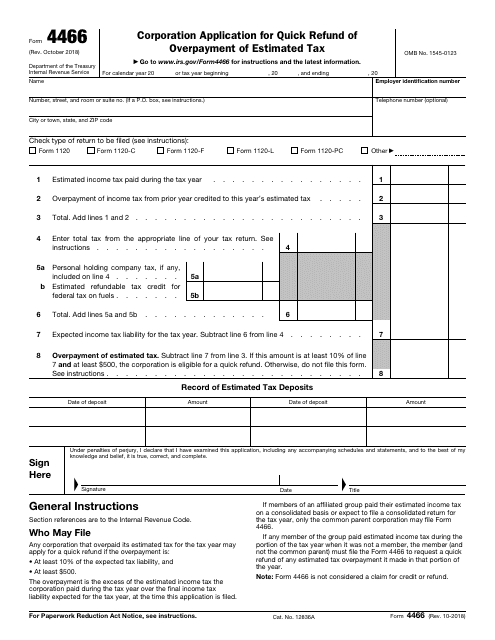

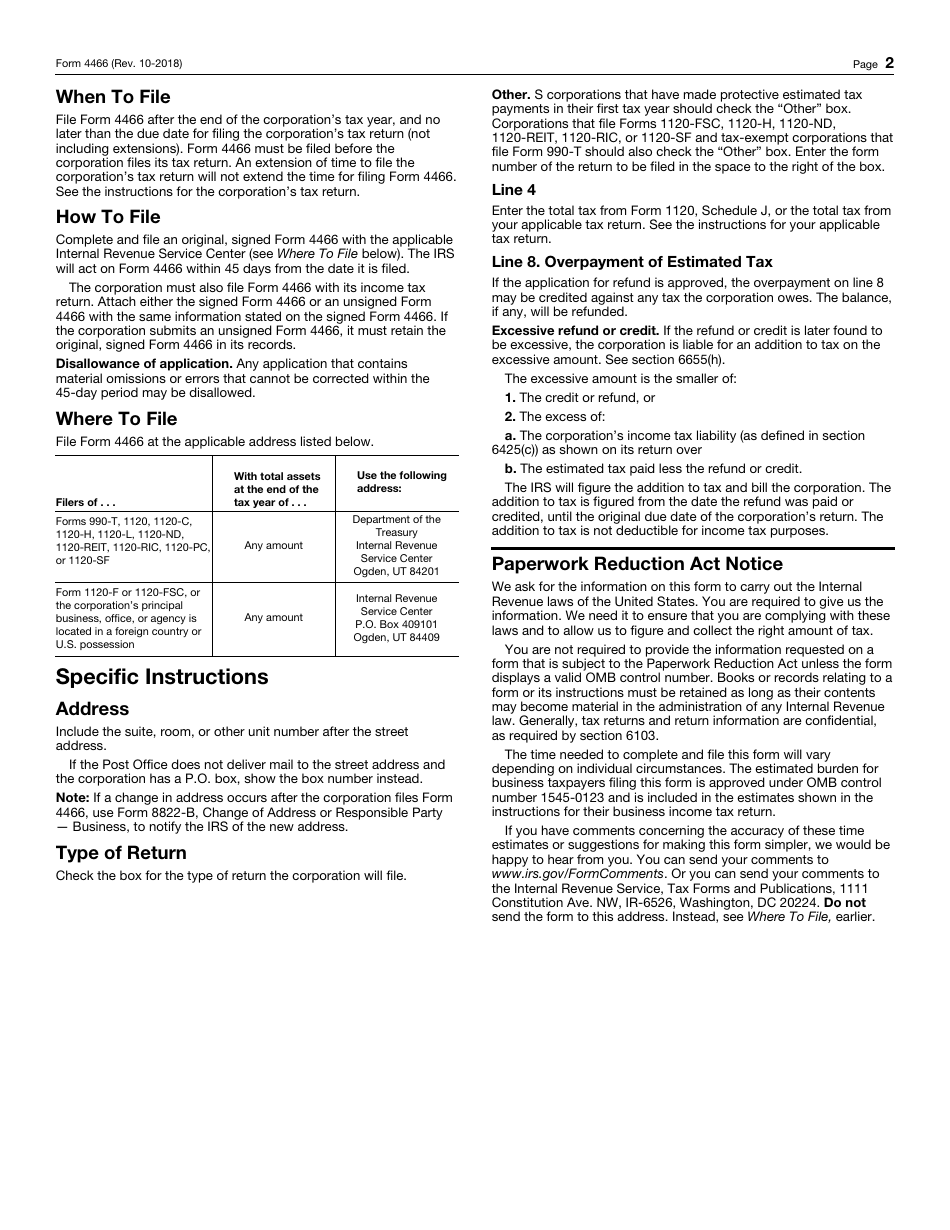

IRS Form 4466 Corporation Application for Quick Refund of Overpayment of Estimated Tax

What Is IRS Form 4466?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4466?

