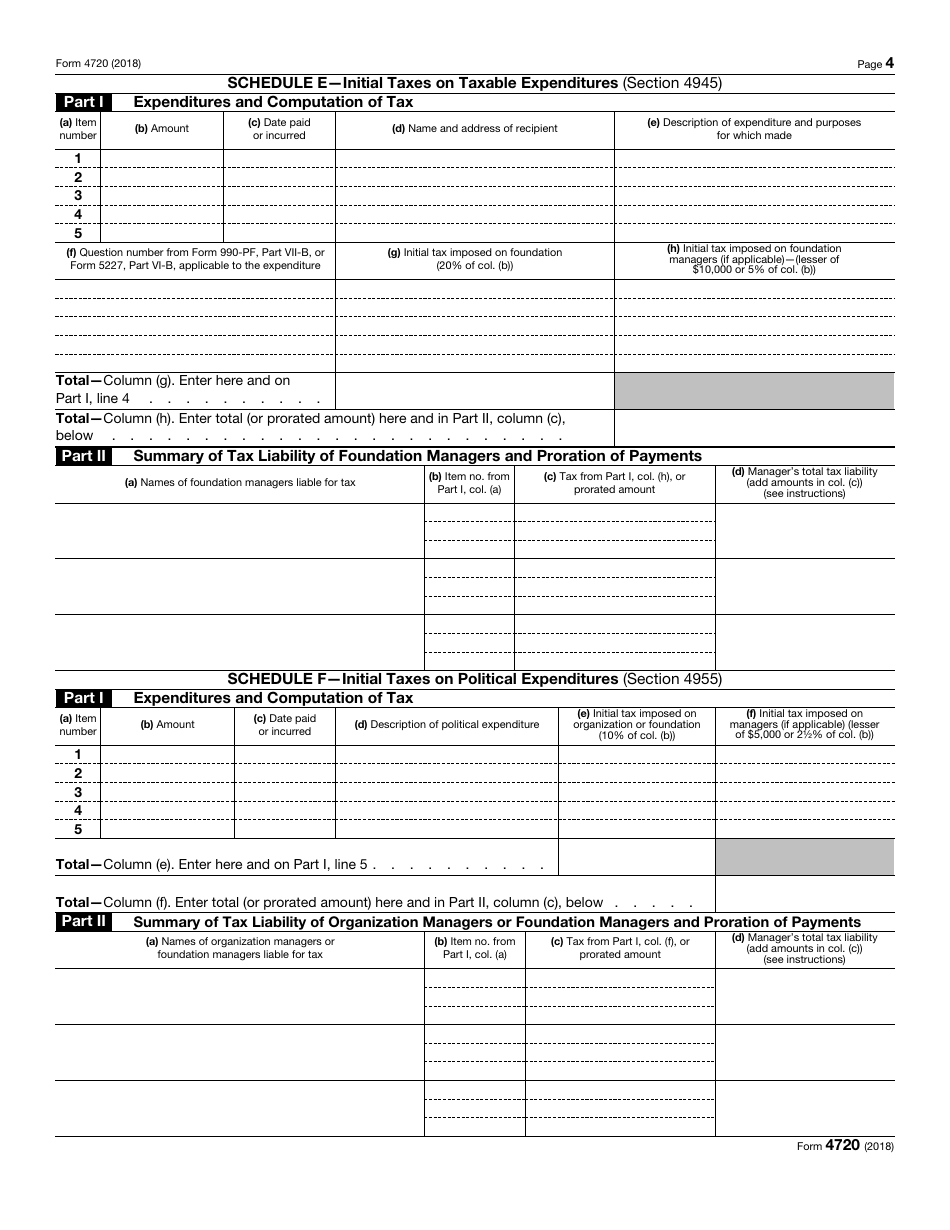

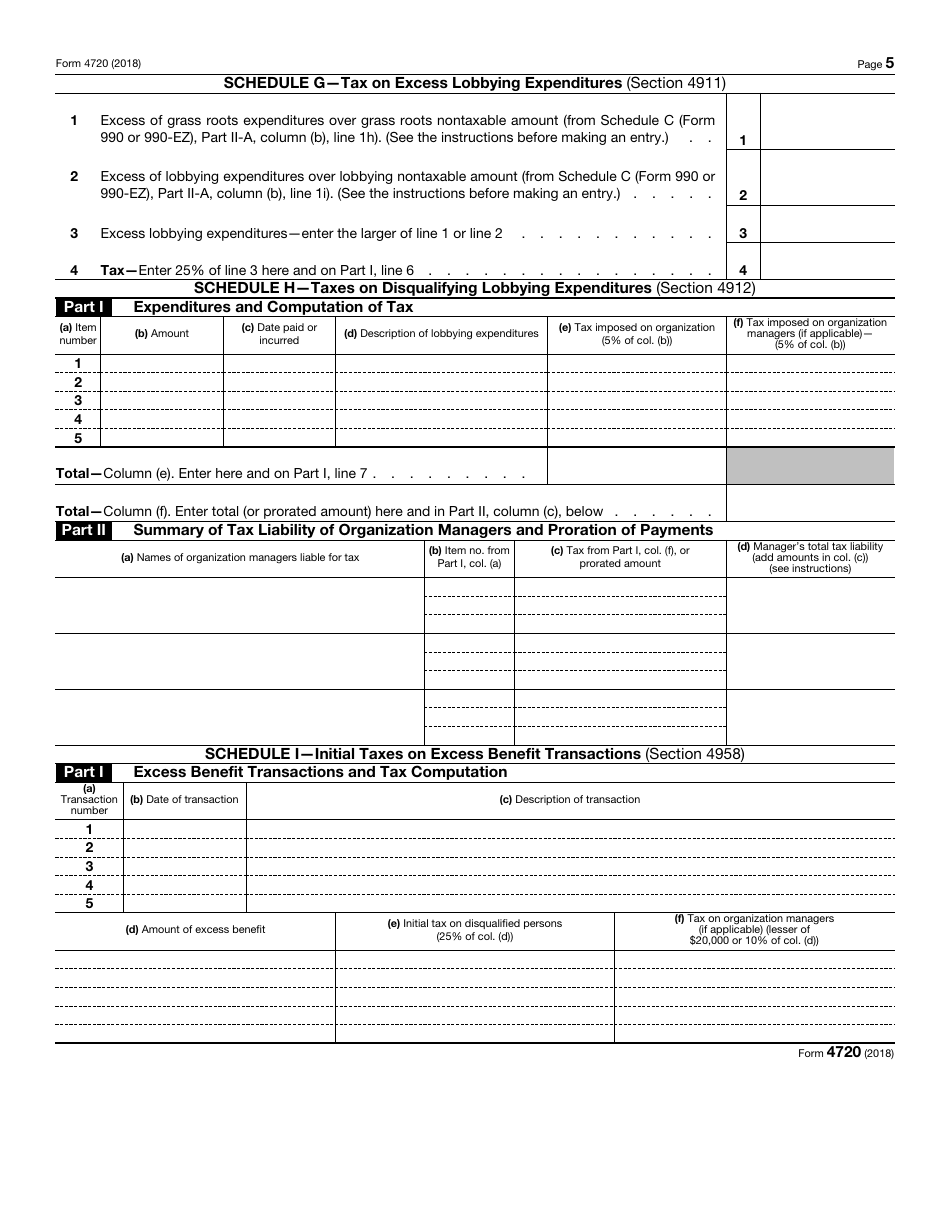

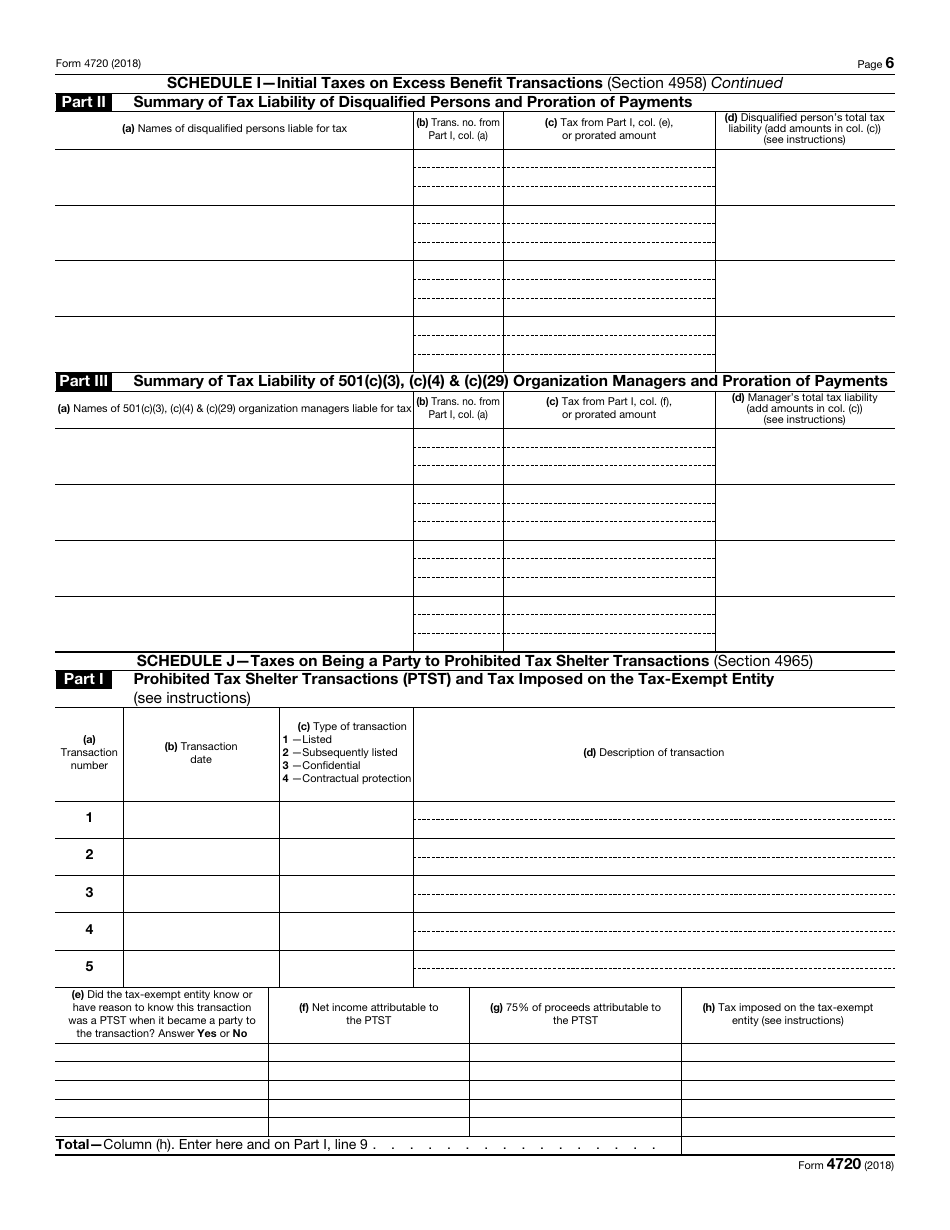

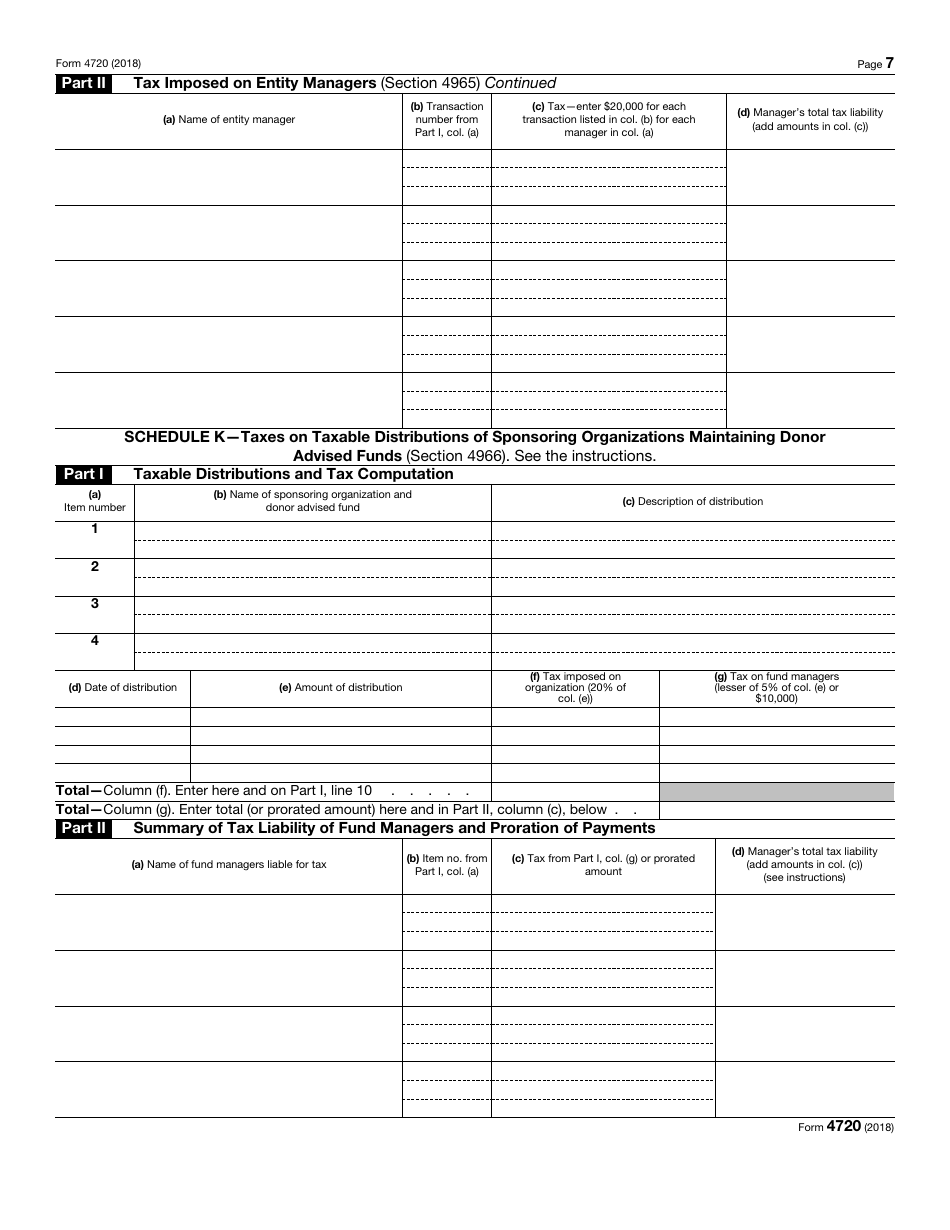

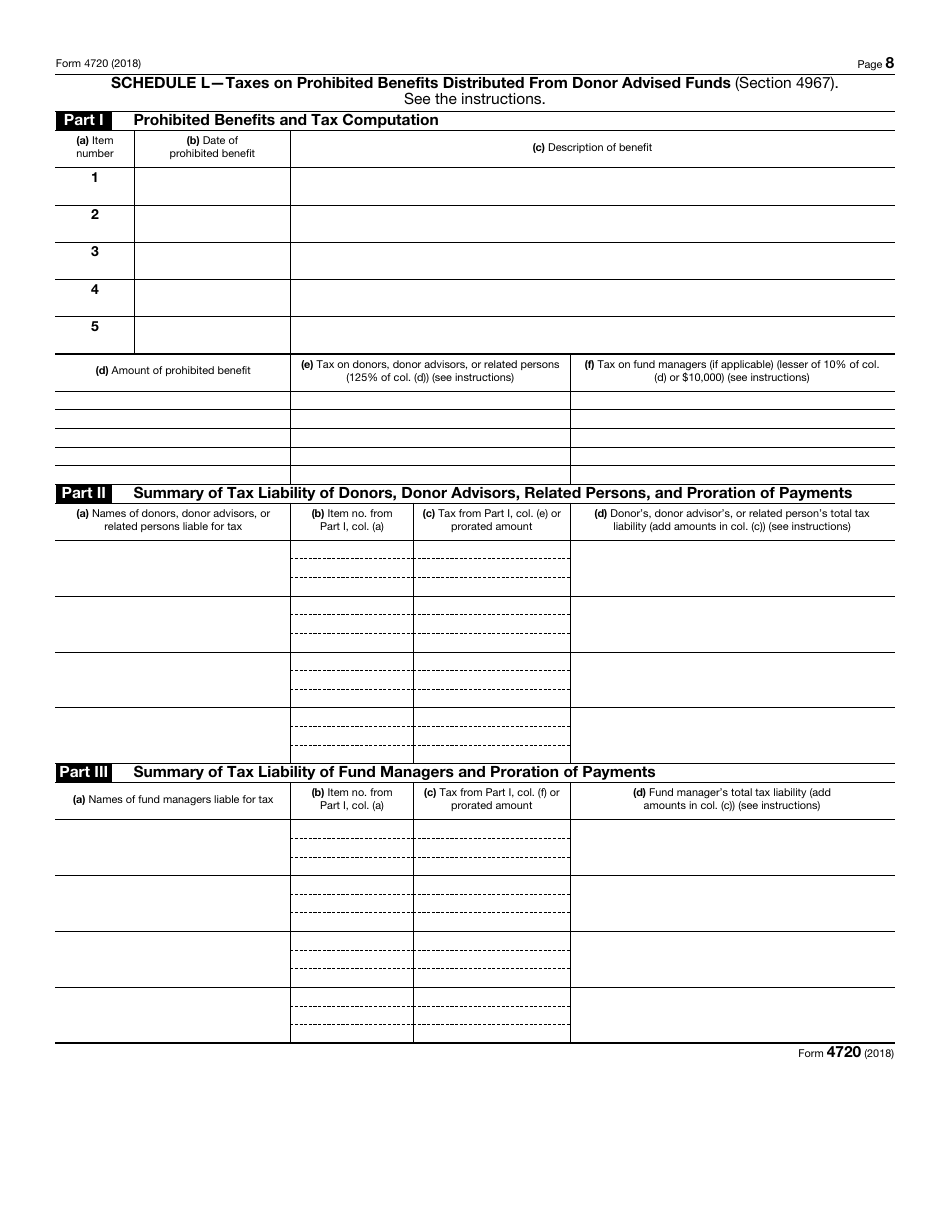

