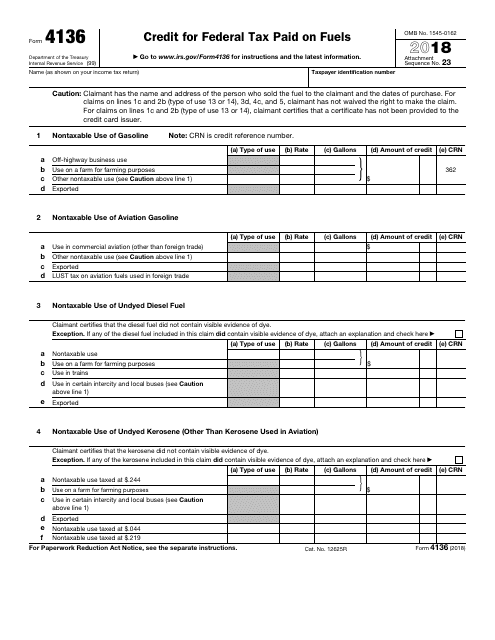

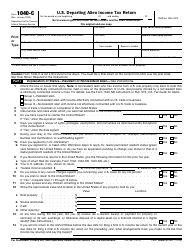

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 4136

for the current year.

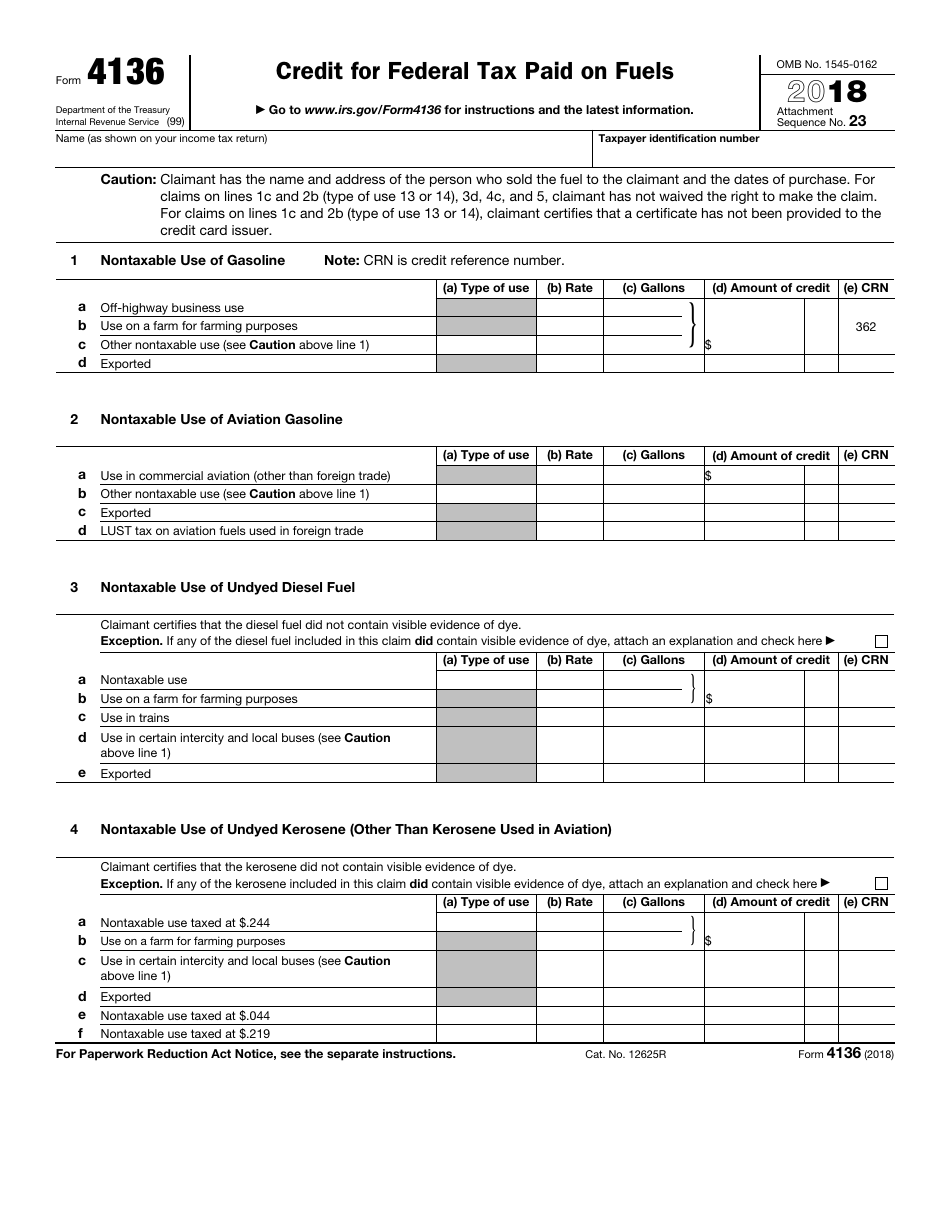

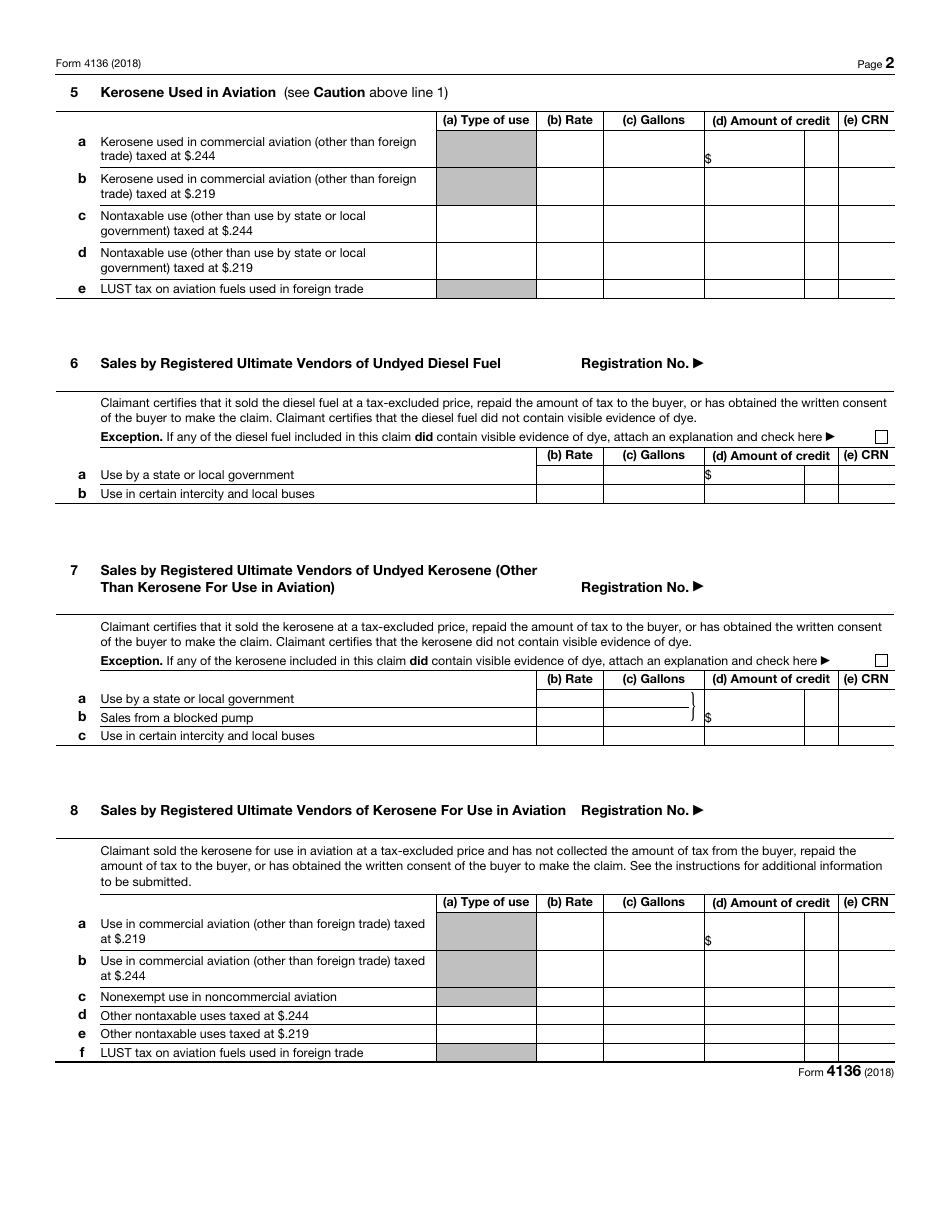

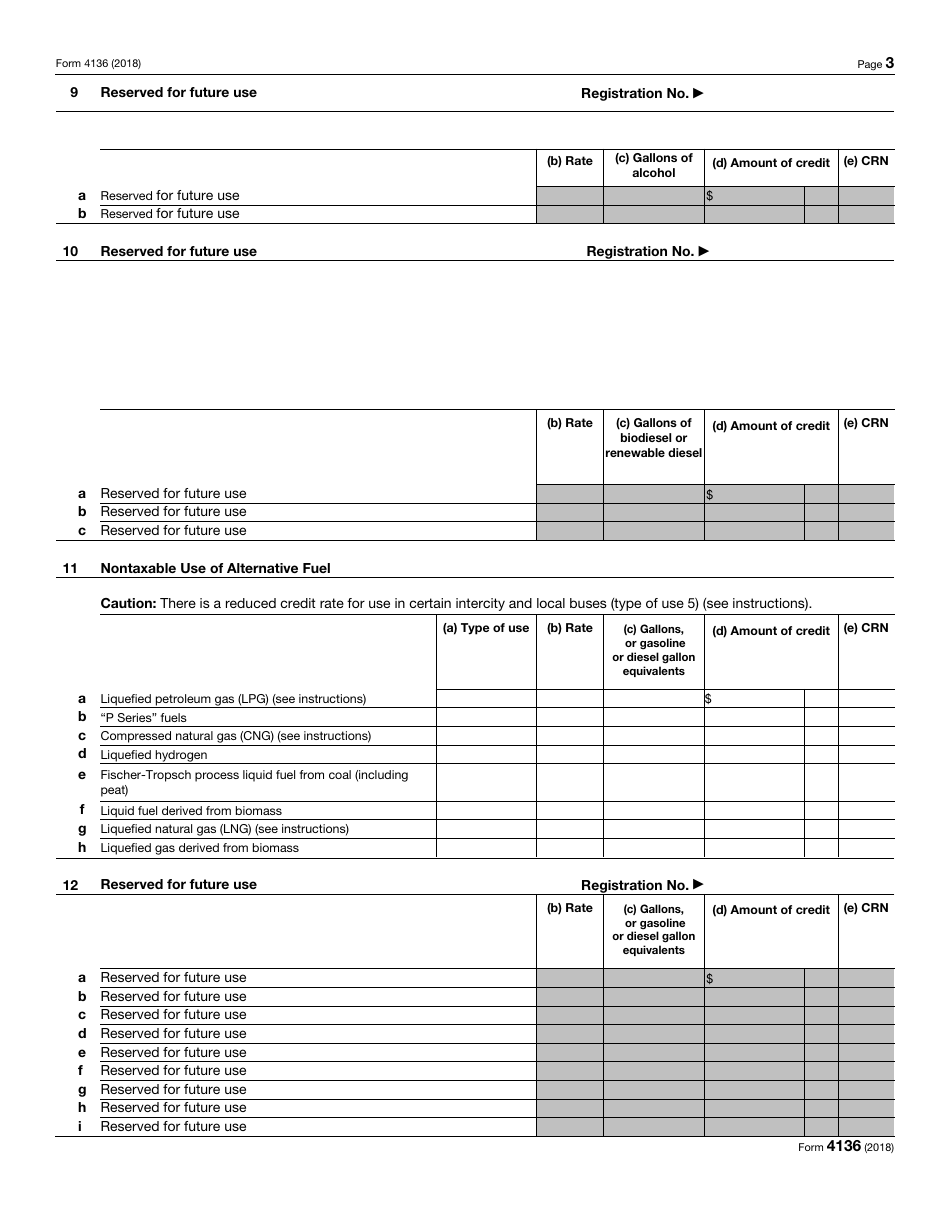

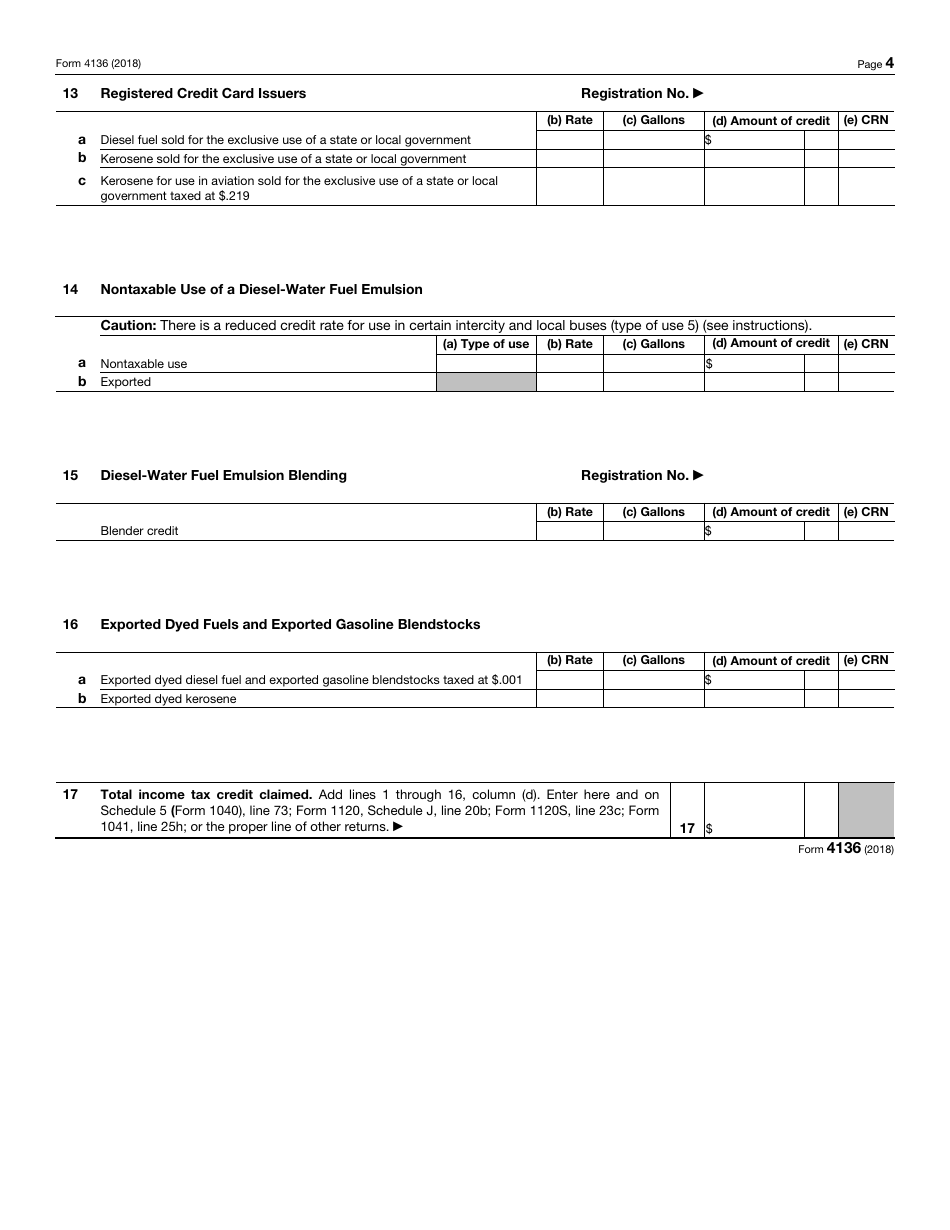

IRS Form 4136 Credit for Federal Tax Paid on Fuels

What Is IRS Form 4136?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 4136?

A: IRS Form 4136 is a form used to claim the credit for federal tax paid on fuels.

Q: What is the purpose of IRS Form 4136?

