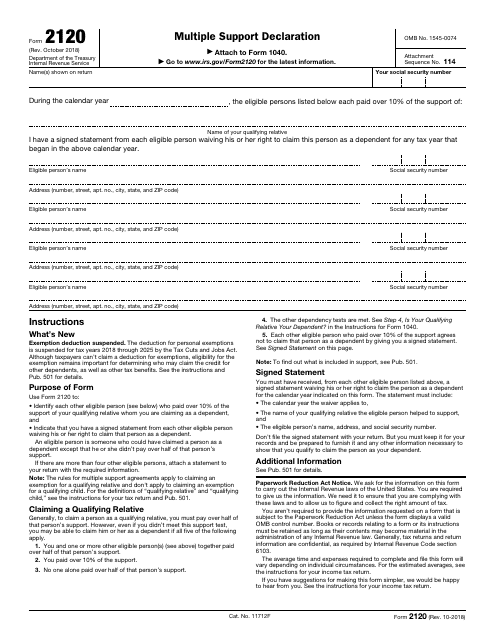

IRS Form 2120 Multiple Support Declaration

What Is IRS Form 2120?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 2120?

A: IRS Form 2120 is a form used to declare multiple support provided by different individuals for a qualifying relative.

Q: Who uses IRS Form 2120?

A: IRS Form 2120 is used by taxpayers who have provided support along with one or more other individuals for a qualifying relative.

Q: What is multiple support?

A: Multiple support refers to when more than one person provides support for a qualifying relative, but no one person provides more than 50% of the person's support.

Q: Who qualifies as a qualifying relative?

A: A qualifying relative is usually a family member who meets certain criteria, such as income and relationship to the taxpayer.

Q: What information is required on IRS Form 2120?

A: IRS Form 2120 requires information about the taxpayer, the qualifying relative, and the other individuals who provided support.

Q: What is the purpose of filing IRS Form 2120?

A: The purpose of filing IRS Form 2120 is to allocate the dependency exemption and other tax benefits among the individuals who provided support for a qualifying relative.

Q: When should IRS Form 2120 be filed?

A: IRS Form 2120 should be filed with the taxpayer's individual income tax return for the year in which the support was provided.

Q: Can IRS Form 2120 be filed electronically?

A: No, IRS Form 2120 cannot be filed electronically. It must be filed by mail.

Q: Are there any deadlines for filing IRS Form 2120?

A: IRS Form 2120 must be filed by the due date of the taxpayer's individual income tax return, including any extensions that have been granted.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2120 through the link below or browse more documents in our library of IRS Forms.