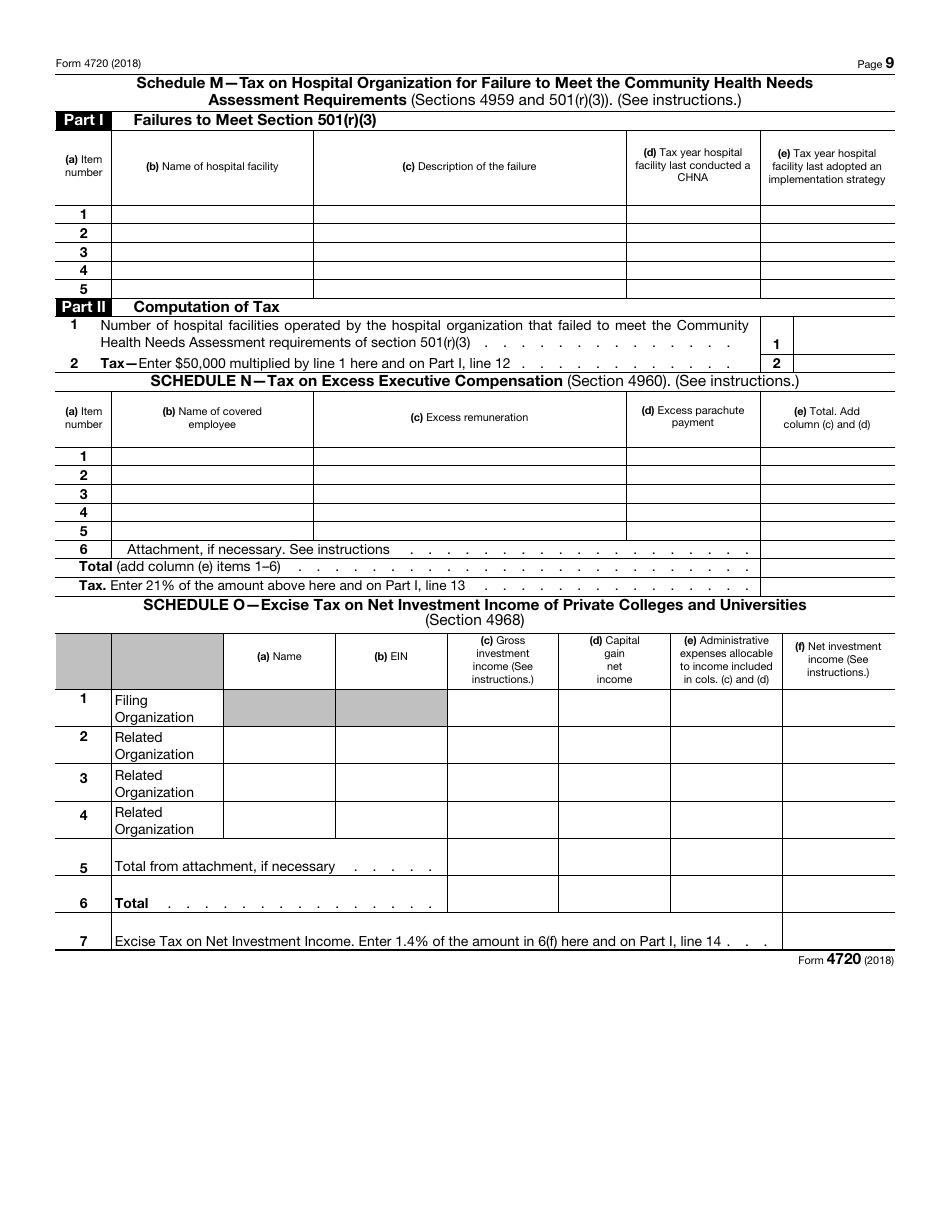

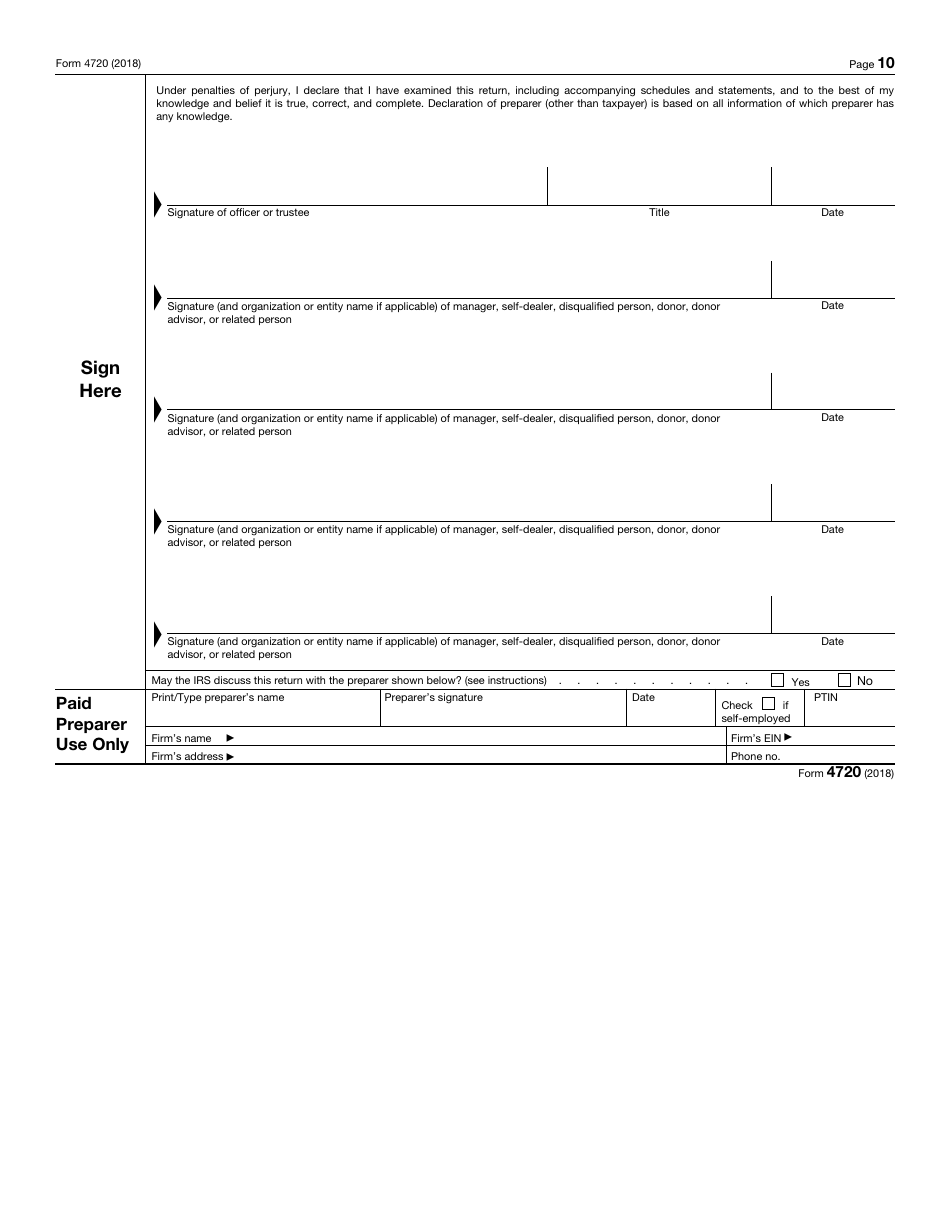

IRS Form 4720 Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code

What Is IRS Form 4720?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 4720?

A: IRS Form 4720 is a form used to report and pay certain excise taxes under chapters 41 and 42 of the Internal Revenue Code.

Q: What are excise taxes?

A: Excise taxes are taxes paid on specific goods, activities, or services, such as alcohol, tobacco, and gambling.

Q: Which chapters of the Internal Revenue Code does IRS Form 4720 cover?

A: IRS Form 4720 covers chapters 41 and 42 of the Internal Revenue Code.

Q: Who needs to file IRS Form 4720?

A: Individuals or organizations who owe excise taxes under chapters 41 and 42 of the Internal Revenue Code need to file IRS Form 4720.

Q: What information is required on IRS Form 4720?

A: IRS Form 4720 requires information such as taxpayer identification, types of excise taxes owed, and the amount of taxes owed.

Q: When is the deadline for filing IRS Form 4720?

A: The deadline for filing IRS Form 4720 depends on the specific situation and can vary. It is best to consult the IRS instructions or a tax professional for the accurate deadline.

Form Details:

- A 10-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4720 through the link below or browse more documents in our library of IRS Forms.