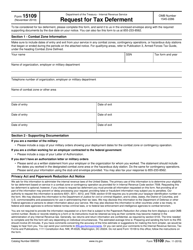

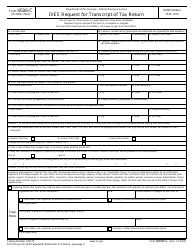

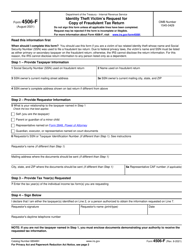

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 4506

for the current year.

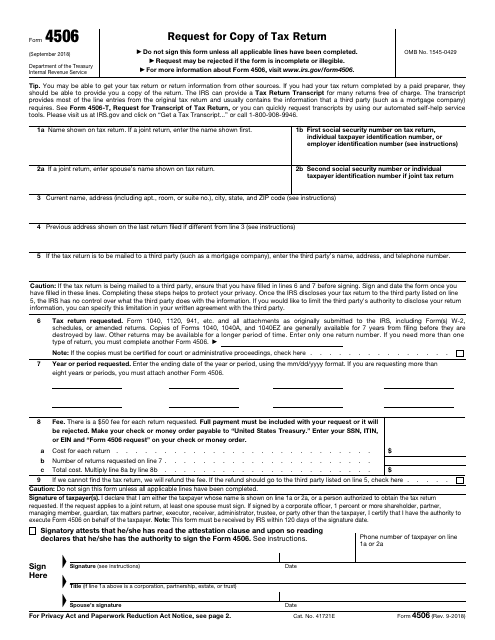

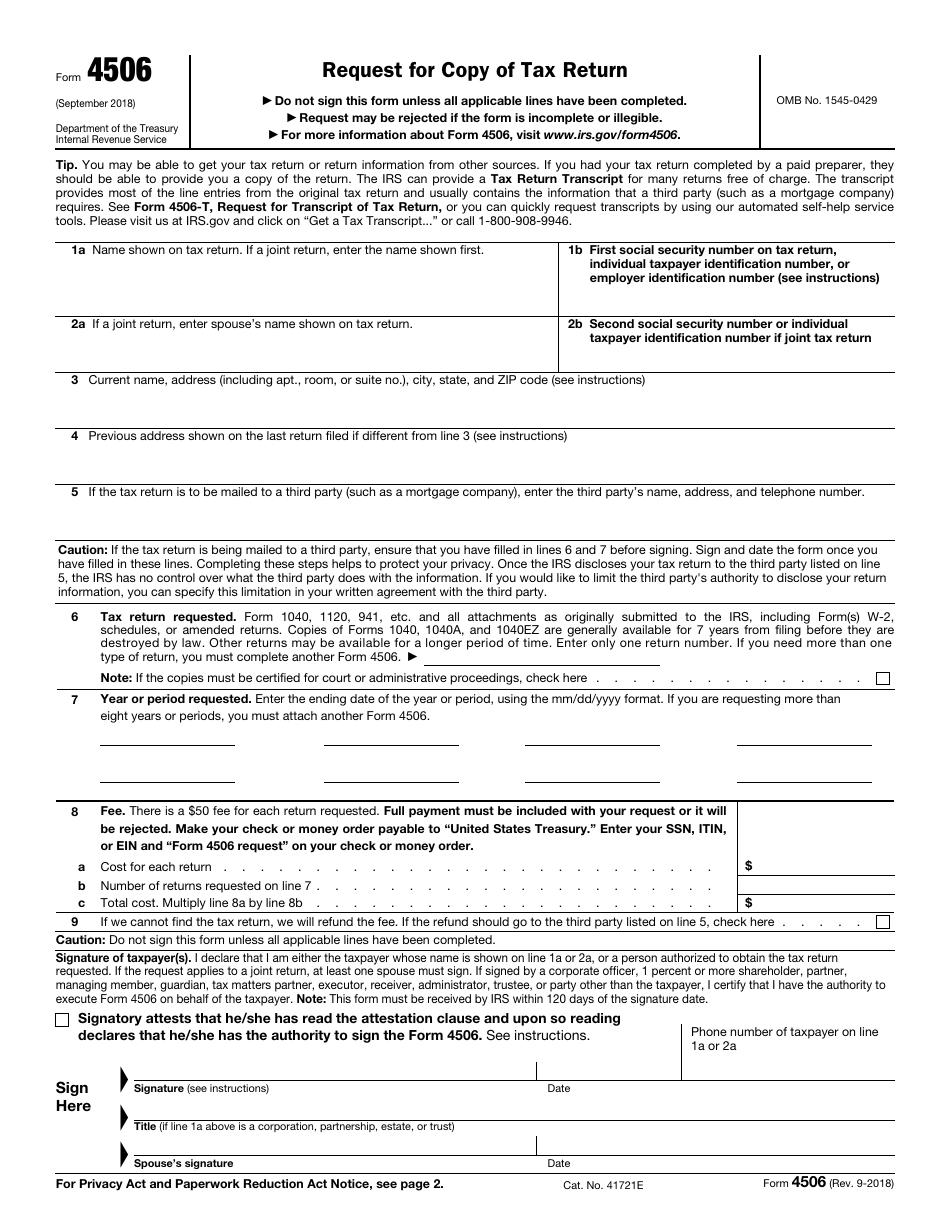

IRS Form 4506 Request for Copy of Tax Return

What Is IRS Form 4506?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4506?

