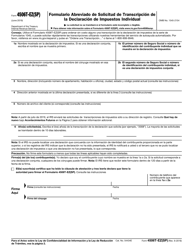

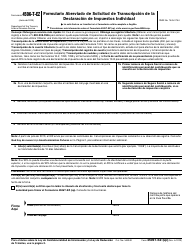

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 4506T-EZ

for the current year.

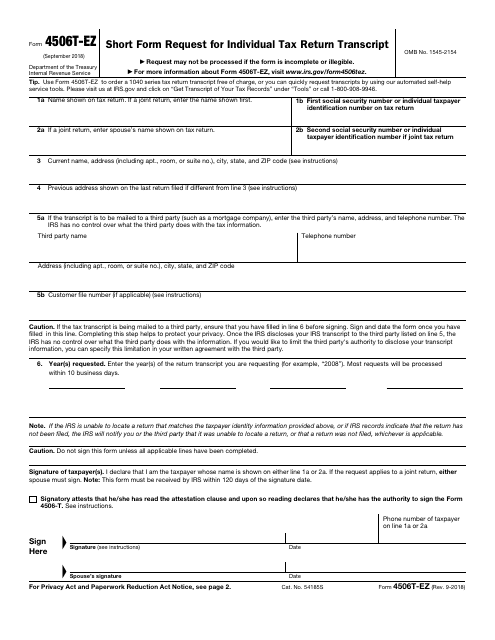

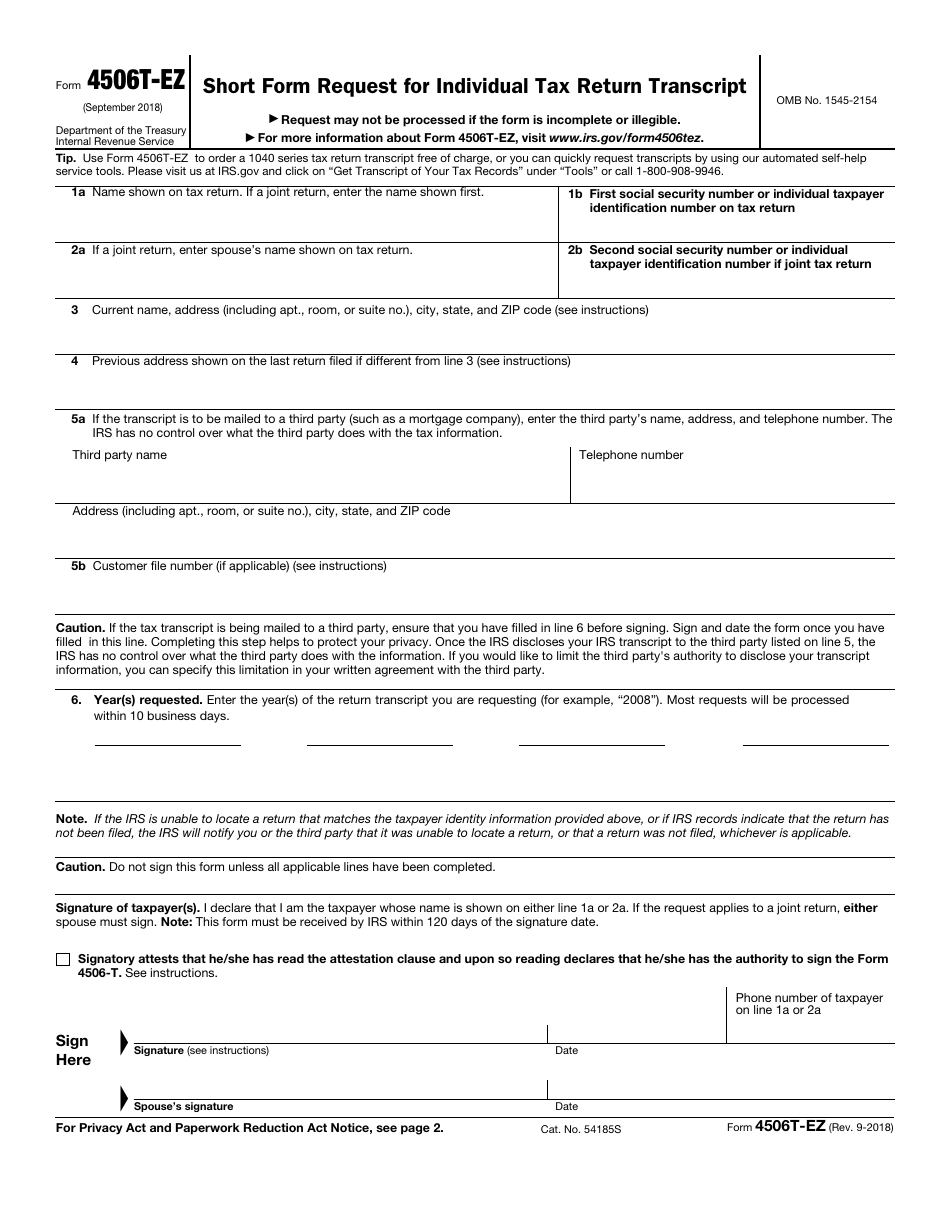

IRS Form 4506T-EZ Short Form Request for Individual Tax Return Transcript

What Is IRS Form 4506T-EZ?