A: The purpose of IRS Form 4136 is to claim a credit for the federal tax paid on fuels used in various activities, such as farming, off-highway business use, and aviation.

Q: Who is eligible to use IRS Form 4136?

A: Anyone who has paid federal tax on fuels for eligible activities, such as farming or off-highway business use, may be eligible to use IRS Form 4136 to claim the credit.

Q: What types of activities are eligible for the credit?

A: Activities such as farming, off-highway business use, and aviation can be eligible for the credit.

Q: How do I fill out IRS Form 4136?

A: To fill out IRS Form 4136, you will need to provide information about the fuels used, the amount of federal tax paid, and the specific activities for which the fuels were used. The form includes instructions to guide you through the process.

Q: Are there any deadlines for filing IRS Form 4136?

A: Yes, IRS Form 4136 should generally be filed with your annual income tax return.

Q: Can I e-file IRS Form 4136?

A: Yes, you can e-file IRS Form 4136 along with your annual income tax return if you are utilizing tax software or working with a tax professional who offers e-filing services.

Q: What documentation do I need to support my claim on IRS Form 4136?

A: You will need to keep records of the fuels used, the amount of tax paid, and any other supporting documents that can substantiate your claim for the credit.

Q: How long does it take to receive the credit after filing IRS Form 4136?

A: The processing time for your claim and the credit will vary depending on the IRS and other factors. It is advisable to check the IRS guidelines or consult a tax professional for more specific information.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4136 through the link below or browse more documents in our library of IRS Forms.