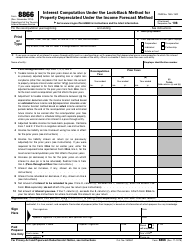

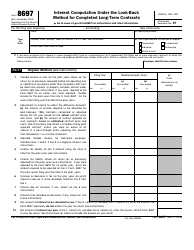

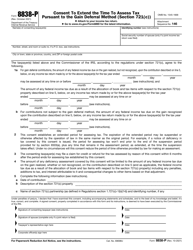

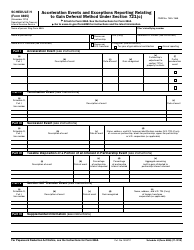

This version of the form is not currently in use and is provided for reference only. Download this version of

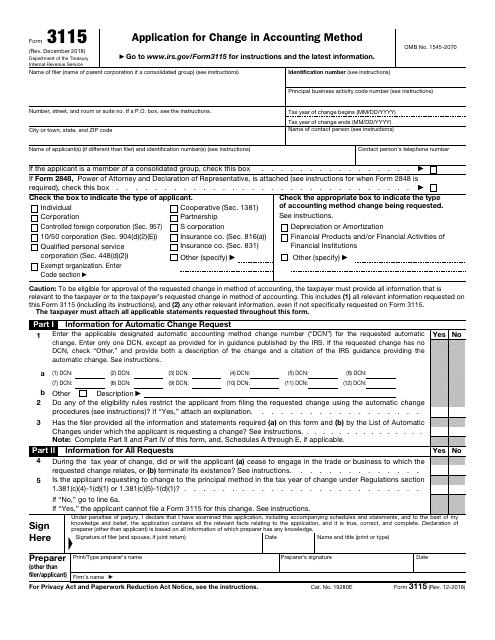

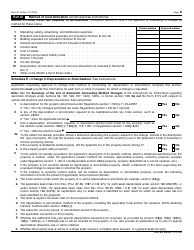

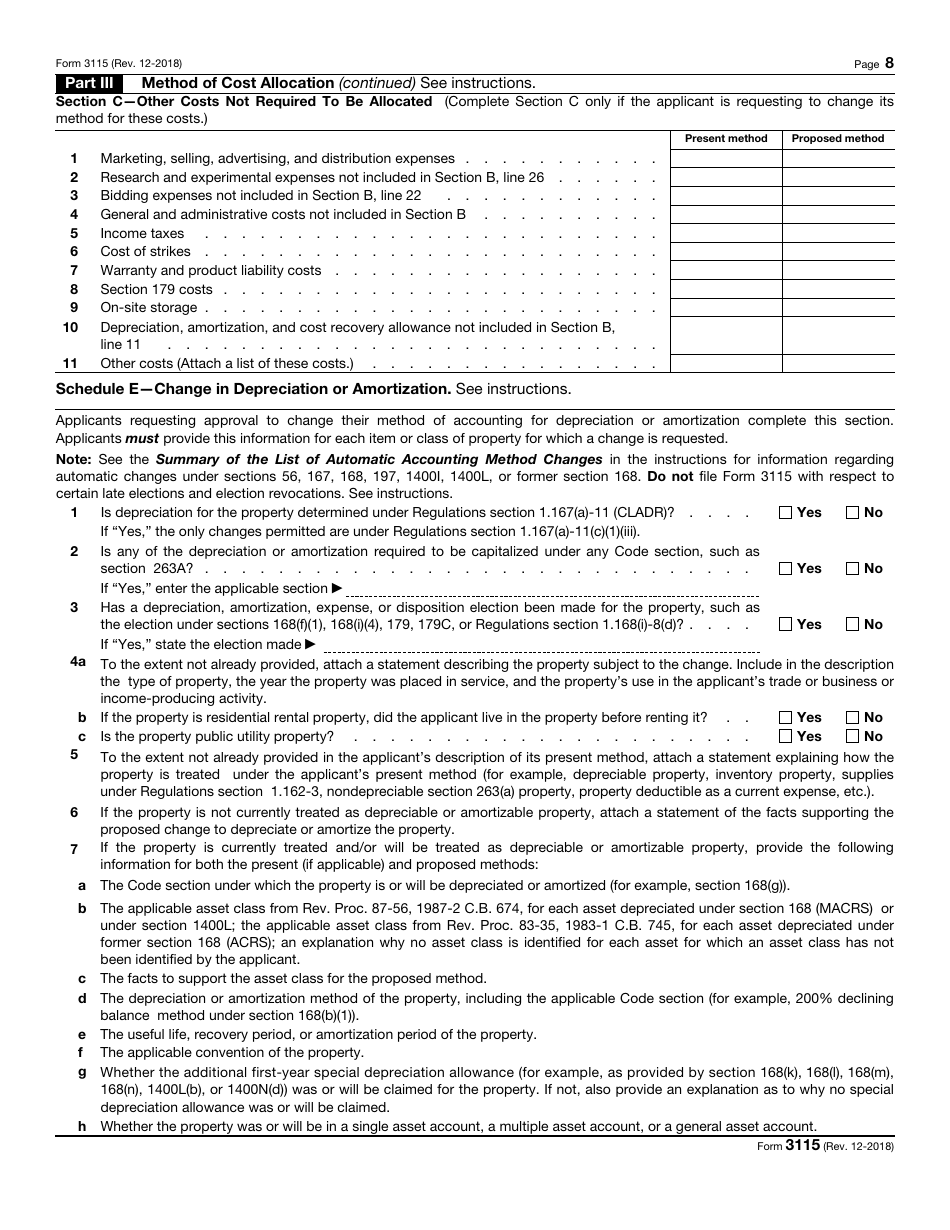

IRS Form 3115

for the current year.

