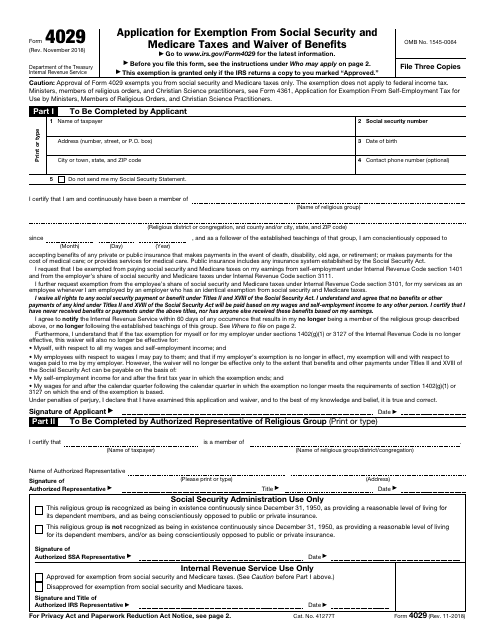

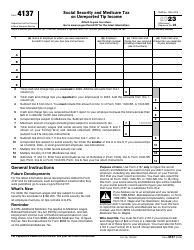

IRS Form 4029 Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits

What Is IRS Form 4029?

IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits , is a fiscal instrument used by taxpayers that seek approval for tax exemption due to their status of a religious group member.

Alternate Name:

- Tax Form 4029.

If you belong to a religious coalition that opposes insurance benefits and pays for healthcare on behalf of its members, you can reduce your tax obligations by filing this statement.

This application was issued by the Internal Revenue Service (IRS) on November 1, 2018 , making previous editions of the document obsolete. You can find an IRS Form 4029 fillable version through the link below.

Form 4029 Instructions

Follow these IRS Form 4029 instructions to file an application for social security and Medicare benefits exemption:

