This version of the form is not currently in use and is provided for reference only. Download this version of

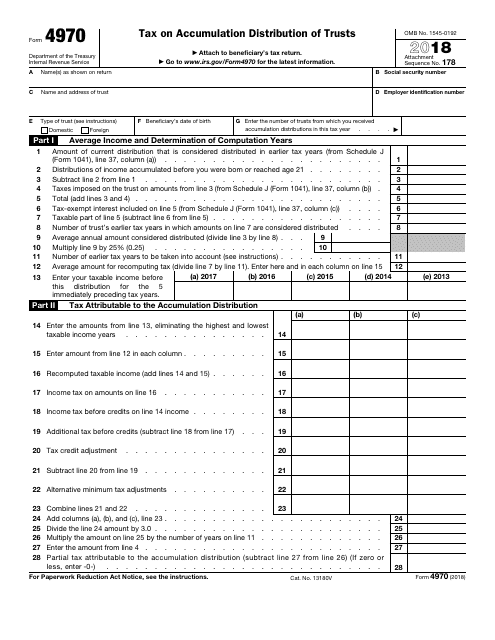

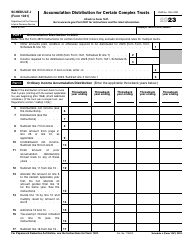

IRS Form 4970

for the current year.

IRS Form 4970 Tax on Accumulation Distribution of Trusts

What Is IRS Form 4970?

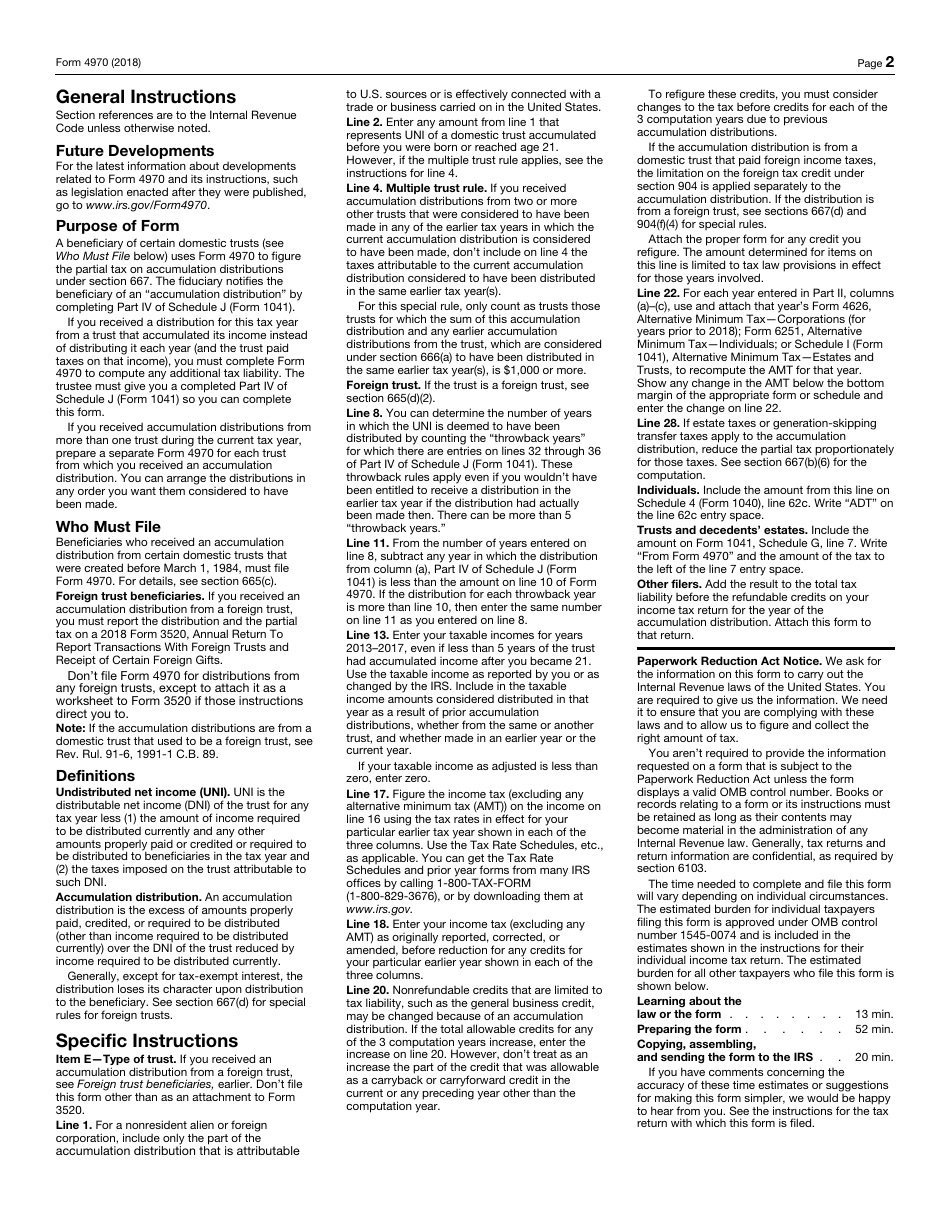

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4970?