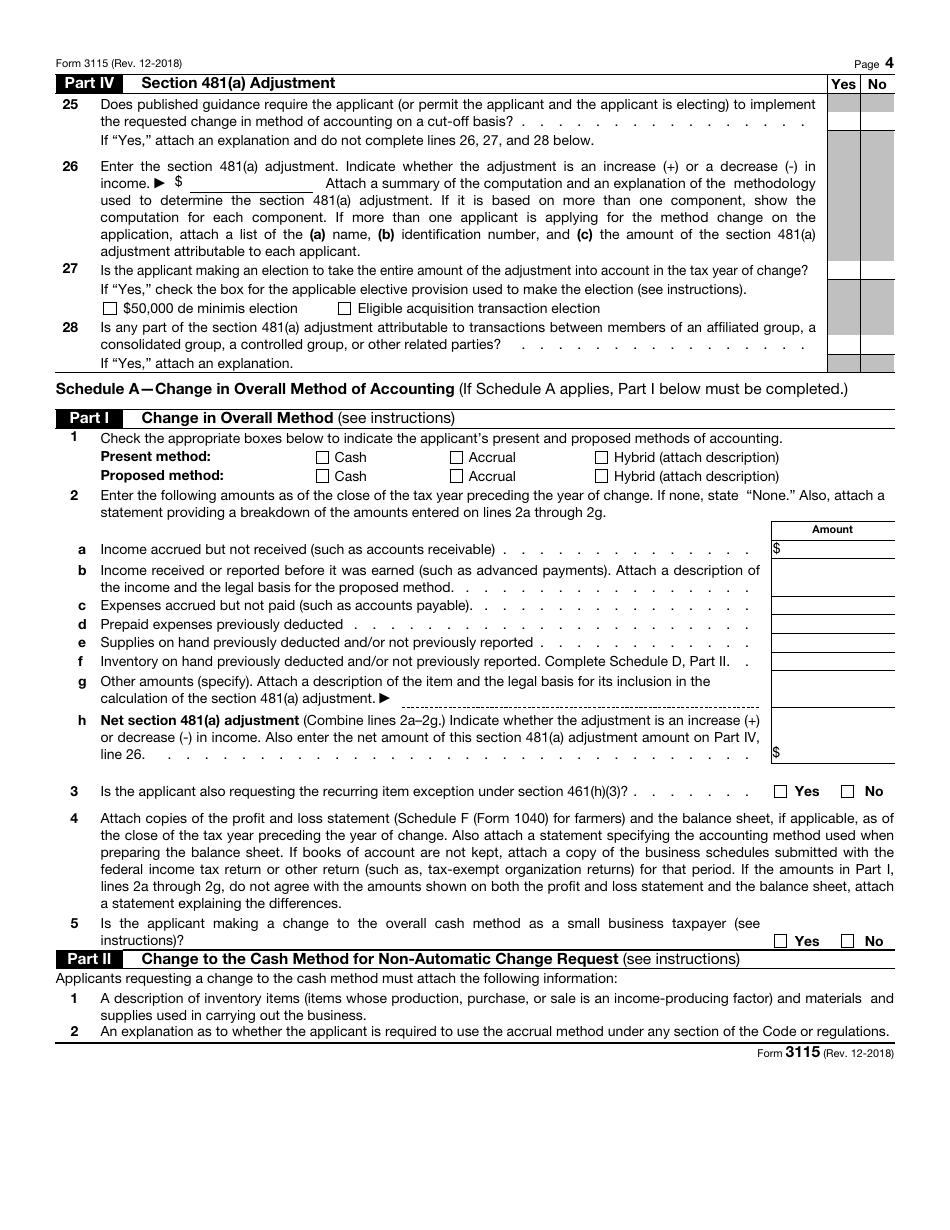

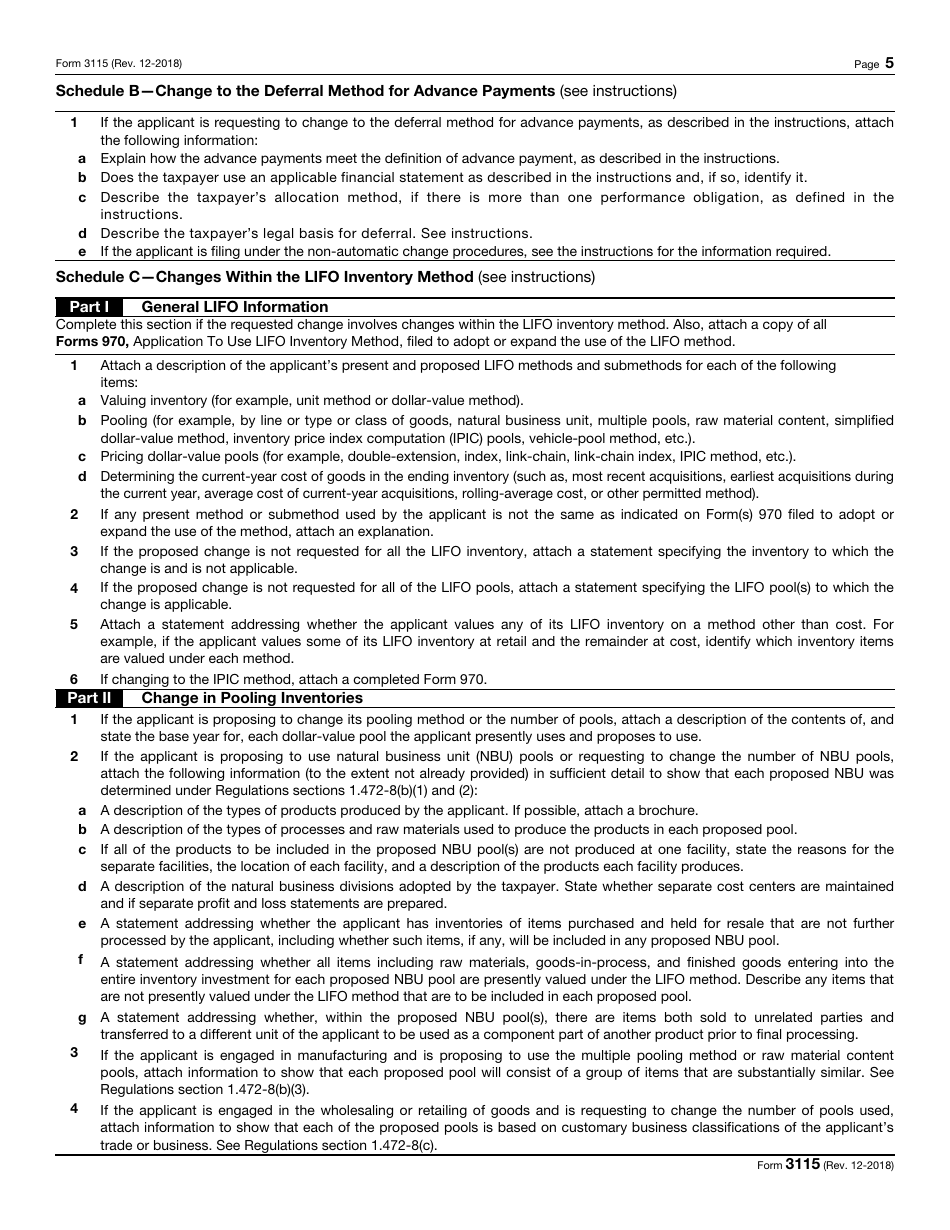

