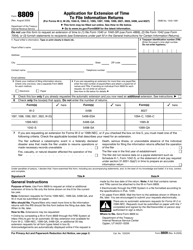

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 2350

for the current year.

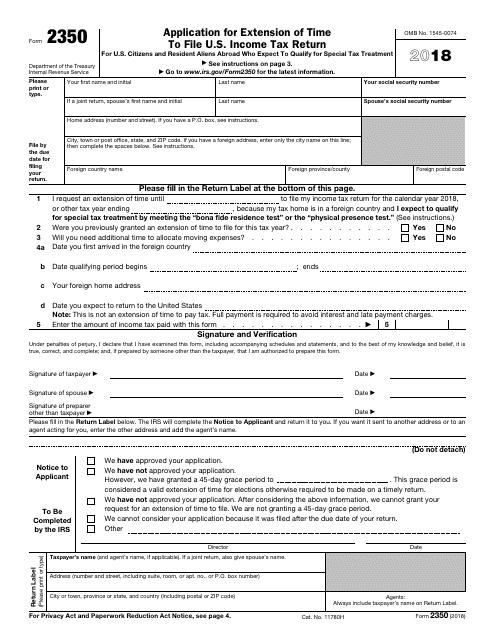

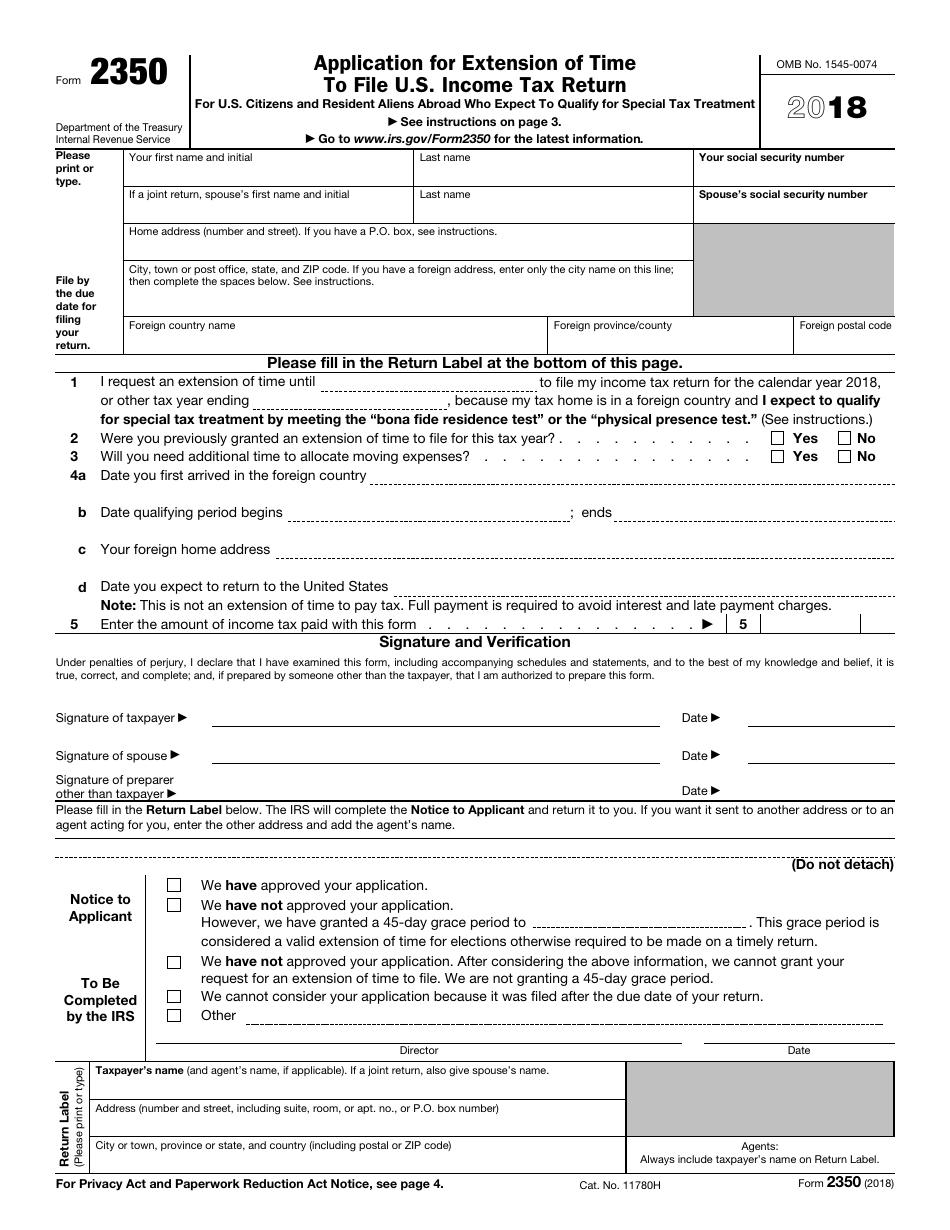

IRS Form 2350 Application for Extension of Time to File U.S. Income Tax Return

What Is IRS Form 2350?