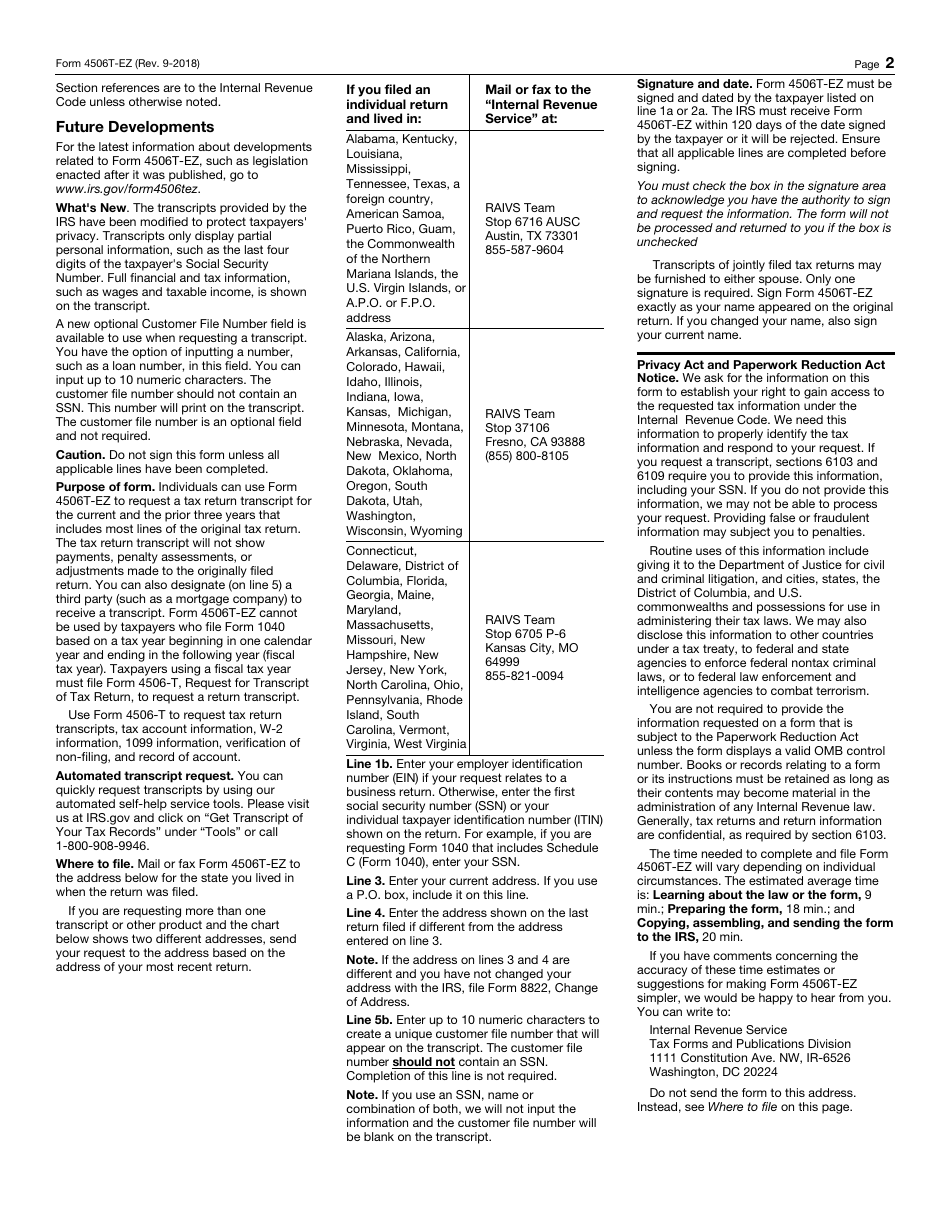

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4506T-EZ?

A: IRS Form 4506T-EZ is a short form used to request an individual tax return transcript from the Internal Revenue Service (IRS).

Q: What is the purpose of IRS Form 4506T-EZ?

A: The purpose of IRS Form 4506T-EZ is to authorize the IRS to release a copy of a taxpayer's tax return transcript to a third party, such as a mortgage lender or financial institution.

Q: Who can use IRS Form 4506T-EZ?

A: Individual taxpayers who filed a Form 1040 series return can use IRS Form 4506T-EZ to request a transcript of their tax return.

Q: Is there a fee for IRS Form 4506T-EZ?

A: No, there is no fee for requesting an individual tax return transcript using IRS Form 4506T-EZ.

Q: How long does it take to receive a tax return transcript using IRS Form 4506T-EZ?

A: It typically takes around 5 to 10 business days to receive a tax return transcript from the IRS after submitting IRS Form 4506T-EZ.

Q: Can I use IRS Form 4506T-EZ to request a copy of my tax return?

A: No, IRS Form 4506T-EZ only allows you to request a tax return transcript, which is a summary of your tax return information.

Q: What should I do if I need a copy of my tax return?

A: If you need an actual copy of your tax return, you can use IRS Form 4506 to request a copy from the IRS, but there is a fee involved.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4506T-EZ through the link below or browse more documents in our library of IRS Forms.