-

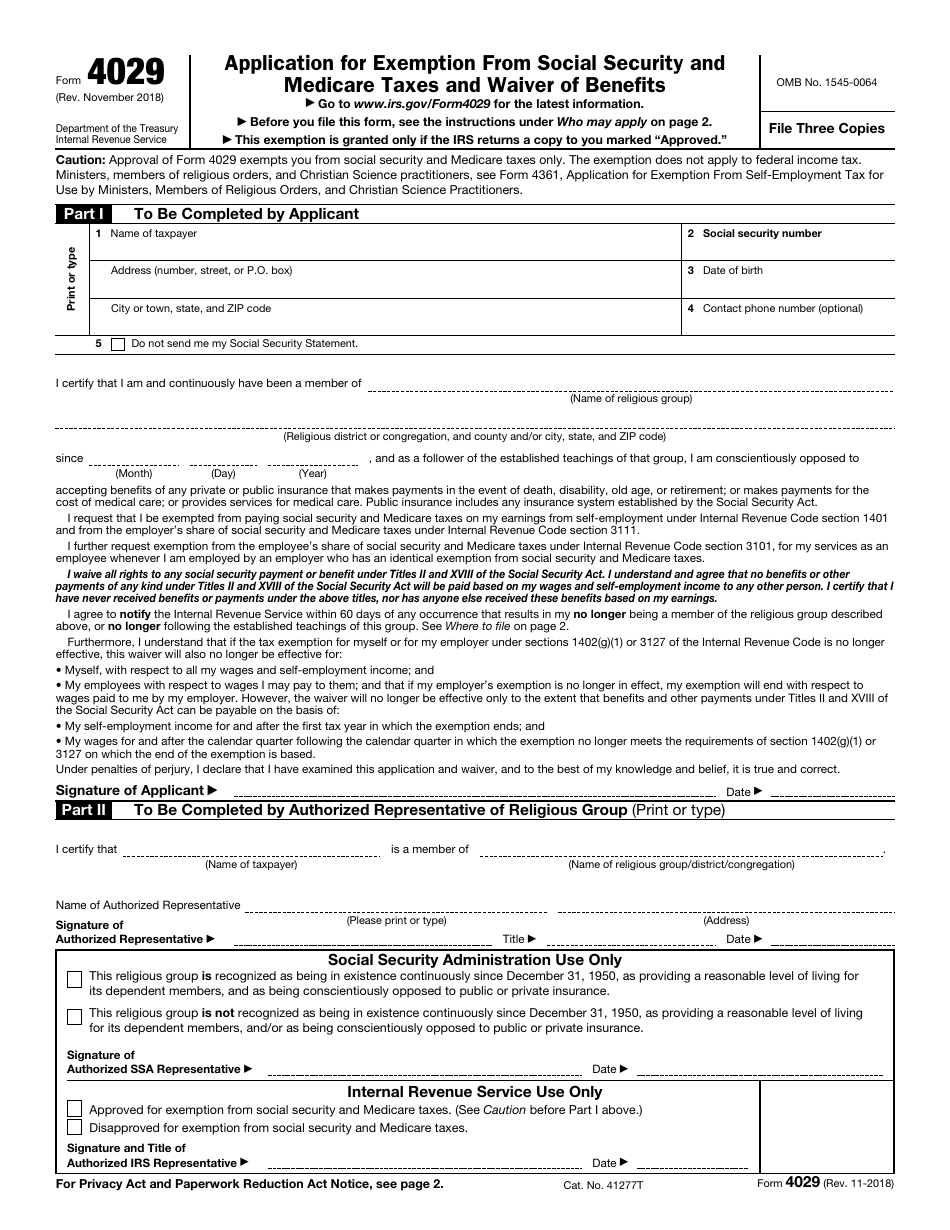

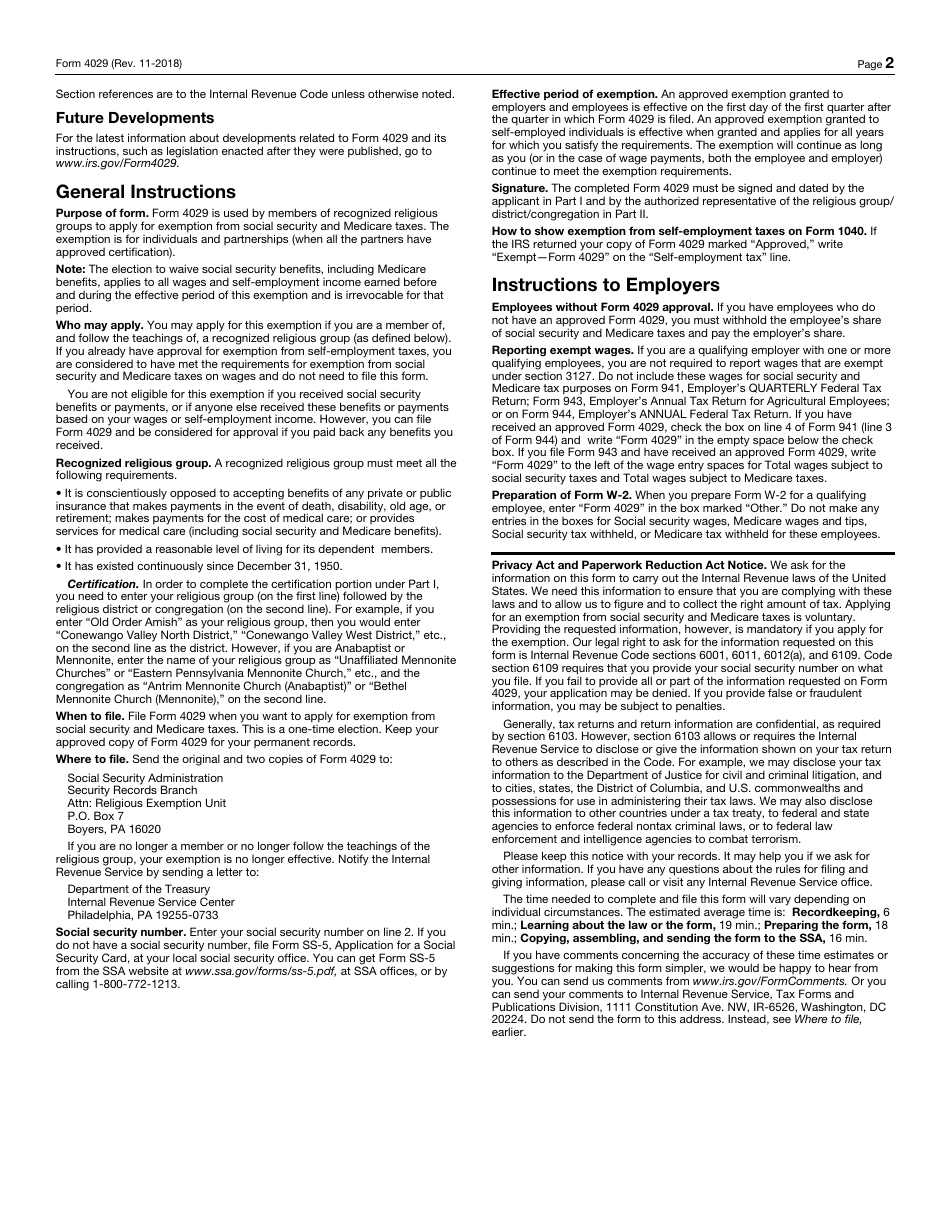

Make sure you meet the criteria for people who are permitted to claim an exemption in question by reading the guidelines on the second page of the form - only members of certain recognized religious groups are entitled to the exemption . In case you already received social security payments or benefits or another individual received them on the basis of your income, the application will not be approved.

-

List your personal details - write down your full name, social security number, and birth date . Add your mailing address and telephone number and specify whether you want to receive information about social security benefits you are currently entitled to or not.

-

Describe your involvement in the religious group by identifying the congregation, recording its present location, and entering the date when you became its member and follower of its teachings . Verify your decision to renounce any public or private insurance benefits you would otherwise receive and certify you waive your right to get social security payments. Sign and date the form.

-

Give the 4029 Tax Form to the religious group representative - they must confirm you are an active member of the congregation identified in writing, state their own name, title, and address, and certify the instrument by signing and dating it . Leave the last section at the bottom of the first page blank - it will be completed by the IRS when they review the documentation and determine whether the taxpayer can be exempt from paying taxes.

-

Once both individuals obliged to fill out the paperwork certify the form, make two more copies of the document and send all three of them to the Social Security Administration, Security Records Branch, Attn: Religious Exemption Unit, P.O. Box 7, Boyers, PA 16020 . The applicant must complete one more copy and obtain the signature of the authorized representative in order to retain a document in their permanent records. Note that if you left the religious group you used to belong to, the exemption no longer applies to you and you need to notify the IRS about your decision that will affect your taxes.