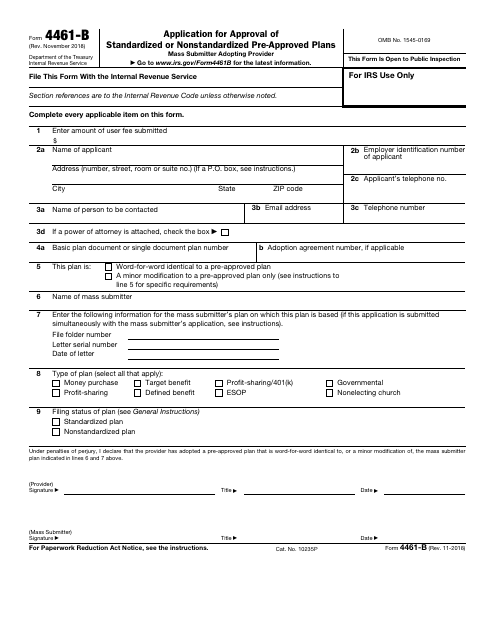

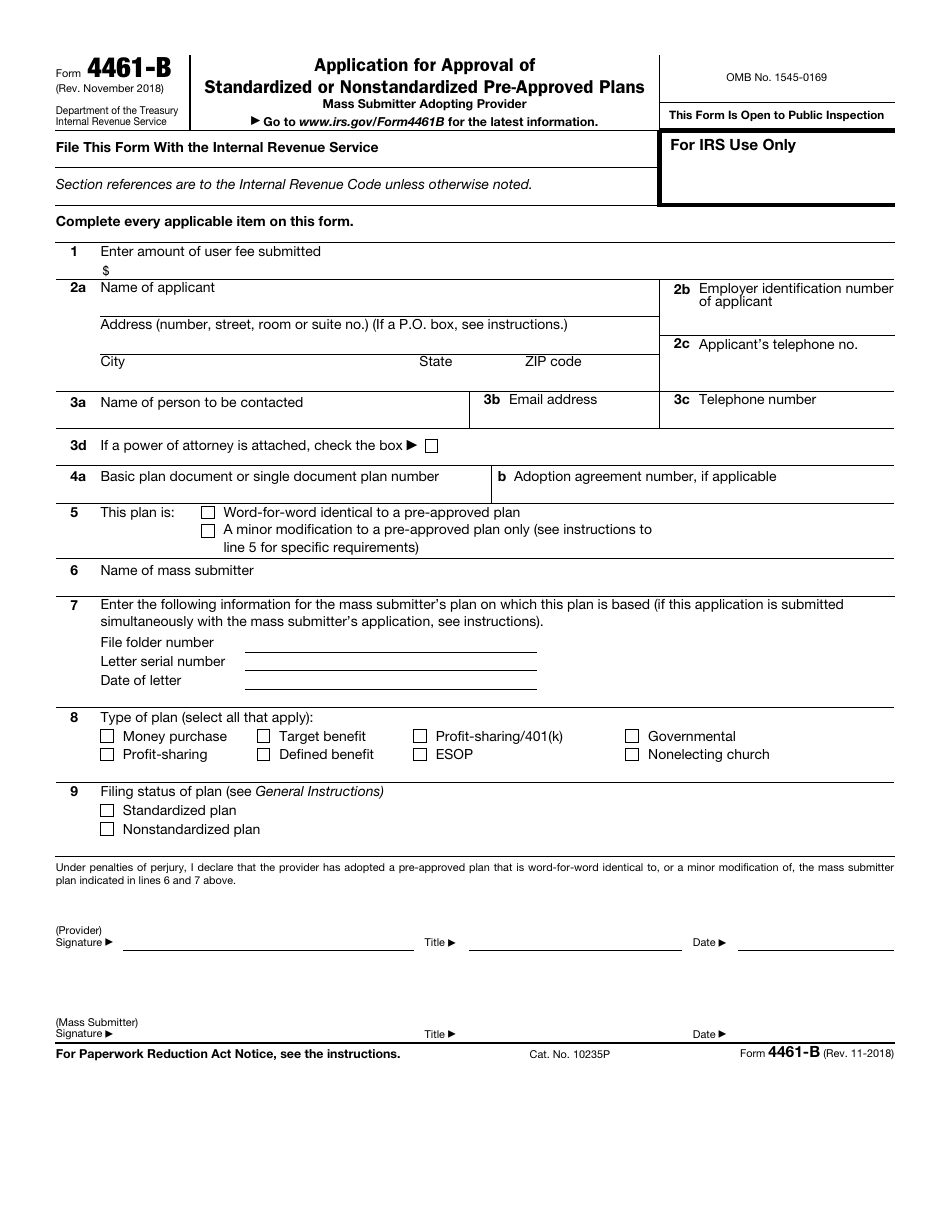

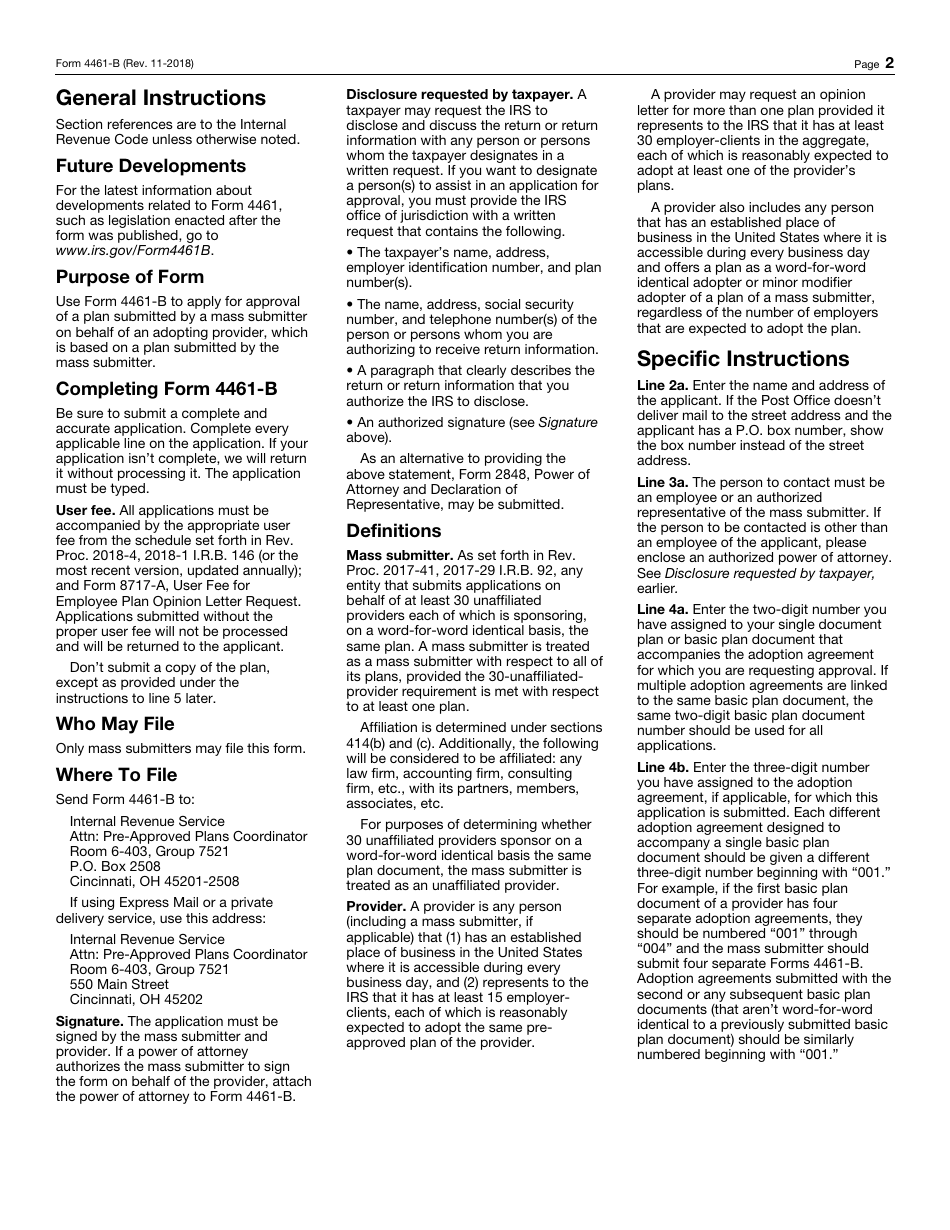

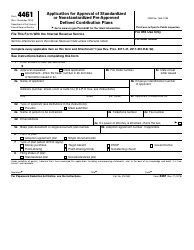

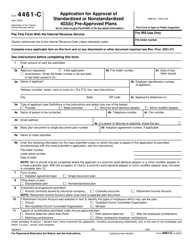

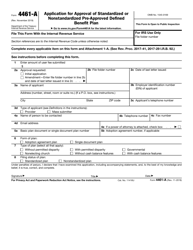

IRS Form 4461-B Application for Approval of Standardized or Nonstandardized Pre-approved Plans

What Is IRS Form 4461-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 4461-B?

A: Form 4461-B is an IRS application used for approval of standardized or nonstandardized pre-approved retirement plans.

Q: Who uses Form 4461-B?

A: This form is used by employers or plan sponsors who want to obtain approval for their retirement plans.

Q: What is the purpose of Form 4461-B?

A: The purpose of this form is to seek IRS approval for retirement plans, ensuring they meet the specific requirements and qualify for favorable tax treatment.

Q: What are standardized and nonstandardized pre-approved plans?

A: Standardized pre-approved plans are drafted by financial institutions, while nonstandardized plans are customized by employers or plan sponsors.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4461-B through the link below or browse more documents in our library of IRS Forms.