This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 4852

for the current year.

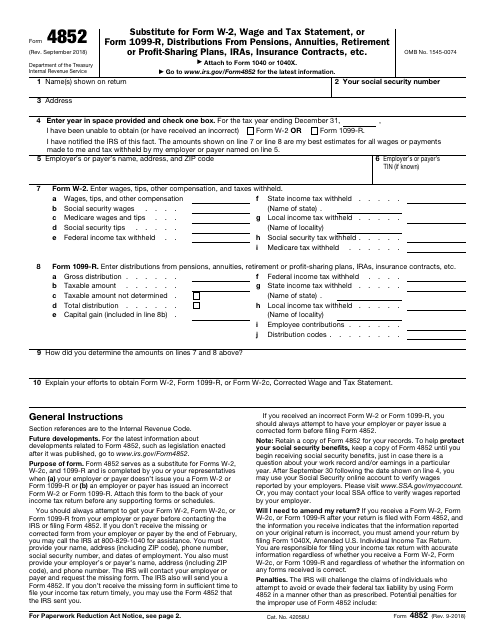

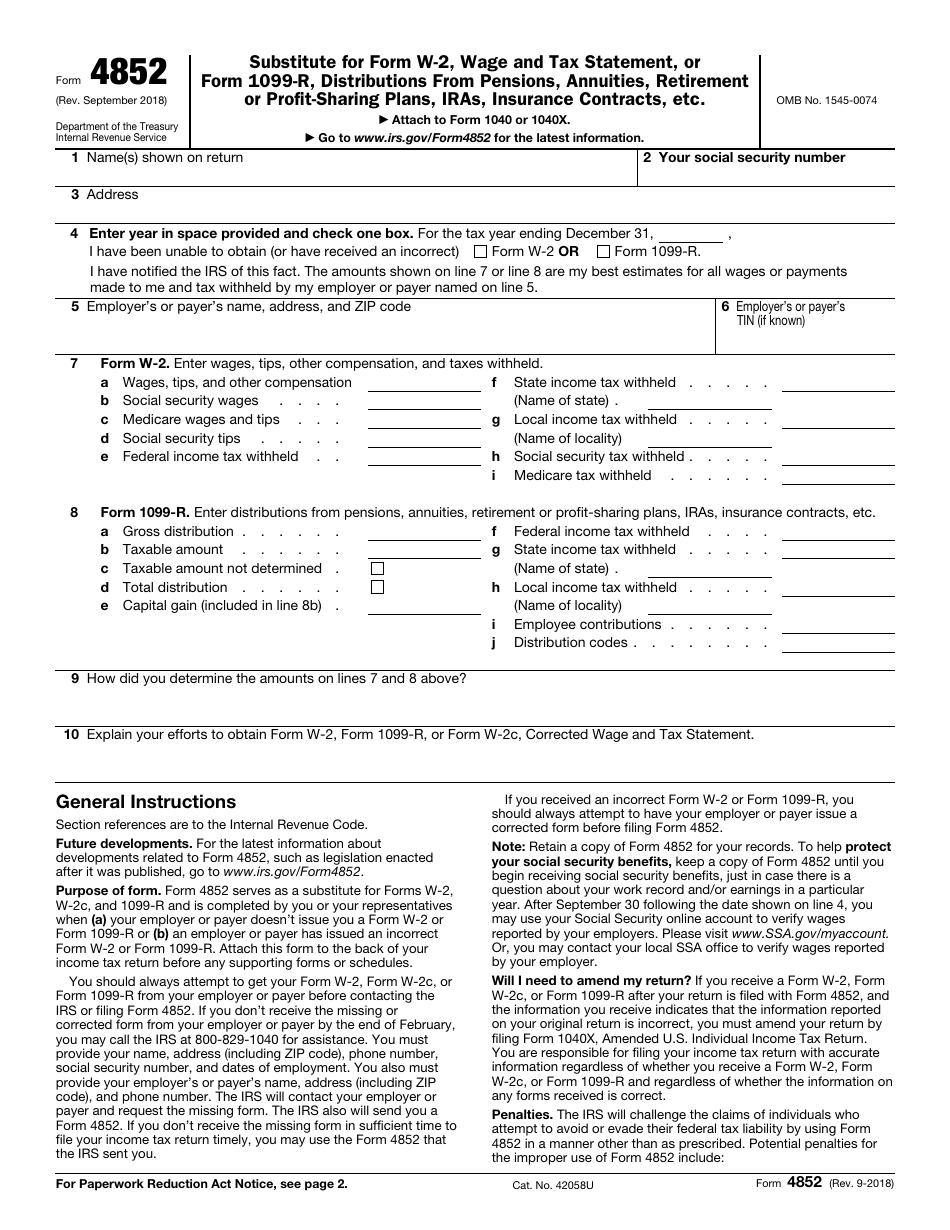

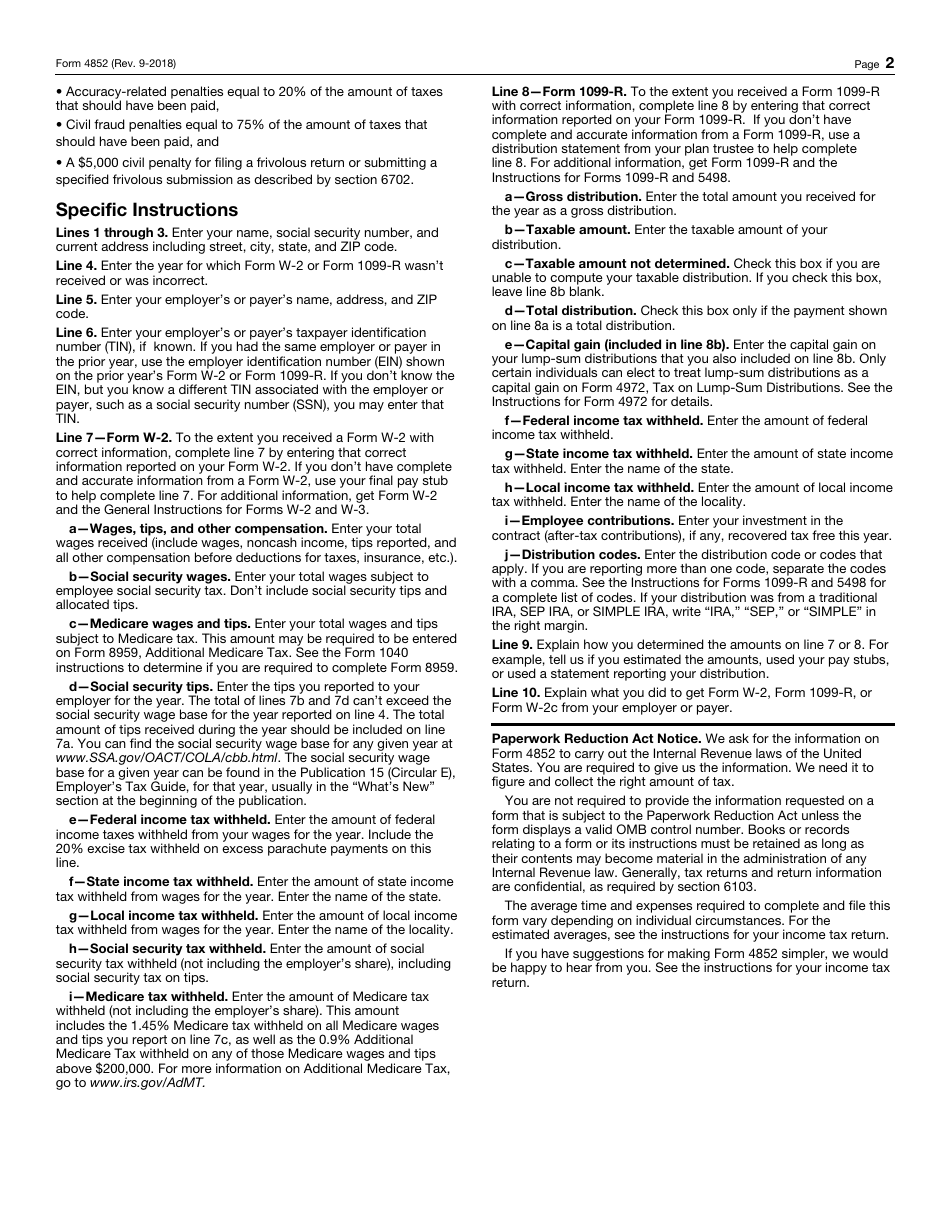

IRS Form 4852 Substitute for Form W-2, Wage and Tax Statement, or Form 1099-r, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.

What Is IRS Form 4852?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4852?

A: IRS Form 4852 is a substitute for Form W-2 or Form 1099-R when those forms are missing or incorrect.

Q: When should I use IRS Form 4852?

A: You should use Form 4852 when you are unable to obtain a correct or timely Form W-2 or Form 1099-R from your employer or payer.

Q: What information do I need to complete IRS Form 4852?

A: You will need your personal information, employer information, and income details for the tax year.

Q: Can I e-file IRS Form 4852?

A: No, you cannot e-file Form 4852. It must be printed and mailed to the IRS.

Q: Is there a deadline to file IRS Form 4852?

A: Form 4852 should be filed as soon as possible after the tax year ends, but there is no specific deadline.

Q: What if I receive a corrected Form W-2 or Form 1099-R after filing Form 4852?

A: If you receive a corrected form, you should file an amended tax return using Form 1040-X to reflect the accurate information.

Q: Can I use Form 4852 to report income from sources other than wages or retirement distributions?

A: No, Form 4852 is specifically for reporting substitute wages or retirement distributions.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 4852 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4852 through the link below or browse more documents in our library of IRS Forms.