A: IRS Form 4506 is a request form used to obtain a copy of your tax return from the Internal Revenue Service.

Q: Why would I need to fill out IRS Form 4506?

A: You may need to fill out IRS Form 4506 if you need a copy of your tax return for various reasons, such as applying for a loan or mortgage, proving your income, or resolving tax-related issues.

Q: How can I obtain a copy of my tax return using IRS Form 4506?

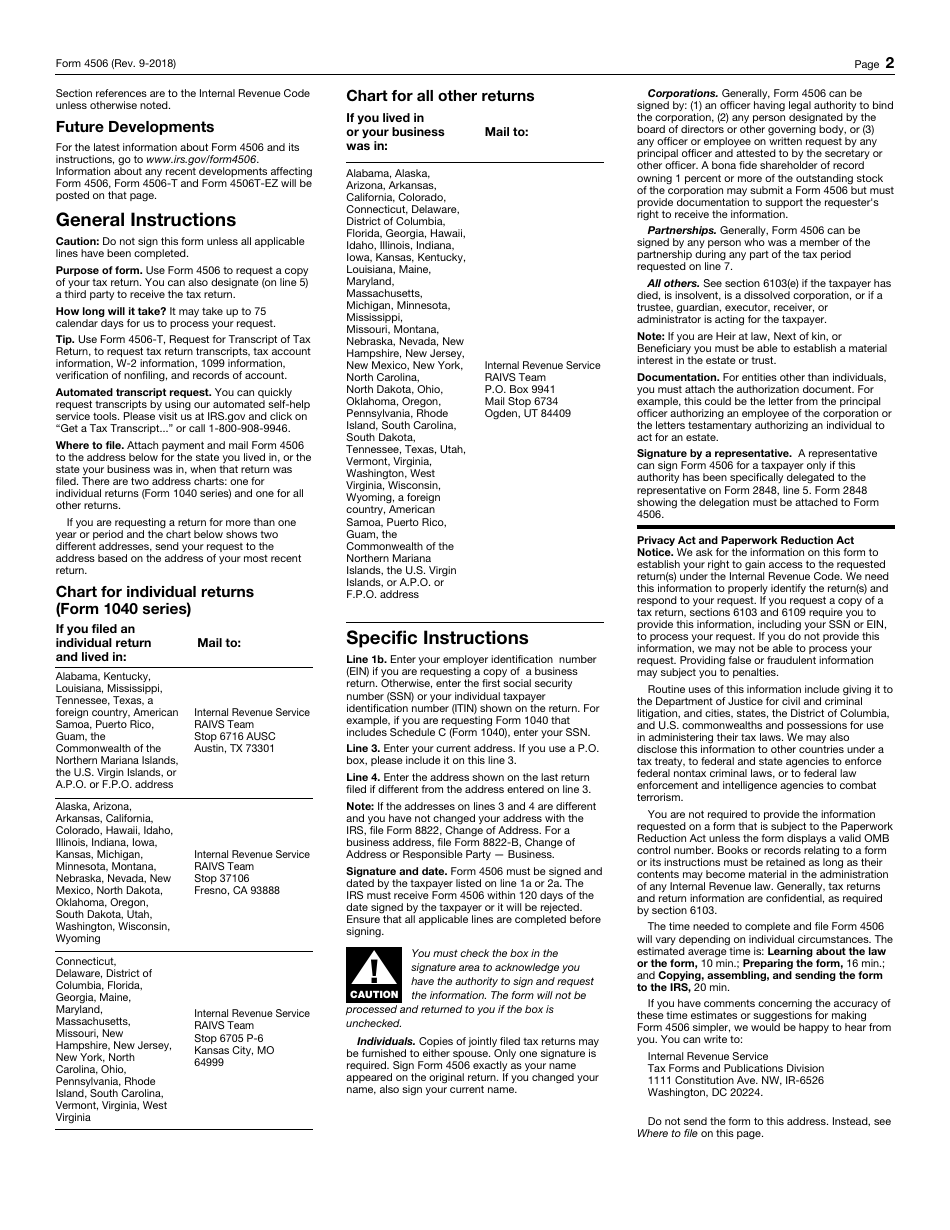

A: To obtain a copy of your tax return, you can fill out IRS Form 4506 and mail it to the address provided on the form, along with the required fee, if applicable.

Q: How long does it take to receive a copy of my tax return using IRS Form 4506?

A: The processing time to receive a copy of your tax return using IRS Form 4506 may vary. It can take several weeks for the IRS to process your request and mail you the requested documents.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 4506 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4506 through the link below or browse more documents in our library of IRS Forms.