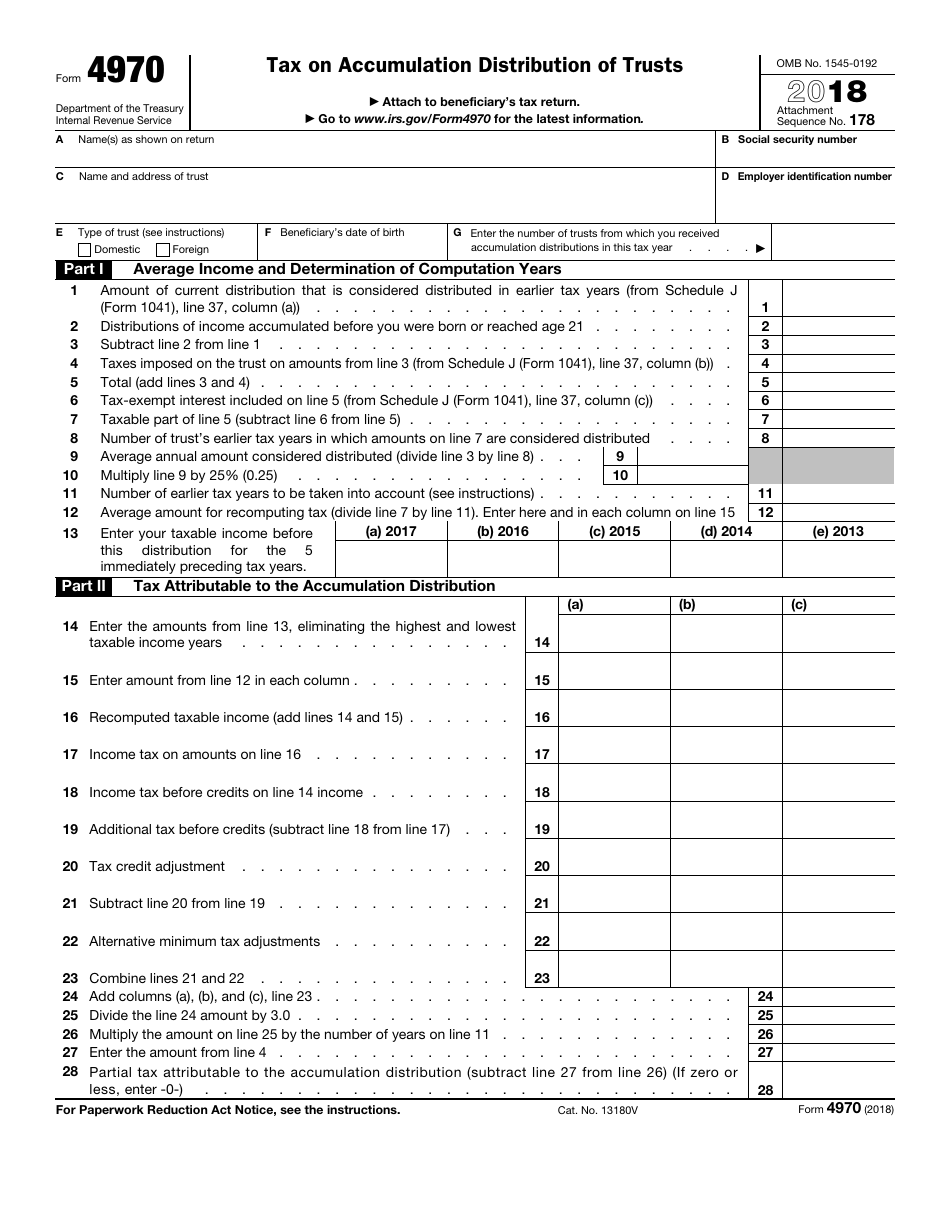

A: IRS Form 4970 is a tax form used to report and calculate the tax on accumulation distributions of trusts.

Q: What is an accumulation distribution of a trust?

A: An accumulation distribution is when a trust distributes its accumulated income and/or gains to its beneficiaries.

Q: Who needs to file IRS Form 4970?

A: Trusts that have made accumulation distributions during the tax year need to file IRS Form 4970.

Q: How do I calculate the tax on accumulation distributions?

A: The tax on accumulation distributions is calculated using the appropriate tax rates based on the trust's taxable income.

Q: When is the deadline to file IRS Form 4970?

A: The deadline to file IRS Form 4970 is the same as the trust's regular tax return deadline, which is typically April 15th.

Q: Are there any penalties for not filing IRS Form 4970?

A: Yes, failure to file IRS Form 4970 or pay the tax on accumulation distributions may result in penalties and interest.

Q: Can I e-file IRS Form 4970?

A: No, IRS Form 4970 cannot be e-filed and must be filed by mail.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4970 through the link below or browse more documents in our library of IRS Forms.