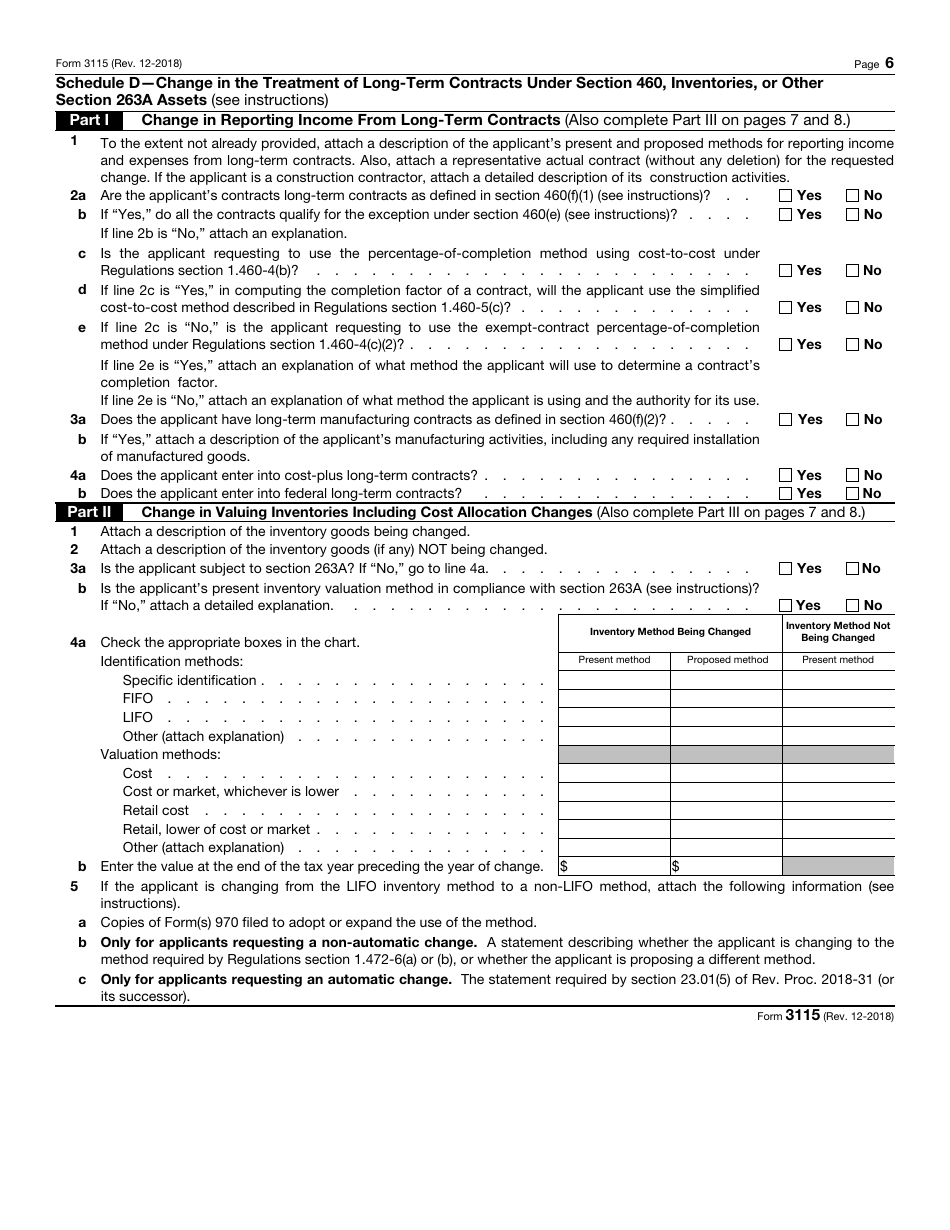

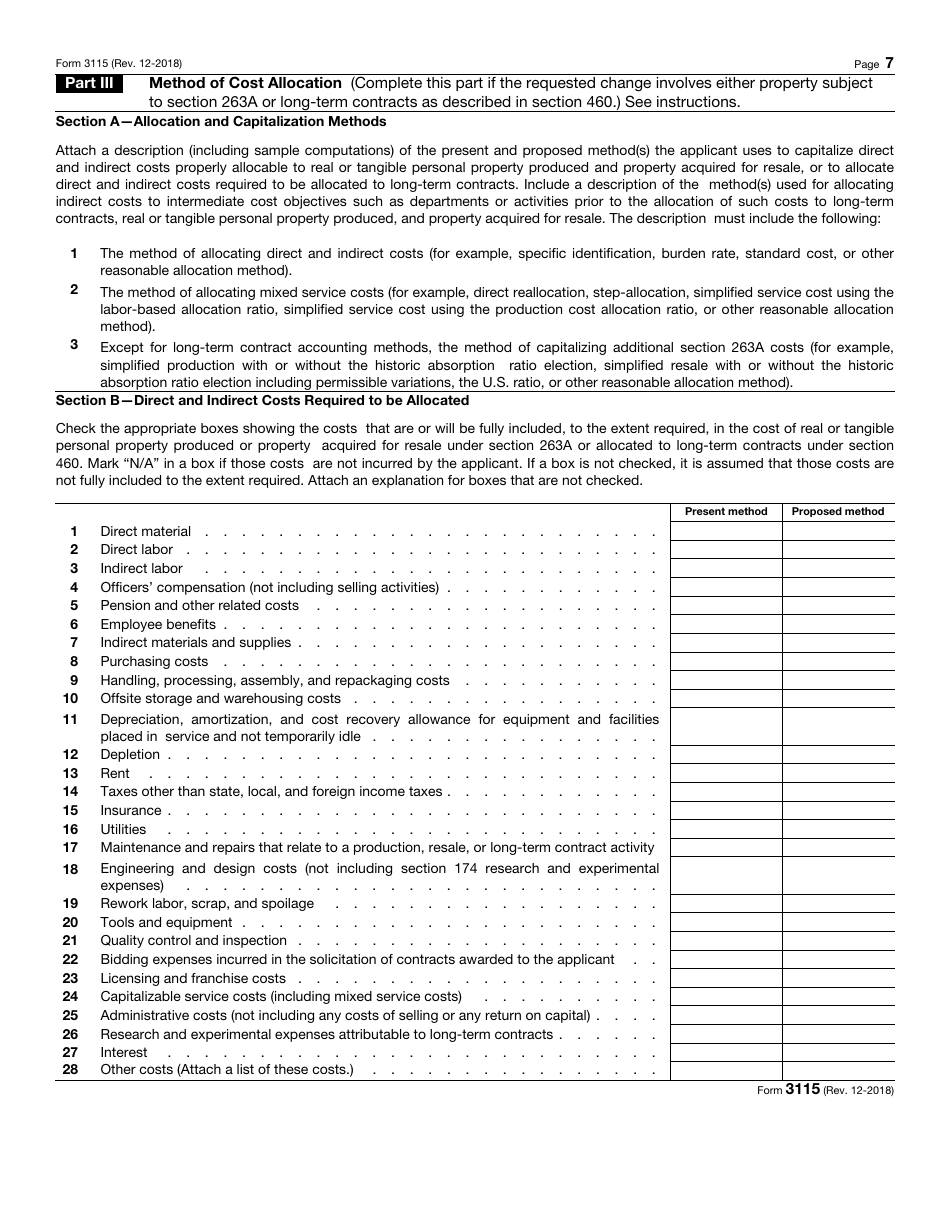

IRS Form 3115 Application for Change in Accounting Method

What Is IRS Form 3115?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 3115?

A: IRS Form 3115 is an application for change in accounting method.