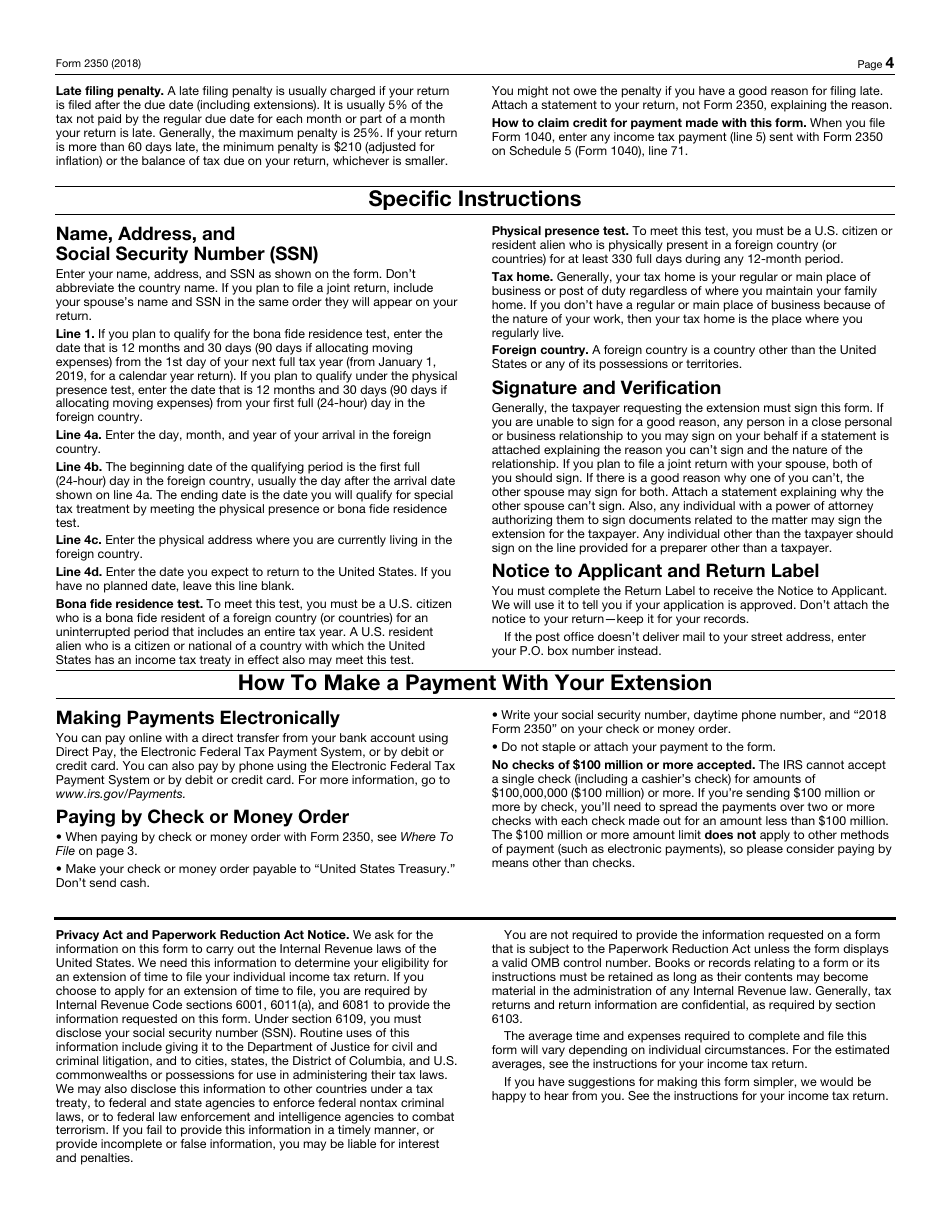

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 2350?

A: IRS Form 2350 is an application for extension of time to file a U.S. Income Tax Return.

Q: Why would I need to file IRS Form 2350?

A: You would need to file IRS Form 2350 if you are a U.S. citizen or resident alien living abroad and need additional time to file your U.S. income tax return.

Q: How do I file IRS Form 2350?

A: You can file IRS Form 2350 by mailing it to the appropriate IRS office.

Q: What is the purpose of filing IRS Form 2350?

A: The purpose of filing IRS Form 2350 is to request an extension of time to file your U.S. income tax return if you are living abroad.

Q: Is there a fee to file IRS Form 2350?

A: No, there is no fee to file IRS Form 2350.

Q: How long does the extension granted by IRS Form 2350 last?

A: The extension granted by IRS Form 2350 typically lasts for an additional 2 months.

Q: Can I file IRS Form 2350 electronically?

A: No, you cannot file IRS Form 2350 electronically. It must be filed by mail.

Q: What documents do I need to include with IRS Form 2350?

A: You may need to include supporting documents such as a statement explaining the circumstances of your request for extension.

Q: Can I file IRS Form 2350 if I already missed the original due date?

A: You can still file IRS Form 2350, but it is recommended to do so as soon as possible after the original due date.

Q: What happens if I do not file IRS Form 2350?

A: If you do not file IRS Form 2350 and fail to file your U.S. income tax return by the original due date, you may be subject to penalties and interest on any tax owed.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2350 through the link below or browse more documents in our library of IRS Forms.