A: IRS Form 4466 is the Corporation Application for Quick Refund of Overpayment of Estimated Tax.

Q: What is the purpose of IRS Form 4466?

A: The purpose of IRS Form 4466 is to request a quick refund of an overpayment of estimated tax by a corporation.

Q: Who should use IRS Form 4466?

A: This form should be used by corporations who have overpaid estimated taxes and want to claim a quick refund.

Q: How do I submit IRS Form 4466?

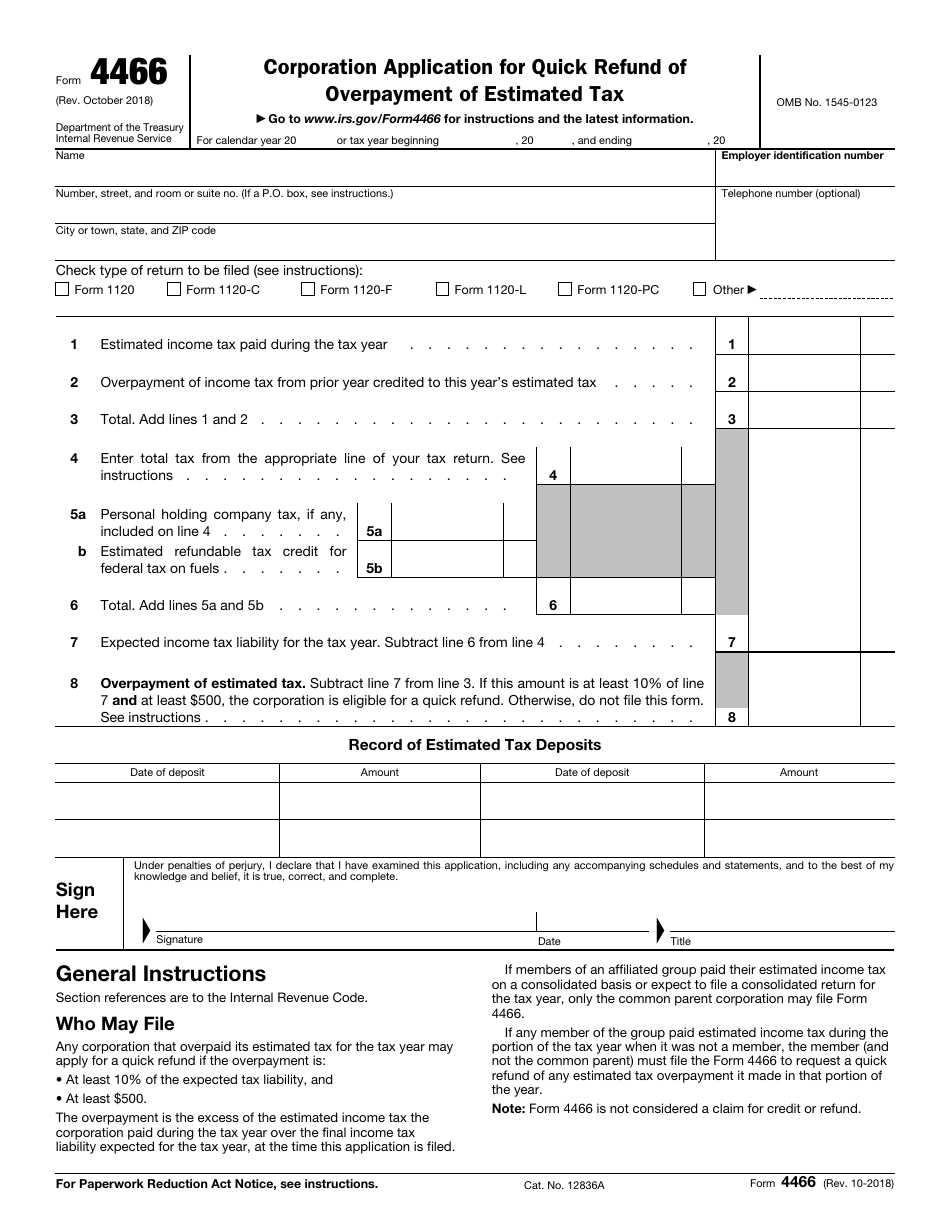

A: IRS Form 4466 should be filed by mail with the appropriate IRS address provided in the instructions of the form.

Q: Is there a deadline for filing IRS Form 4466?

A: Yes, IRS Form 4466 must be filed within 12 months from the end of the tax year in which the overpayment occurred.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4466 through the link below or browse more documents in our library of IRS Forms.