Q: What is the purpose of IRS Form 3115?

A: The purpose of IRS Form 3115 is to request permission from the IRS to change your accounting method.

Q: When should I use IRS Form 3115?

A: You should use IRS Form 3115 when you want to change your accounting method for tax purposes.

Q: How do I file IRS Form 3115?

A: IRS Form 3115 should be filed with your annual tax return. You may also need to attach additional documentation.

Q: Are there any fees associated with filing IRS Form 3115?

A: Yes, there may be fees associated with filing IRS Form 3115. The amount will depend on your specific circumstances.

Q: What are some common reasons for filing IRS Form 3115?

A: Some common reasons for filing IRS Form 3115 include adopting a new accounting method, correcting errors, or complying with new tax laws.

Q: Can I file IRS Form 3115 electronically?

A: Yes, you can file IRS Form 3115 electronically if you are eligible to do so.

Q: What happens after I file IRS Form 3115?

A: After you file IRS Form 3115, the IRS will review your application and determine whether to allow the change in accounting method.

Q: Can I amend IRS Form 3115 after filing?

A: In most cases, you cannot amend IRS Form 3115 after filing. It is important to carefully review and double-check your application before submitting it.

Form Details:

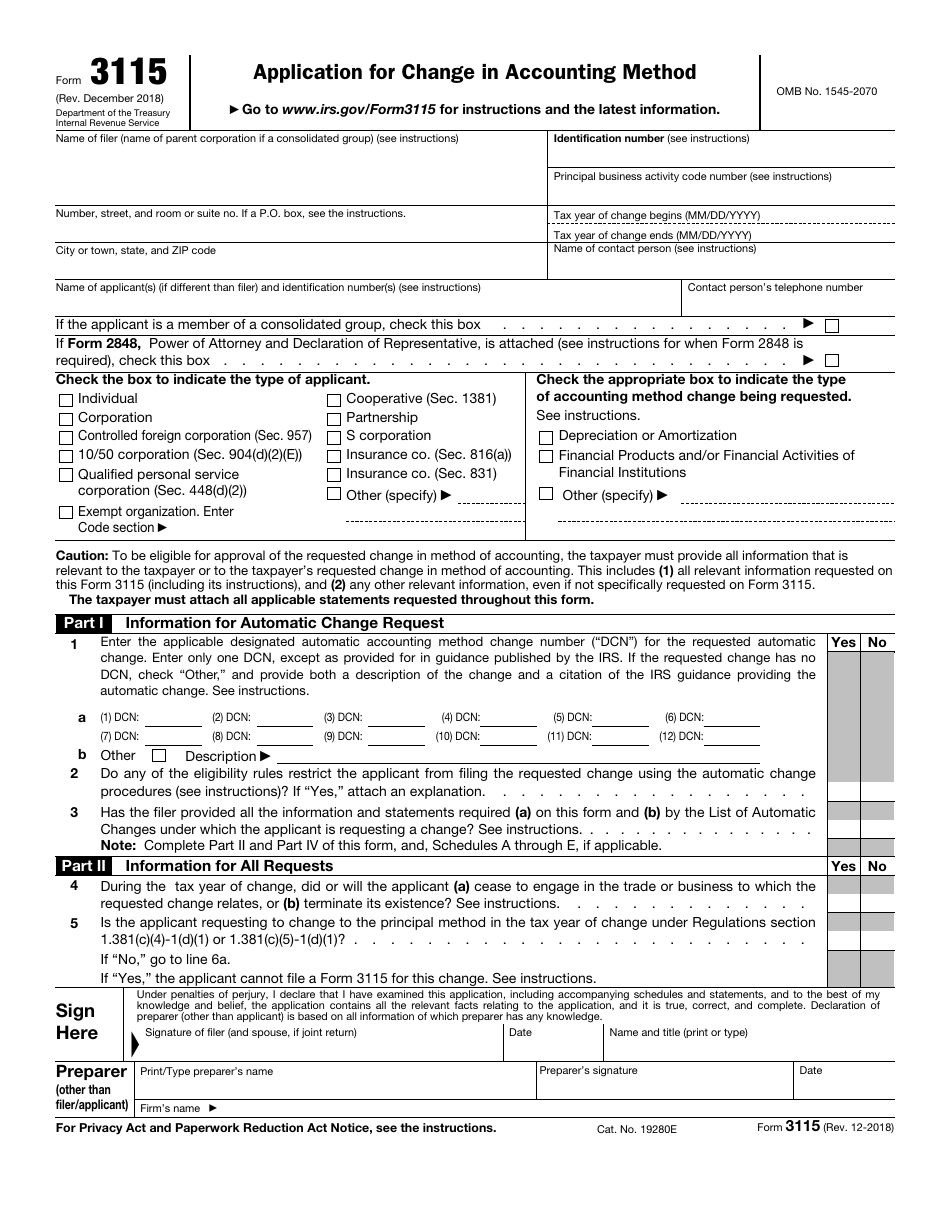

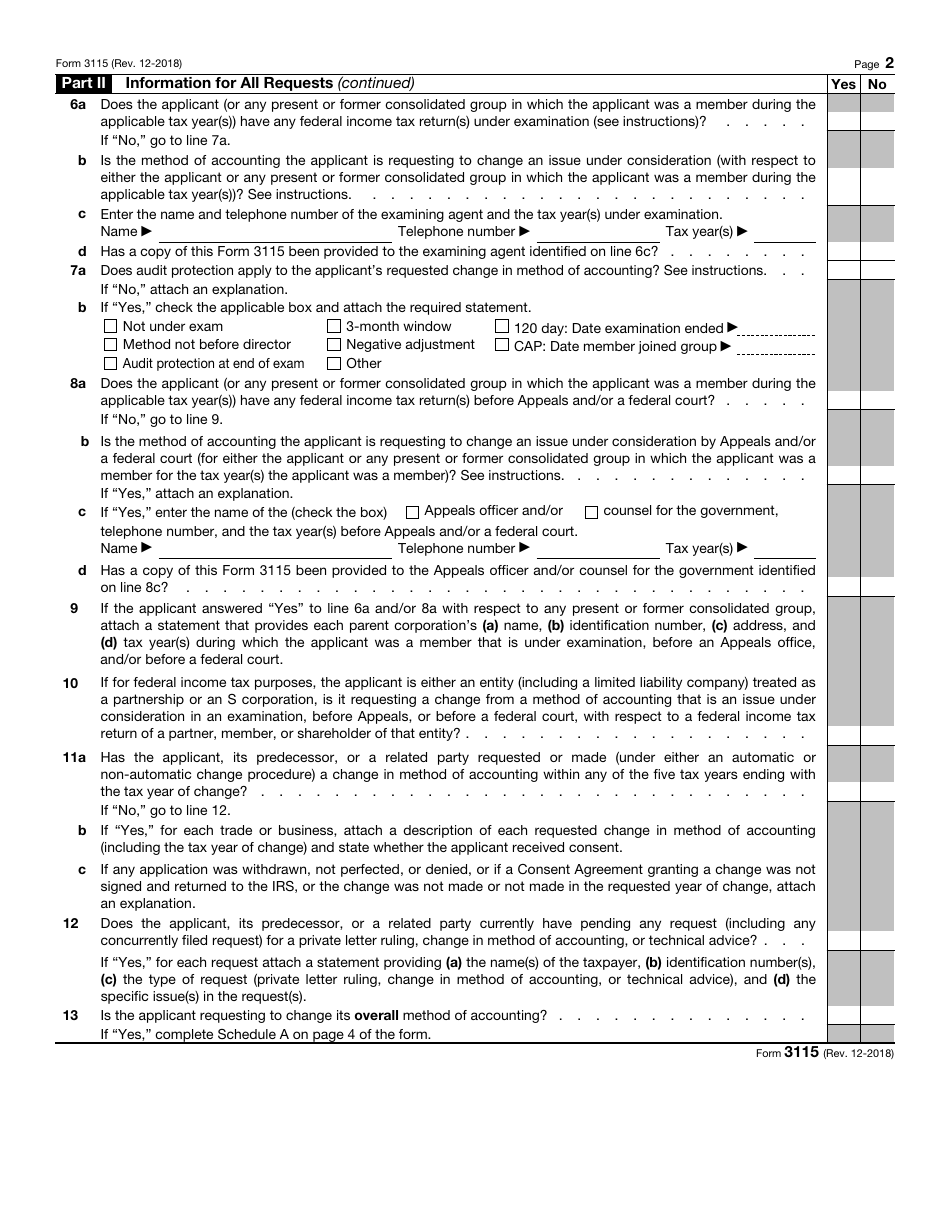

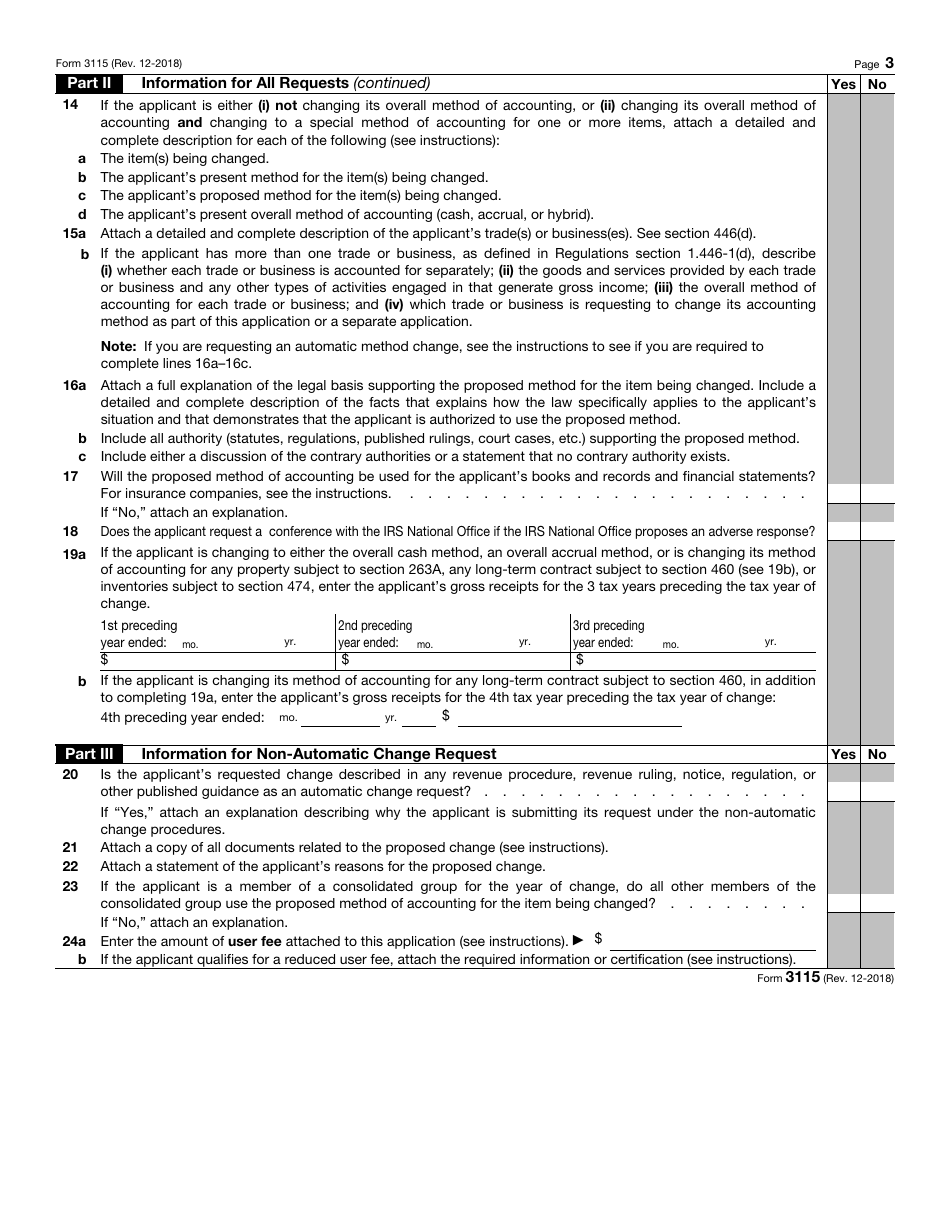

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 3115 through the link below or browse more documents in our library of IRS Forms.